In 2011, former Governor of Minnesota and Presidential hopeful Tim Pawlenty announced he had a plan to grow the United States’ economy by 5% annually. While he was praised by some for the bold assertion (one of the few bold moments of his short Presidential candidacy), many of his challengers and much of the media scoffed at this notion.

As California’s gubernatorial contest ramps up, one thing is certain: Jerry Brown, Neel Kashkari, or Tim Donnelly will not be promising 5% gross state product (GSP) growth for the Golden State. The simple reason: California has not enjoyed 5% real GSP growth since the dot-com boom, and current policy conditions suggest such a target is unreasonable.

Between 2002 and 2012, average annual real GSP growth for the Golden State was just 1.3% (0.2 points below the national GDP). Yet, is there a more reasonable target California’s gubernatorial hopefuls could strive to achieve? According to general consensus among economists, the ideal real growth rate (in an economy experiencing normal employment) is between 2.5% and 3% annually. Economists view this range as the right balance between increased economic activity and the risk of inflation.

If California could return to normal employment levels—the current unemployment rate is 8.3% compared to an average rate of 5.9% during the last expansionary period (December 2001 to December 2007)—the ideal range is attainable for California. Between 2002 and 2008, in the lead up to the Great Recession, average annual real GSP growth was 2.2% and as recently as 2012, real GSP growth was 2.8%. However, as the charts below show, economic growth is not consistent across the diverse Golden State.

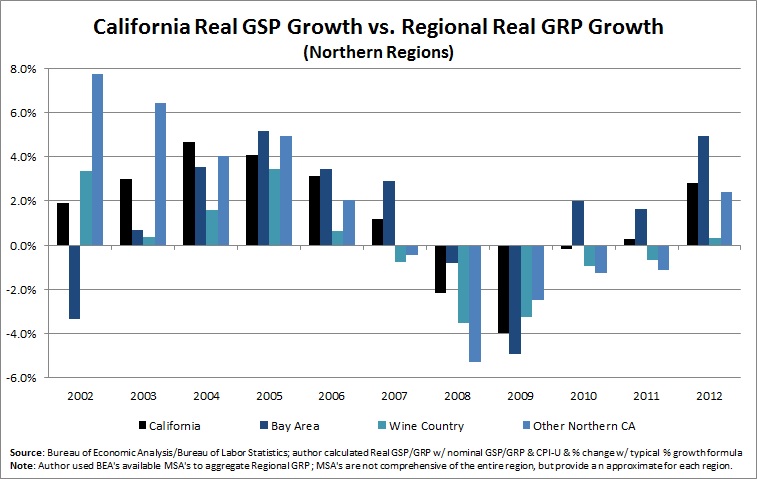

The northern regions are broken into three groups: the Bay Area, Wine Country, and Other Northern California. Following the dot-com bust, Other Northern California grew exceptionally fast. This is mainly driven by the Sacramento-Roseville MSA which accounted for about 83% of the total real gross regional product (GRP) growth between 2001 and 2002. On the other hand, the Bay Area took time to recover, but has bounced back faster than the state as a whole (and both other northern regions) since the Great Recession, almost reaching 5% growth in 2012. Wine Country has on average grown by just 0.1% between 2002 and 2012. So while all northern regions grew, on average, by 1.3% annually over the decade period (the same as the state as a whole), its growth has been driven, initially, by the Other Northern California region, and more recently, by the Bay Area.

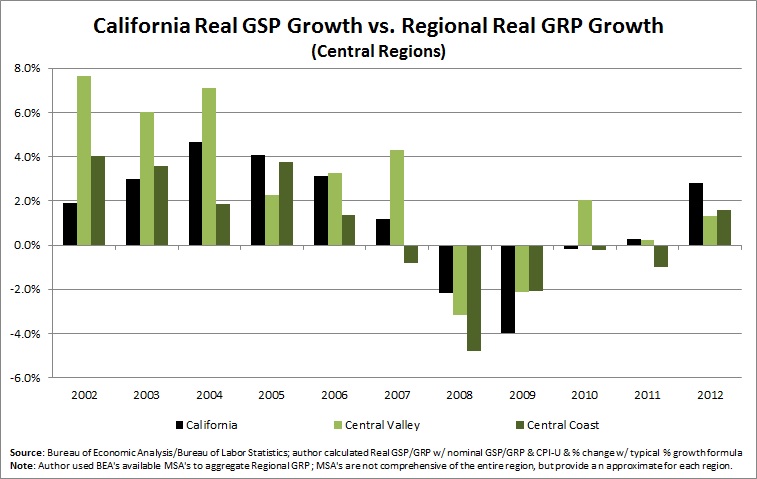

The central regions include the Central Valley and the Central Coast. The Central Coast’s economy is largely driven by tourism and agriculture, while the Central Valley is almost exclusively an agricultural-based economy. During the early part of the decade, the Central Valley easily surpassed California as a whole in terms of growth. On average, the Central Valley’s real GRP growth was 2.6%. However, if we look just at the Great Recession and forward (2009 to 2012), the Central Valley’s average annual growth drops to 0.4%. On the other hand, the Central Coast has experienced much bleaker times throughout the decade. Like the Wine Country, Other Northern California, and the Inland Empire, the Central Coast’s real GRP growth dipped into negative territory a year before the state as a whole did.

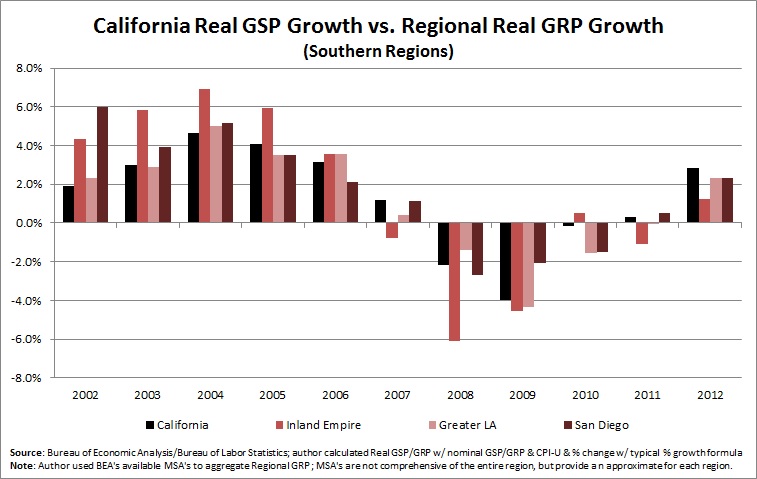

Finally, the southern regions—the Inland Empire, Greater Los Angeles, and San Diego—have largely been unable to pull themselves out of Great Recession’s doldrums. In the years prior to the recession, even the Inland Empire was outpacing the state as a whole. Between 2002 and 2008, the Inland Empire was growing, on average, by 2.8% annually compared to 2.2% for California. Greater Los Angeles and San Diego were growing at 2.3% and 2.7%, respectively. However, since the recession (2009 to 2012), the Inland Empire has averaged -1% growth (-0.9% for Greater Los Angeles and -0.2% for San Diego).

Thus, any “California Comeback” is not spread evenly. While California saw real GSP growth of 2.8% in 2012, only the Bay Area’s growth exceeded that of the state as a whole. By relying solely on one region for economic growth, California finds itself in a precarious position. Diversification is just as important for a state’s economy as it is in an investor’s portfolio.

Yet, California will require substantially greater economic growth than the ideal 2.5% to 3% in order to reach more normal employment. Thus far, the state and its regions have struggled to even match that range. To achieve more uniform, solid, and consistent economic growth across the state, California needs to invest in improving its overall business climate. The Golden State’s built-in advantages—like Silicon Valley, its geography, and climate—can only buoy the state’s economy for so long.

Follow Carson Bruno on Twitter: @CarsonJFBruno