Since the early 1980s the introduction of the individual retirement account (IRA) and 401(k) programs has worked to increase individual saving. Now more saving is done through these plans than through conventional employer-provided defined benefit and defined contribution plans. Altogether, pension plan saving for retirement now accounts for at least 70 percent of personal saving. While encouraging saving with one hand, however, legislators have worked with the other, a mostly hidden hand, to discourage the very retirement saving that accounts for the bulk of personal saving in the United States. In 1982, pension saving was not subject to estate taxes and was taxed only when the funds were withdrawn either by the pension saver in retirement or by the saver's children. Yet today pension saving that passes through an estate can be virtually confiscated through a series of estate, income, and "excess accumulation" penalty taxes imposed on large accumulations of pension saving, and large withdrawals from pension plans are subject to an "excess distribution" penalty tax. We find that

![]() The marginal tax rate on large distributions is likely to be as high as 61.5 percent and that the confiscatory marginal tax rates on large pension assets passing through an estate can be as high as 92 to 97 percent and sometimes even higher.

The marginal tax rate on large distributions is likely to be as high as 61.5 percent and that the confiscatory marginal tax rates on large pension assets passing through an estate can be as high as 92 to 97 percent and sometimes even higher.

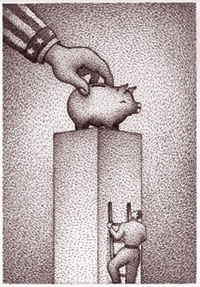

![]() These extraordinary tax rates are not limited to the rich. Rather, they are taxes on lifetime savers. For example, a person with median earnings over a long career who contributes 10 percent of earnings to a 401(k) plan with assets invested in the S&P 500 is likely to be victimized by these "success" taxes. Although only a small proportion of persons now approaching retirement will pay these taxes, the rapid expansion of 401(k) plans in particular will place a large number of future savers in harm's way.

These extraordinary tax rates are not limited to the rich. Rather, they are taxes on lifetime savers. For example, a person with median earnings over a long career who contributes 10 percent of earnings to a 401(k) plan with assets invested in the S&P 500 is likely to be victimized by these "success" taxes. Although only a small proportion of persons now approaching retirement will pay these taxes, the rapid expansion of 401(k) plans in particular will place a large number of future savers in harm's way.

![]() Many lifetime savers will find that the prospect of these taxes completely offsets the incentive to save for retirement in a pension plan. The prospect that most of the funds will be confiscated if pension assets remain at death provides an enormous incentive to limit pension saving. Furthermore, these taxes provide a large incentive to withdraw saving from pension funds before it is needed for consumption. All work to limit the saving of those who would otherwise save the most.

Many lifetime savers will find that the prospect of these taxes completely offsets the incentive to save for retirement in a pension plan. The prospect that most of the funds will be confiscated if pension assets remain at death provides an enormous incentive to limit pension saving. Furthermore, these taxes provide a large incentive to withdraw saving from pension funds before it is needed for consumption. All work to limit the saving of those who would otherwise save the most.

Savers who increase their saving because of the opportunities offered through personal or employer pension plans do not reduce resources available to the rest of the population. Indeed, the gain to savers from consuming tomorrow rather than today is only a portion of the social return from the increment to the pool of saving. Assuming that increased saving leads to increased investment and thus economic growth and, indeed, more taxes in the future, the social return far exceeds the private gain.

| THESE EXTRAORDINARY TAX RATES ARE NOT LIMITED TO THE RICH |

Then what lies behind policies to keep savers from saving? A complete accounting is not possible here. But at least three forces have lurked behind the scenes. One is the widely held view that saving leads to economic growth and will improve the lot of future elderly; combined with the equally widespread belief that the saving rate in the United States is too low, this view suggests that saving should be encouraged. This was an important motivation for the Economic Recovery Tax Act of 1981, which made IRAs available to all employees, and for the 1978 legislation that established the foundation for 401(k) plans.

A second force has been the desire to curb the chronic federal budget deficit, which has led to curtailment of the very saving plans that were intended to encourage saving. This force gives great weight to the short run and little weight to the long-run growth of the economy. The tendency has been to avoid short-run tax expenditures at the expense of long-run revenues.

A third force, and perhaps the most troubling, is the view that saving incentives such as those provided through IRA and 401(k) plans are a gift to the wealthy and thus that their use should be limited for that reason. From this perspective comes the notion that too much saving in this form should be penalized. It ignores the social gain from saving no matter what the mechanism that induces it. All three forces have been at work over the past decade and a half.

It has always been true that most saving is done by people with the most money. That is still the case. If saving is to be increased, people with the greatest income must be induced to save more of it. Since many families with high incomes have accumulated little wealth on the eve of retirement, it is hoped that the inducement to save will add to the financial security of future retirees, even those with higher lifetime incomes. Although Americans of all income levels could benefit by saving more, the bulk of any increase is likely to come from persons with the highest incomes. Encouraging them to save while penalizing them for taking advantage of the inducement is likely to curtail economic growth. An inducement to save, although viewed by some as a gift to the rich, might more properly be viewed as a way to get the rich to use more of their resources to contribute to the national well-being. The United States will benefit more if a wealthy person saves a million dollars than if the wealthy person uses the million to buy a bigger house.

If economic growth is to be quickened and if the well-being of future elderly is to be enhanced, the relative power of the three forces will have to change. The United States can only be hurt by keeping savers from saving.

Illustration by David Ridley