Today, Ben Sasse speaks with Peter Robinson about how he’s continuing to find meaning and purpose in life despite a terminal cancer diagnosis; Ross Levine, writing as Adam Smith, explains why it’s morally dangerous to admire the wrong people; and Frank Dikötter lays out how the Chinese Communist Party has convinced many observers to accept a sanitized and largely fictional historical account of its own revolutionary rise to power in China.

Political Philosophy

In a new and special episode of Uncommon Knowledge, Peter Robinson speaks with former Nebraska Senator Ben Sasse. In December 2025, Sasse announced that he had been diagnosed with stage 4 pancreatic cancer. That’s the primary topic for this far-reaching conversation about mortality, faith, and what truly matters when time is short. Sasse reflects on “redeeming the time”—holding ambition lightly, loving family more deliberately, and resisting the urge to make politics or professional success the center of life. The discussion also covers Sasse’s thoughts on the failures of Congress; the dangers of a fragmented, attention-starved republic; the crisis of higher education; and the moral challenges of technological abundance. Sasse speaks candidly and movingly about regret, forgiveness, prayer, and suffering—arguing that while death is a real enemy, it does not get the final word. Watch or listen here.

Freedom Frequency

At Freedom Frequency, Senior Fellow Ross Levine continues his series of letters in the voice of philosopher Adam Smith, this week exploring the risks of idolizing wealth and celebrity. Levine asks: How does an undue regard for wealth and status affect a free society? In Smith’s thinking, misplaced admiration distorts political judgment, undermines justice, corrupts the incentives for integrity, and breeds servility. “Your moral compass tilts,” he warns, “and when your moral compass tilts, your society loses its bearings.” Levine also channels Smith in a defense of his famous principle of self-interest. Regard for one’s interest is not the same as “greed,” he insists, because self-interest can align with justice and social propriety. Greed, by contrast, “corrodes the very moral sentiments that make markets possible.” Read more here.

Confronting and Competing with China

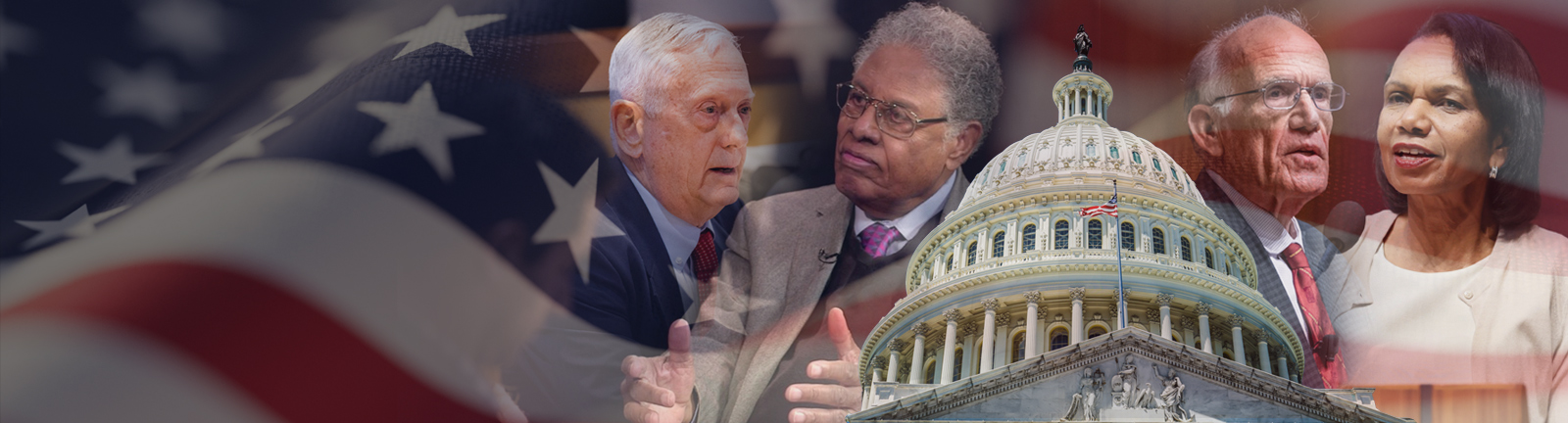

On the latest episode of GoodFellows, Senior Fellow Frank Dikötter joins Senior Fellows Niall Ferguson, John Cochrane, and H.R. McMaster to discuss what shaped the Chinese Community Party in the years 1921–1949. Dikötter shares many insights from his forthcoming book, Red Dawn over China: How Communism Conquered a Quarter of Humanity, including parallels between Xi Jinping and Mao Zedong in terms of amassing power, purging rivals, and practicing economics and geopolitics. After that: Ferguson, Cochrane, and McMaster debate the assertion by a New York Times columnist that Donald Trump has “lost the country,” as well as how much faith to put in economic indicators. The conversation closes with a consideration of musician Billie Eilish’s assertion that “no one is illegal on stolen land.” Read more here.

Law & Policy

When can a public university punish a student for speech that includes violent references and that frightens some people but is not a clear threat? On the latest episode of Free Speech Unmuted, Senior Fellow Eugene Volokh and cohost Jane Bambauer unpack two recent court cases, one that upholds such punishment and another that says it violates the First Amendment. Volokh and Bambauer explore how courts are applying the “substantial disruption” standard from Tinker v. Des Moines, and why speech by public university students that alludes in an ambiguous way to violence creates hard First Amendment questions. Watch or listen here.

Finance and Banking

In a column for Project Syndicate, Senior Fellow Amit Seru argues that while recent moves by the Federal Reserve to streamline banking oversight in pursuit of greater transparency and lower costs have some merit, regulators should recognize the risks of these steps as well. “Treating bank supervision as a mechanical or algorithmic exercise, rather than one that depends on informed judgment, would blind supervisors to early signs of trouble,” Seru writes. Emphasizing the importance of human judgment in bank oversight, Seru says that “modernization is a necessity,” but the US cannot afford a “supervisory system” for its financial institutions “that values simplicity over resilience.” As Seru notes, “In finance, efficiency does not equal safety.” Read more here. [Subscription required.]

Related Commentary