- Economics

- Law & Policy

- Regulation & Property Rights

- Politics, Institutions, and Public Opinion

Many believe that wild greed and market failure led us into this sorry economic mess. According to that narrative, investors in search of higher yields bought novel securities that bundled loans made to high-risk borrowers. Banks issued these loans because they could sell them to hungry investors. It was a giant Ponzi scheme that worked only as long as housing prices were on the rise. But housing prices were the result of a speculative mania. Once the bubble burst, too many borrowers had negative equity and the system collapsed.

Part of this story is true. The fall in housing prices did lead to a sudden increase in defaults that reduced the value of mortgage-backed securities. What’s missing is the role politicians and policy makers played in creating artificially high housing prices and artificially reducing the danger of extremely risky assets.

Beginning in 1992, Congress pushed Fannie Mae and Freddie Mac to increase their purchases of mortgages going to low- and moderate-income borrowers. For 1996, the Department of Housing and Urban Development (HUD) gave Fannie and Freddie an explicit target: 42 percent of their mortgage financing had to go to borrowers with incomes below the median in their area. The target increased to 50 percent in 2000 and 52 percent in 2005.

For 1996, HUD required that 12 percent of all mortgage purchases by Fannie and Freddie be “special affordable” loans, typically to borrowers with incomes of less than 60 percent of their area’s median income. That number was increased to 20 percent in 2000 and 22 percent in 2005. The 2008 goal was to be 28 percent. Between 2000 and 2005, Fannie and Freddie met those goals every year, funding hundreds of billions of dollars’ worth of loans, many of them subprime and adjustable-rate loans, to borrowers who bought houses with less than 10 percent down.

/

Fannie and Freddie also purchased hundreds of billions of dollars in subprime securities for their own portfolios to make money and to help satisfy HUD affordable-housing goals. Fannie and Freddie were important contributors to the demand for subprime securities.

Congress designed Fannie and Freddie to serve both their investors and the political class. Demanding that Fannie and Freddie do more to increase home ownership among poor people allowed Congress and the White House to subsidize low-income housing outside the budget, at least in the short run. It was a political free lunch.

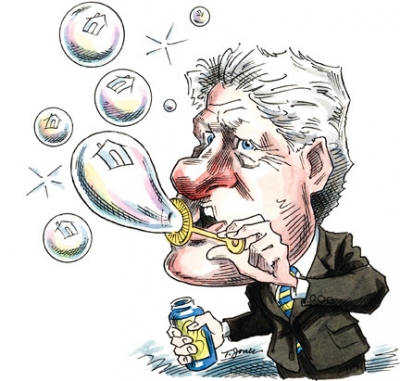

POLITICIANS INFLATE THE BUBBLE

The Community Reinvestment Act (CRA) did the same thing with traditional banks. It encouraged banks to serve two masters: their bottom line and the so-called common good. First passed in 1977, the CRA was “strengthened” in 1995, causing an 80 percent increase in the number of bank loans going to low- and moderate-income families.

Fannie and Freddie were part of the CRA story, too. In 1997, Bear Stearns performed the first securitization of CRA loans, a $384 million offering guaranteed by Freddie Mac. During the next ten months, Bear Stearns issued $1.9 billion in CRA mortgages backed by Fannie or Freddie. From 2000 to 2002, Fannie Mae securitized $394 billion in CRA loans, with $20 billion going to securitized mortgages.

By pressuring banks to serve poor borrowers and poor regions of the country, politicians could push for increases in home ownership and urban development without having to commit budgetary dollars. Another political free lunch. Fannie and Freddie and the banks opposed these policy changes, at first through both lobbying and intransigence. But when they found out that following these policies could be profitable—which they were, as long as rising housing prices kept default rates unusually low—their complaints disappeared. Maybe they could serve two masters.

They turned out to be wrong, and when Fannie and Freddie went into conservatorship, politicians found out that budgetary dollars were on the line after all.

As Fannie and Freddie and the CRA were pushing up the demand for relatively low-priced property, the Taxpayer Relief Act of 1997 increased the demand for higher-valued property by expanding the availability and size of the capitalgains exclusion to $500,000 from $125,000. It also made it easier to exclude capital gains from rental property, further pushing up the demand for housing.

The Fed did its part, too. In 2003, the federal-funds rate hit forty-year lows of 1.25 percent. That pushed the rates on adjustable loans to historic lows as well, helping to fuel the housing boom.

The Taxpayer Relief Act of 1997 and low interest rates—along with the regulatory push for more low-income home owners—dramatically increased the demand for housing. From 1997 to 2005, the average price of an American house more than doubled. It wasn’t simply a speculative bubble. Much of the rise in housing prices was the result of public policies that increased the demand for housing. Without the surge in housing prices, the subprime market never would have taken off.

OTHER PEOPLE’S MONEY

Fannie and Freddie played a significant role in the explosion of subprime mortgages and subprime mortgage-backed securities. Without Fannie and Freddie’s implicit guarantee of government support (which turned out to be all too real), would the mortgage-backed securities market and the subprime part of it have expanded the way they did?

Perhaps. But before we conclude that markets failed, we need a careful analysis of public policy’s role in creating this mess. Greedy investors obviously played a part, but investors have always been greedy and some inevitably overreach and destroy themselves. Why did they take so many down with them this time?

Part of the answer is a political class greedy to push home ownership rates to historic highs—from 64 percent in 1994 to 69 percent in 2004. This was mostly the result of loans to low-income, high-risk borrowers. Both Bill Clinton and George W. Bush, abetted by Congress, trumpeted that rise as it occurred. The consequence? On top of putting the entire financial system at risk, the hidden cost has been hundreds of billions of dollars funneled into the housing market instead of into more productive assets.

Beware of trying to do good with other people’s money. Unfortunately, that strategy remains at the heart of the political process and of proposed solutions to this crisis.