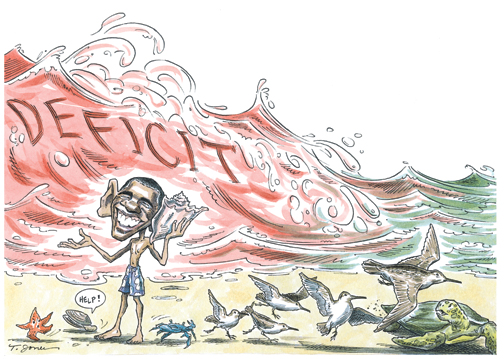

Federal budget numbers released late last summer by the Congressional Budget Office (CBO) ought to be a game changer for Congress and the Obama administration. Even before these estimates were released, opinion polls revealed that most Americans had serious concerns about large deficits and exploding federal debt. Such concerns will only intensify because the estimates show that the budget problem had worsened considerably: the federal deficit will be $2 trillion higher than earlier estimates over the next decade, bringing the debt increase under the administration’s budget policy to $10 trillion.

Adding to the worry is that this large $2 trillion upward revision took place over the short span of five months after the CBO’s previous estimate in March 2009. The revision was mainly due to higher estimated interest payments on the debt and new spending.

The president’s health care plans will pile on more debt, according to the CBO. And all this lies on top of the debt-increasing stimulus package passed last February.

These large deficits represent a systemic risk to the economy—worse, in my view, than the threat of a crisis in the commercial real estate mortgage market, which many think is the next shoe to drop. Under the new estimates, the ratio of debt to gross domestic product (GDP), a measure of our ability to service the debt, will rise from 40 percent at the end of 2008 to more than 80 percent in 2019 with the administration’s budget. It will then continue to rise at an accelerating rate. By way of comparison, the debt-to-GDP ratio was 40 percent at the end of the 1980s—a decade remembered for high deficits—less than half that projected at the end of the coming decade.

Without spending discipline, damaging tax increases are required to close such deficits, which is why rumors of new value-added taxes are circulating. The deficits would also bring a long, painful period of high inflation such as that of the late 1960s and 1970s, a period of frequent recessions and persistently high unemployment when people began to lose confidence in the dollar.

The growing deficits will force the administration to beg China and other countries to buy our debt, adversely affecting our foreign policy.

How much might taxes have to rise? To close the deficit in 2019, when it is projected to be running at a pace of $1.5 trillion per year, a 70 percent tax increase would be needed, clearly damaging to the economy and foolish both politically and economically.

But the calculations show that the problem is way too big to solve by tax increases alone.

So what game change is called for? We must start scaling back the growth of spending now. Lay out a plan to balance the budget in five years. We must also end the bailouts—another government action hated by most Americans—by making it clear that institutions that are “too big to fail” are too big.

We should postpone any new health care efforts that require increased government spending and in the meantime focus on good ones that don’t. In the current tumult we should be reforming existing entitlement programs before adding new ones.

Because the budget problem is too big to solve by increasing taxes, we should not increase taxes. We can hear the objection: pulling out some of the stimulus too soon will cause another downturn. But a growing debt, permanent tax increases, and threats of inflation are far more likely to cause another downturn.

In my view, the government stimulus program is not working. Virtually all the improved performance in the second quarter of 2009 came from private investment; making one-time payments to people is not jump-starting consumption.

But even if you thought the stimulus was working, this is no excuse for trillion-dollar-plus deficits as far as the eye can see. The facts are telling Washington to change course now.