On Thursday, January 9th, Governor Jerry Brown released the details of his FY 2015 Proposed Budget kicking off a six month state budget journey.

Much focus has been on the Governor’s frugality, particularly in crafting the budget. While general fund revenues appear to be on the upswing, historical precedent foretells of how quickly California’s financial status can change.

Understanding that the Governor’s Proposed Budget is only a starting point, today we’ll examine how it stacks up against previously enacted budgets.

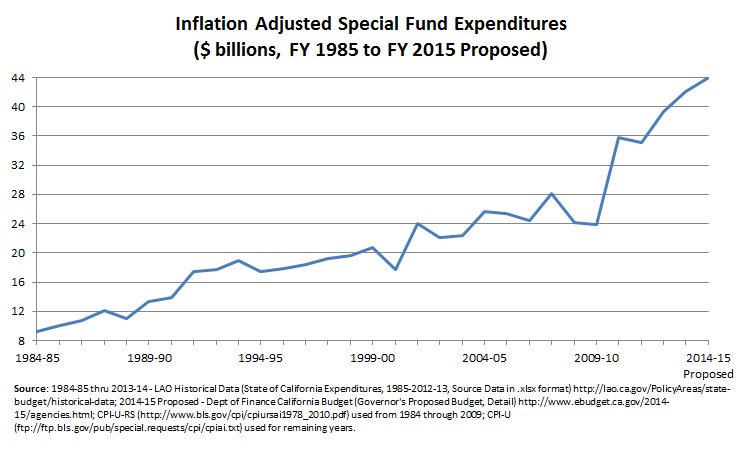

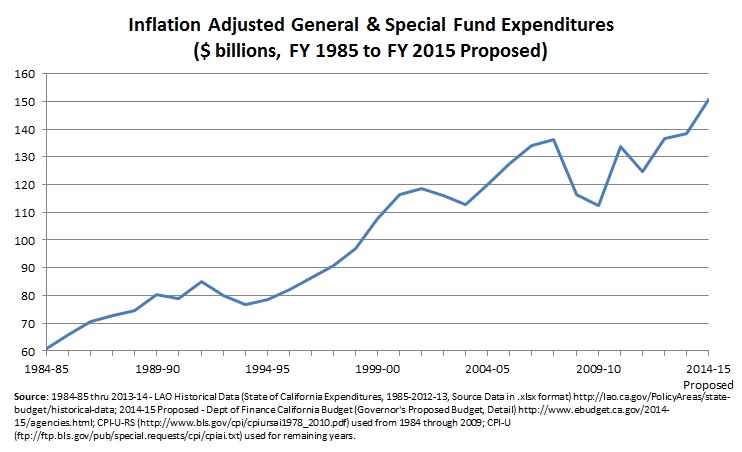

Over the years, Governors and legislative leaders have shifted more state expenditures into special funds, so in order to understand the whole spending picture, we cannot just examine General Fund expenditures, but also total Special Fund expenditures.

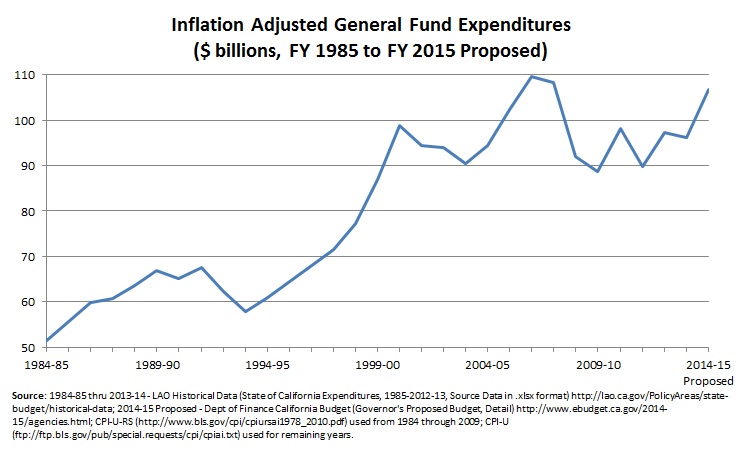

In inflation adjusted terms (2013 dollars), in FY 1985, the enacted budget called for $51.4 billion in expenditures. By the end of Arnold Schwarzenegger’s second term General Fund expenditures had ballooned to $98.1 billion (almost doubling since FY 1985). Despite a brief moment of tightening the belt in FY 2012, Jerry Brown’s budgets ticked upward to Schwarzenegger-levels in FY 2013 and FY 2014, most recently jumping 107.7% over the FY 1985 General Fund expenditures to $106.8 billion.

Special Fund expenditures, again in inflation adjusted terms (2013 dollars), grew at a steady, but modest rate—approximately just doubling between FY 1985 and FY 2001. However, since FY 2010, the growth in Special Fund expenditures has exploded going from 157.1% of FY 1985 levels in FY 2010 to 373% in the proposed FY 2015 budget—essentially doubling since Brown took office.

So, while based solely on General Fund expenditures, Brown’s proposed FY 2015 budget still trails the excess of the Schwarzenegger years, when combined with the Special Funds (a better estimation of total state spending), Brown’s newly proposed expenditures is above and beyond even the largesse of California’s pre-recession era.

Why does all of this matter? California’s notoriously volatile personal income tax means that good times can (sometimes as quickly as overnight) become terrible times. These swings wreak havoc on the state’s budget demanding draconian cuts; and because of politics, these cuts are typically to important areas like education. If tax reform remains off the table (which it appears it will), a strong “rainy day” fund would help to ease the pain of such revenue swings. However, Brown has signaled that he prefers a Democrat-crafted “rainy day” fund plan, which is significantly weaker than the 2010 bi-partisan version, scheduled to appear before voters in November.

Brown’s proposed budget tries to remedy the results of recent belt-tightening, but the bottom line shows that our Sacramento politicians have extraordinarily myopic memories—even, it would appear, the “frugal” Jerry Brown.

Follow Carson Bruno on Twitter: @CarsonJFBruno