- Budget & Spending

- Economics

- Monetary Policy

Earlier this year, Christina Romer, chairwoman of President Obama’s Council of Economic Advisers, and Jared Bernstein, Vice President Biden’s chief economist, estimated the impact of the recently enacted $787 billion U.S. economic stimulus bill on U.S. gross domestic product (GDP) and employment. Using an “old Keynesian” economic model and making highly questionable monetary policy assumptions, the Obama administration’s economists estimate that the stimulus package will raise GDP by 3.6 percent and increase employment by 3.6 million jobs.

In our 2009 paper “New Keynesian versus Old Kenynesian,” we employ a new Keynesian model to estimate the stimulus plan’s impact. The new Keynesian approach to analyzing fiscal policy is taught in most graduate economic programs in the United States and abroad. The model we use is representative of current thinking in modern macroeconomics.

According to our estimates, the stimulus plan’s peak impact is only one-sixth the size of the Obama administration’s estimate. To put this in perspective, the maximum employment increase equals the job loss in the single month of January 2009. Moreover, the primary economic stimulus occurs not when the currently weak economy most needs it but in the fourth quarter of 2010, when the economy is likely to be in recovery. Finally, we find that the economic stimulus plan causes private-sector consumption and investment to decline. The investment decline is particularly disturbing because it puts the U.S. economy on a slower long-term economic growth path.

The results are important for two reasons. First, they call into serious question the Obama administration’s claims that the stimulus package will have large positive impacts on the economy.

Second, estimates of the impacts of government spending and taxes are a crucial input for the policy-making process. They help determine the appropriate size and timing of countercyclical fiscal policy packages, and they help inform members of Congress and their constituents about whether a vote for a policy is appropriate. The stakes are enormous and estimated economic impacts matter. Macroeconomists remain quite uncertain about the measurable effects of fiscal policy. This uncertainty derives not only from the usual errors in empirical estimation but also from different views on the proper theoretical framework and methodology. Therefore, robustness—in other words, statistical data that are not sensitive to small departures from the assumptions on which the data are based—is crucial information in policy evaluation. Robustness requires evaluating policies using other empirically estimated and tested macroeconomic models. The Romer-Bernstein estimates apparently fail a simple robustness test, being far different from existing published results of another model.

The Obama administration’s estimates are based on two particular quantitative macroeconomic models: one from the staff of the Federal Reserve Board and the other from an unnamed private forecasting firm. These models are “old Keynesian” models in which individuals and firms are assumed to function with a high and constant marginal propensity to consume.

Two key assumptions were made to estimate the stimulus package’s impact. First, the administration assumes that the annual government spending increase contained in the stimulus package, about 1 percent of gross domestic product, consists almost entirely of government purchases of goods and services, continues forever, and is financed by the issuance of federal debt. Second, the administration assumes that the Federal Reserve keeps the interest rate—the federal funds rate—at the current level of zero for as long as its simulations run. Given its assumption that the spending increase is permanent, this means forever.

By averaging the impacts generated by these two models, the administration estimates that an increase in government purchases of 1 percent of GDP would induce an increase in real GDP of 1.6 percent compared to what it otherwise would be. The administration therefore estimates that the recently enacted 2009 stimulus package will raise GDP by 3.6 percent and employment by 3.6 million by the fourth quarter of 2010.

In modeling the stimulus package and in contrast to the administration’s interest-rate assumption, we allowed interest rates to rise as the economy recovers. There is a good reason for our alternative, pointed out more than thirty years ago by economists Thomas J. Sargent and Neil Wallace, who said that a pure interest-rate peg will lead to economic instability. Inflation expectations of households and firms will become unanchored and unhinged, and the price level will explode in an upward spiral. Why? A permanent increase in government spending as a share of GDP would eventually raise the real interest rate, the mechanism by which other shares of spending (consumption, investment, and net exports) would be reduced to make room for the increased government share. With the Fed holding the nominal interest rate constant at the current value near zero, and thus below inflation, the lower real rate would cause inflation to rise and accelerate without limit. Thus, the combination of a permanent increase in government spending and the Fed setting the interest rate at zero would lead to hyperinflation.

We therefore assumed that the Federal Reserve will keep the interest rate equal to zero and constant through 2009 and then follow a standard monetary policy rule thereafter. Thus, in 2010, nominal interest rates will change somewhat, and forward-looking households and firms will incorporate this monetary policy response into their decision making.

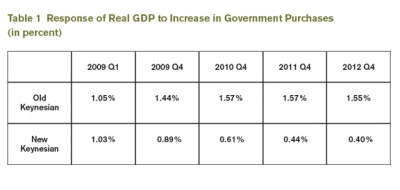

Before analyzing the recently enacted stimulus package, it is instructive to compare the new and old Keynesian models’ respective government spending multipliers. (The multiplier is the amount by which a dollar increase in government purchases of goods and services increases GDP; it is the key policy parameter in policy evaluation of government stimulus plans.)

Table 1 compares the response of real GDP to a permanent increase in government purchases of 1 percent of GDP (beginning in the first quarter of 2009) in the new Keynesian model to the administration’s old Keynesian model estimates. Observe that the new Keynesian model predicts a much smaller boost to GDP than the old Keynesian model. By 2011, the new Keynesian model’s impact is only one-quarter the size of the old Keynesian model’s. More important, the new Keynesian model predicts that the government “stimulus” will quickly produce a permanent contraction in private-sector investment and/or consumption and that the magnitude of the contraction will grow over time. By the end of 2012, for each dollar of “stimulus,” the flow of goods and services produced by the private sector will have fallen by sixty cents.

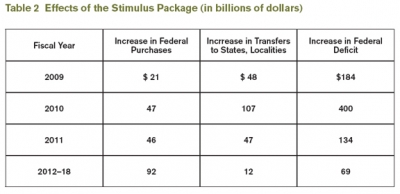

Although modeling a permanent increase in government purchases of goods and services is a good way to understand the properties of the two types of models, it is not a realistic description of the recently enacted U.S. government $787 billion stimulus package signed into law on February 17, 2009. That package is a mixture of increased transfer payments, tax refunds, and higher government purchases. About half the stimulus package consists of transfer payments for unemployment assistance, nutritional aid, health and welfare payments, and temporary tax cuts. In addition, the package does not provide for an immediate permanent increase in government purchases of goods and services. Most of the authorized purchases are onetime and phased in, with the lion’s share completed within four years.

Table 2 shows the effects of the stimulus packages on government purchases of goods and services, payments to states and localities, and the federal budget deficit. Virtually all the difference between the federal budget deficit and the sum of government purchases and transfers to states and localities (80 percent) represents transfer payments to individuals. Observe that $21 billion, or just 2.6 percent of the total $787 billion increase in deficit spending, occurs in fiscal year 2009, which is when the economy is expected to be weakest. Federal purchases then increase in 2010, stay relatively steady for two years, and then begin to decline again in 2012.

Given the composition of the stimulus package, our analysis proceeds in two parts. First we estimated the impact of the increase in government purchases of goods and services on GDP. Second, we added on an estimate of the impact of transfer payments to individuals.

Federal government payments to state and local governments, mainly for education and public safety activities, are similar but not identical to federal purchases. States and localities may use the funds to purchase goods and services; they may also, however, use some or all the funds to avoid raising taxes or increase borrowing. To the extent that they do, the transfer would not produce a net increase in government purchases of goods and services. Consistent with the administration’s treatment of transfers to states and localities, we assume that 60 percent of these payments go to purchase goods and services.

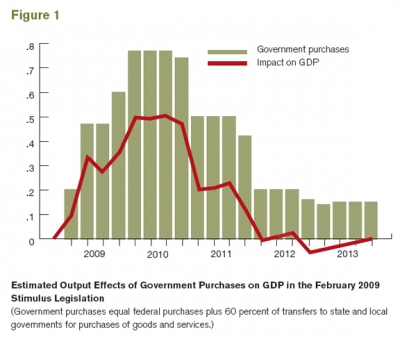

Figure 1 shows the new Keynesian model’s estimate of the stimulus package’s increase in government purchases of goods and services on GDP. The estimated short-term impacts are quite small. Particularly troubling, however, is that, during the first year, when the economy is in recession, the estimated stimulus is minor and even declines during the third quarter, a consequence of the delay in most of the authorized government spending until the second year, and the anticipation by households and firms that the increase in government expenditures will ultimately be financed by higher taxes. Higher future taxes reduce expected wealth and, thereby, reduce current consumption.

Over the long term beginning in 2013, the stimulus package is estimated to have a negative impact on GDP (see figure 2). In addition to the decline in consumption, government borrowing crowds out private-sector investment. The contraction in consumption and investment outweighs the increase in government spending. Our simulations show this decline continues for many years beyond 2013.

To complete our assessment of the stimulus package, we must account for the tax rebates and onetime transfer payments to individuals. There is considerable uncertainty about how much tax rebates and transfer payments will contribute to GDP, but their temporary nature suggests that the impact on aggregate demand will be small. Indeed, our examination of the tax rebates in the Economic Stimulus Act of 2008 indicates that their impact was negligible. (On the other hand, a review of the literature suggests that a dollar of tax rebates or transfer payments may increase aggregate demand by as much as thirty cents.)

Using 30 percent as an upper-bound estimate, the tax rebates and transfer payments, in combination with the stimulus package’s purchases of goods and services, can be expected to add a maximum of 0.65 percent that is expected to occur in the fourth quarter of 2010. In the administration’s analysis, the stimulus package also has its maximum effect in the fourth quarter of 2010. So we focused our comparison on that quarter.

The administration estimates that the stimulus package will raise GDP by 3.6 percent by the fourth quarter of 2010, which is six times greater than our estimate of 0.65 percent.

The administration also estimates that employment will increase by 3.5 million jobs. Our estimate, using the same relationship between employment and GDP, is closer to a half million additional jobs. (To put that smaller number into perspective, it is less than the 598,000 payroll jobs lost in the single month of January 2009.)

The administration is also making future job estimates in a number of private-sector industries, but if our calculations are correct, its estimates will need to be radically scaled down. In addition, our finding about the crowding out of private consumption and investment due to the increase in government purchases raises doubts about the administration’s estimate that 90 percent of the jobs will be created in the private sector. Indeed, with the impact of government purchases on GDP (.46) nearly three times greater than the impact of tax rebates and transfers on GDP (.19), a net decline in private-sector jobs is likely.

In summary, our estimates of the impacts of the administration’s stimulus plans stand in stark contrast to those impacts claimed by the administration. The administration claims impacts on GDP that are six times larger than those implied by government spending multipliers in a typical new Keynesian model and our calculations based on generous assumptions of the impacts of tax rebates and transfers on GDP. It also has announced job estimates that are six times larger than our alternative models, and the impacts on private-sector jobs are likely to be at variance with those models by an even larger amount.

Our results raise serious questions about the economic benefits of the stimulus package. They also raise serious doubts about the robustness of the old Keynesian models as a useful tool for practical fiscal policy evaluation.