- Economics

- Politics, Institutions, and Public Opinion

The financial crisis, deep recession, and anemic recovery have been accompanied by massive policy interventions. Their overall short-run impact on the economy remains controversial: Some claim these policies prevented a much worse recession, others that they delayed recovery.

What is clear, however, is that the public debt has exploded in this period. Policies that could rigorously be expected to strengthen short-term growth at reasonable long-run cost are justifiable, but virtually no attention has been paid to the long-run cost in most studies. Concern about such costs has the International Monetary Fund (IMF) pressing governments to gradually consolidate their budgets. This essay provides estimates of the harm to economic growth and future living standards if the growing debt-GDP ratio is not soon reversed.

Photo credit: 401(K)2012

While temporarily desirable in war and recession, large deficits potentially cause two separate but related problems—shifting the bill for financing the current generation’s consumption to future generations and crowding out of private investment. Thus, deficits are more problematic during economic expansions, if they reduce domestic investment and hence future income, when the national debt is high or rapidly rising relative to GDP, and when they finance consumption, not productive public investment.

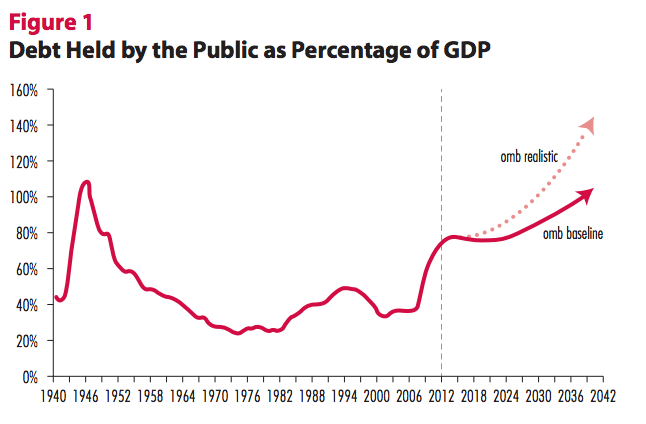

The large deficits and expansion of the national debt since the end of 2008 are unprecedented since World War II (Figure 1). The debt-GDP ratio will have doubled, from 40.5 percent to almost 80 percent, by next year. Every year since 2008, the budget deficit as a percentage of GDP has been larger than the previous post-World War II record of 6.0 percent in 1983.

There are several reasons deficits and debt have soared. The deep recession caused the so-called automatic stabilizers to grow rapidly and they accounted for about a quarter of the deficits. With GDP growing only about 40 percent as rapidly as in the recoveries from the previous deep World War II recessions (of 1973-75 and 1981-82), and job growth only about 20 to 25 percent that of these previous recoveries, the automatic stabilizers remain large compared with these recoveries, when deficits shrank rapidly. There are many reasons for the anemic recovery—some, though not all, of them have to do with policy choices.

Jumping Off the Fiscal Cliff

President Obama also implemented an expensive set of discretionary policies, from stimulus bills to supplemental appropriations to numerous special programs. Each President and Congress inherit a budget and debt from their predecessors and bequeath them to their successors. Interest must be paid on the inherited debt. Some unfunded programs grow and put pressure on budgets. But Presidents and Congresses also inherit a tax system in which revenues tend to rise even more rapidly than the economy, cyclically adjusted, due to real bracket creep and other factors, and they have the option of prioritizing reform of inherited programs as well as implementing their own. The President and Congress thus share responsibility for a sizable fraction of the deficits and debt during their time in office, as well as part of what follows.

However one views his policy prescriptions in the depth of the recession, we are now over three years into recovery and President Obama has not put forward a program to deal with the projected massive long-term entitlement cost-driven debt. Indeed, he is the first President to explicitly abandon even the long-run goal of a balanced budget. He adopted the much weaker goal of stabilizing the debt-GDP ratio at the higher projected FY2016 level, but then did not budget for it.

Instead, he appointed the Simpson-Bowles Commission to propose how to do so; then he ignored its recommendations. He has made no serious proposals to deal with the immense long-run projected deficits in Social Security and Medicare, which total several times the current national debt. When Treasury Secretary Geithner was asked by Congress what the Administration’s plan was, he said, “We don’t have one.” Vice President Biden guaranteed, “No changes to Social Security.”

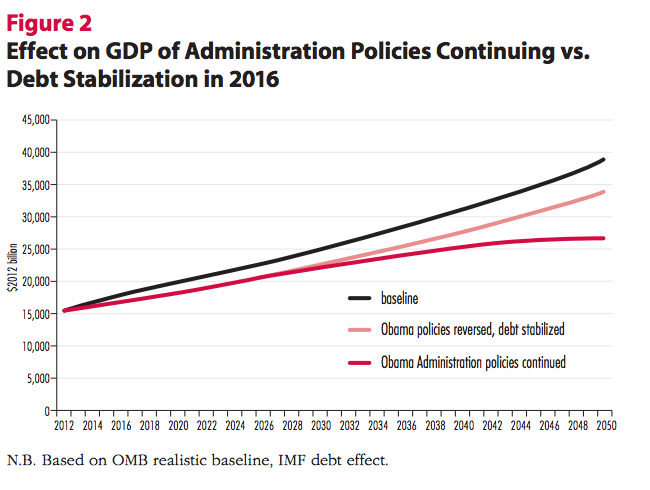

President Obama is thus set to bequeath an immense, costly legacy of debt, whatever the direct benefits and costs are of his specific policy choices. To get a sense of the potential long-run harm from the debt expansion, I combine the debt accumulated since 2008 and an estimate from the Administration’s projections of the future debt if its policies continue. I present two scenarios based on the continuation of the President’s policies: First, that the policies are continued by his successors and, second, that they are reversed and the projected debt accumulation halted by stabilizing the debt-GDP ratio at its projected 2016 level.

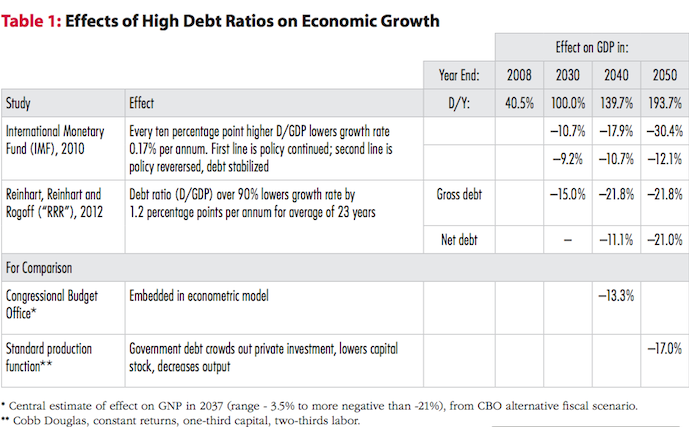

I then discuss two influential studies of the effects of higher debt ratios on economic growth to estimate the potential economic impact of the large expansion of the debt-GDP ratio. For comparison, I also discuss an analogous CBO study and a standard, textbook production function exercise. The result is a range of plausible estimates of how damaging failure to reverse the explosion of debt is likely to be.

Figure 1 presents two projections of the future publicly held debt-GDP ratio from the President’s FY2013 budget. The long-run debt growth is overwhelmingly driven by rapid real growth in entitlement program costs, including Social Security and Medicare. OMB provides a baseline long-run estimate based on President Obama’s policies as implemented and proposed, including his tax increases, health policy and, importantly, the absence of cost growth slowing Social Security and Medicare reform.

After roughly doubling from the end of 2008 to 2014, then briefly leveling off, the ratio exceeds 90 percent in about 20 years, 100 percent soon thereafter, and then keeps rising. OMB also provides several estimates based on less optimistic baseline assumptions. Two of particular interest, given the Administration’s serial overestimate of future economic growth and underestimate of the cost of its health care programs, examine the effects of slightly lower productivity growth (and hence GDP growth) and somewhat higher government health care cost growth.

I combine the slightly lower productivity growth projection with one-half the higher debt effect from higher health cost growth into what I label the realistic OMB projection, which is used in the analysis presented below. It exceeds 90 percent next decade, 100 percent immediately thereafter, and rises exponentially, exceeding 200 percent of GDP around 2050. For comparison, it lies considerably below the CBO’s (often viewed as more realistic than baseline) Alternative Fiscal Scenario. Of course, the further out we go, the greater the economic, financial, policy, and political uncertainties become.

Debt and Economic Growth

How does a high debt-GDP ratio slow growth? Higher debt ratios eventually crowd out investment, as holdings of government debt replace capital in private portfolios. The lower tangible capital formation reduces future income. To the extent the reduced capital formation slows the development and dissemination of new technology, this effect will be amplified. Every dollar borrowed requires future interest to be paid, whose present discounted value equals the debt. So future taxes must go up to cover the interest unless future spending is cut. The prospect and then reality of higher tax rates, plus increased uncertainty about future fiscal policy, slows growth and also raises the specter of higher inflation eroding the value of the government debt and/or a financial crisis, which might sharply raise interest rates.

The federal government has been borrowing to cover 30 to 40 percent of its budget. Presidents and Congresses of both parties have been taking advantage of what Nobel Laureate James Buchanan calls fiscal illusion—government borrowing hides the true tax cost of the government spending from current voters. The $5.5 trillion in debt already accumulated in President Obama’s first four years implies a future $5.5 trillion (in present discounted value) tax hike. And the projected future deficits and debt likewise accrue another immense tax hike, as they have for his predecessors.

Two of the most widely cited studies on the effects of rising debt burdens on economic growth are from the International Monetary Fund (IMF) and Carmen and Vincent Reinhart and Ken Rogoff (RR&R). Just as higher debt ratios can affect the rate of economic growth, the growth rate certainly affects debt ratios. Other factors can affect both debt and growth. So it is no simple matter to clearly identify the causal relationships statistically. While the IMF study deals extensively with reverse causality and endogeneity issues, they are a reason to use alternate studies with somewhat different data and methodologies.

Table 1 describes the effects of debt on growth from these studies. The IMF study by Kumar and Woo analyzes the effects of higher debt-GDP ratios in a panel of advanced and developing countries over the past four decades. They estimate that each 10 percent increase in the debt-GDP ratio reduces the growth rate by 0.17 percent. We use this estimate and extrapolate the effects to the growing debt ratios in the more realistic case from Figure 1. For simplicity and to be conservative in the estimate, we assume the growth effects occur when the debt increases. If debt is rapidly rising toward high levels of GDP, expectations of the higher debt may well accelerate the effect.

The negative effect on GDP grows under both scenarios on the future debt. By 2050, the higher debt ratio brings growth to a halt under the “continuation of Administration policy” scenario (Figure 2). The level of GDP is 30 percent lower than if the debt had not soared and the policies had not continued. That’s most of a generation of per capita income gains wiped out. Or, put another way, it is as large as the gap between American and lower Western European per capita incomes. Under the “reverse course, stabilize debt” policy scenario, the decline in income is “only” 12 percent. That is most of a typical decade’s worth of real per capita income growth.

It is not just in the very long run that substantial damage is done. Under both scenarios, the decline in GDP is about 10 percent by 2030, when, for example, current young children will be entering the labor force. The difference in the two scenarios demonstrates that the gain from stabilizing the debt, about 18 percent of GDP per year by 2050, is enormous. It would be correspondingly larger if the debt ratio were gradually reduced below this level.

Reinhart, Reinhart, and Rogoff examine the aftermaths of debt explosion episodes in a wide array of countries since 1800 and conclude there is something of a “fiscal cliff”: When the debt-GDP ratio exceeds 90 percent for five years, on average the growth rate falls about 1.2 percent (e.g., from 3 percent to 1.8 percent) for 23 years.

Their study uses gross debt, which includes debt held inside the government. In the “Obama Administration policy continued case,” using the gross debt—the United States crashed through the 90 percent “red light” for gross debt in 2010—the negative GDP effect is about two-thirds of the IMF study-based estimate in 2050. If net debt is used, the decline in GDP is roughly similar to the “stabilize debt in 2016” scenario for the IMF-based effect by 2040 and catches up with the gross debt case by 2050.

For comparison, the Congressional Budget Office uses its macroeconometric model fit to U.S. data to estimate the effect of debt accumulation consistent with its Alternative Fiscal Scenario. CBO concludes it would cause GNP to decline 13.3 percent by 2037.

Finally, a standard, textbook constant-returns Cobb-Douglas production function, with a one-third capital, two-thirds labor, share of income, when combined with the projected debt accumulation in the “policies continued” case and full crowding out, would imply a reduction in output of about 17 percent by 2050. Again, to the extent technology augments tangible and human capital (what I elsewhere labeled generalized Solow-neutral technical change), the effect would be larger. If some foreign capital is crowded in, as in the CBO analysis cited above, the reduction would be smaller for GDP, but more income would accrue to foreigners.

Expect a Decline in the Standard of Living

Returning to Figure 2, the difference in the cumulative lost output from 2012 to 2050 between the policy continuing and debt stabilized cases is more than $20 trillion in present value (discounted at 3 percent). Again, it would be larger still if the debt ratio were eventually reduced below this level. This difference reveals the potential payoff from serious spending, debt, and therefore future tax, control.

Left unchecked, as Table 1 implies, the average projected annual per family hit would be about 10, 17, and 30 percent of income by 2030, 2040, and 2050, respectively. Even if the effect of debt on growth is just half that estimated in these studies, the large debt accumulation has severe negative consequences for future living standards.

These estimates of the economic growth effect of the rapid increase in the debt since President Obama assumed office, plus the Administration’s projection of debt based on its policies continuing, are alarming, absent greater productivity growth and health cost containment than seems warranted by its policies. Of course, President Obama’s successors could continue the do-nothing on entitlements policy—at least until forced to do something by a crisis—or reverse course, as could Mr. Obama if he is re-elected and so chooses.

If the Obama Administration policies (including the absence of Social Security and Medicare reform) were eventually reversed, and the debt-GDP ratio stabilized at a lower level than those in Table 1 or, better yet, gradually decreased, the harmful effects would be correspondingly attenuated, as the “debt stabilized at 2016 level” case developed above indicated. While substantial long-run damage would already have occurred, the economic “gain” from the political “pain” of seriously reforming entitlement cost growth is enormous.

Failing to rapidly begin bending the long-run debt-GDP curve down risks a growth disaster, whose severity could be much worse even than the recent deep recession and tragically anemic recovery. Left unchecked, it eventually risks a lost generation of growth, a long-run growth depression.