- Law & Policy

- Regulation & Property Rights

- Health Care

- Economics

|

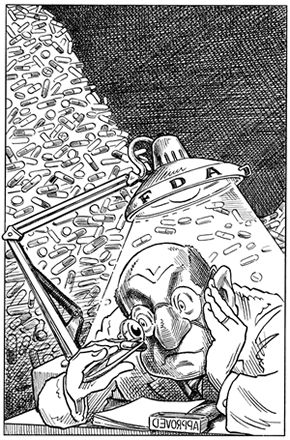

| Illustration by Taylor Jones for the Hoover Digest.

|

We have reached the 20th anniversary of the decisions by U.S. and British regulators to allow Eli Lilly to market human insulin, the first gene-spliced drug, or biopharmaceutical. When the landmark U.S. approval was granted in record time—by the FDA evaluation team that I headed—the New York Times quoted me as calling it a defining moment in the “scientific and commercial viability” of an important new technology.

So, after two decades, how healthy is the biopharmaceutical industry? It depends on how you define “healthy.” On the positive side, more than a hundred gene-spliced drugs and vaccines are on the market and have benefited some 250 million patients worldwide. These include lifesaving therapies for anemia, cystic fibrosis, hemophilia, hepatitis, transplant rejection, and leukemia and other cancers. The approximately 1,400 biotech companies in the United States boast market capitalization of over $200 billion and spend more than $15 billion annually on research and development.

There is less auspicious news, however, on several fronts. The FDA has made the drug development system hugely expensive, and the time and costs of drug development are spiraling out of control. Discriminatory, debilitating taxes on drug development—in the guise of “user fees” paid to federal regulators—continue to increase. This is like the chickens in the henhouse being forced to make welfare payments to the foxes.

The total time required for drug development, from synthesis of the molecule to marketing approval, has more than doubled (from 6.5 to about 15 years) since 1964. The average number of clinical trials performed on a drug before marketing approval is granted increased from 30 in the early 1980s to 68 during 1994–95, while the average number of patients in clinical trials for each drug more than tripled.

Bringing a new drug to market now costs upward of $800 million, by far the highest price tag in the world. An important reason is that the highly risk-averse FDA meddles incessantly in clinical trials and keeps raising the bar for approval. FDA officials have arbitrarily and unexpectedly imposed various burdens on biopharmaceuticals: They’ve directed researchers at biotech companies to begin trials at inappropriately low dosages; injudiciously limited early clinical trials only to single-dose, instead of multiple-dose, studies; demanded unnecessary, invasive procedures on patients; and even required that foreign trials be completed and the results submitted before the U.S. trials could begin.

Such obstructionism is not new, but to many observers it is puzzling. Isn’t it the job of regulators to facilitate the availability of new therapies? And aren’t they good citizens? Don’t they care about public health?

The short answer is that regulators are the victims of a distorted system that requires them to address the potential harms from new activities or products, while leaving them free to discount the benefits of unused or underused ones. The result is a lopsided decision-making process that is inherently biased against innovation. This asymmetry arises from the fact that there are two basic kinds of mistaken decisions that a regulator can make. First, a harmful product can be approved for marketing; second, a product potentially beneficial to society may be rejected or delayed, can fail to achieve marketing approval at all, or may be inappropriately withdrawn from the market.

In other words, a regulator can commit an error by permitting something harmful to happen or by preventing something salutary from becoming available. Both situations have negative consequences for the public, but the outcomes for the regulator are very different.

The first kind of error is highly visible and has immediate consequences: A regulator who approves a harmful product is excoriated by the media, attacked by self-styled public interest groups, and investigated by politicians. By contrast, the second kind of error—keeping a potentially beneficial product out of consumers’ hands—is usually a non-event, hidden by the cloak of confidentiality.

Because regulatory officials’ careers might be damaged irreparably by the good-faith but mistaken approval of a high-profile product, their decisions are often made defensively—in other words, to avoid approvals of harmful products at any cost. Thus, the system is gamed to encourage them to delay or to reject new products of all sorts, from artificial sweeteners and fat substitutes to vaccines and painkillers.

A couple of examples from my own experience at FDA with the review of biopharmaceuticals will illustrate the tension between the regulatory culture and innovation. The team that I led was ready to recommend approval of recombinant human insulin after only four months of deliberation, at a time when the average time for FDA review was more than two and a half years. With quintessentially bureaucratic logic, my supervisor refused to sign off on the approval—even though he agreed that the data provided compelling evidence of the drug’s safety and effectiveness. “If anything goes wrong,” he remonstrated, “think how bad it will look that we approved the drug so quickly.” (When the supervisor went on vacation, I convinced his boss to sign off on the approval.)

Characteristically, the supervisor was more concerned with “cover,” in case of an unforeseen mishap, than with getting an important new product to patients who needed it. This bias is not the way the system is supposed to operate.

Several years and a few biopharmaceuticals later, FDA’s demands for vast, time-consuming, and unnecessarily comprehensive clinical trials delayed the approval of the first gene-spliced vaccine—intended to prevent hepatitis B. This decision caused much misery and cost many lives.

Although the new vaccine was clearly superior to an existing but unpopular one (whose source was pooled plasma from patients with chronic active hepatitis, hardly an auspicious substrate for a drug), FDA characteristically adopted the most risk-averse course: massive clinical trials that had to be performed in Asia (where the disease is epidemic), involving thousands of patients and the expenditure of additional scores of millions of dollars. This decision meant a delay of several years in getting the product to market. During that hiatus, only the inferior, seldom-used, first-generation vaccine was available, during which time more than 10,000 Americans contracted hepatitis B. A significant fraction died from complications of the disease, such as cirrhosis and hepatic carcinoma. Notably, during the decade following the approval of the gene-spliced vaccine in 1986, the incidence of hepatitis B fell by 65 percent.

The aftermath of the 1999 death of a patient in a gene-therapy trial at the University of Pennsylvania offers another example of the effects of regulators’ actions. Although the cause of the multi-organ failure in the teenaged patient had not been determined, FDA tightened manufacturing standards for academic investigators, inaccurately but publicly accused the researchers of various kinds of mistakes and misconduct, shut down all of the university’s gene-therapy trials, and even halted trials being performed by a drug company using a similar preparation. The FDA’s precipitous and punitive actions following a single unexplained death have cast a pall on gene-therapy research throughout the world and discouraged commercial support for the field.

One might expect that a Bush-appointed FDA commissioner—the agency has been without a head since the end of the Clinton administration (although a nomination was finally made at the end of September)—would move things in the right direction, but potential nominees have run up against an intractable Democratic majority on the Senate Health, Education, Labor and Pensions Committee, which must confirm senior political appointees at the agency. Its chairman, Senator Edward Kennedy, has vetoed several superb short-listed candidates, making it known that the committee will not consider anyone with a history of industry ties.

The acting agency head—current FDA deputy commissioner Lester Crawford, a longtime FDA and USDA regulator—is a congenial veterinarian, physiologist, and bureaucrat known neither for making waves nor for a commitment to regulatory reform. After a year back in the FDA harness, there has been no hint that he recognizes the seriousness of the agency’s shortcomings, let alone begun to craft remedies for them. If anything, he seems inclined to expand the agency’s activities still further, by jumping on the fast-moving antiterrorism bandwagon.

Regulation aside, there is arguably too much competition for too small a commercial pie. Nationally, approximately 1,400 biopharmaceutical companies are developing—by the industry’s own count—perhaps 350 drugs. Not all of these products will be successful, and even among the small fraction that do gain marketing approval from federal regulators, historical precedent suggests that fewer than one in three will garner sufficient revenues to recoup the costs of development.

During 2002, a series of study delays and failures and FDA rejections of marketing approvals have contributed to a decline in the capitalization of the sector. The NASDAQ Biotechnology Index, which dropped 16 percent in 2001, declined a stunning 49 percent during the first half of 2002.

Biopharmaceutical companies are more in the red than in the pink. According to a survey of California biopharmaceutical companies, which make up about a third of those in the nation, 35 percent had no revenue in 2000, while 40 percent had no products. These data are not reassuring, especially inasmuch as the financial rescues that traditionally have come to biopharmaceutical start-ups from large-cap pharmaceutical companies are likely to become more rare. The big companies are themselves experiencing financial problems and a slump in productivity and are inclined to support only the most promising, big-ticket, low-risk products. According to data from the venture capital firm Recombinant Capital, the number of announced alliances between biotech and pharmaceutical companies fell from 524 in the year 2000 to 442 in 2002. This does not bode well in the short term for the highly innovative, niche-conscious strategy of many biopharmaceutical companies.

Perhaps even more alarming is that the woes described above have made biopharmaceutical companies less willing and able to fund research collaborations with academics. In the long term, this must adversely affect the scientific substrate on which companies’ innovation is based (to say nothing of the actual creation of the next generation of start-ups).

Biotechnology applied to pharmaceuticals has made seminal contributions to preventive and therapeutic medicine during the past 20 years but languishes far behind its potential. Important and often lifesaving products will continue to emerge, benefiting patients and perhaps lowering medical costs. However, there are too many companies chasing too few products that are overregulated and hugely expensive to test and bring to market. From the vantage point of an individual company (or investor), there seems little reason for unqualified optimism.