The first installment of the “Sacramento Spotlight” series examining Tim Draper’s proposed “Six Californias” ballot initiative found that no single new state could decisively be named a winner based on demographics.

Next up: the economics of the new states.

At face value, each new state would be economically different. Northernmost Jefferson would be mostly an agricultural/resource state with forestry likely to become the dominant private industry. North California, south of Jefferson and spanning from Nevada to the Pacific Ocean, would benefit from a little bit of everything: tech industry, agriculture, tourism, and healthcare. Silicon Valley, of course, would be dominated by tech; Central California, situated between Silicon Valley and Nevada, would mostly be agriculture and resource extraction; West California’s Los Angeles hub would mean entertainment would be a massive force and South California’s Orange and San Diego counties would dominate the economy.

Labor Force

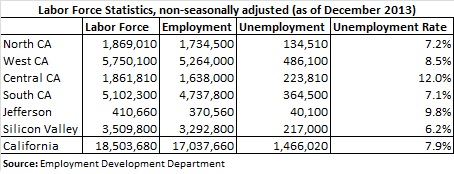

In non-seasonally adjusted terms, California had an unemployment rate of 7.9% in December 2013 (seasonally adjusted rate was closer to 8.3%).

Immediately, we see that there are clear winners from breaking the state apart. Most employment increases in California have come from the San Francisco Bay area. Thus it is no surprise that Silicon Valley would have one of the lowest unemployment rates of the new states – 6.2%, a rate comparable to Texas. South and North California, at 7.1% and 7.2% respectively, would also be winners. Those rates would put those three new states in the top half of all states in terms of unemployment.

Tax Revenue Bases

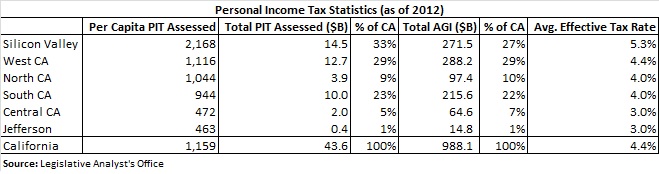

Governments in the new states will need revenue. Currently, personal income taxes, sales taxes, and property taxes make up the biggest segments of government revenue in California. Naturally, new states would likely adjust how they tax their citizens (you could see the more Republican new states shifting away from the high tax burden California currently has, while the liberal Silicon Valley may double-down on it), but let’s examine the status quo.

California’s personal income tax is very progressive. Not only is it progressive, it is highly dependent on capital gains realizations, which occur more often among the wealthy. Naturally, the state to gain the most from the personal income tax would be the wealthy Silicon Valley. Even though West California would have a higher percentage of California’s total Adjusted Gross Income, Silicon Valley (due in no small part to capital gains income) would have a higher percentage of the total Personal Income Tax Assessed. And on a per capita basis, Silicon Valley’s personal income assessed is about double that of the next highest (West California).

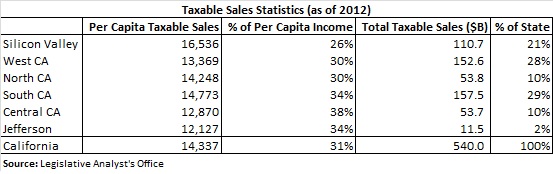

Sales taxes are significantly less progressive (in most cases, they are regressive). As such, we see Central California, which has the lowest personal income per capita, with the highest per capita taxable sales as a percentage of per capita personal income. In total, however, the largest economies will have more taxable sales, which mean more sales tax revenue. Again, South and West California as well as Silicon Valley come out on top.

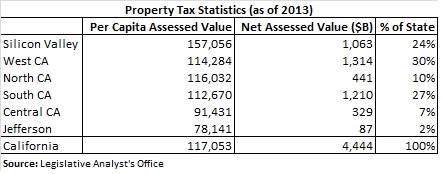

Finally, since property taxes are linked to home values, Silicon Valley, which has among the highest property values in the nation, would have the highest per capita assessed value of the new states. North California would be a relatively distinct second. On a net assessed value basis, however, West and South California come out on top.

As we noted in the first installment of this series, education levels in Central and South California and Jefferson would be among the lowest of the new states. This issue is further exacerbated by the fact that Central California and Jefferson would have low tax bases. Based on 2012-2013 per pupil funding data, areas within Central California fund just 20% of the total K-12 education per pupil funding. The remaining 80% is provided by the state. Overall, California local property taxes account for 35% of total per pupil funding. While Jefferson’s rate is currently at 36%, it and Central California could no longer count on redistribution from the state government to fill the gap. The others states would also need to address funding gaps, but because they would have a larger tax base, it would be easier to do.

Governments require funding to provide basic services. Two of the most basic services necessary from day one are water and prisons.

Both Silicon Valley and West California would be net water importers, meaning they’re dependent on water from resources outside of their borders. South California and Central California, while not net importers, would be particularly prone to drought concerns. Silicon Valley and West California would need to immediately explore innovative water resource concepts (for instance, coastal desalination plants).

Prisons are not evenly distributed across California. As such, while 37% of California’s state prisoners come from areas within West California, the new state would only have 7% of the prisons. Conversely, while Central California has 39% of the state’s prisons, only 14% of California prisoners come from areas within the new state’s borders. West California, Silicon Valley, and, to a lesser extent, South California would need to invest in prison infrastructure.

Extravagant public works projects would also need to be re-evaluated. For example, Central California is unlikely to pay for the most costly and controversial one currently under construction – the Golden State’s ambitious High Speed Rail project – as a vast bulk of the bullet train would serve areas outside its borders.

Nonetheless, examining the economies of the new states shows once again that California is a very diverse place. Such a split would create a handful of wealthy states and a handful of not-so wealthy states, which would have many policy implications.

In the third and final look at the “Six States” proposal, we’ll examine the politics of the new states.

Follow Carson Bruno in Twitter: @CarsonJFBruno