President Obama’s budget for fiscal year 2011 lays out a stunningly expensive big-government spending agenda, mostly to be paid for years down the road. In addition to the proposed increase from today’s levels in capital gains, dividend, payroll, income, and energy taxes, the enormous deficits and endless accumulation of debt will eventually force growth-inhibiting income tax hikes, a national value-added tax similar to those in Europe, or severe inflation.

In the first three years of Obama’s term, federal spending rises by an average of 4.4 percent of GDP. That is far more than during President Johnson’s Great Society and Vietnam War buildup and President Reagan’s defense buildup combined. Spending is to hit the highest level in American history (25.1 percent of GDP) save for the peak of World War II. The deficit of $1.4 trillion (9.6 percent of GDP) is more than three times the previous record in 2008. [All numbers in this article are in, or derived from, the Obama budget; the subsequent CBO analysis projects much higher deficit and debt numbers. And the health care reform bill runs considerable risk of increasing them as well.]

Remarkably, Obama will add more red ink in his first two years than President George W. Bush—berated by conservatives for his failure to control domestic spending and by liberals for the explosion of military spending in Iraq and Afghanistan—added in eight. In his first fifteen months, Obama will raise the debt burden—the ratio of the national debt to GDP—by more than President Reagan did in eight years.

Some specific proposals are laudable: permanently indexing the alternative minimum tax for inflation; part of the increased R&D funding; reform of agriculture subsidies; and a future freeze on one-sixth of the budget (but only after it balloons for two years). But these are swamped by the huge expansion and centralization of government at the expense of families, firms, charities, and lower-level governments that permeates the budget.

Obama inherited a recession and a fiscal mess. Much of the deficit is the natural and desirable result of the deep recession. As tax revenues fall much more rapidly than income, these so-called automatic stabilizers cushioned the decline in after-tax income and helped natural business-cycle dynamics and monetary policy stabilize the economy. But Obama and Congress added hundreds of billions of dollars a year of ineffective “stimulus” spending more accurately characterized as social engineering and pork, when far more effective, less expensive options were available (see “Feeding a Sane and Lasting Recovery,” Hoover Digest, winter 2010).

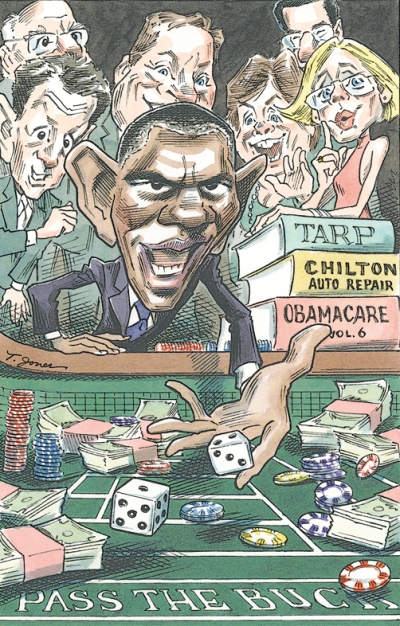

GAMBLE OF GAMBLES

The Obama long-run budget—unprecedented in its spending, taxes, deficits, and accumulation of debt—is by a large margin the most risky fiscal strategy in American history. From the beginning of his term until 2020, the projected spending is $8.8 trillion more than if kept at the historic average of the Clinton and George W. Bush presidencies and $10.7 trillion higher than if spending grew with population and inflation, even from the historically elevated 2008 level. The corresponding cumulative primary deficit, the deficit net of interest payments, is $5.3 trillion. A balanced primary budget stabilizes the debt-GDP ratio, so reasonable spending restraint could stabilize the debt-GDP ratio at safe levels with ample room for lower taxes and high-priority spending.

The president said in his budget message that “we cannot continue to borrow against our children’s future,” but that is exactly what he proposes to do, at large multiples of what was previously considered irresponsible. He projects a cumulative deficit of $11.5 trillion, bringing the publicly held debt (excluding debt held inside the government, for example, for Social Security) to 77 percent of GDP and the gross debt to over 100 percent. Presidents Reagan and George W. Bush each ended their terms at about 40 percent.

The deficits are so large relative to GDP that the debt/GDP ratio keeps growing and then explodes as entitlement costs accelerate in subsequent decades. So worrisome is this debt outlook that Moody’s warns of a downgrade on Treasuries, and major global-finance powers talk of ending the dollar’s reign as the global reserve currency.

Kenneth Rogoff of Harvard and Carmen Reinhart of Maryland have studied the impact of high levels of national debt on economic growth in the United States and around the world in the past two centuries. In a study presented earlier this year to the American Economic Association, they concluded that as long as the gross debt/GDP ratio is relatively modest, 30–90 percent of GDP, the negative growth impact of higher debt is likely to be modest as well (although it has been larger historically for the United States). But as it rises to 90 percent of GDP, there is a dramatic slowing of economic growth by at least 1 percentage point a year (again, historically even higher for the United States). The likely causes are expected much higher taxes, uncertainty over resolution of the unsustainable deficits, and higher interest rates curtailing capital investment.

The Obama budget takes the gross debt over this precipice, rising to 103 percent of GDP by 2015. The president’s economists peg long-run growth potential at 2.5 percent per year, implying per capita growth of 1.7 percent. A decline of 1 percentage point would cut this annual growth rate by more than half. That’s eventually the difference between a society with substantially rising living standards, upward mobility, and sufficient private and public resources to maintain economic, military, and geopolitical leadership, and an ossified society with a stagnant economy and waning power in the world.

Such vast debt implies immense future tax increases. Balancing the 2015 budget would require a 43 percent increase in everyone’s income taxes. A worse detriment to economic growth is hard to imagine.

FAREWELL TO BALANCE AND SURPLUS

Presidents and political parties used to propose paths to a balanced budget. Obama proposes to substitute stabilizing the debt/GDP ratio, a much weaker goal that requires balancing the budget excluding interest payments, the so-called primary budget. But he never achieves this, even after five and a half years of projected economic growth, withdrawal from Iraq and Afghanistan, and repaid financial bailouts. The 2015 budget still calls for a primary deficit of $181 billion (and a total deficit including interest payments of $752 billion). The president’s medium- and long-term budget plan is to outsource the plan to a commission he appoints to suggest ideas for balancing the primary budget by 2015.

For perspective, returning 2015 spending to population growth plus inflation produces a primary surplus of $645 billion (3.3 percent of GDP). It is Obama’s spending that turns a short-run crisis into a medium-term debacle.

Two other factors greatly compound the risk from Obama’s budget plan. First, he is running up this debt and current and future taxes just as the baby boomers are retiring and the entitlement cost problems are growing, which will necessitate major reform. (Obama got no help from his predecessors: Bush’s growing Medicare prescription drug benefit was not funded, and Bill Clinton’s Social Security reform was a casualty of the Lewinsky scandal.) Second, the president’s programs increase the fraction of people getting more money back from the government than they pay in taxes to almost 50 percent, just as demography will drive it up further. That’s an unhealthy political dynamic.

Howard Baker, a former Senate majority leader, famously called Reaganomics, with its defense buildup, tax cuts, and budget deficits, a “riverboat gamble” (which, by the way, worked out well). Obama’s fiscal strategy is more akin to the voyage of the Titanic. Let’s hope he changes course soon enough to prevent disaster.