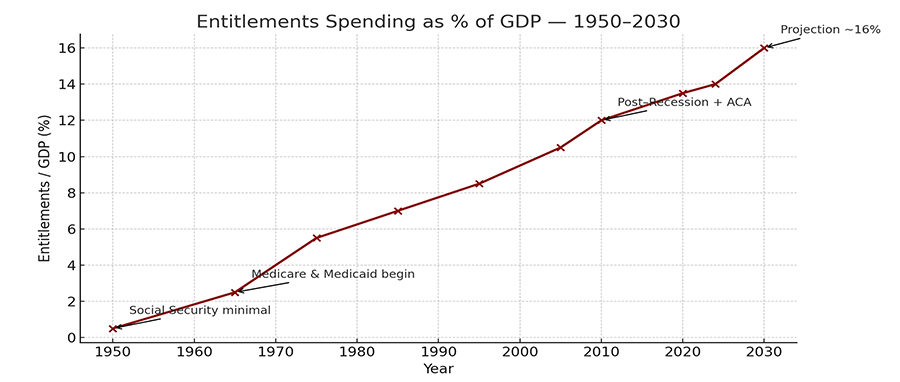

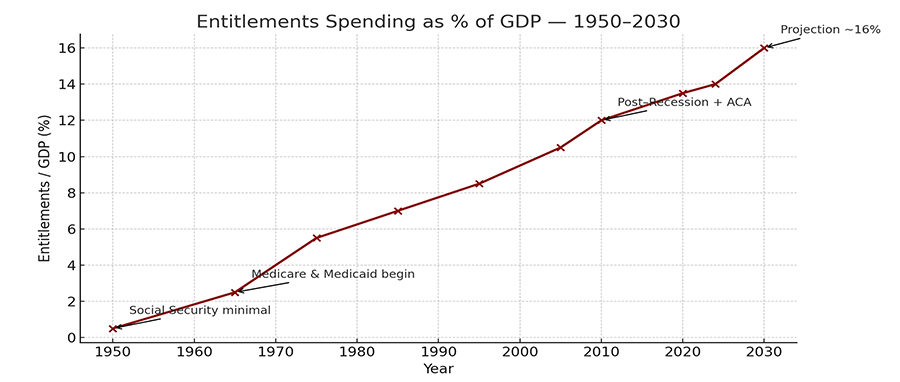

Seven decades ago, President Johnson initiated his “war on poverty,” that gave birth to entitlements. This conferred upon politicians a patina of nobility to hand out money in exchange for votes. Washington runs well over a hundred separate benefit programs, each with its own rules and constituencies. Year after year the payouts rise automatically. The sheer scale makes it almost impossible to track who gets what. Congress paid for these programs, collectively called entitlements, by borrowing more and more money. In 2025, the national debt stands at $38 trillion; every American owes $110,000.

About 150 to 200 million Americans enjoy more entitlements than they pay in taxes for those entitlements.[1] Roughly 40% of all households pay no federal income tax. Half the population (161 million) receive benefits from Social Security, Medicare, Medicaid, Obamacare, or Children’s Health Insurance Program (CHIP). These programs alone comprised 51 percent of the federal budget in 2025. Medicaid for 80 million people cost one trillion dollars. Obamacare enrollment reached 24 million, costing $80 billion. Food stamps (SNAP) served 42 million people for $100 billion. Housing aid for 10 million people cost $60 billion. These constituencies have grown too vast for any politician to oppose them and be elected.

So visceral has become the defense of federal spending that half of the Democrats in the House (127 of 212) opposed a bill to recover $100 billion in fraudulent and stolen pandemic payments. The Democrats in the Senate shut down the government for weeks in a demand to increase Obamacare by $350 billion. Benevolence toward those with lesser incomes had corroded into bitter demands.

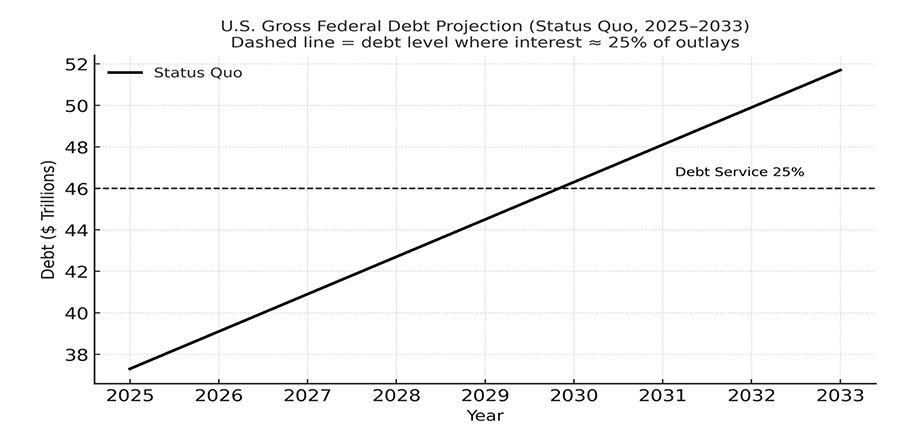

Our productivity and Congressional self-discipline are not robust enough to decrease the debt. At some point in the next decade, the debt will cause a bond selloff equivalent to the market crash of 1929. Many economists warn that the debt vigilantes will rush for redemptions when debt service consumes 25% of all revenues, likely within a decade.

Only then will Congress cut some entitlements and slap on a Value Added Tax. The Fed will respond by injecting more bonds at higher yields, but that drives up inflation and lowers the value of the dollar. This weakens our international power, even as our Defense spending, squeezed by the debt service, drops below 2% of GDP. A rise in external threats and a decrease in our standard of living will follow. Wealthy nations can disintegrate with astonishing speed. Back in the fifth century AD, the Roman senate annually shaved the silver from the coins of the realm. Eventually, the coin was thinner than a wafer, with scant purchasing power. The legions walked off the job, while the barbarians could no longer be bribed. The illustrious city of Rome and the cohesion of the Western Roman Empire collapsed between 406 and 476 AD, a span of seventy years.

Alistair Cooke, the insightful British journalist and broadcaster, wrote that “civilizations decline when they lose confidence in their founding values and worry more about their entitlements than their obligations.” Our debt portends our decline.

At a May 2025 press conference, Federal Reserve Chair Jerome Powell said, “The economy’s in a good place…debt is on an unsustainable path.” Welcome to Washington, where procrastination reigns. Our leaders know the path is unsustainable and refuse to change course.

[1] From Chat GPT, August 8, 2025:

- Medicaid & CHIP—Around 91 million people were enrolled in Medicaid and CHIP as of 2024. Medicaid alone costs about $850 billion annually.

- ACA (Obamacare)—About 12-15 million are covered via ACA subsidies, costing roughly $50-100 billion depending on subsidies and state contributions.

- Food Stamps (SNAP)—Around 42 million people receive SNAP benefits, costing about $120 billion annually.

- Housing Assistance—About 10 million people receive federal housing aid, costing around $60 billion.

- Child Care and Welfare Programs—40 million in various child care and TANF-related programs account for $20-40 billion.

Adding these together, the estimated cost is roughly in the $1.1 trillion range. These programs serve 150 to 200 million Americans (with overlap in enrollment between different programs).