- Economics

Editor’s Note: This is an excerpt from a fuller essay, “Innovation, Not Manna from Heaven,” by Professor Haber that is published by the Hoover Institution as part of a new initiative, Socialism and Free-Market Capitalism: The Human Prosperity Project.

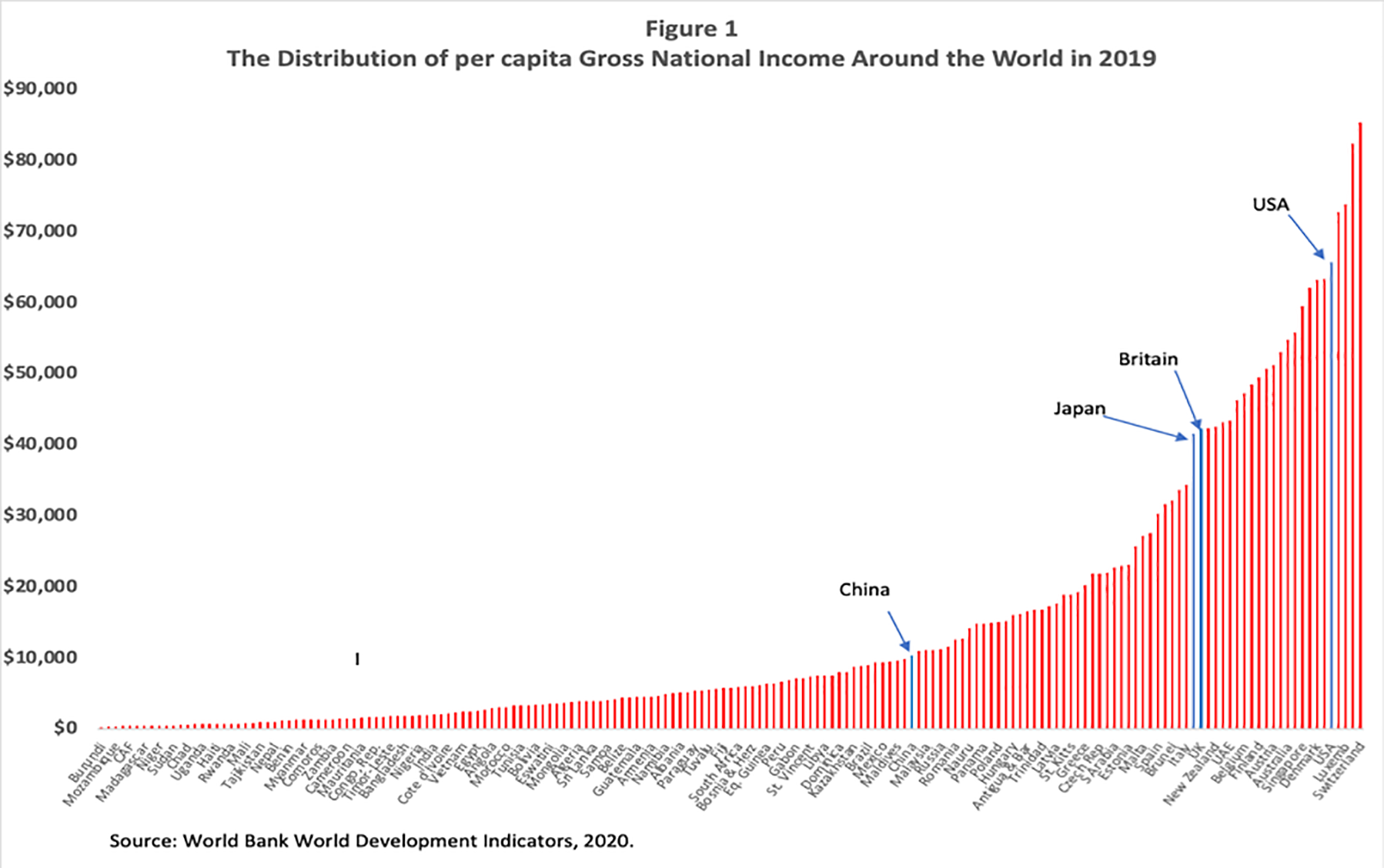

The United States is an outlier in the distribution of prosperity. As figure 1 shows, there is a small group of countries with per capita incomes above $40,000 that stand out from all the others—and the United States, with a per capita income of nearly $66,000, stands out even within this small group.

How can it be that the United States has a per capita income roughly 50 percent higher than that of Britain, its former colonizer? What explains why US per capita income is roughly six times that of China, which was one of the wealthiest societies on the planet when the first British colonists arrived in Jamestown?

The short answer is that the United States is a highly innovative society that competes effectively in markets for high value-added products and services. Some sense of the US innovative edge can be gleaned from the PWC Global Innovation Study, which ranks the world’s one thousand most innovative firms and provides information about the sectors in which they compete, their revenues, and their spending on research and development (R&D). In 2018, 34 percent of the world’s one thousand most innovative firms, accounting for 28 percent of total revenues and 42 percent of total R&D spending, were located in the United States. Within the information technology sector—commonly referred to as high tech—the results are even more striking. In 2018, 46 percent of the world’s most innovative information technology firms, accounting for 48 percent of total revenues and 58 percent of R&D spending, were located in the United States.1

A somewhat more complete answer is that innovation is the creative act of seeing a demand curve that may not yet exist, imagining a product or service that will meet that demand, combining multiple technologies that already exist, while inventing others that do not yet exist, to build that product or service, recruiting people with the necessary skill sets, and persuading yet other people to risk their savings on the idea and the people. Innovation is, in short, about risk taking—but it is not about taking wild risks. It is about taking calculated risks—to start a company, to become an inventor, to invest in specialized skills, to deploy one’s capital—in an environment in which it is common knowledge that lots of other people also are taking calculated risks. The key to innovation is therefore the maintenance of a social and institutional environment in which calculated risk taking is incentivized. The United States has an innovative society and economy because, at least up until recently, risk taking has been rewarded with a share of the economic rents generated by a commercially successful innovation.

An even more complete answer to the question of how a former colonial backwater became one of the world’s most innovative economies is that the social and institutional environment of the United States promoted calculated risk taking because, from the very start of the society, the United States was built around decentralized markets, not centralized political power. An innovative economy/society was not manna from heaven. It was the result of a complex combination of legal, financial, governance, transport, production, education, and warfare technologies—in which the word technology is understood to mean a way of carrying out a task that can be replicated.2 No one chose this particular combination of technologies in any meaningful sense of the word. In point of fact, many of the technologies were initially conceived elsewhere and were then absorbed, modified, or improved upon locally. These technologies had a powerful impact because of their interactions; each technology amplified the effects of the others.

The key to the success of this process of innovation was the lack of centralized planning: people were free to pursue their self-interest through markets. Some of those markets were economic, in which the currency was dollars. Some of those markets were political, in which the currency was votes. The net result is the equilibrium outcome we observe in figure 1: a society with an unusually high level of material prosperity.

Modernity and the American Experience

Most of human history has been characterized by stasis rather than innovation. The archaeological evidence indicates that from the emergence of Homo sapiens as a species roughly three hundred thousand years ago to the Neolithic Revolution (the domestication of plants and animals that took place roughly ten thousand years ago), there was little in the way of technological change. Innovation after the Neolithic Revolution tended to be slow. Thomas Malthus’s Essay on the Principle of Population perhaps captures the pace and state of technological development. As of its publication in 1798, the fundamental problem facing human societies had not really changed since the invention of agriculture: how to avoid starvation.

Beginning in the late eighteenth century, and then intensifying in the nineteenth and twentieth centuries, a suite of new legal, financial, educational, governance, production, transportation, communication, and warfare technologies that historians refer to as modernity began to emerge. The new technologies did not emerge fully formed from any single society. Rather, the process was recursive, multicountry, iterative, and mutually reinforcing. That is, from the point of view of any society, modernity was an exogenous shock.

The challenge facing societies in the nineteenth and twentieth centuries was how to absorb the new technologies as a broad suite. Societies that were able to accomplish this task relaxed climatologic and geographic constraints on food availability, produced manufactured items on a scale previously unimaginable, conducted industrialized warfare, and built capacious nation-states. Those that were unable to do so were open to being dominated by, colonized by, or subsumed into those that had moved more quickly.

In the United States, a social and institutional environment conducive to innovation began to emerge well before independence. The key to it was a decentralized and democratic political system.

This did not happen because anyone planned it. Quite the contrary: Stuart kings used the colonies to reward their family, friends, and political supporters by setting up proprietary colonies. A “lord proprietor” was essentially a monarch in his own realm, a prince who ran an outlying part of the kingdom with full authority to establish courts, appoint judges and magistrates, impose martial law, pardon crimes, call up the men of fighting age to wage war, grant land titles, levy duties, and collect tolls, so long as he agreed to maintain allegiance to the king (see David Galenson, 1996). The Massachusetts Bay Colony, which was founded by Puritans and consumes so many pages in high school history textbooks, was an outlier.

The goal of the lords proprietors was not to create a democratic society of yeoman farmers that would one day throw off British rule. It was to re-create the manorial system, which had long since disappeared from England. The problem with this plan was that British North America contained neither a Potosí that produced piles of silver coins nor a Pernambuco that yielded prodigious quantities of highly valuable sugar. Cotton would play this role in the US South, but only much later, in the nineteenth century.

The one thing the thirteen colonies did have, however, was seemingly endless expanses of farmland suitable for tobacco, corn, and wheat. Crucially, those crops share characteristics that allow them to be grown efficiently on family farms: they are highly storable and exhibit modest scale economies in production (see Hans Binswanger and Mark Rosenzweig, 1986). Growing tobacco, corn, and wheat was not particularly attractive to the gentlemen that the lords proprietors hoped would establish rural manors, but it did prove attractive to small farmers who came as freemen and indentured workers in order to take advantage of the “headright system” that permitted them to obtain family-sized tracts in fee simple.3

Much to the shock of the lords proprietors, the free farmers soon began to take advantage of the fact that many of the royal charters called for the establishment of colonial assemblies. The charters creating those assemblies had envisioned a system in which lords proprietors, or governors acting on their behalf, would decree laws, “with the advice, assent, and approbation of the freemen of the same province” (see Aubrey Land, 1981). Rather than approving or suggesting changes to laws crafted by the lords proprietors, however, the assembled freemen began to draw up their own laws, challenged the lords proprietors to veto them, and gave one another proxies to represent them at assembly meetings.

Independent farmers thus created the right to vote for representatives endogenously in the seventeenth century; no one “granted” it. When the United States threw off British rule there was never any doubt that the political system would remain decentralized and, by the standards of the eighteenth century, democratic. When the founders crafted the Constitution they grafted two additional eighteenth-century governance technologies onto these native-born institutions: judicial independence, which was created by England’s 1701 Act of Settlement through the stipulation that a judge’s commission could be removed only by both houses of Parliament; and separation of powers, an institution whose benefits were first articulated, at least in the modern world, by Montesquieu in 1748 in The Spirit of the Laws.

One of the first acts of the new constitutional government was the creation of a patent system designed to encourage inventive activities by a broad cross section of American society. As Sean Bottomley has shown, the legal concept that a patent of invention was not a monopoly but instead a temporary property right to something that did not exist before and which could be sold, licensed, or traded, emerged out of British jurisprudence during 1730–80. The United States Patent Acts of 1790 and 1793 were crafted with an eye to democratizing the British system by simplifying the application process, lowering the fees to 5 percent of the British level, requiring the patentee to be “the first and true inventor” anywhere in the world, and obliging the inventor to provide sufficient technical detail that the technology could be copied upon expiration or invented around prior to expiration.4

The legal technology of a patent of invention as a tradable property right interacted with the governance technology of judicial independence, thereby creating an institutional environment in which patents were enforceable.

The response of the American public was even more enthusiastic than the authors of the patent acts had imagined. By 1810, the United States surpassed Britain in patenting per capita. From the 1840s through the 1870s the per capita rate of patenting increased fifteen times. Many of these patents were taken out by ordinary citizens operating with common skills and represented technological improvements across a broad range of economic sectors As B. Zorina Khan and Kenneth Sokoloff have shown, they played a crucial role in incentivizing many of the key inventions of the nineteenth century. Virtually all the great inventors of the nineteenth century made use of the patent system to appropriate returns to their efforts. In fact, rather than practicing their inventions themselves, more than half of them licensed or assigned their patents to other firms or individuals. Among these licensors were people whose names still adorn products today, such as Charles Goodyear, who invented the process for vulcanized rubber in 1839 but never manufactured or sold rubber products. Instead, Goodyear transferred his patent rights to other individuals and firms so they could commercialize them.

The legal technology of a patent of invention as a tradable property right and the governance technologies of federalism and judicial independence interacted with yet another American invention: general incorporation (the creation of a limited liability, joint stock company without a special act of a legislature or royal decree). The idea of the limited liability, joint stock company extends back to ancient Rome in the form of the societas publicanorum, which was used to mobilize capital for public works and services. Cities, universities, and trading companies in medieval and early modern Europe were often organized as corporations operating under special charters. In eighteenth-century Britain, as a result of the treatment of patents by courts as property rights, joint stock companies were created, with inventors as shareholders, that specialized in commercializing patents by licensing them to manufacturers. General incorporation democratized access to incorporation by eliminating the need for a special act of a legislature or ruler.

Fueling the Innovation Machine

We cannot stress strongly enough that general incorporation, much like the patent system, was not a standalone technology: it could mobilize capital efficiently only in the context of a governance technology that prevented rulers or legislatures from arbitrarily amending or abolishing corporate charters. Thus, the spread of general incorporation was dependent upon an independent judiciary that limited the power of the government to interfere with private charters.5

The combination of these legal, financial, governance, and manufacturing technologies yielded innovations whose products were greater than the sum of their parts. The railroad, perhaps the quintessential innovation of the nineteenth century, provides an example. The social returns to railroads were immense because they fed back into production, military, and governance technologies: food could be moved longer distances, making it possible to support larger populations devoted to nonagricultural activities; manufacturers could reach larger markets, allowing them to capture scale economies; and militaries could move troops and materiel rapidly, allowing governments to expand the scale and scope of the nation-state.

Nevertheless, railroads did not diffuse around the planet at a uniform rate. While the technical innovations that underpinned the railroad were worked out in Britain during the first three decades of the nineteenth century, financing, building, and operating a railroad network required the absorption of numerous complementary technologies. In the United States all of these complementary technologies predated the railroad. Thus, railway construction got under way in the 1830s, and by 1860—which is to say even before the transcontinental railroad—the United States already had a rail system with thirty thousand miles of track. This was roughly three times the size of the British system, four times that of Germany, thirty times that of Spain, and 1,560 times that of Mexico.

The innovation machine that emerged from America’s underlying political and economic system did more than build railroads; it played a critical role in the emergence of new industrial centers. By the 1870s and 1880s, for example, Cleveland, Ohio, which specialized in electrical machinery, embodied the innovation frontier. Indeed, as Naomi Lamoreaux, Margaret Levenstein, and Kenneth Sokoloff have shown, from the 1880s to the 1920s Cleveland bore a strong resemblance to today’s Silicon Valley, where local networks of firms and complementary educational, technological, and financial institutions helped to initiate and sustain waves of startup enterprises.

Nations Diverge

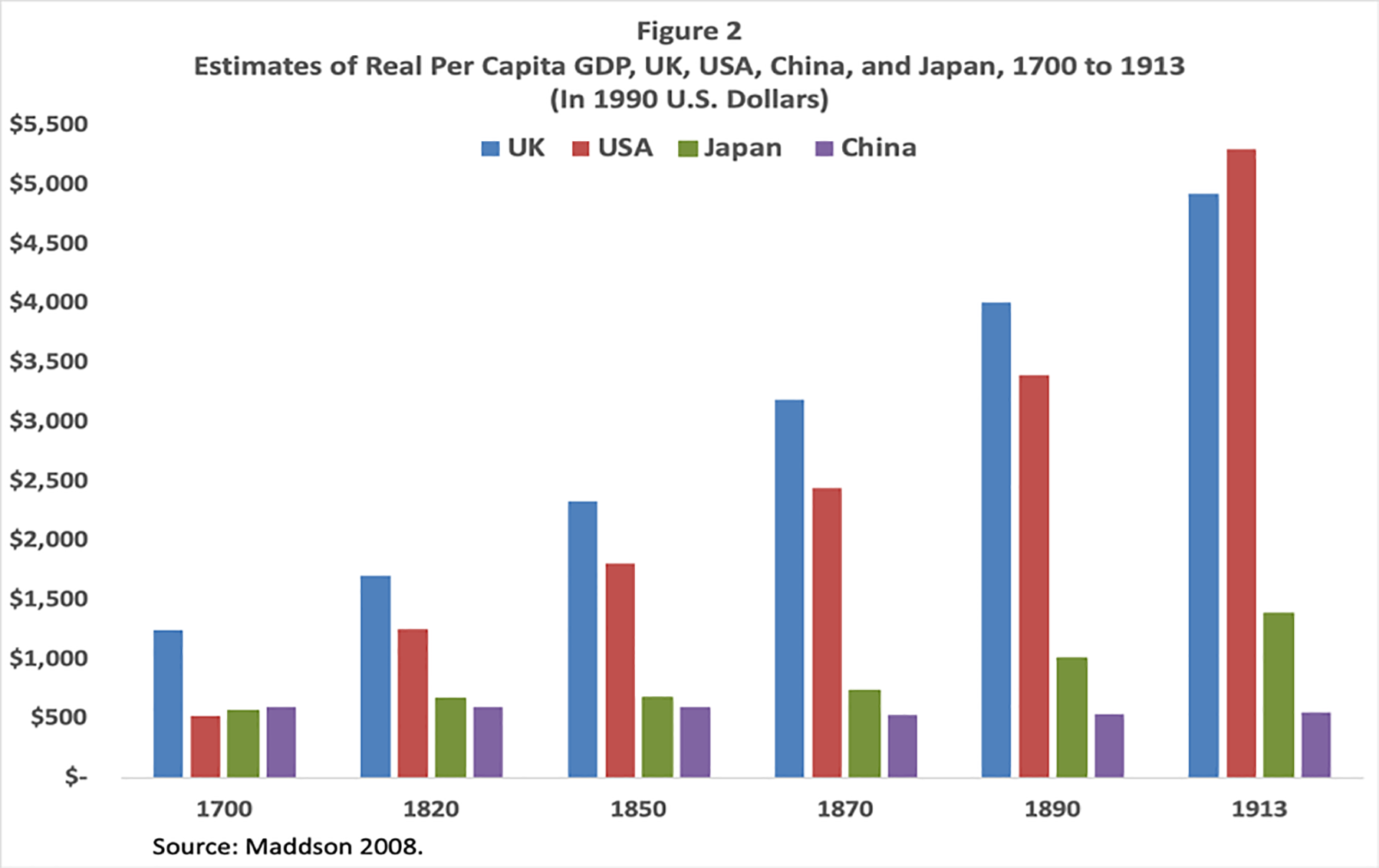

Some sense of the differences in equilibrium outcomes across the United States and selected other nations can be approximated using data on per capita GDP (figure 2). These figures should be taken with a grain of salt. Modern systems of national accounting were not developed until the 1950s; everything before that is a reconstruction. The data points should be taken as statements of relative magnitude rather than as absolute values. That said, the difference in relative magnitudes is clear.

Innovation is not an event, it is a process. It happens when individuals take risks because they know risk taking will be rewarded. Without a common belief that individuals will share in the rents from innovation, the necessary complementary skills, laws, and technologies do not come into existence. Moreover, innovation and the prosperity it brings are not manna from heaven. They are equilibrium outcomes of a complex combination of political structures, laws, judicial systems, stocks of human capital, and belief systems. As such, they are fragile plants.

1 The most recent version of the dataset, covering 2012 to 2018, was retrieved from https://www.strategyand.pwc.com/gx/en/insights/innovation1000.html on September 8, 2020. Readers curious about the other countries highlighted in figure 1 may find it interesting that 160 of the one thousand most innovative firms, accounting for 15 percent of total revenues and 15 percent of R&D spending, were located in Japan; 133 firms, accounting for 14 percent of total revenues and 7 percent of R&D spending, were in China; and thirty-seven firms, accounting for 4 percent of total revenues and 3 percent of R&D spending, were in Britain.

2 In this sense, a patent system is a legal technology that incentivizes invention by creating a tradable property right; a banking system is a financial technology that mobilizes capital by removing the need for savers and investors to know one another; public schools are an educational technology that promotes a broad distribution of human capital by giving all children the opportunity to study; and political correctness is a governance technology that reduces the ability of citizens to make up their own minds by shaming those who reject the orthodoxies promulgated by cultural elites.

3 The lands were obtained as grants from the lords proprietors. Each grantee received fifty acres of land for each person they brought into the colony, whether as settler, indentured servant, or slave. The lord proprietors received an annual “quitrent” from the grantees (Land, Aubrey. 1981. Colonial Maryland: A History, Kraus Intl Publications).

4 Patents were further strengthened by the Patent Act of 1836, which introduced the examination system still in use today, thereby reducing concerns third parties might have had about a patent’s novelty. Britain, seeing the superiority of the US system at the Crystal Palace Exhibition of 1851, adopted many of the features of the US system in 1852. The US system also became the basis for Germany’s 1877 patent law and Japan’s 1888 patent law. The German system, in turn, influenced the patent systems of Argentina, Austria, Brazil, Denmark, Finland, Holland, Norway, Poland, Russia, and Sweden (Kahn, B. Zorina. 2008. “An Economic History of Patent Institutions.” EH.Net Encyclopedia).

5 Even though general incorporation laws were later adopted by other countries, the extent to which they could mobilize capital varied widely. In settings in which connections to political elites were important to the success of an enterprise, general incorporation tended to only be used by those who were already well connected (Haber, Stephen, Armando Razo, and Noel Maurer. 2003. The Politics of Property Rights: Political Instability, Credible Commitments, and Economic Growth in Mexico, 1876-1929. Cambridge: Cambridge University Press.)