Introduction

The European Union (EU) is a large and powerful economic area. With a gross domestic product of around 19 trillion dollars in 2018, the EU has a similar economic size as the United States of America.1 It is home to 512 million inhabitants and will remain more populous than the United States even after the possible departure of Great Britain in March 2019.2 Europe hosts numerous world market leading firms, especially in manufacturing, which export high-quality products everywhere. It is a highly competitive and advanced economy.

More broadly speaking, millions of people around the world tend to project their hopes and visions for a brighter future onto Europe. In his celebrated book, American author Jeremy Rifkin described the “European dream:” a continent of peace, solidarity, tolerance, and economic prosperity. An inclusive environment where human rights are respected, differences and diversity are celebrated, and social justice is enforced. Back in 2004, when the book was published, Rifkin viewed the European Union as the first truly post-modern government body that was ever created, and he argued that this “soft power” may be better-suited to face 21st-century global challenges than the traditional nation state.

Fifteen years later this “European dream” is still alive, at least for many, but it is under fierce pressure. Populist movements have gained support across the continent, which basically represent the opposite of it. They promise that the nation state will “take back control” to the benefit of ordinary men and women, something that the globalist elites in power have apparently failed to deliver during the past decades. The Brexiteers in England—themselves former members of the establishment, who felt that their peers did not give them quite the attention they deserve—are just one example for such a campaign based on the rhetoric of national identity. A similar spirit can be found in the French National Rally (previously known as the National Front), the German Alternative für Deutschland (AfD), and in many other European countries. In Italy, Hungary, and Austria, populists have even risen to power.

Why have those populist movements emerged? One key factor in my interpretation is that Europe is facing a multitude of complex problems such as demographic change, climate change, rising inequality, and above all, technological change. Those phenomena are global in nature and also affect other areas of the world. But Europe has developed a perception, rightly or not, that others might be better prepared to deal with the challenges ahead. Thereby it is concerned to fall behind on a global scale. This creates an uncertain and pessimistic outlook regarding the continent’s future economic prosperity and social progress.

Being global in nature, addressing issues like climate and technological change very likely requires cooperative and multilateral answers. Those profound answers are complicated but still need to be communicated in a simple and accessible manner. Globalist elites seem to have largely failed on this task. As a result, easy and seemingly appealing pseudo-solutions at the national level are currently in high demand, in Europe and elsewhere. But Europe may be especially vulnerable, because a pessimistic outlook breeds populism.

In this essay, I will try to describe some of those deep and interrelated challenges. I will mainly focus on technological change and competition for worldwide technological leadership with the United States and China, because I believe those are the most fundamental issues in the next decades. I will analyze if Europe’s pessimistic outlook is really warranted or if there are signs of hope. And towards the end I also hope to provide some ideas for sensible policy implications.

Europe in a Changing World

Among the key challenges for Europe is a dismal demographic trend. The world population is projected to grow to 10 billion people by 2055.3 Europe, however, is rapidly aging and eventually shrinking, and is thus bound to lose influence on a global scale. Offsetting this decline by more inward migration has proven to be a highly contentious issue, especially when migrants lack education and come from certain culturally distant backgrounds. Climate change may even exacerbate those apparent tensions. It will hit Europe not only directly, by raising temperatures and sea levels and creating more extreme weather events. There may also be indirect impacts when people from even more deeply affected world regions come to look for shelter. Those prospects are deeply concerning for many Europeans.

Further adding to this list are pressing internal problems. The economy of the Eurozone still lacks a coherent institutional framework to deal with large-scale economic shocks. The creation of the single market and the monetary union initially led to economic convergence. But this reversed after the 2008 financial crisis. The subsequent handling of the debt crisis was deeply flawed in hindsight. Depressed economies such as Greece had gone through tough austerity, only to further deepen the depression. Ordinary folks across Europe faced higher taxes and cuts in their pensions, as governments had to bail out big banks. The European Central Bank (ECB) stepped up much too late as a lender of last resort. When Mario Draghi’s famous speech put an end to the acute phase of the crisis in 2012 (“whatever it takes”), for the time being, much social capital and trust between and within the European countries had been wasted.

The architecture of the Eurozone is currently under reform. But countries remain divided about the speed, even about the direction of the required changes. Some economists push for strong automatic stabilizers and elements of risk sharing at the European level. Others fear that such instruments would imply massive fiscal transfers across countries, undermine market discipline and exacerbate moral hazard problems. What is left from this debate is uncertainty whether the European economy will be resilient enough when the next large-scale crisis arrives. This uncertainty is certainly one important cause for a somewhat pessimistic outlook into the future.

The Labor Market Challenges of Digitalization

Unfortunately, the list of issues doesn’t stop here. Possibly the biggest challenge for Europe may come from new digital technologies that change production in numerous, if not all sectors of the economy, and thereby fundamentally reshape the labor market.

In manufacturing, we have already witnessed the proliferation of industrial robotics. For this particular technology, we have detailed empirical evidence about its labor market consequences that I will discuss in greater detail below. In a nutshell, our research shows that dramatic dystopia about robots creating a “technological mass unemployment” are vastly overblown. But this does not mean that we can be relaxed and need not worry about digitalization. Problematic distributional consequences from this technological development have already become visible: the real income gains are not widely shared across society but tend to be concentrated on capital owners and a minority of highly skilled workers. Robots have caused the labor income share to fall. So far, this impact has still been small in magnitude. But things may get worse.

Industrial robots are no longer the technological cutting edge. Their labor market impacts may have been limited. But more profound changes are ahead, coming most likely from advances in artificial intelligence (AI) and big data analysis. Those technologies can substantially raise productivity and open up many previously unexplored business models. But these technologies, in particular, have the potential to replace many tasks or even entire jobs formerly carried out by humans, from truck drivers and bank clerks to radiologists. And those labor market impacts may, to a large extent, happen in the service sector where union coverage tends to be low and where jobs are mostly unprotected.

Current projections suggest that technologies will make spectacular progress in the next decades. Self-driving trucks are just the beginning. Some estimate that machines equipped with full AI will soon be able to compose best-selling books and operas, perform heart surgery, and at some point (maybe in 2060 or so) perform essentially all human tasks.4 Only the crystal ball knows whether those speculations are correct. But it is probably safe to assume that fundamental technological changes are indeed ahead.

As noted by former secretary of state George P. Shultz, all history displays the process of inexorable change; but what is utterly new is the speed of change today. In previous episodes of groundbreaking innovations, change often occurred across generations. For example, when rural agricultural employment started to decline in the United States and in Europe, it was children of farmers turning into urban manufacturing workers. Artificial intelligence, however, can be more disruptive. It may require a fresh start in the labor market even of incumbent middle-aged workers in their 40s or 50s; possibly several times during a working life, maybe in an entirely new work environment, a different industry, even a different city.

For young, educated urbanists, such job mobility is normal. They perceive the coming “second machine age” as a blessing, filled with many new job and consumption opportunities. But less skilled workers probably have a different opinion. The upcoming transformations easily feel like an existential threat to them, one that creates damaging uncertainties and career concerns.

The Luddites, English textile workers in the 19th century, destroyed weaving machines to secure their jobs. A modern version of this tale might involve marginalized manual-routine or service workers to rebel against globalization and digitalization, or to despair over it, in either case fueling backward-looking political movements that try to turn back the clock.

Why Is Europe So Concerned?

Those challenges do not only affect Europe but essentially all economies around the globe. Given its demographic situation, one might even argue that Europe can be quite relaxed about labor-saving digital and other technologies. Europe could benefit from the promise of additive manufacturing, also known as 3D printing, to “reshore” some jobs moved abroad in the era of multiplying global supply chains. Moreover, labor supply is also decreasing. This can create skill mismatch, i.e., a coexistence between job displacements in one end of the market and labor shortages in other ends. But a prolonged “technological mass unemployment” is unlikely.

Japan, where population aging is even worse than in Europe, seems to have realized this. The country is deliberately forging ahead in introducing robot technologies even in industries such as elderly care. Hysteria about robots taking away jobs are mostly unheard of in Tokyo, but not so in Berlin, London, or Paris.

Why is Europe so concerned? The key reason probably is that Europe doesn’t see itself in the center of technological development anymore. It fears to be overtaken by others and is thus mostly concerned about negative consequences of technological change.

At the firm level there is one distinct pattern: job losses of new digital technologies tend to accrue indirectly. Firms that adopt the latest and most advanced technologies do not displace workers; instead they gain market shares and hire new workers. Amazon is a good example. Between 2014 and 2016, the firm has increased its stock of warehouse robots from below 2,000 to over 40,000. In parallel, it has hired over 200,000 employees worldwide. Job losses do occur elsewhere, however, namely in small retail stores or even chains such as Barnes & Noble which did not introduce new technologies at the same pace as Amazon did and consequently lost market shares. Our research shows a similar pattern among European manufacturing firms: Those that were already highly productive tended to digitalize more intensively and were able to raise productivity, expand output, sales, markups, and employment. Job losses occurred in competing smaller firms that don’t adopt those technologies and don’t digitalize. As those firms fall behind technologically, they lose market shares, profits, and ultimately have to cut jobs.

The same principle may also apply for countries: those at the technological frontier, or those that experience rapid technological growth, may be less concerned about domestic displacements or other adverse labor market effects of new technologies. Matters are different, however, when countries have the impression of falling behind or not being at the technological frontier any longer. This is where Europe currently seems to be.

Competition for Technological Leadership

The five most valuable companies in the world by market capitalization are Apple, Amazon, Alphabet (Google), Facebook and Microsoft.5 In the top ten, there are eight American and two Chinese firms. Europe has none. In modern software and information technology, Europe is almost entirely dependent on the United States. The same is true for military and defense.

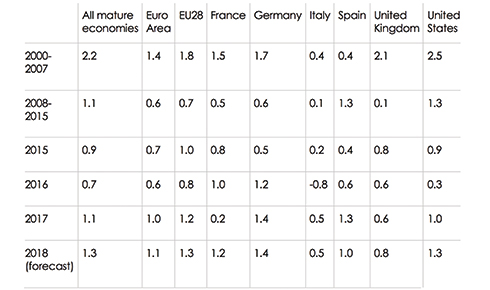

Table 1 reports productivity growth rates before and after the crisis for various countries. On a global scale, there has been a productivity slowdown across mature economies, with an average rate of only 1.1% in the period 2008-2015 compared to 2.2% in 2000-2007. Productivity growth strongly differs within Europe. But in all major European economies, it has been consistently lower than in the United States over time.

Such observations and statistics may have led Tim Höttges, CEO of German telecommunications provider Deutsche Telekom, to conclude that “Europe has lost the first half of the game called digitalization.”

Table 1. Growth of GDP per hour worked, selected mature economies, 2000-2018

Notes: Growth rates are based on the annual percentage of difference of each variable and are aggregated using shares in nominal PPP converted GDP. Growth rates for 2000-2007 and 2008-2015 are the averages of yearly growth rates. Source: The Conference Board Total Economy Database™, March 2018.

Those numbers alone would not justify a deep inferiority complex. After all, the EU remains highly competitive in many sectors—automobiles, machinery, chemicals, and other specialized manufacturing products, just to name a few—and runs a large surplus in goods trade vis-à-vis the United States, very much to the discomfort of President Donald Trump.

But when it comes to the most exciting new digital business models, the ubiquitous platforms and social networks, they are all dominated by American superstar firms whose world market positions seem almost untouchable. And with this comes a dark presentiment: Europe may not only have lost the first half against the United States, but catching up during the second half will not be easier since American tech giants can use their enormous resources to preempt any competition and dominate also the next wave of digitalization.

When it comes to future developments in artificial intelligence, big data analytics, self-driving vehicles, and other cutting-edge technologies, the common perception in Europe may be even more pessimistic. Many believe that, if anyone has the capacity to compete against the United States in those fields, it will not be Europe but someone else: China.

China

With a GDP of $12.3 trillion, China is still ranked third after the United States and the EU, yet already well ahead of Japan. But economic growth has been spectacular, and it is only a matter of time before China overtakes Europe in terms of the absolute size of its economy.

The People’s Republic of China, officially a communist country, is factually an El Dorado of capitalism but of a different variety: with powerful state-owned enterprises, active industrial policy, and strategic government planning for key industrial sectors.

Even when China joined the World Trade Organization (WTO) in 2001, and thus formally subscribed to the multilateral system of rule-based world trade, it was even less of a “free trader” than anyone else in the club. There continued to be heavy restrictions on inward foreign direct investment, there was forced technology transfer in exchange for access to the Chinese market, intellectual property theft, subsidies to Chinese exporters, currency manipulation to foster export-led growth (at least initially), and so forth.

Another game changer came in 2015, when Chinese leader Xi Jinping and Premier Li Keqiang announced their “Made in China 2025” plan. It is a three-phased strategy to initially make China self-reliant and independent of imports in ten key industries (including robotics, IT, aeronautics, etc.) by 2025. Eventually, by 2049, China then strives for worldwide technology leadership in those areas. Closely related is the Chinese “belts and roads” initiative, an infrastructure investment plan in over 60 countries to secure trading routes and the supply of natural resources. Among them are many African states, but also countries in Eastern and even Western Europe.

The European Union is deeply affected by those initiatives in various ways. One direct influence is that China tries to acquire tangible and intangible assets whenever it has the chance. Examples include the takeover of the German robotic producer Kuka, the Greek Piraeus harbor, the (failed) attempt to acquire the 50 Hertz electricity network, the involvement of Huawei in building 5G mobile networks across the continent, and so forth.

In principle, Europe is open to capital inflows and foreign direct investments, including from China. But in all of the above cases, concerns were expressed that those investments were not solely carried out by Chinese firms in search of profit opportunities, but that the Chinese government was effectively involved in pursuit of longer-term strategic objectives such as technology transfer or influence over key infrastructures. Various European governments have therefore launched plans to scrutinize Chinese investments more closely, and to push for stronger reciprocity to open the Chinese market for European investors.

But this debate is just one aspect of a more general geostrategic conflict: an increasingly tough systems competition between the Chinese-style state capitalism, and the European model of a social market economy embedded in a rule-based multilateral framework.

Relative to GDP, China spends more on research and development than the EU does on average. In purchasing power terms, R&D spending in China has recently overtaken the EU and is coming close to the American level.6 The Chinese authoritarian top-down approach was often believed to be not conducive to scientific progress, but recent trends in patenting and publication outcomes tend to suggest otherwise.

Whether China really has the potential to become a scientific superpower is still undecided. But it is far from clear that Europe will automatically maintain its technological leadership over China, and its role as the main competitor of the United States.

The United States

The role of the United States in this mélange became clearer after President Trump took office. America and Europe traditionally have been, and continue to be, close friends and allies. Donald Trump’s “America first” policy—the various trade conflicts and import tariffs, the disengagement from multilateral agreements and institutions such as the WTO—are certainly a burden for the transatlantic partnership. But his policy also revealed one piece of information very clearly: President Trump considers China to be the main contender of American global hegemony in the 21st century, while Europe is at best of second-order importance in his thinking.

American trade policies have taken various twists and turns. It has, at times, been hard for many observers to discover a coherent underlying strategy or what Donald Trump’s goals and motives actually are in this trade conflict. But one factor has been very consistent throughout: the main opponent is China, while the conflicts with the other trading partners never actually escalated.

Why Trump’s focus on China? The most obvious argument becomes transparent when looking at bilateral trade imbalances, which are very important to him. The American trade deficit with China is gigantic: roughly 380 billion dollars in 2017. In the case of the European Union it is “only” 150 billion, and the deficit disappears entirely in the bilateral current account once services trade and primary incomes are included.7 This is probably one reason why the trade conflict between the United States and Europe so far remained on a rather symbolic level. It is restricted to tariffs on steel and aluminum imports, which are small in volume (but allegedly endanger American national security). Trump threatened to raise tariffs also against European cars, but that did not happen so far. Quite the opposite, in the meantime he even declared his intention to sign a comprehensive trade agreement with the EU while remaining tough on China.

But President Trump’s focus does not only reflect those aggregate numbers in bilateral trade statistics. In the early stages, before the majority of Chinese imports was included, he focused tariffs on several high-tech goods (such as satellites or electric engines), which are part of the “Made in China 2025” plan. Currently China exports hardly anything of those products. But Trump’s tariffs had pre-emptive motives: by precluding access to the American market, they were supposed to hinder Chinese development in those industries.

This shows that the Sino-American trade conflict is really just one piece of a broader global race for technological leadership. Donald Trump is not pursuing well-defined trade policy goals with his tariffs. He uses them as an instrument to contain China’s economic development more broadly. Europe’s role in that race appears to be limited to an outside spectator. In the short term, consumers and producers in the EU may even benefit from the tariffs that China and the United States impose on each other, because this leads to standard trade diversion effects (soybeans are a case in point here). But the longer-term message is that nobody, at least not Donald Trump, expects Europe to really catch up in the second half of digitalization. The race is fought between the United States and China.

Example: The Car of the Future

The automobile industry may serve as an illustration. At the moment, European automakers (especially the German ones) are still highly successful on export markets. But their current business model, based on sophisticated combustion engines, is slowly coming to an end. The next generation will be self-driving cars with much simpler electric engines. German automakers have recently announced that they will eventually produce only such cars.8 But it is still far from clear how global supply chains will look like in this key industry.

The software will probably come mostly from the United States. Europe may keep the design and bodywork stages. But the third key component—the batteries—are produced almost exclusively in Asia, especially in China. The CEO of Volkswagen, Herbert Diess, recently labelled this European dependence on Chinese batteries as “frightening.” But large-scale investments to develop battery production in Europe are still hardly anywhere to be seen.

Ironically, the Chinese manufacturer CATL recently made a first move and built a large-scale battery production plant in Germany, close to the city of Erfurt. But the major German car producers themselves have not yet followed this example. They do spend considerable amounts on research and development of electric engines, but they are yet unwilling to open up production facilities. They passed the ball over to car parts suppliers, such as Bosch, but those suppliers also seem unwilling to engage in major investments.

Where does this reluctance come from? Germany’s Secretary of Commerce, Peter Altmaier, probably had the same question in mind when he recently, in an unusual appearance, openly criticized the German automobile industry and requested from them “to build a car at least half as sexy as Tesla.” One reason why this takes so long is possibly that firms are still too busy and successful with their current business models, and therefore care too little about the future. Another reason may be that they are just waiting for government subsidies. Minister Altmaier is forging ahead in establishing a so-called “European battery alliance” these days. This would amount to an industrial policy where clusters of battery producers are actively supported. One cluster may emerge in Lausitz, a declining coal mining area in East Germany, and would involve a combined effort with the governments of the bordering Western Poland and Northern Czech Republic in order to overcome European state aid rules.

Maybe we will see an increase in investment activity, and eventually European battery production, once these industrial policies are set up and firms can partly recoup their costs from the government. But even when that happens, questions remain. Sophisticated combustion engines consist of thousands of parts, which are combined in a highly complex global supply chain. Electric engines are much simpler, and it is questionable if battery production could ever make up for the losses in value-added and employment in this flagship industry of European manufacturing. The major concern is that the largest slices of the pie in this key industry will go to other countries in the future

Summing up, Europe tends to be scared about the current rapid development of new digital technologies because it believes it cannot compete in the longer term. Europe is skeptical whether it can keep up with the growth of Silicon Valley, and the United States more broadly, and it fears to be to be taken over by China. All the other problems mentioned before, from demographic trends to the malfunctioning of institutions, come on top. The recent surge of populism in Europe may be one reaction to this dark outlook, and this fear of losing status.

Has Europe Really Lost the First Half of Digitalization? The Robots Experience

The previous section has been (deliberately) quite pessimistic. Maybe it was even too pessimistic about the prospects for creating economic prosperity in Europe by developing and implementing new technologies. The purpose of this section is to take a somewhat different, more positive perspective.

To be sure, there are no European internet and tech giants like in the Silicon Valley, and Europe is lagging behind when it comes to artificial intelligence and big data analysis. But in other domains, Europe is actually ahead of the United States; in particular, European countries clearly dominate when it comes to automation technologies in the manufacturing sector, with new digitally controlled machines such as industrial robots. Those robots did induce severe labor market challenges for manufacturing workers, both in the United States and Europe. Many popular books have been written about the “rise of the robots”, and how they will lead to a technological mass unemployment.9

Given that Europe (and especially Germany) has many more robots and many more potentially endangered manufacturing jobs prone to automation than the United States, those alleged devastations should have hit Germany much more severely. But, as it turns out, it is actually the opposite. European labor markets, the German one in particular, have coped better with this technology shock than the American market.

I will describe our research more closely in this section, and thereby I will be casting some doubts on whether Europe has actually lost the first half of digitalization so clearly. I focus on Germany, because it is by far the most robotized European economy, and we have conducted research on the detailed labor market impacts of robots only for this country (for reasons of data access and availability).10 Detailed analyses for other European countries are currently in the making, but they have not yet been finalized to the best of my knowledge.

Robot Data

The International Federation of Robotics (IFR) defines a robot as an “automatically controlled, re-programmable, and multipurpose machine” which is fully autonomous, does not need a human operator, and can be programmed to perform several manual tasks such as welding, painting, assembling, handling materials, or packaging. Single-purpose machines such as elevators or conveyer belts are, by definition, not robots.

In contrast to many other new technologies, such as full AI, there is already reliable representative data on the proliferation and usage of robots across industries and countries. This allows researchers to take one important step: rather than speculating what could happen in the labor market in response to those new technologies, they can conduct detailed statistical analyses what did actually happen. This evidence-based approach, obviously, needs empirical data. And this data is provided by the IFR based on annual surveys of robot suppliers, capturing around 90 percent of the world market.

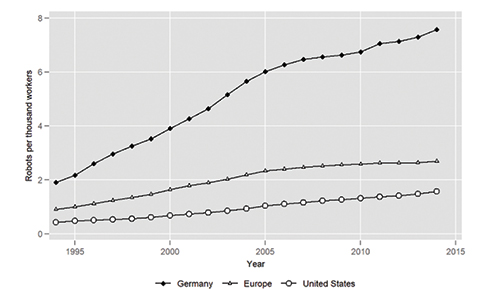

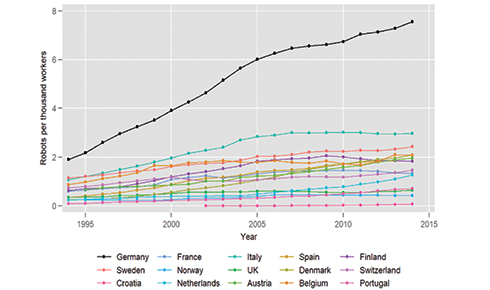

The IFR data clearly show that robots are much more prevalent in Europe, especially in Germany, than in the United States. The left panel in Figure 1 reports that almost two industrial robots were installed per thousand workers in Germany in 1994, more than twice as many than in the European average and four times as many than in the United States. Usage almost quadrupled over time, and now stands at 7.6 robots per thousand workers compared to only 2.7 and 1.6, respectively. The right panel shows more detailed trends for different European economies and consistently shows that Germany is clearly an outlier when it comes to robot usage. Moreover, it is not only a heavy user but also an important engineer of industrial robots. The “robotics world rankings” list eight Japanese firms among the ten largest producers in the world; the remaining two (Kuka and ABB) have German origin and mostly produce in Germany. Among the twenty largest firms, five are originally German and only one (Omron) is from the United States. China was so far absent from this ranking. This changed when a Chinese investor recently acquired a majority share of Kuka, which triggered many alarm bells in the public discussion and in policy circles. But, at least so far, Chinese domestic production is not nearly as robotized as European (especially German) manufacturing.

Figure 1. Robot installations across countries, 1994-2014

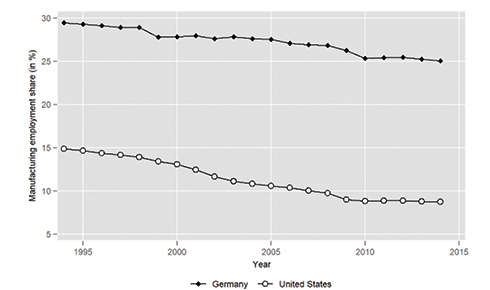

Despite the fact that there are many more robots around in Germany that could potentially replace human workers in production, Germany is still among the world’s major manufacturing powerhouses with an exceptionally large employment share. Figure 2 shows that the manufacturing share in employment ranges around 25% in 2014, compared to less than 9% in the United States. This German manufacturing share has been declining during the last 25 years, from roughly 30% in 1994. But even this decline was less dramatic than in the United States. In short, Germany is the land of the robots and of potentially endangered manufacturing workers.

Figure 2. Manufacturing employment share in Germany and the United States, 1994-2014

Recent research by MIT’s Daron Acemoglu and Pasqual Restrepo has combined this robot data with detailed administrative information on jobs and wages across local labor markets in the United States (1993-2014).11 The empirical picture that emerges from their analysis is quite sobering. They find significantly negative impacts on labor force participation. More specifically, one additional robot reduces total employment in the United States by around 3-6 jobs. It also reduces average equilibrium wages for almost all groups in the labor market.

Those numbers are nowhere near the dramatic dystopias about mass unemployment that are often cited in the media, according to which almost half of all jobs will soon be taken by robots. But the upshot of Acemoglu’s and Restrepo’s research is still that displacement effects caused by robots seem to be widely dominant in the United States.

Robots in Germany

In our research, we conduct a similar analysis for the German labor market, which is really an ideal laboratory to study the precise labor market consequences of robots.12 One might expect even more dramatic impacts in Germany, given that there so many more robots than in the United States that could potentially replace manufacturing labor, and so many more manufacturing workers whose jobs could potentially be automated.

Quite surprisingly, however, we find exactly the opposite result: Robots have not been job killers in Germany. There is no evidence for employment or wage losses like in the United States. The overall effects are very close to zero, i.e., robots did not change the total number of jobs in the German economy during the period 1994-2014.

Digging deeper into the data, we find strong compositional effects because robots do have negative impacts on manufacturing employment. We calculate that every additional robot eliminates two manufacturing jobs on average. Roughly 275,000 full-time manufacturing jobs have therefore been destroyed by robots in the period 1994-2014. This accounts for almost 23% of the decline that is illustrated in Figure 2.

But those sizable losses were fully offset by job gains outside manufacturing, mainly in business-related service industries. In other words, robots have strongly changed the composition but not the overall level of employment in Germany.

Moreover, another key insight is that the induced compositional change—fewer manufacturing and more service jobs—has not been disruptive at the level of individual workers but occurred across generations. Our linked employer-employee data allow us to trace employment biographies and earnings profiles of roughly one million manufacturing workers with a varying exposure to robots (and some other technology and trade shocks) over time. This analysis is, to the best of our knowledge, the first in the literature to address comprehensively how individual workers were affected by, and have responded to, the rise of the robots.

This worker-level analysis delivers a surprising insight: more robot-exposed workers did not face a higher risk of job displacement or unemployment. Quite the opposite, they even had a substantially higher probability to keep a job at their original workplace. The negative overall effect of robots on aggregate manufacturing employment is instead solely driven by smaller inflows of labor market entrants into more robot-exposed industries.

In other words, robots did not destroy existing manufacturing jobs. Incumbent workers were safe, although many of them ended up performing different tasks (sometimes even different occupations) in their firm than before the robots came along. But when those workers reached retirement age, their vacant jobs were no longer filled. Manufacturing firms hired fewer young labor market entrants as replacements, and those youngsters instead started their careers directly in the service sector at comparable wages.

The German education system might have been helpful to facilitate those patterns. After high-school, those graduates who don’t go to college or university typically enter the apprenticeship system before actually entering their first job. This system provides occupation-specific but also general training, whereas comparable juveniles in other countries are often only confronted with on-the-job training. This provision of general skills in the German system might be particularly conducive to job mobility and allow labor market entrants to respond more flexibly to changes in labor demand. More specifically, when robots reduced the job prospects in the manufacturing sector for young workers, they probably had an easier time to change plans and prepare for a career in the service sector even before entering their first real job.

Wages and the Income Distribution

The good news of our analysis is, therefore, that individual disruptions for incumbent workers were mostly avoided. Robot-exposed incumbent workers were retained, retrained, and repositioned inside their firms. But, unfortunately, there are also downsides and less cheerful results. When it comes to the wage and earnings effects, we find considerable heterogeneity at the individual level. Robots caused notable on-the-job earnings gains for high-skilled workers in scientific and management positions. Those workers gained, because they possess complementary skills to this technology, and perform tasks that are not easily replaceable.

But for low- and especially for medium-skilled manufacturing workers we find moderate but still significant negative impacts. Completed apprenticeship is the typical profile for manufacturing workers in Germany, and this group of medium-skilled workers accounts for almost 75% of all individuals in our sample. They are overrepresented in manual and routine-intensive occupations, such as machine operators. Those professions have become mostly obsolete, because robots—by definition—do not require a human operator anymore. Even for those workers we still find no increased displacement risk, however, because many of them were retrained and repositioned inside the firm. Again, the apprenticeship system might have helped in that respect, because it potentially preserves general skills and thereby facilitates later job mobility.

But despite this maintained safety of jobs, many medium-skilled manufacturing workers had to swallow real wage losses along the way, and thus experienced cumulative earnings losses caused by robots. In the aggregate, we find that robots raise average productivity as well as total output and profits, especially in highly productive firms, which tend to have large market shares and charge high markups. But robots did not lead to higher average wages, despite the increases in average productivity.13 In other words, our analysis suggests that robots have contributed to the decline of the labor income share. The rents of this new technology seem to be captured by profit claimants, capital owners, and by skilled workers with high levels of human capital working in robot-intensive firms. But the bulk of low- and medium-skilled workers did not benefit from this new technology. Many of them even suffered (moderate) real income losses.

Comparing the Impact of Robots in Germany and the United States

Those latter results regarding the impact of robots on the income distribution are certainly worrying. They beg the big question: who owns the robots? How can societies disperse capital and profit earnings more widely, so that they don’t end up only in the deep pockets of a few individuals in the top percentiles of the wealth distribution, where asset and firm ownership tends to be concentrated? These are key questions for the future, in all developed countries, and Germany is no exception in that respect.

By and large, however, it seems that this German experience with the rise of the robots has been a big success story. Individual job disruptions and involuntary unemployment episodes were mostly avoided. And overall, it seems that the German labor market has digested the very same technology shock—the rise of the robots—much better than the American one.14

What may be the reason? I have already pointed to the German education system, especially the apprenticeship system, as one potentially important factor. We have seen that many medium-skilled manufacturing workers were repositioned to new jobs inside the same firm. Former machine operators turned into logistics managers, sales representatives, and so on. Such transitions only happen smoothly with some specific training, but they also require a certain degree of general skills that allow for occupational mobility. The German apprenticeship system of professional education may be particularly well suited to provide this skills mix to workers without a college degree, while the American system may impede this mobility because it strongly focuses on firm-specific on-the-job learning.

Labor relations. But I believe there is more than just the education system. The system of industrial relations in the German labor market plays an equally important role. The manufacturing sector is still highly unionized. Wages for blue-collar wages are typically determined collectively at the industry level, but there is also strong involvement of work councils at the firm level. When unforeseen shocks arise, firms can deviate from industry-wide wage floors. But work councils must agree. In larger firms, worker representatives are even part of the board and are, thus, directly involved in key strategic management decisions.

Those institutional features played a considerable role to cope with the robot threat. It has been frequently argued that German unions have a strong preference for maintaining high employment levels and are relatively more willing than their colleagues from other countries to accept wage restrains. This flexibility was already used in the past to react to other big shocks, more specifically to the threat to offshore production to Eastern Europe after the collapse of the Soviet Union in the early 1990s. Also in that case, unions allowed for flexible wage setting arrangements, such as opening clauses, and thereby retained many jobs in Germany that otherwise would have left. Another related instance is the reaction to the great recession in 2008/09. Confronted with a massively negative demand shock, most firms tried to avoid mass-layoffs or ultimate terminations of job contracts. Instead, with the help of the government, they went to short-time work (“Kurzarbeit”): Firms cut hours but retained workers and their firm-specific human capital. Again, this would not have been conceivable without the consent of works councils, worker representatives on company boards, and unions more broadly. This flexible reaction turned out to deliver amazingly well and was one important reason why unemployment returned to pre-crisis levels amazingly quickly in Germany, very much in contrast to the experience in other European economies.

Our analysis suggests that the rise of the robots may have triggered a similar response. In view of the potential threats that robots can mean for labor demand, insiders (represented by the unions, the works councils, and representatives) have been willing to swallow wage growth below inflation in order to stabilize the existing jobs for medium-skilled workers. By keeping their incumbent old workers, manufacturing firms have supposedly retained specific human capital, benefited from enhanced job stability, and the acceptance of management decisions by the workforce.

Spillovers. Those smaller disruptions may then, in turn, have led to smaller negative demand spillovers into the local economy. When mass layoffs occur, and many workers become unemployed at the same time, this can create a severe local recession when displaced workers cut their consumption spending. When that happens, many jobs in local service industries—restaurants, hairdressers, etc.—also run into trouble and can disappear.

This is probably what happened in the American Rust Belt in response to the disruptions from the robot shock. In the German case, however, negative spillovers were probably avoided (or at least were substantially smaller), because robot-exposed manufacturing workers only faced some relatively mild real wage losses.

We even obtain evidence for countervailing positive spillovers: Robots increased output and productivity, and this seems to create additional demand for specialized local business services, and thereby tends to increase wages in those industries.

Demography. And finally, the reaction of German firms to retain and retrain workers might have already taken demographic trends into account.

Robots replace certain tasks and jobs, but they also create new tasks and the need for additional staff. In a perfectly flexible market with abundant labor supply, firms would probably hire highly specialized new workers whose profiles fit exactly to their specific needs. But in an aging society with skill shortages, it may be more attractive for firms to hang on with those workers whom they already know and trust.

More generally, our evidence has shown that the same technology shock can have very different effects in different countries, given their particular institutional arrangements. So far I only know of our evidence for Germany, and the work by Acemoglu and Restrepo for the United States. Future research is urgently needed also for other countries. This would allow us to understand more precisely which institutional settings are most appropriate to deal with robots or other technological shock, and to develop best practices and lessons about how countries can learn from each other.

Outlook: What Might Happen in the Second Half?

The experience with the industrial robots clearly suggests that Europe also scored during the first half of digitalization. The United States is certainly leading in some very important internet and tech industries, but America does not dominate all digital technologies. When it comes to the manufacturing sector, European countries (Germany in particular) seem to be way ahead in the adoption and the engineering of those technologies. And European labor markets seem to have coped better with the challenges for low- and medium-skilled workers.

This diagnosis lends itself to a somewhat more optimistic outlook for what might happen in the second half of the game called digitalization, which may have started already and now go on for an indefinite time period. As explained at length above, Europe is aware (or even frustrated) that it will be difficult to catch up, because the American tech giants have very deep pockets and China has entered the playing field.

It is probably unrealistic to expect that Europe will play a world-leading role in cutting edge areas such as artificial intelligence or digital platforms anytime soon, although Europe might try to develop its own templates and solutions that put more weight on issues such as data protection and privacy concerns that traditionally matter a lot more to European consumers.

But things may be different in the manufacturing sector where substantial technological advances are also looming large on the horizon. The future of the European automobile industry was already discussed before with a somewhat pessimistic undertone. But things could also get back on track: Once European carmakers start investing massively in solutions for electric mobility and battery production, there is hope that Europe can retain sufficient parts of the global supply chain for self-driving cars and thereby hold on to one of its key industries.

Additive Manufacturing and Reshoring

Another future development that may play an important role is additive manufacturing, also known as 3D printing. To appreciate the involved issues, consider the example of the German sportswear producer Adidas. The firm currently produces around 4 million pairs of shoes every year. More than 96% of this currently happens in Asia. The reason is obvious: low production costs and wages in countries such as Bangladesh or Vietnam (China may be already too expensive). This offshoring approach was heavily used by European manufacturing firms ever since the early 1990s. It has been a key factor behind the economic growth and development of emerging Asian economies, including China.

But offshoring also has downsides. Above all, most European firms are restricted to mass production. Adidas essentially produces thousands of pairs of identical shoes to realize economies of scale, and then ships them from Asia back to Europe on container ships subject to transport costs and considerable CO2 emissions.

Quality-sensitive consumers in Europe and elsewhere increasingly expect customized products, however: special designs, sizes, colors, and so forth. Coordinating such customization across thousands of kilometers is hardly possible, given all sorts of communication, legal, contractual and cultural barriers that play a role in an offshoring relationship.

This is probably why Adidas has recently decided to build a fully automated factory with 3D printers in a small Bavarian town, Ansbach. Customers can effectively design their individual shoes online. The specifically designed and unique product is then manufactured on site, and directly shipped (over a much shorter distance) from Ansbach to the client. Adidas is currently planning with an overall capacity of 500,000 pairs, and roughly 150 full-time jobs.

It is probably too early to tell if this Adidas example is just one singular case, or if it represents a broader reshoring trend of European (and also American) manufacturers repatriating global supply chains. Available evidence suggests that we may indeed be talking about the latter. Based on data from the World Input Output Database, Krenz et al. (2019) show that reshoring of manufacturing activities is clearly on an increasing trend among advanced economies, and in particular, that technological advances trigger this reshoring.15 More specifically, they estimate that an increase by one robot per 1000 workers is associated with a 3.5% increase of reshoring activity in the respective manufacturing industry.

Global Implications of Reshoring

When this reshoring indeed becomes a broader trend, it has potentially profound implications for the distribution of economic prosperity across the globe. For emerging economies in Asia and possibly Africa this reshoring to Europe and North America may become a fundamental problem. Following the Chinese example, their development strategy typically relies on low wages which in turn facilitate export-led growth. But when 3D printing or other automation techniques become widespread, this may deprive the global South of its main competitive advantage. Or it may require even lower wages in the South to remain competitive with the sophisticated but fully automated production lines in the global North.16

For Europe, on the other hand, reshoring of global supply chains and the resulting deglobalization is an opportunity. The number of jobs created in (almost) fully automated factories in Ansbach or elsewhere is, of course, substantially below the number of jobs that are replaced in Vietnam or Bangladesh. But 150 jobs are better than no jobs in Ansbach, and workers in the maintenance and supervision of such production lines tend to be sophisticated and well-paid.

These opportunities for Europe are potentially larger than for the United States, because there has been even more substantial offshoring in the past, which can now be reversed. Also other recent developments for technological advancements within the manufacturing sector, such as the internet of things (IoT), possibly benefit mostly Europe. The reason is simple: The United States has the internet. But the next development step will be about connecting the internet to “the things,” and with its traditional manufacturing focus, Europe has “the things.”

For those and many more reasons, it is not at all clear that Europe is doomed to be left behind in the second half of digitalization. It has enormous potential for growth and economic prosperity and good chances to remain competitive with the United States and China.

But to fully exploit its potential, Europe must get its act together. The internal divisions over the institutional design of the European Union and the Eurozone are not helpful at all, because they distract Europe from the real challenges. European countries must realize that they are much too small and too unimportant on their own to play any meaningful role in the global race for technological leadership. Europe stands a chance to remain at the technological frontier, or at least close to it, then only as a powerful and united global entity. And this entity should be one that also works on its potentially biggest problem: excessive pessimism.

Jens Suedekum is a professor of international economics at the Düsseldorf Institute for Competition Economics (DICE) at Heinrich Heine University Düsseldorf and a research fellow at the Center for Economic Policy Research (CEPR).