- Economics

- Budget & Spending

- Monetary Policy

- Law & Policy

- Regulation & Property Rights

- History

- Economic

- Politics, Institutions, and Public Opinion

The Federal Reserve’s recent announcement that it would purchase $600 billion in Treasury securities has opened a much-needed debate over the central bank’s proper role in economic policy decisions. We share the concerns that many economists and policy makers have expressed about the Fed’s decision to act.

The Fed’s recent departures from rules-based monetary policy have increased economic instability and endangered the central bank’s independence. It is time for commonsense reforms that refocus the Fed on sound monetary policy and remove it from contentious political debates over what policies are best to achieve other national goals.

Policy makers in Washington must recommit to laying the foundations for economic prosperity. Low and equitable taxes, reasonable and predictable regulations, restrained and responsible spending, and sound and honest money are the indispensable cornerstones of sustained economic growth and job creation.

By rejecting Washington’s agenda of tax, spend, and borrow, American voters took a critical step last November toward returning these foundational principles to the center of our fiscal policy debates. But we must also realign our monetary policy if we are to achieve lasting prosperity.

Nearly a century ago, Congress established the Federal Reserve as an independent central bank with the power to control the supply of money and thereby achieve price stability. The administration of monetary policy was rightly quarantined away from legislative deliberations on tax and spending policies.

Yet in the 1970s, Congress endangered the Fed’s independence by giving it a dual mission: promoting “maximum employment” in addition to maintaining “stable prices.” This dual mandate placed the central bank in the middle of heated political debates over economic and fiscal issues.

The Fed’s latest unconventional program—commonly called quantitative easing 2, or QE2—follows the unusual interventions of a year earlier (now known as QE1), in which the Fed bought large amounts of not only Treasury securities but also securities backed by private mortgages.

Quantitative easing is part of a recent Fed trend toward discretionary and away from rules-based monetary actions. The consequences of this trend are clear: the Fed’s decision to hold interest rates too low for too long in 2002–4 exacerbated the formation of the housing bubble. And while the Fed did help to arrest the ensuing panic in the fall of 2008, its subsequent interventions have done more long-run harm than good.

QE1 failed to strengthen the economy, which has remained in a high-unemployment, low-growth slump, and there is no convincing evidence that QE2 will help either. On the contrary, QE2 will create more economic uncertainty, stemming mainly from reasonable doubts over whether the Fed will know exactly when and how to contract its balance sheet after such an unprecedented expansion.

If the money created to finance these asset purchases is not withdrawn in an expedient and predictable manner, the Fed risks higher inflation and a depreciated currency. On the other hand, exiting these programs too abruptly would also disrupt the economy.

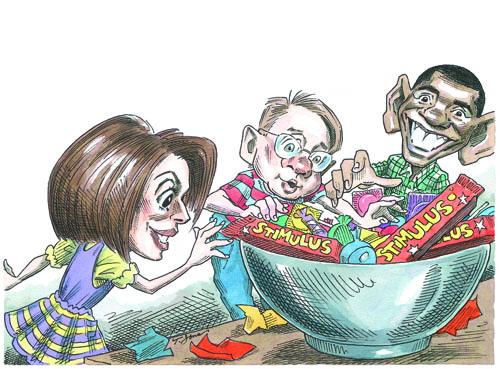

Those economists who believe these risks are worth taking argue that the trillion dollars Congress spent on short-term stimulus bills was not enough, and that the Fed must now step into the breach.

While consistent with the “sugar-high economics” practiced in Washington of late, quantitative easing marks a further departure from the foundations for prosperity and another step toward an increasingly politicized central bank.

QE1 involved the Fed in areas of fiscal policy, such as credit allocation, that are properly (and constitutionally) the domain of Congress. QE2 would double down on these expansions, as the planned purchases of Treasury securities would constitute a large fraction of soon-to-be-issued federal debt.

This looks an awful lot like an attempt to bail out fiscal policy, and such attempts call the Fed’s independence into question.

For all of these reasons, Congress should reform the Federal Reserve Act, particularly the section of the act that establishes the Fed’s dual mandate. The Fed should be tasked with the single goal of long-run price stability within a clear framework of overall economic stability. Such a reform would not prevent the Fed from providing liquidity, serving as lender of last resort, or cutting interest rates in a financial crisis or a recession.

Experience shows that a focus on price stability is the surest way for monetary policy to lay the groundwork for strong economic growth. The 1980s and 1990s had better economic performance than the stagflationary 1970s in part because the Fed did not waver from its primary goal of checking inflation.

Advocates of aggressive Fed interventions cite the “maximum employment” aspect of the Fed’s dual mandate. But such interventions force Fed policymakers to try to steer a middle course between inconsistent goals, which unintentionally leads to lower employment and higher interest rates.

Fed intervention is a poor substitute for sound fiscal policy. The central bank should be taken off this particular beat.

Congress should also amend the act so that it once again requires the Fed chairman to report on, and be accountable for, the Fed’s strategy for monetary policy in writing and in public hearings before Congress. These reporting and accountability requirements were removed from the act in 2000. They should be restored and strengthened.

In particular, the Fed should explicitly publish and follow a monetary rule as its means to achieve price stability. Such a rule should include, among other things: greater simplicity; a description of interest-rate responses to economic developments, including how the Fed will achieve those responses through money growth; and greater attention to commodity prices, including food and energy, as opposed to a myopic overemphasis on core inflation.

Within the context of crisis conditions, the Fed should have the discretion to deviate from its strategy of rule. However, it should have to promptly report to Congress and the public the reasons for the deviation.

Establishing a goal of long-term price stability within a framework of economic stability, including clear reporting and accountability requirements, would lay the monetary foundation for strong and sustained economic growth and job creation. Strong foundations, not short-term quick fixes, are required if we are to rebuild a prosperous United States.