What the next President decides to do with the federal budget will impact the lives of each and every one of us. For example, what should the next President do with the current budget surplus—pay down the national debt, set aside money to strengthen Social Security, or cut taxes? Milton Friedman answers these questions as well as addressing how the next President should approach the issues of education, health care, and the future of Social Security.

To view the full transcript of this episode, read below

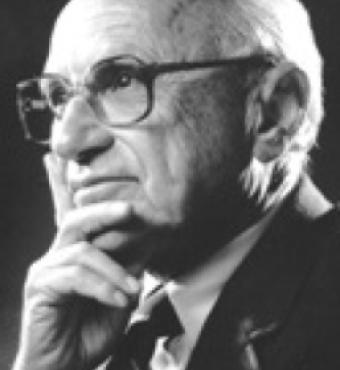

Peter Robinson: Welcome to "Uncommon Knowledge." I'm Peter Robinson. On our show today, Nobel prize-winning economist Milton Friedman offers a little free advice to the next president of the United States.

Right now Al Gore and George W. Bush are both busy spending millions on their presidential campaigns. They have some decisions to make. How much to spend on TV spots? How much to spend on print ads? For that matter, how much to spend on confetti at the conventions.

But when one of them is finally elected president, the money in his campaign coffer will look like chicken feed by comparison with the money in the Federal Treasury.

For the next president, whoever he is, five question: how to keep the economy growing? What to do about the federal surplus? How to fix Social Security? How to improve education? And what to do about health care?

In each case, billions of dollars are at stake. Consider the surplus. Will the next president use it to pay down the federal debt? To launch big new federal programs? Or to cut taxes, and put a little money back in the taxpayers' own pockets?

Needless to say, on each of the five questions, Milton Friedman has an answer.

Let Us Now Praise Gridlock

We now give the next president the opportunity to be briefed by Milton Friedman. We'll send tapes to all the candidates.

Milton Friedman: And they will have complete freedom to throw them away.

Peter Robinson: Question number one: keeping the economy growing. Let me open, if I may, with a tale of two administrations. The economy expands during the administration of Ronald Reagan and during the administration of Bill Clinton. But of course they represent two quite different approaches.

Reagan cuts marginal income tax rates quite dramatically. Top rate goes from about 70 percent to under 40 percent. That largely because he increases defense spending. He piles up massive--

Milton Friedman: That's not the reason.

Peter Robinson: No? Okay, correct me.

Milton Friedman: The reason you had massive deficits was because they were more successful at reducing inflation than they had anticipated. Inflation is very productive of taxes. Because at that time there was no indexing of tax brackets, and inflation pushed people up into higher and higher brackets.

Peter Robinson: So they give a larger percentage of their real income to the government?

Milton Friedman: Right. Now, after 1980, '81, when inflation came down much more sharply than anybody had predicted. If you look at the predictions at that time, they thought it would take ten or more years to wring inflation out of the economy. It took more like three or four years. And as a result, the actual tax receipts during those periods were very much lower than the estimated tax receipts, based on the higher inflation assumption. And that's the main reason we've got a deficit.

Peter Robinson: But we did get a deficit.;

Milton Friedman: Because actual spending, the increase in spending on the military, was offset by reductions in spending in the rest of the budget. Not entirely.

Peter Robinson: Not entirely.

Milton Friedman: Not entirely. But very largely.

Peter Robinson: Okay. I'm rejiggering my question as we go here, but I'll keep going. So we had Reagan cutting taxes, but with a deficit that piles up; but nevertheless the economy grows.

Then we have Clinton who raises taxes early in his administration, and indeed his tax increases are on top of tax increases enacted by President Bush, but Clinton, we actually have, whether you give credit to President Clinton or Republicans in Congress, we actually have relatively moderate growth in federal spending; so that as a proportion of GDP, the federal government actually shrinks; we end up in the last couple of years in the Clinton administration with a surplus. Who's a better model for the president?

Milton Friedman: The better model is Reagan, cutting taxes. The reason you have a surplus today, in my opinion, the credit for that has to be given overwhelmingly to gridlock.

Peter Robinson: To gridlock?

Milton Friedman: If you had had a Democratic House and Senate, as well as a Democratic president, you would not have a surplus today in my opinion. They would have spent it. Similarly if you had had a Republican president as well as a Republican House and Senate, I doubt that there would have been a surplus today. Because they would either have spent it or had tax reductions.

Peter Robinson: So when President Clinton steps forward to take his bows, you don't applaud at all?

Milton Friedman: Well, I applaud. He provided gridlock.

Peter Robinson: Okay, you applaud but for a different reason than the one he supposes.

Milton Friedman: The winning thing that really contributed to our successful economy over recent years is that the government has stayed out pretty much, with the White House and the Congress and the Senate haven't done much.

Peter Robinson: In this upcoming election, you'd hope for the White House and Congress to be captured by different parties? You vote for gridlock? Or what would you tell the next president about keeping the economy growing?

Milton Friedman: First of all, I don't think the president has a great deal to do with keeping the economy going.

Peter Robinson: All right.

Milton Friedman: I think presidents have a great deal to do with keeping the economy from growing. They can follow follow-throughs which will cause contractions. But I think the economy is largely independent of the government, and what keeps it going is its own internal development.

However, you can short-circuit that internal development. If you impose very high taxes, and eliminate the incentive to innovate, to improve, to take risks, and do things, you'll kill the economy. And that's what's happened over and over again in other countries around the world.

Peter Robinson: I have to remind you at this point of a story that I heard from James Buckley who served in the United States Senate. He was elected in 1972. He flew down to Washington to meet President Nixon. AS the door to the Oval Office, Nixon was concluding a meeting with John Ehrlichman, his domestic policy adviser. And as James Buckley walked into the Oval Office, the first words he heard Richard Nixon utter were: I don't care what Milton Friedman says, he's not running for reelection.

So the point is, if you're suggesting that the next president say in his inaugural address, my fellow Americans, I promise not to get in the way of the economy, you're promising something that a politician finds unsatisfying.

Is there any positive?

Milton Friedman: Yes. Cut taxes.

Peter Robinson: Cut taxes? Okay.

What does Milton suggest we do with the federal budget surplus?

My Cut Runneth Over

We have money piling up in the federal coffers.

Milton Friedman: And you think you have choices?

Peter Robinson: Well, we could spend it on new programs.

Milton Friedman: Don't you think if--let me ask you a question. Suppose you don't cut taxes. Do you think the surplus will last?

Peter Robinson: In other words you're asking a political question?

Milton Friedman: Absolutely.

Peter Robinson: And Congress resists the temptation to spend it?

Milton Friedman: Exactly. Exactly.

Peter Robinson: My opinion is no.

Milton Friedman: Right. Mine too. I think they cannot resist.

Peter Robinson: So this notion of paying down the debt is a nice idea, but it'll never happen.

Milton Friedman: It'll never happen. Moreover, I'd go further than that. Suppose you succeed--what may happen, what may really happen, is that because of the gridlock for two or three years you do pay down the debt. What do you suppose will happen to those saved interest payments?

Peter Robinson: Socrates, I think I see where you're going with this.

Milton Friedman: And I want to ask you another question that ties in with that. I believe, and you believe, that that saved interest payments would be spent on another government project. Would that government project do more or less harm than the payment on the current debt?

Peter Robinson: That's a good question--isn't it?

Milton Friedman: Yes, it is.

Peter Robinson: That's not obvious is it?

Milton Friedman: No, I think the answer is obvious. The marginal projects that the government would undertake would certainly do more harm. See, one of the least harmful of government expenditure projects if the payment of interest on debt. That's a transfer of money from taxpayers to taxpayers.

Peter Robinson: With the government skimming a little something for the bureaucracy.

Milton Friedman: That's right. But in the main you're taking money from taxpayers, and you're giving it over to other taxpayers who own the bonds, and the harm that is done is by what the government takes off, and by the fact that the higher tax rate tends to reduce incentives.

So that's--but regardless of what the money is used for. And if you look at what the money is used for, most government spending projects do harm, not good.

Peter Robinson: Now let me ask you, I want to back up to this question of, cut taxes versus pay down the debt. So what you're saying is, cut taxes, because Congress will never be able to resist the temptation to spend it. Paying down the debt may be a good idea, but it'll never happen.

But let me ask you as an economic matter, if Congress could find the willpower to pay down the debt, should it? In other words, what would be better at this point purely on an economic analysis: paying down the debt or cutting taxes?

Milton Friedman: Well, let me talk about paying down the debt, because that ties in with your Social Security problem. They're not really paying down the debt. They're converting funded debt to unfunded debt, because of the coming problem in Social Security.

Let's look at it this way: they pay down the debt. They buy up government bonds. What do they do with those government bonds? They put them over here in a box labeled: trust fund for Social Security. Now you come to the period when current receipts from wage tax are too sparse to pay benefits.

Peter Robinson: Right, into the Social Security fund.

Milton Friedman: So they take these bonds out and sell them again to the public. How else are they going to pay for it? So what you are doing is simply changing the form of the debt, but you're not really reducing the debt--

Peter Robinson: Because these obligations are going to be there no matter--

Milton Friedman: And their present value is a debt. And that debt is all recorded in this fake trust fund, which is pure paper artifice; has no real role.

Peter Robinson: But if you cut taxes, what does that do to help the government meet its unfunded obligations.

Milton Friedman: It doesn't do a thing, but let's go back. To meet the unfunded obligations, you really need a change in Social Security. All the rest of this talking about paying down the debt as a way of solving the Social Security problem--

Peter Robinson: Is nonsense?

Milton Friedman: --is an evasion. In the long run government will spend whatever the tax system will raise, plus as much more as it can get away with. That's what history tells us, I think. So my view has always been: cut taxes on any occasion, for any reason, in any way, that's politically feasible. That's the only way to keep down the size of government.

Peter Robinson: So you for example would be in favor of this ban on Internet taxes?

Milton Friedman: That's a little difficult. No, I'm not saying that.

Peter Robinson: You're not?

Milton Friedman: No, no. No, no, no. I want to cut taxes. But there are better and worse taxes; better and worse taxes to cut. And there is--

Peter Robinson: And the income tax is the one that really needs to be whacked at?

Milton Friedman: The income tax is the one that really needs to be whacked at.

Milton Friedman: Because of the disincentives to produce--[fades out].

Milton has already suggested the need to change Social Security. What would he do?

Saving Private Earnings

Social Security, how would you fix it, Milton?

Milton Friedman: The only way really to fix it in the long run is to convert it into a strictly privatized investment fund. Because what you really need is to increase savings. You see why is it that when you get a life insurance policy, for example, you don't have the same problem? Why is it that there isn't an unfunded liability of the life insurance companies? Why don't they have a problem in the future?

And the answer is: because when you pay for your life insurance policy--

Peter Robinson: I'm paying for my life insurance policy.

Milton Friedman: --your life insurance policy, the company takes that money and invests it in real capital. And that real capital, the machine, the building, the house, whatever it is, provides an income which will be available to pay you your benefits when the time comes.

Peter Robinson: Right.

Milton Friedman: On the other hand, in the case of the present Social Security system, the money you pay isn't tied to--isn't used to produce any real capital that will be productive in the future. It's being put into pieces of paper, to promises to pay. There is nothing there that will yield more income.

So the only real solution to Social Security is to shift to a system under which you have higher savings; under which you have fully funded benefits, fully funded annuities.

But without going into too much technical detail, the essence of it is that you have to shift to a privatized system; you have to recognize that for awhile you're going to have to pay twice as it were.

Peter Robinson: Right, that is to say, my generation or the one that follows will have to pay for retirees and themselves.

Milton Friedman: The young have always paid for the social security of the old. But what it used to be is that people, the young, would pay for the social security of their parents. Now the young pay for the Social Security of somebody else's parents. And that's a change for the worse and not the better. I think it's a very unjust system.

Peter Robinson: You don't buy--I mean even the harshest critics of the welfare state say, look, we have to admit that Social Security eliminated poverty among the elderly; that is the one success that everyone agrees upon. Right?

Milton Friedman: Sure. But at what cost? Tell me, here's a young man, 40 years old. He suddenly--he discovers he's got AIDS. He's got ten more years to live. And the government comes along and says, we've got to take 15 percent of your income to provide for your old age after 65.

Peter Robinson: And it's by law, and we don't care when you die, we're going to take that money.

Milton Friedman: Is that just.

Peter Robinson: No, that's ridiculous.

Milton Friedman: We want responsible individuals. People should take care of their own old age.

Peter Robinson: New president: take note.

Education, Milton. We have--

Milton Friedman: Education ought not to be a federal issue.

Peter Robinson: But the president has to say something about it. All the polls show that it's at the top of people's concerns.

Milton Friedman: I'll tell you what he should say.

Peter Robinson: What should he say?

Milton Friedman: What he should say. I am announcing tonight that the federal department of education is disbanded. That the amount of money that we are now sending to the states we will continue to spend in the form of free funds for them to use, at a declining rate, and get through with that subsidy over the next 10 years. And we want the education to be handled by the individual states, by the local governments, and by the parents.

But the parents are the only ones who have a real responsibility for the schooling of their children. There is nothing in the Constitution that justifies the federal government being involved in schooling children.

Peter Robinson: Next issue for the next president: what to do about health care?

Bitter Medicine

Medical care: now that's something that you may say the federal government ought not to be in it, but it's in it.

Milton Friedman: Yes.

Peter Robinson: And we have this paradox, this peculiar paradox, that in recent decades we've seen one miraculous medical breakthrough after another, and yet at the same time, increasing dissatisfaction with health care in this country.

Milton Friedman: And an enormous increase in spending.

Peter Robinson: And an enormous increase in spending.

Milton Friedman: In the period from 1929 - 1950, spending on medical care in the United States was between 3-5 percent of national income.

Peter Robinson: 1929-1950?

Milton Friedman: Yeah.

Peter Robinson: Between 3-5 percent. That's low, by comparison with anything I ever heard about what's going on today.

Milton Friedman: Today, it's 14 percent. Today the nation is spending more on medical care than on all the food, alcohol and tobacco they put in their mouth. We've had an absolutely tremendous overshoot, increase.

And what's more, the U.S. spending on medical care is way out of line with other countries.

Peter Robinson: Oh, so you're suggesting then that this is out of whack. It's not just--

Milton Friedman: Absolutely out of whack.

Peter Robinson: --due payment for all these marvelous breakthroughs we've had?

Milton Friedman: All these other countries have had these marvelous breakthroughs. The second-highest country is now Germany at 10 percent. We're over 14, they're 10.

Peter Robinson: So we should of course socialize our medical system the way Germany has.

Milton Friedman: Yes, that's one answer, but it's not the right answer. If we really socialize the medical system, costs would go down.

Peter Robinson: They would indeed go down.

Milton Friedman: Because government would ration medicine.

Peter Robinson: So the right answer is?

Milton Friedman: Let me go back. The reason we have trouble, fundamental reason why we have high expenses and trouble is because everything is a third party payment. Nobody pays for himself. Very rarely. That's an exaggeration. But most payments for medicine are third-party payments. The insurance company pays, the government pays, but if you're my physician and I come to you, there is no payment between us.

And as a result, everybody is spending everybody else's money, and nobody spends somebody else's money as carefully as he spends his own.

Why should people have to get their medical care in that way? Why shouldn't they be able to arrange for it themselves? Why shouldn't they be able to pay for it directly?

The problem really resolves itself into catastrophe versus ordinary. With respect to ordinary medical care expenses, they are relatively modest; there is no reason why people can't pay for it on their own.

Peter Robinson: Ordinary would be, I have a cold, my kids get the flu, that sort of thing.

Milton Friedman: You have an annual examination. You take your kids in for a regular examination. Those are the ordinary expenses.

Peter Robinson: Right.

Milton Friedman: Catastrophic expenses arise when you have a major thing.

Peter Robinson: AIDS, heart attack, cancer.

Milton Friedman: Right. And in most areas, we buy insurance only for catastrophic expenses. You don't insure your house for--against the cost of having to mow your lawn. You don't insure your car in such a way that if you buy gasoline, you get repaid by the insurance company.

Peter Robinson: Right.

Milton Friedman: But in medical care we've gotten almost to that point, where medical insurance provided by the employer, if you have to get some aspirins, you have to get approval and its paid for. That's a little exaggeration--

Peter Robinson: Not that much.

Milton Friedman: --because there are deductibles, but the deductibles are relatively small.

And so the system that should have developed, it seems to me, is a system under which people would buy insurance for catastrophic expenses; very very high deductible. A deductible of $4- to $5,000 a year, and not a few hundred or a thousand. But with the employer-provided medical care, that of course is not what you're going to have.

Peter Robinson: Right. As in any tax exemption, there's a huge incentive to push as much under the exemption as you can.

Milton Friedman: Of course.

Peter Robinson: Okay.

Milton Friedman: So it has two effects. It causes you have to have this third-party payment. But it also causes them to spend more on medical care than you would spend if you were free to dispose of your income after tax as you wish.

Peter Robinson: Right.

Milton Friedman: So the right solution in my opinion is again to privatize. And there are two ways to do that. You can either eliminate the tax exemption, which I think is politically not feasible; or you can spread the tax exemption, and say it will apply to expenses paid by you.

See if you pay now, the medical care expenses you pay now out of your own pocket--

Peter Robinson: Are after taxes.

Milton Friedman: --are after taxes now. But with medical savings accounts, you set it up so that you put money into the medical saving account--

Peter Robinson: Untaxed money.

Milton Friedman: Untaxed money. When you pay your medical care from that, it's not subject to tax. So that would extend the tax exemption, but permit the elimination of employer-provided, or at least the substitution of personally provided medical care.

Peter Robinson: And what would you do? You'd phase out Medicaid and Medicare somehow?

Milton Friedman: In my ideal situation, I would phase out Medicare and Medicaid, but I would have government provide catastrophic insurance. Voucherize it.

Peter Robinson: You would keep the location of catastrophic insurance in the government?

Milton Friedman: No [unintelligible].

Peter Robinson: Explain what you mean?

Milton Friedman: The government is committed to paying for a certain part of my medical care. Let them give me a voucher which I can use to buy a catastrophic insurance policy equal to the amount that they're committed to spend on me. But let the market--

Peter Robinson: The position becomes more that of the individual in the marketplace?

Milton Friedman: And let the market work.

Peter Robinson: Milton has given us a few radical proposals. Does he really think the next president could carry them out?

Milton's Paradise Gained

Now Milton, here's what I see you counseling the next president to say.

My fellow Americans, we are eliminating Social Security. I'm whacking the Department of Education. I'm phasing out Medicare and Medicaid, and by the way, this tax exemption for medical expenses when it's paid by the employer, I'm looking askance at that too.

Now this is a little hard to--

Milton Friedman: That's why I am not a politician.

Peter Robinson: Now here's my last question then.

Milton Friedman: You're never going to do all this. But it's well to have in mind what you'd like to do. So that the incremental--everything has to be done incrementally, and will be done. But unless you have in mind where you want to go, you're not sure your steps are taking you there. So I'm not putting this forth as a practically feasible platform for tomorrow. I'm saying, let's look at the long run, where you would like to be. And then let's ask ourselves with respect to each proposal, does it take it in that direction? Or does it take it in the opposite direction?

Peter Robinson: Now that's a fair statement. Now as it applies to politics, I read one of the central lessons of your whole life's work as this: the less government the better.

Milton Friedman: That's right.

Peter Robinson: All right. Let me ask you to make a prediction here. Let's assume that the next president whoever he is--this is your judgment of the political state of the country--the next president, whoever he is, let's assume that he serves two terms. So eight years from now, 2008, will the federal government, as a proportion of GDP, be smaller than it is at present, or bigger?

Milton Friedman: Whether it's smaller or bigger will not depend to whether people have listened to this program or have read what I write. It will depend on how effective the Internet is making it hard to collect taxes.

Peter Robinson: Oh, now, you've just thrown a whole new topic at me. Explain what you mean by that?

Milton Friedman: Well, the Internet is--one of the great virtues of the Internet is that it enables people to make transactions at a distance, anonymously, over various countries--

Peter Robinson: And in secret, encrypted.

Milton Friedman: --encrypted, so it makes it much more difficult to collect taxes. And if that effect is strong enough, then government spending as a fraction of GDP will be lower than it is now.

Peter Robinson: So sales taxes would also be in trouble. Because I could presumably buy my L.L. Bean sweater in an encrypted form through some secondhand reseller in Bermuda or Barbados.

Milton Friedman: Absolutely, absolutely.

Peter Robinson: And I could presumably--if I could swing this it would be marvelous--I could get paid through [Kurasaou]. Also my income could be encrypted. So what would the government be left to tax?

Milton Friedman: Property.

Peter Robinson: My car, my house. And that's a world that makes you smile?

Milton Friedman: No, no, it's not going to go that far.

Peter Robinson: Oh, it won't?:

Milton Friedman: It won't go that far. There are things you're not going to be able to avoid. The most obvious subjects for taxation are things that are fixed. That's why property taxes--

Peter Robinson: Can't hide your house.

Milton Friedman: You can't hide your house. You tax people. They can move. That's why state income taxes can't possibly reach the level that federal income tax has reached, because the barrier to a person moving from one country to another is much higher than moving across states.

Peter Robinson: From California to Nevada, no problem.

Milton Friedman: Right, right. Similarly, the Internet comes along and now computer companies are hiring people in India to do their work for them, and they're paying them in India. That's something that never gets into the U.S. tax system.

So you have in addition to the kind of tax evasion that you're speaking of, you have the fact that transactions take place in a way that are attracted to the low-tax areas.

Peter Robinson: So your sort of concluding note to the next president would be: if you're a Democrat, this may upset, if you're a Republican, it may cause you secret glee, but one way or the other, the technology is moving such that the government is likely to get smaller?

Milton Friedman: Right.

Peter Robinson: Milton Friedman, thank you very much.

Milton Friedman: You're welcome.

Peter Robinson: One of Milton Friedman's central pieces of advice to the next president: cut taxes to give money back to the taxpayers every chance you get. Something about me especially likes that piece of advice.

I'm Peter Robinson. Thanks for joining us.