- Budget & Spending

- Economics

- Law & Policy

- Regulation & Property Rights

- US Labor Market

- Energy & Environment

- World

- Contemporary

- Campaigns & Elections

- Politics, Institutions, and Public Opinion

- The Presidency

- Health Care

- History

Nick Gillespie, Reason: We’re two years into Obama’s presidency, and he’s managed so far to post an even worse record than George W. Bush. The economy has lost 3.3 million jobs, consumer confidence is at half of its historical average, unemployment is over 9 percent and has been that way for well over a year. To what extent is Obama responsible for this?

Richard Epstein: Well, I think certainly he added another nail to the coffin. At least the early George Bush and Obama have a lot in common. The difference between them, which is why Obama is the more dangerous man ultimately, is he has very little by way of a skill set to understand the kinds of complex problems that he wants to address, but he has this unbounded confidence in himself.

Gillespie: He is the perfect Chicago faculty member.

Epstein: No, he wasn’t on the faculty. He was actually a very bad Chicago faculty member in this sense: to the extent that he was an adjunct and we’d always hoped that he would participate in the general intellectual discourse, but he was always so busy with collateral adventures that he essentially kept to himself. And the problem when you keep to yourself is you don’t get to hear strong ideas articulated by people who disagree with you.

Gillespie: Did you encounter him at all?

Epstein: Sure.

Gillespie: What kinds of interactions did you have?

Epstein: Usually in the breezeway, because he was always running and gunning for some other kinds of things. I also knew him because my next-door neighbor is one of his best friends, probably his best friend—Marty Nesbitt—and I would see him there or speak about him. He was, I think in many kinds of cases, always a tremendously engaging and charming individual, but he is not the kind of guy who likes to be pushed. So what he does in effect, he has a way of listening to you to make it appear as though you are the only person in the world who matters. And then when it’s all done, you say now what does he believe?

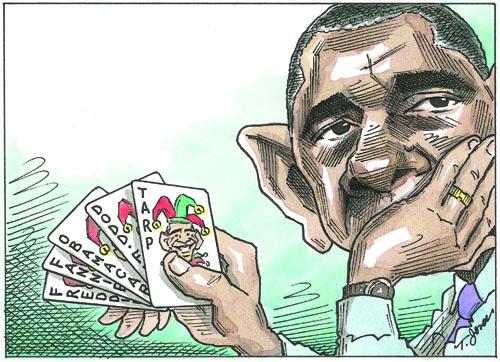

He is amazingly good at playing sort of intellectual poker. But that’s actually a disadvantage, because if you don’t put your ideas out there to be shot down, you are never going to figure out what kind of revision you want. What is characteristic of his temperament of mind right now is that he is basically set in concrete. If he thought a stimulus would work in 2009, he thinks it today.

Gillespie: Let’s talk about the stimulus. Critics say it’s like taking one bucket of water from an end of the pool or a cesspool and dumping it in the other—it doesn’t get you anywhere. Are there any surprises with stimulus spending?

Epstein: No. I mean, I think only the following—when you run these stimulus programs you tend to use models of consumer behavior that work in good times, but there is no guarantee that they will work in bad times. So the idea was that if you put more money into the pockets of middle- and lower-income-class people, you get higher levels of consumption. It hasn’t worked out that way. Why should it work out that way? These people have consumer debts, they are behind in their mortgages, and they want to save for college. They will change their strategies as they see the world of opportunity shrink, so they will save more and spend less.

Gillespie: Would tax cuts have stimulated the economy?

Epstein: Permanent tax cuts would have that effect, and a flattening of the tax rates. The old Adam Smith adage is correct: low, easy, and reliable taxation is what commits people to long-term investments. If you give a short-term cut with a gimmick, then people are going to worry—what about next year?

Gillespie: What about people like David Stockman, who was Ronald Reagan’s budget director, who says that given the huge amounts of federal debt and deficit, extending the Bush tax rates forward at any level is a problem? Does that make sense?

Epstein: I think the problem about the political economy of David Stockman is he doesn’t realize that increased revenues don’t go to discharge debts, they go to create new debts. So I have no confidence in that proposal. What you need to do is to take a pickax or a hammer or some very large tool and cut out huge numbers of government programs.

Gillespie: What is the first government program that you’d cut?

Epstein: It’s difficult to know, but agricultural subsidies and import barriers are certainly a very obvious place in which to start. Knock out something like ethanol. Certainly you want massive liberalization with respect to labor markets. You don’t want to have strong civil rights laws, which only gum things up. You want to get rid of the Family Medical Leave Act and so forth. You want to knock out the minimum wage—

Gillespie: What about entitlements?

Epstein: Medicare is a very hard thing to deal with because you create all these expectations for people who are in midstream. What I would like to see done under that is to increase the co-pays and to try to reduce the time that you are in the program by raising the eligibility under these things, and the same thing with Social Security.

Gillespie: Should there be means testing?

Epstein: Then you increase the level of income redistribution that is going to take place in society. You get more high marginal taxes on the most productive individuals and what you gain in the savings under the Medicare program, you are likely to lose in overall terms of productivity. I’m just basically a strong flat-tax guy, because I don’t think an economy runs as well when you have all these peaks and valleys inside the operation. You just have to cut back.

Gillespie: What aspects of President Obama’s health care bill do you think will be most detrimental to patients?

Epstein: Well, I think the whole thing in many cases will be so, because of the constant intrusion of third-party providers—i.e., the government—in the physician/patient relationship. The one area that is causing the greatest short-term problem is to try to figure out what you do with these medical loss ratios with respect to private plans. Because what happened is the Democrats in Congress, with some Republican acquiescence, said we know that the reason why things are too expensive is that, by God, there is too much waste in the system. Competition doesn’t control costs. So they mandate price controls and it’s going to be just like rent control: the only way you can meet the price control requirements is in effect to reduce the quality of the services.

Gillespie: What’s the outlook for the legal challenge to ObamaCare?

Epstein: It’s actually better than one had thought. There are two kinds of challenges that could be made; one of those is facial challenge on the medical mandate. And when the case was brought—

Gillespie: That’s the coverage mandate that everybody has to enroll?

Epstein: Two thousand dollars if you don’t get these plans. Randy Barnett, for example, who helped organize this, did a very clever job of advocacy for two reasons. One, he dreamed up an argument which didn’t threaten Social Security and Medicare with constitutional extinction; and two, he gave a relatively clear line, so now it’s the government that has to face the slippery-slope problem. If you could force us to buy [medical insurance] . . . why can’t you force us to brush our teeth three times a day, have certain kinds of balanced diets, do exercise? And it turns out that you get yourself into a totalitarian state. So it was a peculiar mixture of libertarian sentiments, with jurisdictional issues. It was very well done.

Gillespie: What do you think the odds are on the legal challenge working to invalidate ObamaCare?

Epstein: Twenty percent, I would say, 25, but this is up from 5–10 percent. But I do think that as the politics become more controversial and the unpopularity of the plan becomes more evident, the willingness of judges to entertain novel arguments will increase and therefore the odds will start to move up.

Gillespie: Let’s talk about financial reform. In July, Obama signed the Dodd-Frank Financial Reform Act. Will this bill make good on claims that it will simplify consumer credit markets and inoculate us from bank bailouts?

Epstein: Let me start with the consumer credit markets. I am now one of the lawyers working for a bank called TCF, which is the old Twin City Federal Bank, and we filed suit in South Dakota trying to declare this statute unconstitutional insofar as the Durban Amendment specifies in very precise detail the amount of money that is collected that the retailer has to pay to Visa for processing the stuff, its own bank for processing the thing, and most importantly for the banks that issue the debit cards to maintain their very extensive network. And essentially what happens in our case, to give you the numbers, is right now on a typical $35 debit card transaction, TCF Bank gets 47 cents. When you are done looking at the numbers under this particular statute, that number is down to 7 cents.

The theory of the statute is, well, just raise your rates to your customers, as if you could do that. But unfortunately, all banks with under $10 billion in assets are exempt from the statute. We know what the market looks like—if you raise your rates, you will lose your customers in droves. So we are basically between a rock and a hard place, and the challenge is to take the price restrictions on the one hand and the alternatives of unregulated firms on the other, and you have a confiscatory/regulatory scheme.

We filed that case and I actually think it’s a pretty solid case. It’s unlike the health care situation. These costs are very carefully analyzed and so forth. The program is certainly going to create absolute chaos inside the market and everybody knows that, and I think the constitutional challenges will win. I don’t think that constitutional challenges are likely to win to the two-tier stuff that you see with respect to the rest of Dodd-Frank—big banks that are too big to fail going in one area.

Gillespie: It definitely won’t inoculate us from—

Epstein: Nothing will inoculate us. These banks are insanely large. To just give you a perspective, TCF is a pretty big bank—they have $18 billion in assets, a real company. Chase has a hundred times that size, it’s $1.8 trillion or something. The left hand does not know what the right hand is doing. And the third feature is—Senator Dodd came here and spoke at NYU and somebody asked him: What about Fannie and Freddie? He said, “Oh, we couldn’t tackle it at this point.” Well, that is obviously the biggest source of problems that we have, and if that continues—

Gillespie: How is that the biggest source?

Epstein: Because these people are completely irresponsible in the way in which they issue and guarantee loans. So what they do is they put more crapola into the market and you get cheap mortgages and what you do is you bid up the price of assets and then you wait for the crash to come and you will get more default. In fact, one of the terrible things in the Obama administration is they will not “let nature take its course” by constantly trying to fend off foreclosures, which means that the market never clears, these properties are held in overhang, and people who could actually afford to buy them at market prices are excluded from the market. On this issue, they get themselves a straight “F.”

Gillespie: What are policies that Congress and the president could have gotten behind that would prevent massive bank bailouts?

Epstein: For one thing, make it very clear that we don’t guarantee you in the event of loss and that if counterparties want protection, they better get it either from their trading partners or a third party. Because the tougher you are at the beginning, the less likely it is that you are going to have these kinds of situations and you won’t get the mad scramble where an AIG bailout essentially works for the benefit of Goldman Sachs, who is by far the shrewdest player in all of this stuff. The more solid market depends upon having large numbers of intermediate-sized players. Something like BB&T Bank is about $150 billion worth of assets—that’s plenty big to do virtually any transaction that you need—but it’s not going to create systemic risk. The real systemic risk that you create is having five major banks, which amongst them have $10 trillion worth of assets floating around in their coffers.

And you asked what I would do more generally. The basic mechanism is mutual gains through trade. Every regulation basically has to be justified because the moment it limits gains from trade, you have to explain why it’s needed. And these guys that impose these regulations like they are candy going down the throat of a two-year-old: it just tastes sweet, we better do more of it.

Gillespie: In the large sense of shifting from a rule by kind of an aristocratic fiat or monarchical fiat to a government of rules—that’s an old shift from a kind of feudal mentality to a republican one (small-R republican)—what do you do to spread that and make that more persuasive?

Epstein: You simply—and I think that’s the message that you get out of this election—you show people that all the ingenuity of gimmicks fails. You gave the figures at the beginning. We have more debt, more unemployment, and less happiness in this country now, because hope and change turns out to be discord and confusion. And there’s no way that you can stop that. You cannot stop the blunders of one government program by putting another one on top of it. That’s what I learned in the Yale Law School. You don’t like what the minimum wage does, you create a welfare program. You don’t like what a welfare program does, you just get a back-to-work program. If you just got rid of the minimum wage, you would get rid of three programs and free up lots of economies. What people have to understand is that Mies van der Rohe was essentially a political theorist when he said, “less is more.” You get more production out of fewer regulations. And one of the great tragedies is that we’ve spent all this time on monetary and fiscal policy, where regulatory policy, taken in the round and taking particular cases, is in fact every bit as important.

Gillespie: A liberal friend of mine asked me to ask you: how do you sleep at night?

Epstein: Let me put it this way: I don’t stay awake because of a guilty conscience.

Gillespie: Well, thank you, Richard Epstein.