Not too many people get excited about dry budget numbers. Most people care instead about what’s behind those numbers -- how much of our money will the government take, what kinds of services will it provide?

Indeed, those programmatic and policy questions are far more important than the latest assessment of how bad our fiscal situation is. They’re also the subject of the remainder of this week’s conversation on these pages.

As a former Director of Finance for the state, it falls to me to give an overview of the arithmetic and the budget process.

Bear with me: you’ll laugh, you’ll cry!

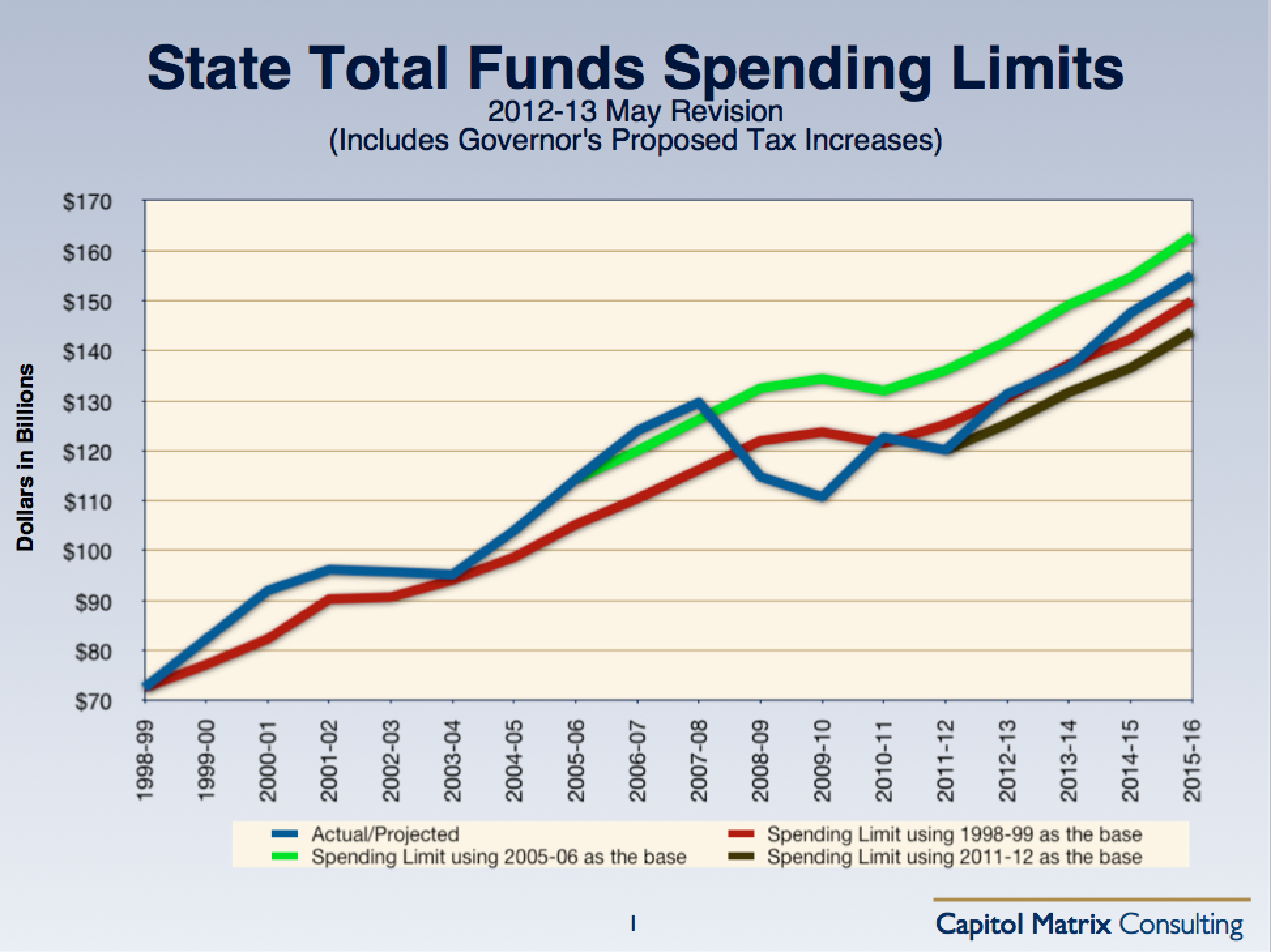

The complexity of the California budget is notorious. So, in presenting an overview of its history, I chose a fairly complex chart (prepared with the help of my two partners at my analytical firm, Capitol Matrix Consulting, LLC).

Let’s start with a simple explanation of what this chart shows (click to enlarge).

Total Funds. We normally hear about the state’s General Fund budget, usually in the context of its latest huge shortfall. For historical accuracy, however, it’s actually best to look at total funds spending. Total funds include the General Fund, but also state special funds. It doesn’t include spending from certain bond funds (although spending to repay bonds is included), nor from federal funds. The reason this total is more helpful than just focusing on the General Fund is that, over the last few years, state budgets have shifted certain costs away from the General Fund and into special funds.

The most recent example was last year when, under Governor Brown’s leadership, the state shifted about $6 billion in a variety of public safety costs to local governments and reimbursed those local governments through some newly created special funds (revenues for which were shifted from the General Fund). This kind of shift really does cut General Fund costs, but it masks the fact that total costs are unchanged. So, for historical comparability, it’s best to look at total funds.

The Blue Line. This line shows actual spending up to last year. The spending for the current fiscal year is an estimate, and for future years it’s the DOF’s projection. The DOF’s projections assume the Governor will succeed in getting his tax increase (which is on the November ballot), so they include spending from those proposed new revenues. (One clarification: The DOF does not project special funds spending, so we just assumed that spending would grow at historical rates, about 3%, excluding those fund shift years).

The Red Line (aka Pete’s Line). This line shows what spending would have been if annual growth since 1998-99 had been held to no more than what the “Gann Limit” growth factors would allow. The Gann Limit was enacted right after Proposition 13 and it limited appropriations to the prior year’s amount plus a percent equal to the combination of the increase in population and the increase in the per-capita personal income in the state for the same period (this is more generous than a simple population and inflation factor since per-capita personal income grows not just with inflation, but also with productivity). The Gann Limit is irrelevant now because it is far above current spending levels, and it has been since it was modified (re-based) in the early 1990’s. However, we apply its growth factors in this chart just to create a benchmark. Why did we start with 1998-99? Because that was not only then-Gov. Pete Wilson’s last budget, but also the last state budget that the non-partisan Legislative Analyst forecast to remain in balance over the long haul. In other words: it was the last truly, structurally, sustainably balanced budget our state has had.

The Green Line (aka Arnold’s Line). This line shows what would’ve happened if we had limited spending to the 2005-06 level, plus the Gann factors. Sharp eyes will note that we would get much the same effect if we applied the factors starting in 2000-01, so we could also call this the “Gray Line”. Then again, the darned chart is already complicated enough – and Gov. Davis has been kicked around enough.

The Brown Line (aka Jerry’s Line). This line shows what would happen going forward from the current year level, plus the Gann Factors.

So what does it all mean?

Let’s start with the obvious. If we’d restrained our spending since Governor Wilson left office to just the percentage increase allowed by the Gann Limit factors (Red Line), total spending would have grown smoothly and steadily at about 4% annually – and we would be just a bit over where we actually are in the current year.

Looking forward, Gov. Brown’s budget forecast for the next year and the year after that actually (the Blue Line) do come back to Pete’s Line. And, in political terms, that could be a pretty good argument for approving his tax increase. Without some additional revenue, we’ll have to drop down to the Brown Line level. And that will require permanent cuts of about $5 billion – tough to do politically and practically.

On the other hand, the Governors proposal (still on the Blue Line) puts us above Pete’s Line in the last two years shown on the chart. And that could be used to argue against his tax increases.

I don’t like to talk about the Green Line. After all, I was there at its birth!

I remember my first meeting of the National Association of State Budget Officers. We all reported on developments in our states. I began my presentation by saying that the worst thing that could happen to a Budget Director had happened to me: our revenue forecast update added $10 billion to our revenues available to spend in the two-year budget planning period.

In our defense, we did manage to put some money away by repaying some loans. And we did not make any new, major ongoing spending commitments. However, we failed to do what we should have done, which was to actually cut the budget back to that Red Line and save that money for the future.

A less obvious point is that, back in 2005-06, we were still digging our way out of the budget shortfall we inherited from the previous Administration. So, while we did not increase programs, the new revenue went to backfill some of the temporary measures and gimmicks that had been used to paper over the previous years’ budget shortfalls (one by Davis, one by Schwarzenegger, both equally full of one-time fixes).

Of course, the most striking feature of the chart is that the Blue Line is so erratic.

Why? Because the revenues available to spend each year are very volatile.

This revenue volatility is almost entirely due to our state’s heavy reliance on upper-income taxpayers. When they have a good year, as they did in 1999-00, 2005-06, and 2006-07, the state has a boom in revenues.

Fixing this volatility, with a flatter and broader tax code should be one of our state’s highest priorities. But, Brown’s tax proposal, which relies heavily on a tax increase on “millionaires” (which he defines as people earning more than $250,000 per year . . . please, don’t ask) is likely to only make it worse.

Why is revenue volatility a bad thing for budgets? Back to the Blue Line.

If our budget process could restrain itself and sock away money in those boom years, the Blue Line would probably look very much like Pete’s Line. To make matters worse, when the volatility turns negative, as it did in the early part of the decade and in 2008, the budget is caught with its pants down, so to speak.

So, do we immediately restore sanity and cut spending back to more supportable levels? You might be thinking that the Blue Line shows that we actually cut spending back to Pete’s Line in 2003-04 and far below that in the years of the Great Recession.

But, the reality is more complicated.

The “cuts” in 2003-04 were largely temporary. That meant that their ongoing effect on spending was nada – and you see that, as the Blue Line bounces back up after. The same is true during the recession, when we did make real cuts and a whole variety of temporary ones.

Temporary cuts, temporary tax increases, and budget gimmicks enacted to “solve” one year’s problem only make matters worse in subsequent years. Most folks would agree that is just stupid!

Why do we keep doing it?

To find out, you’ll need to read the next column.

Michael Genest runs Capitol Matrix Consulting, LLC. Previously, he served as Director of California's Department of Finance for four years under Governor Schwarzenegger.

Click here to subscribe to the Eureka channel's RSS feed.