On March 30, the Hoover Institution’s Working Group on Global Markets convened a one-day policy workshop on the future of central banking. Since August 2007, turmoil in the financial markets has given rise to numerous unprecedented actions by the Federal Reserve, including interventions on behalf of Bear Stearns and AIG, a variety of large new lending and financing programs, and the purchase of assets backed by mortgages, credit card debt, and student loans. Participants from the Fed, leading private firms, and academia gathered to present new research, analyze the implications of the Fed’s actions, assess challenges going forward, and identify constructive policy approaches. Workshop agenda

George P. Shultz, the Thomas W. and Susan B. Ford Distinguished Fellow at the Hoover Institution, opened the workshop with an address encouraging participants to “think long” and consider future implications as they address urgent policy challenges. Ed Lazear, the Morris Arnold Cox Senior Fellow at the Hoover Institution, chaired the first panel discussion, in which Allan Meltzer of Carnegie Mellon University and Peter Fisher of BlackRock discussed the causes of the financial crisis and lessons learned thus far.

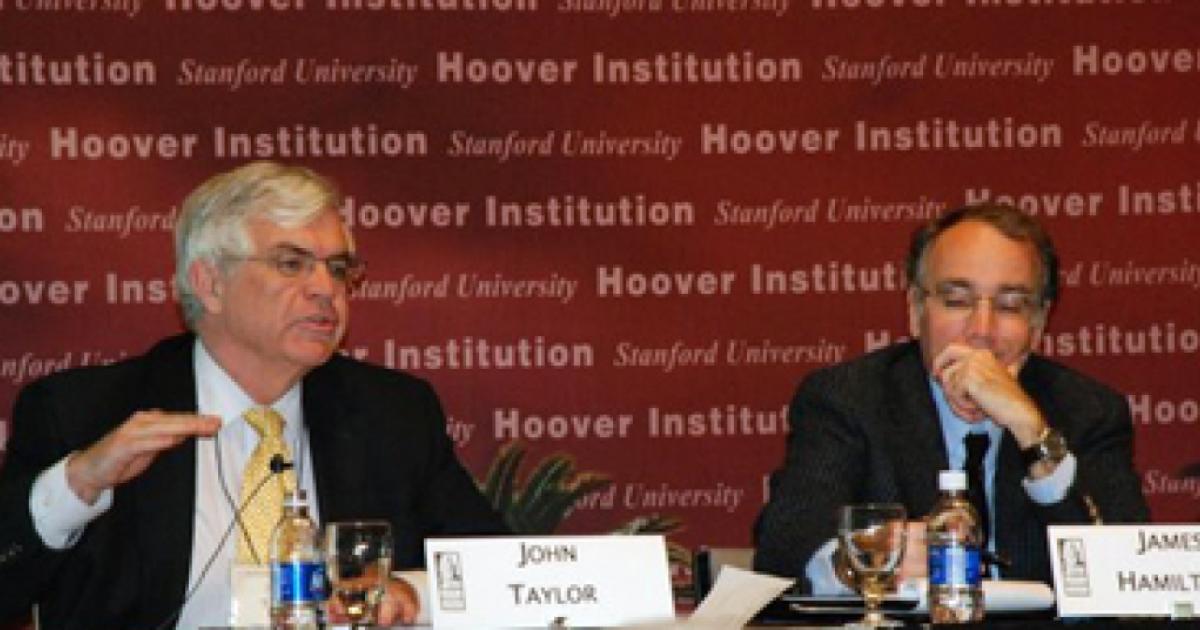

The second panel, chaired by Hoover senior fellow Michael Boskin, focused on the Fed’s expanded balance sheet. Donald Kohn, vice chairman of the Board of Governors of the Federal Reserve System, began by explaining the basis for the Fed’s recent actions. James Hamilton of the University of California at San Diego and John B. Taylor, the Bowen H. and Janice Arthur McCoy Senior Fellow at the Hoover Institution, evaluated the economic and policy implications of the expanded balance sheet.

In the third session, Darrell Duffie of the Stanford Graduate School of Business and Myron Scholes of Platinum Grove Asset Management addressed regulatory challenges in credit derivatives markets. Finally, Andrew Crockett of J. P. Morgan International and Michael Halloran, former counselor to the chairman at the Securities and Exchange Commission, led a panel that discussed proposals to establish a “systemic stability regulator” in the United States.

For a complete agenda and list of participants, please click here.