- Budget & Spending

- US Labor Market

- Economics

- Law & Policy

- Regulation & Property Rights

- Monetary Policy

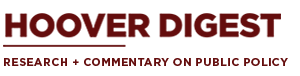

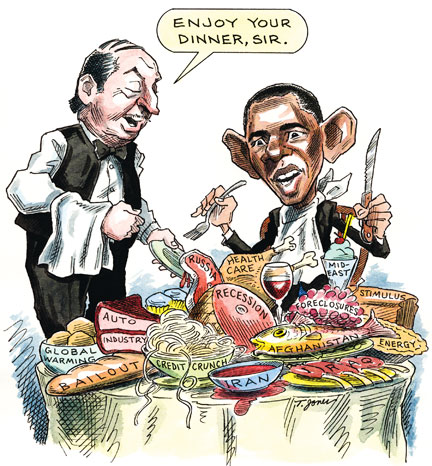

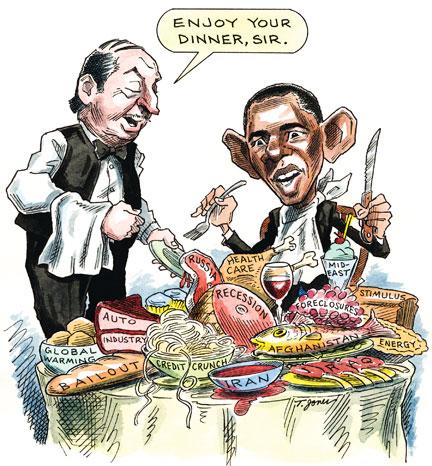

The new administration has a full plate. It will need to continue to inject capital into the financial system and take measures to ensure the functioning of the payments system and short-term credit markets. It will also need to return to the mortgage problem and reset terms, avoiding a flood of foreclosures— for efficiency, equity, and political reasons. It will then need to inject a fiscal stimulus while communicating a plan to return the budget deficit to more sustainable levels in the medium run. It will need to coordinate policies with other major economies to avoid unintended and unwanted volatility in capital flows searching for the safest haven. It will need to structure its ownership and substantial control of the financial sector so as to make it possible for private capital to re-enter as the damaged balance sheets get better and the visibility/transparency improves. After the crisis, it will need to thoroughly examine the systemic failures with a view to redesigning regulatory oversight.

Priorities will have to be set on the fly as conditions shift, often rapidly. The overriding priority should be to have a top-flight team in the Treasury Department, led by a secretary who, like outgoing Secretary Paulson, has experience and stature in the financial sector.

Let’s review some of the recent attempts to repair the U.S. economy, which, along with much of the rest of the developed world, has been enveloped by the collapse of an asset bubble fueled mainly by excess leverage.

Collapsing asset values led to damaged balance sheets in major financial institutions, capital adequacy problems, and a drying up of credit, which is the most serious. The unavailability and cost of credit led to further collateral damage to assets, an inability (or, in some cases, unwillingness) to raise additional capital, and a widening of the credit problems.

Central banks have been injecting capital, taking on an ever wider and riskier array of assets as collateral. And interventions with respect to specific institutions have been growing bigger and more frequent.

Yet it became clear to the Fed and the Treasury Department—as panic developed and short-term credit dried up—that the case-by-case approach was unlikely to solve the problem or, at least, was a much riskier path than a more comprehensive approach. It was as if we had a very good and alert fire department but too many actual and potential fires to make the firefighting mode by itself an effective resolution of the problem.

As the list of distressed or at-risk financial institutions grew, and the frequency of emergencies increased, investors panicked and credit markets locked up. Banks stopped lending to one another. The transparency fog surrounding derivative securities did not help; locking up credit markets dramatically increased the likelihood that the fear that every institution was at risk would become a reality—a case of self-confirming expectations. This led the Fed and Treasury to conclude that dealing with emergencies case by case was, although necessary, far from sufficient. In this judgment, and in the need for action and speed over design fine-tuning, they were surely right.

The pressing issue is restoring credit at a reasonable cost, so that the financial sector, the business sector, and the housing markets can function. A failure to restore credit would produce much wider and deeper damage than just the resetting of the values of assets and liabilities, the concomitant deleveraging, and the failure of a few financial institutions.

RIPPLES FROM A SINKING HOUSING MARKET

One should ask why a housing bubble, brought on by low interest rates and the inappropriate and excessive extension of credit, has caused such a widespread financial crisis.

The short answer is balance sheets. Through securitization—the packaging and repackaging of mortgages (and securities backed by mortgages)— the holding of the highly leveraged and now damaged securities was widespread, including by all the principal financial institutions that supply credit to the economy.

Insurance also played a role. Securities that looked risky were nevertheless rated highly and purchased in part because of the addition of credit insurance. But insurance works only when individual risks are substantially uncorrelated in the pool being insured. No one would undertake to provide hurricane insurance for a single town on the Gulf Coast. When risk is as systematic as it has become in the financial sector, you can’t provide insurance without an enormous capital underpinning. That was not in place.

The profitable business of providing insurance until the risk materialized morphed into financial distress, and the insurance vanished, further damaging credit ratings and balance sheets. This is not to say that derivative products are not useful in moving risk around; they are. But major revisions in the way risk is assessed will be an important part of the aftermath of the crisis, including considerations of appropriate capital requirements and regulations.

To deal with the credit lockup, capital has to be injected into institutions and, if possible, a value established for some of the assets that they already hold. Unfortunately, almost all the institutions that are the normal channels for credit have been damaged and have capital-adequacy problems. Private and sovereign-wealth-fund capital, which was injected earlier, did not fare well and, as a result, dried up. It is widely accepted that at this stage the only viable source of capital is the government.

The challenge, then, is to inject capital into the only channels we have for providing credit—to wit, existing institutions such as the major banks— without bailing out the existing investors. (If by “bailing out” one means adding value, with the starting point being the current depressed prices for equity and preferred stock in the financial sector, it is probably impossible to inject capital and avoid bailouts unless the government takes ownership of a substantial fraction of the sector, at least for a while.)

PUTTING THE BAILOUT INTO ACTION

The bailout legislation passed last fall set out to inject capital by allocating $700 billion to buy mortgage-related assets. Other provisions include limits on executive compensation, having equity in the form of warrants or options for institutions that sell assets to the Treasury, and a commitment to resetting mortgage terms aggressively to limit foreclosures and help households with debt service they cannot afford. In addition, deposit insurance in banks has been expanded and tax adjustments added for political reasons.

One clear goal is to help households whose mortgage balances exceed the current value of the house or who cannot pay the interest and principal. This important political step can be accomplished by purchasing bundles of mortgages, resetting the terms of the loans, and avoiding foreclosure.

A second goal is to initiate a process in which something like market values are established for assets whose value is currently highly uncertain, or discounted dramatically, to attain counterparty solvency, visibility, and transparency.

The third is to inject capital into the system by replacing highly discounted or underpriced assets with cash. But what is the “right” price for these purchases? Arguments run roughly as follows: if the purchases are made using the current, extremely distressed prices, not much capital will enter the system; if the purchases are made at higher prices, the institutions are being bailed out, with the taxpayer footing the bill, or there is warrant dilution.

The theory of the case, as outlined by experts like Bill Gross and Warren Buffett, is that the assets, when properly managed with ample capital backing, have intrinsic value that can be arrived at by hard work and due diligence. Further, these assets can be purchased at well below those intrinsic values because the holders and other potential buyers do not have adequate capital.

The assets should be purchased at a discount to intrinsic value so as to yield a reasonable return (7 percent) on the taxpayers’ investment but above the current market value (if there is one) of the assets. The sellers gain because they add capital and reduce distressed assets—and because markets that are currently closed to these mortgage-related assets begin to open and prices are established, restoring both value and visibility to parts of the balance sheets.

This does not mean that solvency will return to all institutions but that a more realistic assessment of their value will emerge, making it easier in some cases to raise private capital. In other cases, the institutions will be insolvent, even with more realistic asset valuations, and will go into Chapter 11 and be dismantled or acquired.

The level of rigor of the due diligence used to sort through the wide spectrum of quality in the asset pool is crucial to the success of the program. Without high levels of rigor, the government could end up purchasing assets at the bottom of the quality spectrum, knowing less about the underlying quality than the sellers.

The government, with patient capital, holds the mortgages, resets terms, and waits for private capital to enter the system. If the due diligence was done well, market prices (including housing prices) will, over time, return to something like their intrinsic values, at which point the government will be inclined to sell the assets and mortgages at a measured pace.

Will this work? It could. No one knows for sure. But $700 billion is not enough additional capital. The bailout will, therefore, stand or fall on whether it causes private capital to return to the sector. It is even possible that, if the strategy works, large external holders of treasuries will find the risk-return mix attractive.