The skyrocketing cost of public employee retirement benefits is one of the greatest threats facing cities across California. Up and down the state, cities are being forced to slash services and lay off workers in order to pay their rising pension and retiree healthcare obligations. Left unchecked, these unsustainable retirement benefits will threaten cities’ ability to provide even the most basic services.

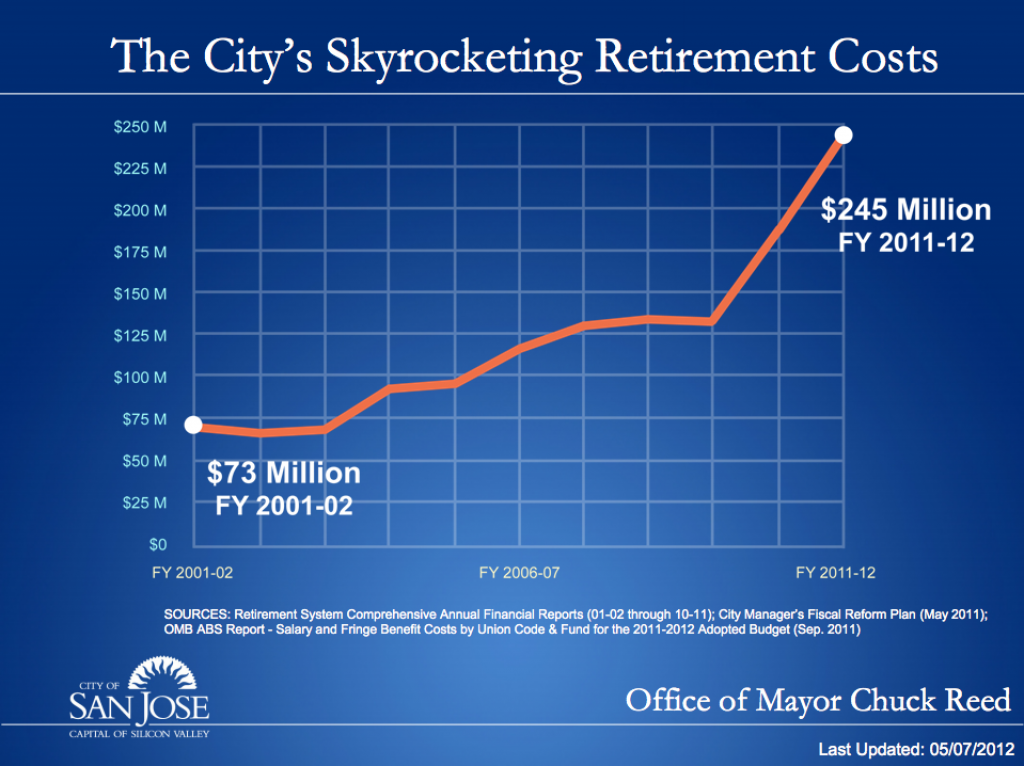

In San Jose, the annual cost of employee retirement benefits grew from $73 million to $245 million over the past decade. Retirement benefits now cost more than 50% of base payroll and consume more than 20% of the city’s entire General Fund. Even worse, San Jose’s two retirement plans have about $3 billion in unfunded liabilities and the city’s annual retirement costs are expected to continue growing for another dozen years.

These rising retirement costs were the primary cause of decade-long budget deficits that forced San Jose to make significant cuts across the city. We laid off police officers and firefighters, we closed libraries and community centers, and we watched our streets deteriorate year after year.

That’s why I’ve been a staunch advocate for pension reforms that will help bring our retirement costs under control and allow us to restore critical services to our residents.

In June 2012, nearly 70% of San Jose voters approved “Measure B” – a set of pension reforms that the City Council placed on the ballot after more than 8 months of negotiations with our employee unions. While we were unable to reach an agreement, the final set of reforms included a number of changes to address concerns raised during these negotiations.

Among San Jose’s reforms:

- New employees will be placed in a new, lower-cost retirement plan.

- Current employees will retain benefits earned and accrued to date under the existing pension plans. Going forward, they will have the option to: a) pay more to keep their current plan or b) choose a new, lower-cost plan.

- The City Council will have the ability to temporarily suspend retirees’ cost-of-living adjustments (prospectively) during a fiscal and service level emergency.

- Disability retirement rules will be reformed to prevent abuses.

- The retirement plans will be prohibited from paying “bonus” pension payments from excess earnings.

- Voter approval will be required to enhance retirement benefits in the future. (Here’s more on San Jose’s pension reforms)

These reforms will provide significant savings necessary to eliminate our structural budget deficit and to begin restoring core services in the community. They will also help preserve the long-term health of our retirement plans and ensure that we can pay for the retirement benefits that employees and retirees have earned to date.

Unfortunately, the implementation of San Jose’s reforms could be significantly delayed by litigation or a lengthy IRS review process. These obstacles could also hamper the efforts of other cities to enact their own pension reforms.

As a result, I’ve joined with the U.S. Conference of Mayors and the mayors of other large California cities in advocating for:

- The IRS to promptly rule on the tax-status of “optional” pension plans. A key element of San Jose’s plan is to give employees the choice to either pay more or accept a lower-cost plan going forward. San Jose’s optional plan was designed to avoid conflicts with the federal tax code. However, the IRS has been reluctant to issue tax rulings on “optional” pension plans since 2006. A delay in the approval process will prevent employees from having an alternative to contributing more of their paycheck for pension benefits.

- State legislation giving cities the clear authority to modify pension formulas for an employee’s future years of service. While San Jose’s reforms were carefully crafted to follow state law and avoid potential “vested rights” conflicts, we are nonetheless in litigation over these issues. A constitutional amendment that settles the legal debate around future benefit accruals would help cities across California make changes to reduce the cost of retirement benefits.

These policies are key to overcoming the complex legal and tax issues surrounding pension reform. Just as importantly, these policies will provide cities with viable alternatives for reforming pension benefits, without forcing employees to pay more.

The central problem is that no one can afford to pay the full cost of these generous retirement benefits. They are too expensive for cities and too expensive for employees. The only viable solution is to reduce the cost of the benefits to a level that both cities and employees can afford.

Modifying actuarial assumptions and relying on rosy investment projections does nothing to reduce the true costs of our retirement benefits. This just pushes these costs out further into the future, making the problem even bigger and placing an even greater burden on our children and grandchildren.

Solving this problem will require local, state and national leaders to step up and take decisive action in support of pension reform. Without fundamental reform, growing retirement costs will decimate public services across the state and push more California cities towards a fiscal disaster.

Chuck Reed is the second-term mayor of San Jose, the third largest city in California.