- Budget & Spending

- Economics

- Law & Policy

- Regulation & Property Rights

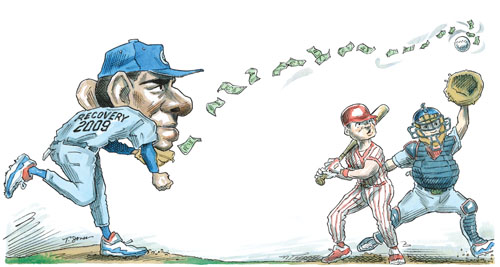

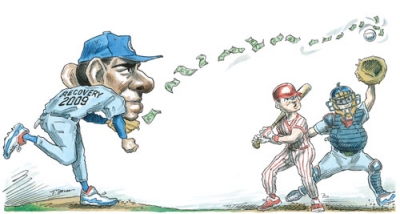

Imagine this: pitcher Smith replaces the starting pitcher in the fourth inning, when his team is down by three runs. The team scores two runs in the next inning, almost tying the score. But in the sixth inning, Smith gives up five runs, putting his team hopelessly behind. After the loss, Smith tells reporters that he did not pitch well in the sixth inning because the team was behind before he entered the game in the fourth.

Claiming that the U.S. economy has slowed during the past couple of years because it was in poor shape when a new president took office in January 2009 makes no more sense than Smith’s explanation of his disastrous sixth inning. Just as poor pitching by Smith doomed the home team, ineffective and counterproductive policies of the past three years have put us back on the brink of recession.

There can be no dispute that the economy was in recession in January 2009. That recession had started a little over a year before, according to the National Bureau of Economic Research, and it was long and deep. Whereas the average postwar recession lasted eleven months, the 2007–9 recession lasted eighteen. But all recessions end, and the 2007–9 one ended in June 2009. What we are experiencing today is a new wave of slowdowns, not a continuation of past problems.

A recession begins when the economy peaks and begins to turn down. A recovery begins when the economy reaches a trough and begins to turn up. Our economy is in recovery not because it is doing well—it clearly is not—but because it hit bottom and started moving in a positive direction.

Because economies eventually rebound, the President’s Council of Economic Advisers (on which I served from 2006 to 2009) predicted a recovery beginning in 2009 and accelerating sharply in 2010. The council’s estimates, issued in early 2009, assumed an economy with no stimulus. The forecast of a return to above-normal growth was based on the historical evidence, which demonstrates that robust recoveries follow severe recessions. Although our growth-prediction numbers were off (they always are), the predicted recovery began about on schedule. The economy achieved almost 4 percent growth in three consecutive quarters beginning in late 2009. By spring 2010, there was reason to believe that we were on our way back.

Then something happened. Starting in July 2010, the economy slowed and we sank to rates that are below our thirty-year average of 3.1 percent and are too low to propel a proper recovery. Worse, during the most recent five quarters, the growth rate has averaged a dismal 1.6 percent.

Like the pitcher who has a terrible inning after his team starts to make a comeback, our economy has taken a new turn downward that began in summer 2010. Job growth has stalled. One or two months of data are never enough to conclude that something is wrong, but we are now seeing a trend. Despite President Obama’s comment (later retracted) that “the private sector is doing fine,” there is plenty of slowdown in the private sector.

Is it time for more stimulus? Some are believers in the notion that a government can create growth by spending. But we should base our decision on facts, rather than religion. Keynesian fiscal stimulus is measured not by target numbers and program promises, but by the increase in government spending over past levels. The data show that real government spending was slightly lower in fiscal 2010 than in 2009, but GDP growth rates were higher in 2010 than in 2009. More significant, government spending in 2011 was about $150 billion higher than in 2010 and GDP growth slowed.

The White House forecasts that government spending in 2012 will exceed 2011 levels by 5 percent and will be 27 percent higher than it was in 2008. With all this, the number of people working is still half a million below where it was in January 2009, and several million below where it should be were the economy back at normal levels of employment. At best, there is no positive correlation between government spending and GDP growth during the stimulus years.

The logical conclusion is that what has happened since 2010 is a result of more recent policies, not ancient ones. In recent years, the strategy has been to emphasize short-run gimmicks and social goals rather than policies that could have produced economic growth and jobs. That strategy has been augmented by negative signals—such as blaming the rich and threatening new taxes and regulation—for investors and job creators.

Rather than stick with more of the same, we should adopt a different strategy from those that seem to be driving us back toward an ever-weakening economy. Policies should include moving to a tax structure that creates a positive climate for investment, an aggressive trade agenda to open our markets and those of other countries to more goods and services, a more cautious view of business-killing regulation, and attention to the rapidly growing debt.

The pitcher’s failure to throw strikes this late in the game is not a consequence of what happened during the first three innings. It is because he is throwing the wrong pitches.