- Law & Policy

- Regulation & Property Rights

- Budget & Spending

- Contemporary

- Health Care

- Economics

- History

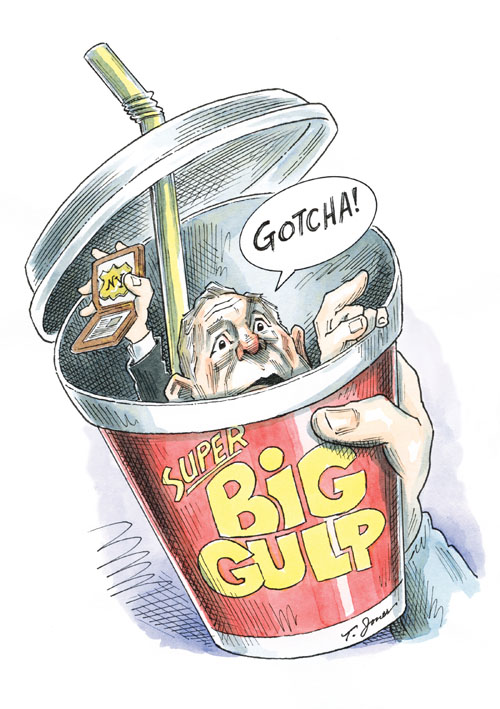

How far should governments go in interfering with consumer choices? New York Mayor Michael Bloomberg has won a ban on sugary drinks larger than sixteen ounces from restaurants, street carts, movie theaters, and stadiums. This might seem like joke fodder for late-night comics were the mayor not completely serious—never mind that the proposal makes little sense and could even increase the consumption of those drinks.

On one side of the question are libertarians who argue that individuals, particularly consumers, should be free to make their own choices unless those choices hurt others. According to this view, consumers have the right to drink and eat what they prefer. Driving while drunk should be punished, of course, because drunk drivers are more likely to get into accidents that harm others. One qualification under this view is that when consumers do not have enough information to make good decisions, governments may help in providing that information. For example, packaged foods are required to show the amount of fat and certain other ingredients they contain.

On the other side are those who claim that many consumers are unable to make decisions in their self-interest. These consumers, according to this argument, may be fooled by the way choices are presented, have limited self-control, rely on inefficient rules of thumb, or for other reasons make bad choices. There is even a literature on “libertarian paternalism,” which argues that governments “should attempt to steer people’s choices in welfare-promoting directions without eliminating freedom of choice,” as Cass Sunstein and Richard Thaler wrote in a research paper, Libertarian Paternalism Is Not an Oxymoron.

LOOKING FOR WISE DECISIONS

Consumers do not always make choices in their own interest, even when they have sufficient information. But I do question how pervasive unwise decisions are, especially for important matters. And I have misgivings about using the government to try to improve consumer choices.

It is not clear that government bureaucrats generally understand why consumers make defective decisions. It is even less likely that government policies will help improve those decisions. As is well known, government officials, including regulators, legislators, and executives, are subject to powerful pressures from interest groups that often greatly affect public policies, to the detriment of consumers.

To illustrate, consider subprime borrowers in the housing boom (or bubble) whose loans came crashing down with the financial crisis. It is frequently argued that subprime borrowers were ignorant of the risks they were taking, and were fooled by lenders and others into buying houses with mortgages that they would be unable to handle.

Yet the decisions by subprime borrowers made a lot of sense in light of the very low—sometimes nonexistent—down payments that lenders required, and the low mortgage interest rates available. These borrowers had perhaps a once-in-a-lifetime opportunity to be owners rather than renters. Certainly some families might not have bought their homes if they had known a crash was coming, especially those who took out loans a year or two before the crash. But how could they reasonably have been expected to know that, when few housing market experts were predicting a crash? The banks that bought subprime and other mortgage-backed securities should be far easier to blame. They presumably were much more knowledgeable about housing markets than poor and first-time homebuyers, yet along with homeowners most banks suffered badly from the financial crisis.

Nor did the federal government, including the Federal Reserve, take actions that helped subprime and other homeowners. Leading members of Congress and other government officials pressured banks to offer mortgages on generous terms to consumers with bad credit histories and poor job prospects. The Fed contributed to the housing bubble by helping to keep interest rates low. Consumers made their housing decisions in an environment where both banks and governments actively promoted the purchase of homes with low interest rates and down payments.

To take another example, consider the obesity among adults and teenagers that encouraged Mayor Bloomberg’s proposal on sugary drinks and similar efforts by others. It is argued that many adults and teenagers do not know the health consequences of their diets and lifestyles. That may well be true for some, but most may be rationally trading off the negative long-run effects on their health for more immediate enjoyment from french fries, cheeseburgers, and other weight-raising foods. One should demand evidence that the great majority of obese adults fail to make the connection between diet and health before one tries to restrict their consumption.

We should also recognize that many of the restrictions, including Bloomberg’s, would not reduce obesity by much, if at all. The mayor’s idea might even increase the consumption of sugary drinks. Suppose that drinks came only in ten- and sixteen-ounce sizes. Many consumers might substitute two ten-ounce drinks for a single sixteen-ounce drink and thus increase their total consumption—as well as New York’s.

THINK OF THE CHILDREN

Children are less likely than adults to make an effective tradeoff between current pleasures and future costs. Traditionally this is why we distinguish between children and adults when formulating policies. The implication in the case of sugary drinks would be to restrict access by children to these drinks. For example, they could be banned from schools and other places where children congregate. Young people might be forbidden to buy them. However, concern about children’s consumption does not justify restricting the choices of adults as well.

Taking another tack, some people attempt to justify government policies against obesity by saying that obese adults are less healthy and therefore put a greater burden on a health care system financed by taxpayers. This argument has merit, but figuring out the true impact of obesity is not easy. If obese people died earlier than others and therefore spent less on health care over their lifetimes, should obesity instead be encouraged? No one would argue that point of view. And on the consumer level, the mortality effect does not necessarily enter into externality calculations because (rational) individuals consider the effects of their behavior on their own life expectancy.

Consumers may not make decisions in their own self-interest, but that failing does not provide sufficient ground for governmental efforts to regulate and tax these decisions.