- Economics

- International Affairs

- US Foreign Policy

Frustration with u.s. foreign aid is widespread. The left complains that the United States does not provide enough money to developing countries. The right laments that aid is an inefficient use of resources. Both sides are to some degree correct. While the United States distributed $ 23 billion in 2006 — more than any other country — it was still very little for the billion people living on less than one dollar a day. And for every dollar given to sub-Saharan Africa, less than 44 cents reached the ground, partially because of inefficient spending and corruption.

Given the justifiable frustration with the current system, there have been surprisingly few attempts to fundamentally alter the architecture of foreign aid. Suggestions for change usually take the form of either advocating for more aid or calling for a different distribution of existing resources. Typifying the first of these approaches, Barack Obama recently suggested that the United States double its aid spending to $ 50 billion a year. Epitomizing the second is the Millennium Challenge Corporation, a government initiative touted by President Bush in his 2007 State of the Union address that distributes a portion of U.S. foreign aid based on the political and economic environment in the recipient country.

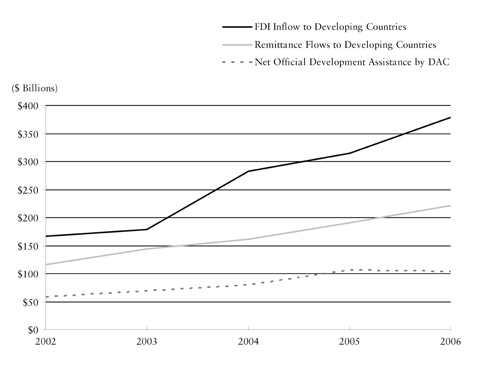

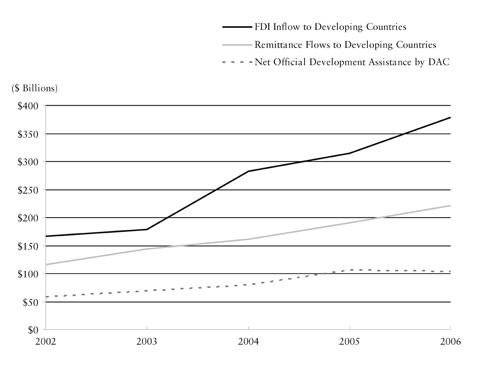

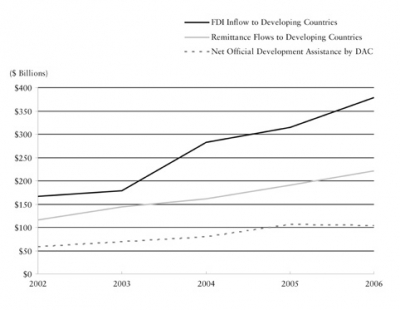

This focus on either growing the pie or distributing it differently takes as a premise that the current system of government-to-government aid is the best way forward. We suggest a different path. Rather than providing aid according to the wishes of foreign governments, the United States should provide incentives to encourage corporations and individuals to distribute development dollars. In 2006, $380 billion of foreign direct investment flowed to developing countries and $ 220 billion in remittances was sent home by developing-country migrants. As figure 1 indicates, these numbers far surpassed the $104 billion in official foreign aid flows. Government policy can act to shape the direction of these dynamic flows of private development capital rather than solely relying on the old model of government-to-government transfers.

One simple way to provide incentives for private development finance is to give tax credits to American companies that invest in developing countries. We will argue that shifting money from government-to-government aid to tax credits would allow more total dollars to be distributed without increasing the cost to the taxpayer (addressing the critique of the left); would reduce money lost to mismanagement and corruption (addressing the critique of the right); and would more effectively foster the building of institutions necessary for sustainable economic development. We will outline how such a system can be put into operation, addressing the types of investments that should qualify for tax credits and which countries should be eligible to benefit from them.

A second way to channel private development finance is to give tax breaks to individuals working in the United States who remit money home. It is easy to forget that the most effective unit of redistribution is the family. Frequently, families are straddled across poor countries and rich countries like the United States. Tax breaks can increase the amount of intra-family redistribution and therefore contribute to global poverty reduction. And by restricting remittance tax breaks to certain countries, U.S. policymakers can involve poor-country diasporas in lobbying for positive political change in their home countries.

Fixing foreign aid is vital to the U.S. national interest. Not only does aid play an essential humanitarian role, but it provides a number of direct benefits to Americans, from opening new markets to alleviating conditions that aid terrorist recruitment. The current system has proven over the past half century that it faces serious challenges. Tax credits for companies, and tax breaks for individuals offer a pragmatic, incremental solution that should appeal to both sides of the aisle.

Channeling investment

The u.s. government currently distributes most foreign aid directly to or in consultation with foreign government officials. However, an alternative system could be modeled on a successful domestic initiative. In 2000, Congress established the New Market Tax Credit program to provide a 39-cent tax credit for each dollar American companies invest in poor communities within the United States. The idea behind the program is that business development does more for long-run economic prospects than an aid check. The program did not start distributing funds until 2003, so there has not been sufficient time to gauge its effect on long-term poverty reduction. However, interest from the business community has been very promising. In 2006, so many businesses wanted to invest in poor communities because of tax credits that Congress had only enough funding for one-quarter of those who applied.

Using this domestic initiative as a template, Congress should provide a 39-cent tax credit to American companies for each dollar they invest in certain developing countries rather than distributing all foreign aid to foreign governments. For example, instead of giving $ 3.9 million of aid to the government of Mali, Congress should grant a $3.9 million tax credit to an American company for building a $10 million factory in Bamako. The cost is exactly the same to taxpayers — the $3.9 million is simply going to a private company rather than a foreign government.

Substituting tax credits for traditional foreign aid would have three simple and powerful benefits. A principal advantage is that Mali now receives $ 10 million rather than $3.9 million in development finance. The impact of the incremental $6.1 million on regular Malians could be substantial. For those who clamor for more aid, this is a cost-neutral way of making a real difference.

Another benefit is that money distributed to developing countries will be spent more prudently. As the economist Jeffrey Sachs has noted, of every dollar given to sub-Saharan Africa, only about 44 cents is actually directed toward economic development. The rest goes to debt service, consultants, and humanitarian emergencies. And after those expenses are subtracted, the remaining money is further reduced by mismanagement and corruption. Yet while government bureaucracies may be notorious for inefficient spending (or worse), American markets reward companies if they use capital efficiently. Because private companies are focused on the bottom line, they will be much more protective of money they invest than government officials, which means more of the aid will reach its intended destination. Combining more total aid with more efficient spending, there could be a severalfold increase in development dollars deployed.

A third important advantage of involving the private sector is that doing so will help to build institutions in developing countries. Institutions, such as a functioning market economy, a fair and enforceable legal system, and basic infrastructure, are vital to development. Yet traditional foreign aid, if it focuses on institution-building at all, does so from the top down. For instance, many U.S., World Bank, and imf grants require countries to adopt political or economic reforms in order to receive aid. The trouble with this approach is that it does not rely on a genuine desire by constituents within states to reform. There is clearly a desire to get free money. But since many of the states would not undertake reforms without the promised aid, reform occurs largely because it is externally mandated. This may work to some degree, but institution-building is more likely to succeed if states want to do it rather than if they are told to.

A system of tax credits will slowly fuel a desire within states to build growth-friendly institutions. When U.S. companies invest in developing countries, they will foster institution-building in a host of ways. As they interact with local businesses and governments, there will be a formal transfer of knowledge. Malian contractors might learn from U.S. engineers how to build better buildings. More informal idea-sharing will also occur. When American businessmen share meals with Malian political leaders, they will exchange thoughts about what sorts of legal and political reforms would encourage businesses to invest. Furthermore, U.S. companies will, out of self-interest, demand a better business environment. For instance, after making an initial investment in Mali because of tax credits, General Electric might be more likely to increase its presence in the country if the government invests in infrastructure, such as its road and sewage systems. Tax credits thus take seriously the notion that in order for reform to succeed over the long run, there must be a genuine demand for institutional development from constituents within a country rather than only from government bureaucracies on high.

In sum, tax credits for U.S. companies promise more aid, less waste, and the hope of better institution-building than government-to-government assistance. The next question is how a system of tax credits should be designed — which sorts of investments should qualify for credits, which countries should be eligible to benefit from them, and what the total size of the program should be.

Value creation, not transfer

Only certain business investments should qualify for tax credits. When developing countries offer tax subsidies for foreign investment, they tend to favor investments that will create jobs or bring in new technologies. Similarly, a system of U.S. tax credits should be structured to encourage investments that will generate benefits for the recipient country. Tax credits should therefore be restricted to new investments rather than the acquisition of existing companies (even though the latter officially counts as foreign direct investment, or fdi). New investments will generate new industry, and therefore jobs, technologies, and skills development. In contrast, if U.S. firms were permitted to use the tax credits to purchase already-existing businesses at a discount, Malian firms would be at a competitive disadvantage.

Even a tax credit restricted to new investment could still harm businesses in the recipient country if subsidized U.S. firms beat out local ones. To prevent this from occurring, tax credits should be restricted to new investments that do not harm local business. There are three broad categories that fit this restriction: export-oriented investments, investments that require large capital outlays, and investments that bring in substantial positive spillovers.

Export-oriented investment can be subsidized without harming existing domestic firms. A new footwear manufacturer in Mali selling shoes to the European Union, for example, would have little effect on the profits of an existing footwear manufacturer selling shoes to the same market. After all, Malian exporters comprise such a small share of European consumption that different exporters do not really compete with one another.

Similarly, investments that require large capital outlays may not harm domestic businesses even if the proposed market is internal. Development scholars believe credit constraints are a key impediment to development, and as a result sectors that are capital-intensive are likely to be relatively immature in poor countries. Thus, the tax credits could be used to jump-start industries such as equipment manufacturing or greenhouse farming that might not take off in the absence of subsidies.

Tax credits could also be used to finance investments that generate major positive spillovers, even if they are neither export-oriented nor capital-intensive. Investments with substantial positive spillovers might transfer a new technology to the recipient country, such as a precision manufacturing plant, or improve the business environment for domestic firms, such as a for-profit stock market. The key point is that even though such investment entails profit being earned by foreign owners rather than local firms, certain types of investment produce substantial local returns that benefit the recipient country long after dividends have been remitted abroad — in the form of employment, know-how, and more nebulous benefits like reducing market frictions.

In order to ensure that tax credits go toward investments that benefit the recipient countries, the United States can establish an application process for tax credits similar to the process it established for the domestic New Markets Tax Credit program. As with the domestic program, companies seeking tax credits would submit an application to the Treasury Department detailing how they would spend the money. Treasury officials would review the applications against pre-established criteria, awarding tax credits to those who will make best use of the funds.

Eligible countries: Mali, not China

Development tax credits for U.S. businesses should be restricted not only to certain investments, but also to certain countries. Most important, eligibility criteria should target countries that will not threaten American workers. Therefore, only poor countries that have been bypassed by American investors in the past should qualify. To this end, there should be a cap on gdp per capita for eligibility. Moreover, eligible countries should have a low existing stock of U.S. investment. This will ensure that countries like Mali and Mozambique are the recipients rather than China or Mexico.

In addition to protecting U.S. workers, guidelines should ensure that investments do not prop up corrupt regimes and that, where investments are made, they can be reasonably supported by the political environment. Consequently, tax credits should be permitted only for investments in countries that, at the very least, are not blacklisted by the State Department, have reasonable political and civil rights, and are democratic. We would favor the use of indicators provided by respected third parties such as Transparency International (which rates countries on their corruption levels), Freedom House (which rates countries according to their civil and political liberties), and the conflict group at the University of Maryland (which analyzes the level of democracy in countries).

Matching these criteria to country data allows a determination of the potential size of a development tax credit program, as described in Table 1. Eliminate all countries whose gdp per capita in purchasing power parity is above $2,500 as well as countries that have a substantial existing stock of U.S. foreign direct investment. Exclude countries in the bottom half of civil and political liberties, as measured by Freedom House, and countries with a low level of democracy, as reported by University of Maryland researchers. Eighteen countries, listed in Table 1, remain. Then calculate how much fdi is required for these countries to reach $10 of U.S. direct investment per person, approximately equivalent to that in Ghana or Croatia. (In comparison, there is over $ 650 U.S. direct investment per person in Mexico.)

According to this exercise, U.S. companies should be encouraged to invest approximately $ 4 billion in developing countries. Multiplied by the $0.39 tax credit, this implies Congressional allocations on the order of $1.5 billion. If this were provided over five years, the $300 million per year would represent only 1.3 percent of foreign aid. As such, a development tax credit could be rolled out relatively cheaply — initially just an incremental change to U.S. foreign aid policy — and if the results are encouraging, the program can be expanded. Much as private companies test new products in the market, the U.S. government should experiment here, especially since the cost is relatively low, the potential benefits significant, and the current foreign aid regime wanting.

Remittances and individual tax credits

The other major flow of private development finance occurs not through large companies but at the level of the family. Many families have a husband, daughter, or cousin living and working in a developed country. Research has shown that remittances lead to increased schooling and entrepreneurship in the recipient family and that foreign migrants help to “insure” their family members at home who suffer from income shocks.

Using the U.S. tax system to encourage and channel person-to-person remittances can also work, in principle, to achieve development and foreign policy goals. Given the decentralized nature of remittances, this innovation would be difficult to implement, but we nonetheless sketch how such a policy might be structured.

Congress could authorize changes in the personal income tax code that would enable individuals to deduct from their pre-tax income contributions earmarked for remittance. The contributions would be routed through pre-approved financial institutions in the recipient countries. As with the tax credits for investments, only the qualified developing countries described above would be eligible. The remitter would have the option to allocate her funds to one of several productive uses in her home country. For instance, she could pay the tuition of a family member at a post-secondary institution. She could make monthly payments on business loans or home mortgages (some of which already qualifies under existing tax law). Or she could put it in long-term savings products to prepare for her eventual return while funding domestic investment through the banking system.

This system has many of the advantages of the tax credit to companies. First, it can be structured in a revenue-neutral fashion by reducing the traditional foreign aid budget by a dollar for every dollar granted in tax benefits. If the typical marginal tax rate of a remitter is 30percent (and it might often be 15 percent), a one-dollar reduction in foreign aid can lead to over $3 in increased private development assistance.

Second, remittance tax credits can reduce leakage and waste. Since funds go directly to beneficiaries in poor countries, the remittances would bypass the consultants and administrators who populate the current foreign aid approach. And the beneficiaries would, under the constraints outlined above, manage their own funds and certainly be vigilant about corruption or misuse.

Third, as with tax credits for business investment, restricting remittances to certain countries with good policies, democracy, and respect for human rights can serve as a catalyst for positive institutional change. Imagine the lobbying power of millions of immigrants in the United States who cannot qualify for the tax break because their government at home is relatively corrupt. Many countries like the Philippines and Cape Verde depend on their emigrants for contributing to family members who have not left. The diaspora is an important constituency for lobbying for change in these and other developing countries.

A tax break for remittances would bring additional benefits to the United States. Many migrants intend to return to their home countries once they have saved up enough money, and a well-thought-out system would allow them to plan properly for their return. This mirrors the incentives the tax system offers to U.S. citizens to plan for their own retirement through pre-tax retirement deductions. Moreover, by taking the lead among developed countries in allowing remittances to be deducted pre-tax, the United States would be able to attract talented foreign workers who have their choice of rich countries within which to work. The foregone domestic consumption from increased remittances (up to a few billion dollars) would be minuscule compared to the nearly $ 10 trillion of existing U.S. consumption. In any case, the political benefits of mobilizing the diaspora, allowing migrants to plan for a return home, and attracting foreign talent would outweigh the negligible amount of lost consumption — though the effect on consumption should be monitored to ensure that it does not become meaningful if the remittance program grows.

Without a doubt, subsidizing remittances would pose some challenges. For one, many remittances will occur anyhow without a tax break, so to be justified the program would have to be structured to generate new remittances. Second, clever remitters could evade taxes by sending income home tax-free, only to work with a financial institution on the other side to transfer it back. This could be dealt with through an effective bilateral remittance treaty, complete with monitoring mechanisms of the implementing financial institutions. While this seems like an administrative hassle, remember that there is already a web of bilateral trade and investment treaties — even between much smaller economies. Surely the cost of overseeing a remittance scheme run through private institutions would be far lower than the cost of implementing the same amount of government-to-government foreign aid with its program design, procurement, and evaluations overseen by a cadre of American overseas bureaucrats.

Yes, this is foreign aid

Traditional government-to-government aid can be spent by the recipient country on public goods the private sector might not supply, such as medicine for those who cannot afford it and public schools. Defenders of the status quo might therefore argue that tax breaks do not allow for public goods spending, since these breaks go to businesses and individuals, both private recipients. There is merit to such an argument, and public goods are clearly a worthwhile use of money, which is one reason we suggest transferring only some taxpayer dollars from traditional aid to tax credits. Yet a body of academic research shows that private capital flows can raise wages and create positive spillover effects in the host country. These are valuable benefits which over the long run will allow a country to provide for its own public goods rather than relying on foreign handouts to do so.

In fact, developing countries have themselves already understood what current U.S. foreign aid policy has not — that private development finance is vital to long-run development. The best evidence of this is that many developing countries are already spending their own money on tax credits to attract foreign investment and on programs to enable their citizens to seek work overseas. World Bank studies show that tax credits and investment promotion work to attract foreign investment, so it is not surprising that countries spend money in these areas. Of course, these countries have no shortage of competing priorities that require funding. A system of U.S. tax credits and breaks would allow the benefits of foreign investment and remittances to take hold much more quickly and without breaking the bank of developing countries.

A development tax credit thus represents a shift in the delivery of foreign aid. It is a move from handouts to empowerment, from less aid to more, and from waste to efficiency. It is what developing countries themselves recognize as the key to long-run sustainable growth. And since tax credits and pre-tax deductions can be adopted incrementally, they are a pragmatic way to introduce changes to the model of foreign assistance.

More broadly, employing the tax system for development is a way to use government incentives to encourage and channel private transfers that will have a great impact on reducing poverty. Large government-to-government aid programs worked well in the period immediately following World War II, when the Marshall Plan brought the economies of Europe and Japan back up to speed. But those nations already had experience with market-driven prosperity and the institutions to support it. What was missing was a stimulus to demand (plus foreign exchange), and foreign aid packages provided that. However, countries that have escaped poverty in the postwar era have largely done so through harnessing the productive capacities of the private sector — frequently foreign investment. It is time that policymakers heed the lessons of development success stories from the second half of the twentieth century and rethink the old foreign aid paradigm.