- Economics

- US Labor Market

- Law & Policy

- Regulation & Property Rights

- History

- Economic

- Politics, Institutions, and Public Opinion

- The Presidency

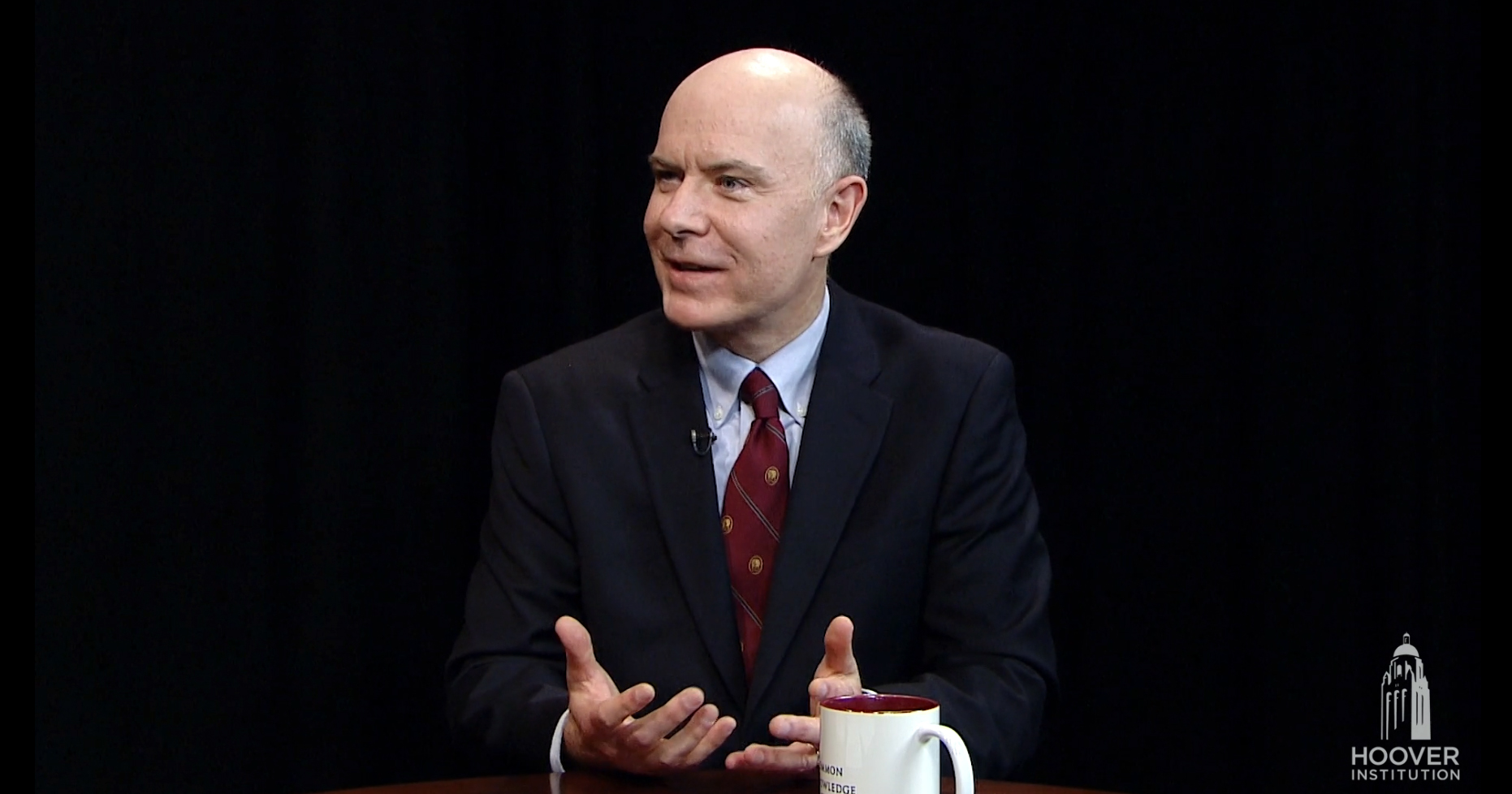

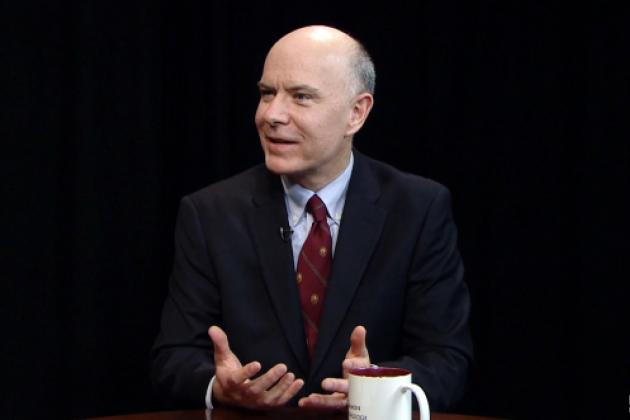

Recorded on December 2, 2016

Professor Douglas Irwin defends the benefits of free trade and explains why protectionism, high tariffs, and currency wars could cause economic problems. Irwin explains the misconceptions around trade surpluses and deficits and the historical consequences and benefits of trade. He talks about an absolute versus comparative advantage with trade and why and how a trade deficit with China still benefits the United States. Irwin refers to Adam Smith’s view of trade in explaining the absolute advantage of trade. Smith argued for unregulated foreign trade, reasoning that if one country can produce a good, for example, steel, at lower costs than another country, and if a different country can produce another good, for example, an iPhone, at lower costs, then it is beneficial to both parties/countries to exchange those goods. This has become known as the absolute advantage argument for both international and domestic trade.

Irwin notes that trade still benefits the United States enormously and that striking back at other countries by imposing new barriers to trade and/or ripping up existing agreements would be self-destructive. Finally, Irwin talks about problems within the American economy, how too many people are not working, which cannot be blamed entirely on the trade deficits. Some reasons people cannot find jobs are mechanization, efficiency, productivity, technology, and skills. Irwin discusses a few options for helping people with limited education and few skills survive, including paying a basic wage, improving our educational system, and reducing regulations so the costs of hiring an employee are not as steep.