The United States is awash in crises. The crime rate is surging; inflation continues to rise; COVID-19 is still not tamed; curricular reform is a contentious issue at all levels of education; global warming continues to be the source of much anxiety; the antitrust laws are under strong attack; social media continues to be a flashpoint. But for the readers of the New York Times Magazine, on April 10, 2022—devoted largely to The Money Issue—attacking the proliferation of new billionaires, who now total 735 (or is it 927?) has become the centerpiece of their campaign to reduce income and wealth inequality.

The alarm bells of this trend have been rung by Willy Staley, one of its staff writers, whose lead delivers this supposed knockout punch: “Their numbers are out of control—and the rest of us are subject to their whims.” This makes great copy, but horrific economics. Just why is the increased number of billionaires a bad thing? Theirs is not a coming crime wave in which each of us are put at risk for the loss of our lives or property by a new band of predators. Indeed, the exact opposite is true. Although none of the Times’s writers cares to mention the point, each of these billionaires (or their direct ancestors) created the wealth by selling goods and services to people, which at a minimum had a total value far greater to those people than the fraction of the gain that the billionaires were able to garner for themselves.

These billionaires had to form businesses and share the gains so created with their many partners, employees, suppliers, and customers who fill essential roles in the chain of production and consumption. Perhaps the most important component in this calculation is the consumer surplus—i.e., the maximum price that consumers are prepared to pay for given goods and services, less their market price—a number that is often huge relative to the fraction of the gains that the billionaires retain. As the future Nobel Prize winner William Nordhaus noted, the retained earnings are far lower than commonly supposed, such that since World War II, consumers have collected 98 percent of the social gain from innovation.

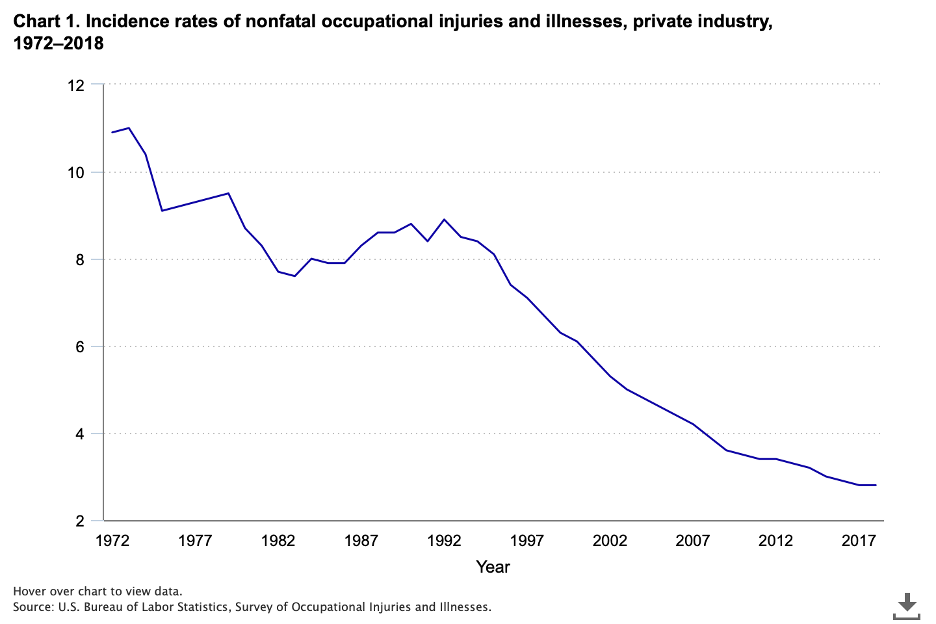

The clear inference is that the greater the number of innovators, the greater the social wealth, and the broader its dissemination, a multiplier effect could drive up social gain 50-fold. The dollars in the wallet of ordinary people might not soar, but their level of satisfaction from using those dollars will indeed skyrocket, unless someone thinks that the consumer who (adjusted for inflation) spent $1,000 for an IBM Selectric typewriter in 1970 gets the same level of satisfaction as the modern consumer who purchases a laptop for the same price. If that answer is no, don’t offer the response that these financial gains are offset, for example, by the riskier world in which we live today. Try this OSHA graph for occupational safety:

Fatal automobile accidents, another measure of risk, are harder to track in the past two years, given COVID, but the long-term trends also show a dramatic downturn: “The 2020 rate was still less than one-third the 1970 rate, less than half the 1980 rate, 37 percent lower than the 1990 rate, and 10 percent lower than the 2000 rate.”

At this point, the discussion turns from markets to politics. The main concern voiced by the New York Times is that we might all become subject to billionaire “whims,” as if this motley crew of billionaires acts both arbitrarily and in concert over the full range of political issues. But it is all too obvious that there are as many billionaires on the left as on the right, if not more, so when Jaime Lowe laments that “billionaires can be private about their politics, but their spending gets politicians to listen,” she never asks whether this diverse group of billionaires is seeking to gain unfair preferences from the system or whether they are seeking to prevent an overweening state from enacting some oppressive scheme of taxation or regulation.

Curiously, this billionaire class has been utterly unable to nip in the bud the extensive support for the recent Biden administration proposal to tax the unrealized gains in stocks, bonds, and private corporations that are held by households with at least $100 million in accumulated wealth. It’s a familiar political-economy story: a large number of voters are often able to outspend and outmaneuver a small and isolated political class. As it stands, the net transfer of wealth through the political system is such that the top 1 percent of families pay about 40 percent of the revenue realized from federal income tax, in return for far less in private benefits. This new tax will make the skew even worse by upending the uniform practice that for all taxpayers has always gone in the opposite direction. This well-established practice avoids taxing unrealized appreciation in order not to disrupt the formation, reorganization, or spinoffs of corporations to the extent that they have not distributed cash or other marketable property to their shareholders.

It is not just that these Biden rules will spawn an administrative nightmare. It is that they will force a massive disruption of successful business operations, whether the tax is paid immediately or becomes a lien on the corporation that can be discharged over some period of years. That loss of innovation will reverberate throughout the economy, depressing wages and capital investment across the board—and reducing tax collections nationwide.

Rather than face the consequences of this counterproductive removal, one common response is found in David Marchese’s interview with Thomas Piketty, the author of the famous (but flawed) book, Capital in the Twenty-First Century: that “all wealth is collective by nature.” This sentiment echoes Barack Obama and Elizabeth Warren’s famous war cry, “If you’ve got a business, you didn’t build that. Somebody else made that happen.” The point is an intellectual muddle, for just who is that somebody else? Thankfully, Piketty backtracks, at least momentarily, from this overstatement by noting that development relies on the action of “hundreds, thousands, and millions of engineers, technicians” for the accumulation of knowledge. But that last qualification cuts against his grand claim of collective wealth creation: it pinpoints gains from market transactions as the source of wealth creation, not heavy-handed government interventions.

Piketty then goes off the rails again, insisting that “none of these assets are their assets,” without telling us just whose they are. It is of course necessary to add the caveat that no wealth creation is possible without peace and good order, for which the collection of taxes from the public, billionaires included, is necessary. Yet at no point should it be thought that the rest of society pays for a set of services that the rich gobble up without making any contribution of their own, any more than ordinary people receive these services without taxes from the rich. Instead, a sound system of social relations asks all individuals to contribute to a common fund to create a platform on which a rich array of voluntary enterprises can operate.

It is therefore a mistaken leap to claim that wealth is collective “by nature” or to conclude that we must tax the rich to subsidize poor. Red flags should be raised against this egalitarian campaign. The standard measure of social welfare asks that new social arrangements create an increase of wealth and/or utility, and whether we can make one person better off without making anyone worse off. By this so-called Pareto standard, there is a social improvement if the rich (or the poor) get richer when no one else gets poorer. Ultimately, there can be social improvements even if the income gaps widen between the rich and the poor; if the sequence is done often enough through market transactions, a rising tide will raise all boats, albeit in different proportions.

In response, it can (and should) be said that an increase in wealth gaps ignores the diminishing marginal utility of wealth. But billionaires, like the rest of us, have figured that out already without any assistance from Obama, Piketty, or Warren. A huge number of major charitable activities are undertaken by rich people of all political persuasions, whether or not they sign the famous Warren Buffett pledge to leave at least half their wealth to charity. But even if the rich hoard their wealth, they are unable to consume it at anything close to the rate of its creation, so that perforce they invest in ways that expand economic growth far more rapidly than any program of government spending.

Piketty and company constantly preach that wealth transfer is the key to growth, but at no point do they look at the alternative. Deregulation (especially at the lower end of the income scale) is a far better way to expand the pie, not taking the risky gambit of shrinking the pie in the vain hope that ordinary people will somehow benefit most in a political environment in which special interests are sure to reach the trough first. First, deregulate; only then think of expanding transfer taxes.