Concepts bearing the name of Hoover senior fellow John B. Taylor have become so pervasive that Federal Reserve Board Chairman Ben Bernanke has joked that “with our appetites whetted by the Taylor rule, the [Taylor] principle, and the [Taylor] curve, we now look forward to the Taylor dictum, the Taylor hyperbola, and maybe even the Taylor conundrum.”

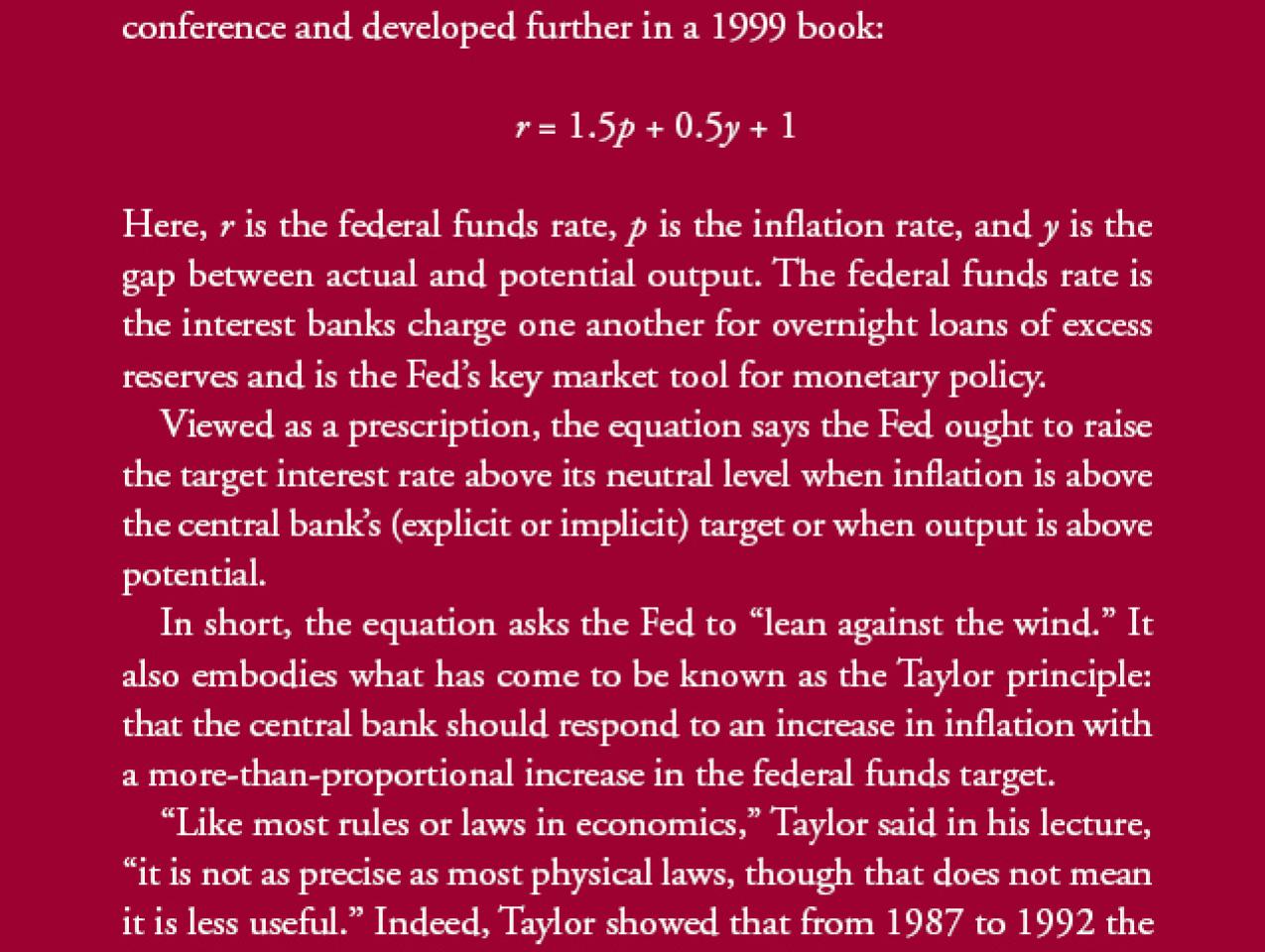

The best known of these concepts, the Taylor rule, is a simple equation that the Stanford economist propounded in 1992 to describe the response of the Fed’s interest-rate target to inflation and business cycles. The equation succeeded as both description and prescription: it described how the Fed had been setting its interest-rate target and prescribed what the Fed ought to—and might—do next. The equation quickly gained wide acceptance among central banks as a useful guide for policy.

The Taylor rule is as influential as ever—and now it has been celebrated. A conference on “John Taylor’s Contributions to Monetary Theory and Policy” was held at the Federal Reserve Bank of Dallas in October 2007. The first deputy managing director of the International Monetary Fund, John Lipsky, a graduate-school classmate of Taylor’s, said: “If there had been a yearbook of our Ph.D. cohort at Stanford, the caption beneath John’s picture might well have stated: ‘Most Likely to Develop a Successful Monetary Policy Rule.’ His interests and training surely pointed toward such a contribution.”

The academic work laid the foundation, Taylor agrees, but what “made it all gel” was his policy experience in Washington during two stints at the U.S. Council of Economic Advisers (CEA). Indeed, Taylor’s career has been marked by an easy back-and-forth between academia and policy making, most recently as the U.S. Treasury’s top official for international affairs.

FROM DISCRETION TO RULES

Until the 1970s, the workings of the Fed and other central banks were shrouded in mystery. Monetary policy was considered an esoteric topic best left to the discretion of technicians. The problem was that this use of discretion often led to costly mistakes: for example, during the Great Depression, when the Fed sent the economy into a tailspin by stepping on the brakes instead of the accelerator, or during the Great Inflation of the 1970s, when the Fed let inflation ratchet up to double digits.

The solution, according to conservative economists such as the late Milton Friedman, was to bind the Fed into following fairly rigid rules. In fact, Friedman had for decades been calling for a rule under which the Fed would keep the money supply growing at a fixed rate of about 3–5 percent a year—essentially turning over the conduct of monetary policy to a computer. However, when the Fed tried such money-supply-based rules in the early 1980s, it was unsuccessful: the short-run relationship between the money supply and the economy was too unstable for the rules to be a good guide to monetary policy.

Sympathetic to Friedman’s advocacy of rules over discretion, Taylor was one of a younger generation of conservative macroeconomists interested in devising a monetary policy rule that would fare better. He brought remarkable skills and training that positioned him as the front-runner in the quest to formulate a practical monetary rule. As an undergraduate at Princeton in the mid-1960s, he wrote an award-winning senior thesis that simulated the economy’s response under different types of economic policies. He built on this foundation during his graduate work at Stanford, where he studied with famous statisticians such as T. W. Anderson on so-called joint estimation and control problems: sophisticated statistical methods of simultaneously modeling the behavior of the economy and the choice of optimal economic policies.

At Columbia University, his first position after graduate school, he worked with Edmund Phelps—who won the Nobel Prize in 2006—on models that incorporated sticky, or sluggish, behavior of prices and wages. By bucking the then-prevalent academic trend of assuming flexible prices and wages, Taylor was able to impart greater realism to his models and make them more palatable to those working on models at the Fed and other central banks.

Both Taylor and fellow faculty member Guillermo Calvo went on, among their other academic achievements, to do pathbreaking work on sticky prices and wages. Indeed the terms “Taylor contracts” and “Calvo contracts,” referring to the alternative ways that the two proposed for capturing sluggish wage and price behavior, have both entered the lexicon.

A BRIEF, PRACTICAL EQUATION

It was during his two tours at the CEA that Taylor discovered the practical side of making monetary policy. As a staff economist in 1976–77, he learned the importance of economic concepts such as potential GDP and the natural rate of unemployment. One major achievement of the CEA during this time, he says, was to bump up the estimate of the U.S. natural rate of unemployment from 4 percent to 4.9 percent. “The political people were scared of going up to 5 percent,” Taylor says. “It was a bit like gas stations pricing gasoline at $1.995 a gallon instead of $2.”

In 1989—he had by then moved from Columbia to Stanford—Taylor returned to Washington after President George H. W. Bush appointed him one of the three members of the CEA. Among his responsibilities was to serve as the administration’s liaison with the Fed. “I could see that the Fed’s behavior was not as chaotic and discretionary as was often being described,” Taylor says. “Fed officials I spoke to saw themselves as trying to react to events in the economy in a fairly systematic way.”

In 1991, at the end of his second stint at the CEA, Taylor began to think seriously about devising “a simple and practical rule”—an equation that would both help outsiders understand how the Fed behaved and give the Fed a benchmark against which to measure its performance. Taylor presented this equation at the November 1992 Carnegie- Rochester conference. It soon drew plaudits, not just in academia but also in policy-making circles and the private sector. Lipsky, then at Salomon Brothers, gave it an early thumbs-up: “We utilized Taylor’s equation in our December 1993 forecast publication to signal to our clients that a monetary tightening was both overdue and imminent. Indeed, the Fed did tighten in February 1994, a development that confounded the market consensus.”

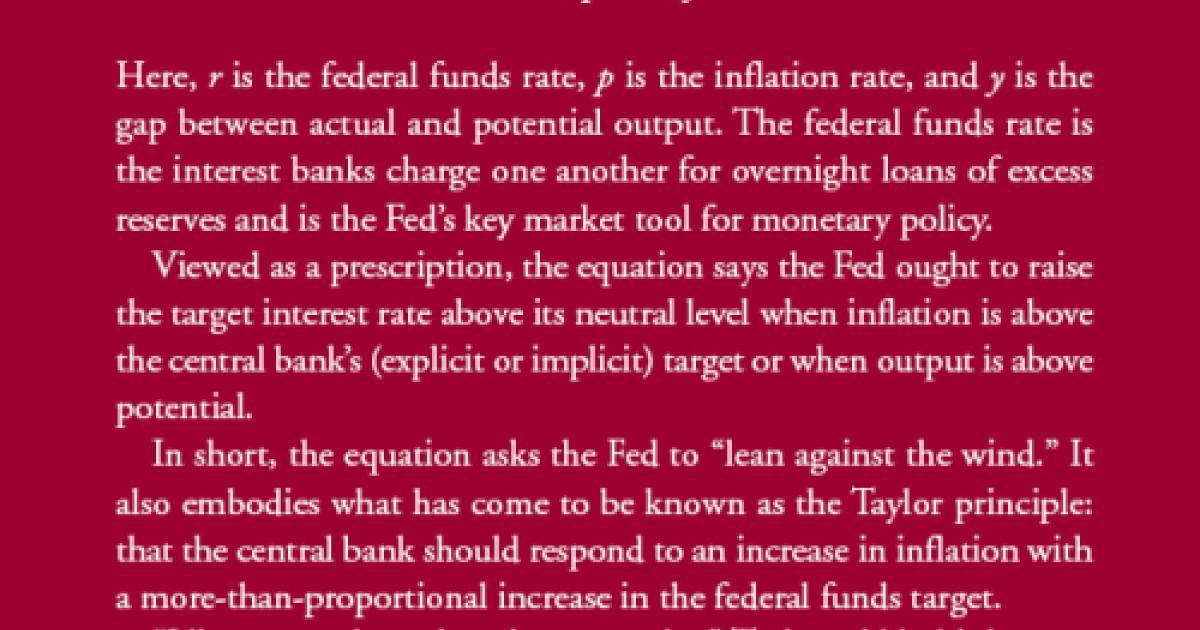

The equation that Taylor proposed was simplicity itself—so simple that he was able to put it on the back of his business card. It said that from 1987 to 1992, the Fed’s setting of its policy instrument, the federal funds rate, had been motivated in large part by two considerations:

- How close the U.S. inflation rate was to 2 percent. If inflation inched above 2 percent, the Fed tended to raise the federal funds rate target to cool inflation.

- How far the economy’s real income was from its potential. If income was below potential, the Fed tended to lower the target interest rate to stimulate the economy.

Taylor showed that if his proposed equation had been adhered to in the 1970s, the performance of the U.S. economy would have been better than it was. Inflation would not have ratcheted out of control because the Fed would have met each increase in the inflation rate (above 2 percent) with a greater-than-proportional response of the federal funds rate—this greaterthan- proportional response of interest rates to inflation has become enshrined as the Taylor principle.

Using the metric of his rule, Taylor gives the Fed mixed grades in its more recent performance. At the 2007 annual economic conference in Jackson Hole, Wyoming, Taylor showed that between 2002 and 2005, the Fed increased the federal funds target rate more slowly than his rule would have suggested. Had the Fed followed the rule, much of the boom in housing starts as well as the subsequent bust might have been mitigated, according to Taylor.

COOPERATION AMID CHAOS

Why did such a simple equation gain acceptance as a successful monetary policy rule? One reason was Taylor’s reputation as someone who had worked on much larger-scale and more complicated multicountry models of the global economy, particularly at a time when few other macroeconomists were doing so. Andrew Levin, one of a number of Stanford graduate students nurtured by Taylor who are in senior positions in the Fed system, says Taylor was always known for “pushing the limits of the Stanford supercomputer” to solve his models. That such a person was proposing a simple rule gave it a credibility it might not otherwise have had.

In 2001, Taylor returned to Washington, this time as U.S. Treasury undersecretary for international affairs in the administration of President George W. Bush. His work centered on rallying political support from finance ministries to freeze terrorists’ assets in the wake of the September 11 attacks. Taylor says he is proud that the September 11 Commission, which examined the government’s response to the attack, gave the work on freezing terrorist finances “its top grade, an A-minus, among a sea of Ds and Fs” given to other aspects of the war on terror.

In this role he again had to deal with central banks but in the very different context—narrated in his 2007 book, Global Financial Warriors— of overseeing the birth of an independent central bank in Iraq and handling the huge logistical challenges of introducing a new currency, the dinar. The highlight of that episode was the printing of a huge amount of dinars, enough to fill twenty-seven Boeing 747s, at seven printing plants around the globe and delivering it via armed convoy to 240 places around Iraq. The task was complicated by Saddam Hussein’s theft of $1 billion from the central bank’s vaults just before his regime fell.

“The image of the Iraqi central bank with its foreign exchange reserves depleted was enough to send shivers up the back of a monetary economist like me,” Taylor wrote. Fortunately, the currency proved so popular that people started trading in their U.S. dollars for the new dinars. The central bank’s foreign reserves rose. “When they rose above the billion-dollar mark, I breathed a sigh of relief,” Taylor wrote.

NEW RULES FOR THE IMF

Taylor’s stint at Treasury was also notable for his attempts to guide the reform of the International Monetary Fund. Consistent with his emphasis on rule-based policies, Taylor thought that “one of the problems with the IMF was that there was too little systematic behavior. Will it bail out a country or won’t it? When will it?” He felt that this lack of systematic behavior helped create uncertainty in the markets and was one reason for “so much contagion” during the financial crises of the 1990s. Taylor therefore strongly supported the reforms adopted at the IMF that sought, in his words, “to put some more rules on the IMF.”

Taylor also championed the IMF’s introduction in 2005 of a Policy Support Instrument, which he has called “an IMF program without the borrowing.” Taylor argues that this new instrument—which has so far been used by Cape Verde, Mozambique, Nigeria, Senegal, Tanzania, and Uganda—allows countries to receive the benefits of IMF programs, such as expert advice on designing economic programs, even when they have no pressing financial needs. Without this instrument, Taylor writes, “IMF loans were being given and then rolled over because they were the only way” for countries to signal to markets and donors that they had received “the important seal of approval” from the IMF.

Back at Stanford, Taylor is active again in teaching, research, and keeping a watchful eye on the Fed. He has been supportive of the Fed’s actions during the recent global turmoil, including the dramatic 75-basis-point cut in the federal funds rate in January 2008. Taylor told the Financial Times that this cut “was moving forward something that was going to happen anyway. The idea of doing it in the middle of very difficult market times seems to me was a good thing.”

This year, as in the past several U.S. presidential elections, Taylor is also busy as an economic adviser to the Republicans. He is working for the campaign of Republican nominee John McCain, which brings him back to Washington frequently. Asked to speculate on the outcome of the election, Taylor laughs and says, “Sorry, I don’t have a Taylor rule to predict what’ll happen in elections.”