- Economics

- US Labor Market

- Budget & Spending

- Law & Policy

- Regulation & Property Rights

- Education

- K-12

- Health Care

- Politics, Institutions, and Public Opinion

- State & Local

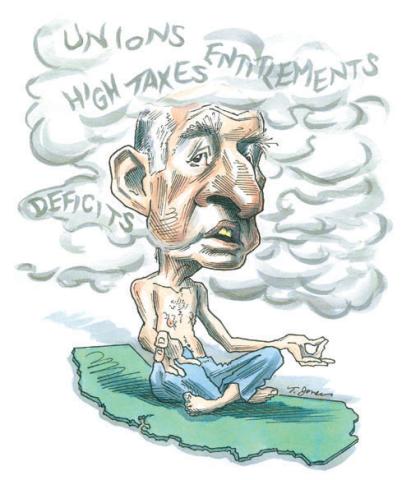

- California

Long a harbinger of national trends and an incubator of innovation, cash-strapped California spent the spring eagerly awaiting a temporary revenue surge from Facebook IPO stock options and capital gains. Meanwhile, Stockton teetered on the brink of bankruptcy. Call it the agony and ecstasy of contemporary California.

California’s rising standards of living and outstanding public schools and universities once attracted millions seeking upward economic mobility. But then something went radically wrong as California legislatures and governors built a welfare state on high tax rates, liberal entitlement benefits, and excessive regulation. The results, though predictable, are nonetheless striking. From the mid-1980s to 2005, California’s population grew by ten million, while Medicaid recipients soared by seven million; tax filers paying income taxes rose by just 150,000; and the prison population swelled by 115,000.

California’s economy, which used to outperform the rest of the country’s, now substantially underperforms. The unemployment rate, 10.9 percent at the start of spring, is higher than that of every other state except Nevada and Rhode Island. With 12 percent of America’s population, California has one-third of the nation’s welfare recipients.

Partly because of generous union wages and benefits, inflexible work rules, and lobbying for more spending, many state programs and institutions spend too much and achieve too little. For example, annual spending on each California prison inmate is equal to an entire middle-income family’s after-tax income. Many of California’s K–12 public schools rank poorly on standardized tests. The unfunded pension and retiree health care liabilities of workers in the state-run CalPERS system, which includes teachers and university personnel, total around $250 billion.

Meanwhile, the state lurches from fiscal tragedy to fiscal farce, running deficits in good times as well as bad. The general fund’s spending exceeded its tax revenues in nine of the past ten years (the only exception being 2005, at the height of the housing bubble), abetted by creative accounting and temporary IOUs.

Now, the bill is coming due. After running a $5 billion deficit last year and another likely deficit this year, Governor Jerry Brown’s budget increases spending next year by $7 billion and aims to pay for the higher spending with income and sales-tax hikes. Specifically, he’s proposing a November ballot initiative to raise the state’s top income tax rate to 12.3 percent, making it the nation’s highest, and boost the basic state sales-tax rate, already the nation’s highest, to 7.75 percent from 7.25 percent.

While Brown deserves credit for some earlier spending cuts to reduce a large inherited budget shortfall, the budget fails to address long-run structural problems, counting on a cyclical economic recovery and stock bubble for a bailout until the next self-inflicted crisis. Moreover, he’s thus far failed to embrace a bold reform agenda to save money, improve services, and restore confidence among the state’s beleaguered taxpayers and bond holders.

The ballot initiative’s $31 billion, multiyear “temporary” tax increase is larger than the “temporary” hike it replaces, and its income-tax increase would be retroactive to January 1. Worse, it doubles down on excessive reliance on high-income taxpayers, especially their stock options and capital gains, which are taxed as ordinary income. During economic good times, it’s not unusual for the state to collect one-half of all income-tax revenue from the top 1 percent. This extreme progressivity leads to boom-bust cycles of rapidly rising revenue followed by complete collapse. Not surprising, the revenue is all spent on the upswing, forcing disruptive “emergency” cutbacks on the way down.

The state’s progressive tax-and-spend experiment is broken, threatening basic services, from courts and parks to education and health care for its most vulnerable citizens. Brown’s tax initiative only exposes the state to an ever more dangerous roller-coaster ride.

No wonder many Silicon Valley CEOs say they won’t expand in California because of high taxes and burdensome regulation. And no wonder net migration has recently reversed, with hundreds of thousands of workers and their families leaving the state in search of better opportunities.

California still ranks first in technology, agriculture, and entertainment among the fifty states. But it is near the bottom in business and tax climate and state bond ratings. It’s a complex picture, but at its core is the high-tax welfare state run amok.

Many Americans fear the federal fiscal train wreck will turn our nation into Greece. But, barring major change, they need look no further than California to see what this future portends. Relying on ever-higher taxes to fund payments to an outsized population of benefit recipients is a recipe for exporting prosperity. That is one California trend that other states emulate at their peril.

No one should write off California. It still has great strengths. And it can turn some of its short-term challenges, such as the pressures from ethnic and linguistic diversity (the state is now 37 percent Hispanic and 13 percent Asian), into long-term strengths in the global economy. But the political class must face up to the reality that services will have to be far more carefully targeted; the tax system overhauled with lower rates on a broader base of economic activity and people (almost half of all Californians pay no state income tax); and inefficient state programs reformed to spend less and produce far better outcomes.

Brown is a man of ideas, having run for president in 1992 on a bold flat-tax agenda. Instead of still more antigrowth tax hikes, he should break the grip on the state legislature of his party’s special interests: public employees’ unions, trial lawyers, teachers’ unions, and extreme environmentalists.

A California renaissance—building on the best reforms in budgeting and taxes, education, welfare, crime prevention, and pensions by such leaders as Rudy Giuliani, Jeb Bush, Chris Christie, and Andrew Cuomo—is still possible. What it requires is a governor with the vision, determination, and political will to see it through.