Over the course of a long friendship, Alan Greenspan and I have generally found ourselves in accord on monetary theory and policy, with one major exception. I have long favored the use of strict rules to control the amount of money created. Alan says that I am wrong and that discretion is preferable, indeed essential. Now that his 18-year stint as chairman of the Fed is finished, I must confess that his performance has persuaded me that he is right—in his own case.

His performance has indeed been remarkable. There is no other period of comparable length in which the Federal Reserve System has performed so well. It is more than a difference of degree; it approaches a difference of kind. For the first 70 years after it opened in 1914, the Fed did far more harm than good, presiding over inflation in two world wars, converting a moderate recession into the Great Depression, and then, in the 1970s, producing the most serious peacetime inflation in our nation’s history. We would clearly have been better off for those 70 years if the Federal Reserve System had never been established.

In 1979, Paul Volcker was named chairman of the Fed (at the time, he was president of the Federal Reserve Bank of New York). The great inflation of the 1970s was still raging and became a major issue in the 1980 presidential election. After the election, Ronald Reagan encouraged Volcker to take whatever measures were necessary to tame the beast. Supported by President Reagan, Volcker broke the back of inflation, in the process producing a recession. The recession produced a public reaction that seriously lowered the president’s popular standing. Fortunately, President Reagan did not waver in his support, reappointing Volcker to a second term. He later appointed Alan to succeed him as chairman.

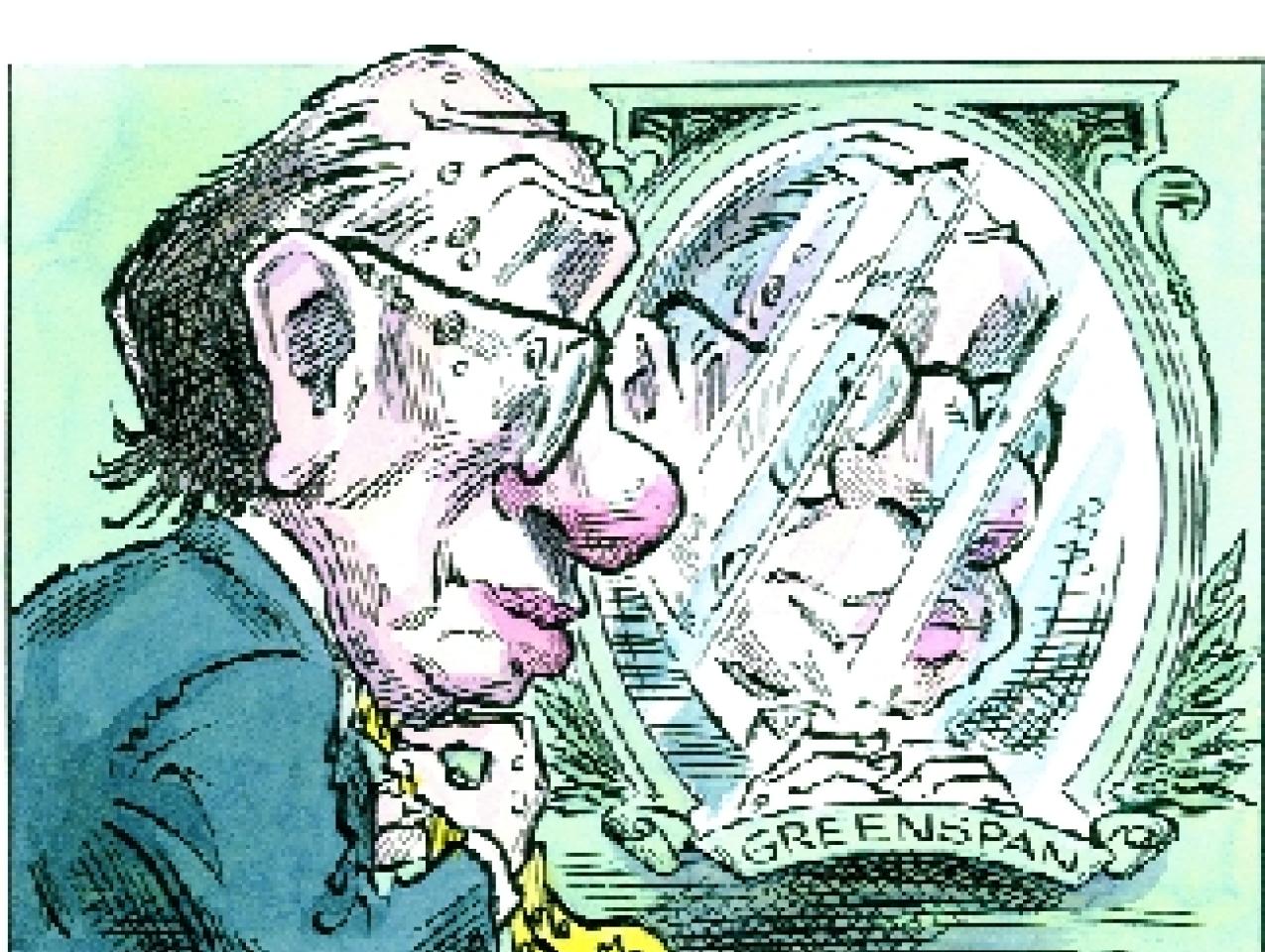

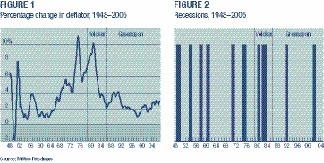

Figure 1 shows what a difference ending inflation made. It plots the year-to-year percentage change in the price index used to deflate the gross domestic product. I use the price index because the key responsibility of the Fed is to keep the price level stable—one source of Alan’s success is that he recognized that fact. It takes the whole space from top to bottom to record the inflation rates before the Greenspan era. It takes only the bottom strip to record the inflation rates for the Greenspan era.

Inflation averaged 3.7 percent a year from the end of World War II to the Volcker era but only 2.4 percent a year during the Greenspan era. Even more important, inflation was much less variable. In the pre-Volcker postwar period, it ranged from a low of –2 percent to a high of more than 11 percent; in the Greenspan period the range was from a low of 1 percent to a high of 4 percent. Stated differently, the standard deviation of the inflation rates (a measure of variability) was three times as high during the pre-Volcker period as during the Greenspan period (2.6 versus 0.8).

Greater price stability had far-reaching effeacts. By greatly reducing the uncertainties, enterprises could use their resources more efficiently and steadily. Price stability fostered innovation and supported a high level of productivity. (See figure 2, which plots every month of recession as a vertical line, illustrating the effect.) Of the 379 months from January 1948 to Volcker's accession, 17.4 percent are months of recession; of the 220 months of Greenspan's tenure, only 7.3 percent are.

It has long been an open question as to whether central banks have the technical abilty to maintain stable prices. Their repeated failures to do so suggested that they did not—whence, in part, my preference for rigid rules. Alan Greenspan's great achievement is to have demonstrated that it is possible to maintain stable prices. He has set a standard. Other central banks around the world, whether independently or by following his example, are following suit. The timeworn excuses for the failure of central banks to stem inflation will no longer do. They will have to put up or shut up.

This essay appeared in the Wall Street Journal on January 31, 2006.

Available from the Hoover Press is The Essence of Friedman, edited by Kurt R. Leube. To order, call 800.935.2882 or visit www.hooverpress.org.