- Economics

- Politics, Institutions, and Public Opinion

The level of economic commentary during the presidential campaign has not been high. Democrats have accused Mitt Romney of the crime of shipping jobs abroad while at Bain Capital, and Mr. Romney has responded by denying the charge. No one takes the economically appropriate position for a job outsourcer: "Yes, I shipped some jobs abroad to save money, and this choice was correct not only for my company but also for the U.S. economy."

Outsourcing is essentially the same as importing a good from a foreign country. In the former, a company buys foreign labor services. In the latter, a company buys the good that embodies foreign inputs, particularly labor services. So, it makes no sense to be a free trader with respect to imports and exports of goods while opposing outsourcing. Opposing either is protectionism.

The central issue is why free trade is attractive. Suppose a Chinese company learns how to manufacture a computer at a cost below that for U.S. companies. In that case, the U.S. economy comes out ahead by importing the computer and shifting its labor and other inputs to producing other things—some of which will be sold to China. It's true that shifts in the composition of international trade will make specific companies and workers worse off, but free trade will benefit the overall economy.

An important part of the argument is that the resources previously used to manufacture computers in the U.S. will typically not remain idle after a shift to importing computers from China. Instead, the profit-oriented market will find (via Adam Smith's "invisible hand") productive alternative uses for these resources, thus contributing to growth.

What about industrial policies in the forms of subsidies or bailouts for chosen companies and industries? In a case like Solyndra, the California-based solar technology company that received $535 million in guaranteed federal loans before going bankrupt, it's easy to see that the policy was a failure. Then there's the Chevy Volt, which stays alive with government subsidies, but at a cost to taxpayers far too large to make sense.

General Motors as a whole is more interesting, because the post-intervention company is employing lots of people, producing lots of cars, and even reporting positive profits. But these results do not prove that intervention was desirable.

If GM had disappeared, its former workers and other inputs would not have sat around doing nothing. Another company—be it Toyota, Honda or Ford—would likely have taken over its operations, expanding production in the U.S. As a matter of economic theory, the overall economy—though perhaps not parts of Michigan and Ohio—would have done better if the market had been allowed to reallocate GM's labor and other inputs.

We must also factor in the cost of the bailout to taxpayers, recently estimated by the U.S. Treasury at more than $25 billion, and the long-term economic harm from government partially repudiating the rights of GM's bondholders. More generally, the theoretical arguments are supported empirically by the tendency for countries to perform better economically when they rely more on free markets and less on socialism.

From this standpoint, it was scary to hear President Obama's recent assessment of the GM bailout, in which he declared it a success and vowed to apply this policy broadly to U.S. manufacturing. This promise of expanded socialism is, to paraphrase the great 20th-century economist and philosopher Friedrich Hayek, the Obama Road to Serfdom.

Drawing correct policy implications is hard because one naturally focuses on the jobs and production that are directly saved or lost when the government bails out GM or when Chinese imports expand. In contrast, it is impossible to detail where U.S. jobs and production would have been created or destroyed if GM had been allowed to fail or if trade with China were curtailed.

What is feasible is to look at the overall impact of a set of policies. For example, a general increase in socialistic policies tends to lower economic growth. And, more specifically, the Obama administration's weakening of individual incentives to work and produce by its sharp expansion of transfer payments can be reasonably viewed as retarding the U.S. economic recovery since the end of the recession in 2009.

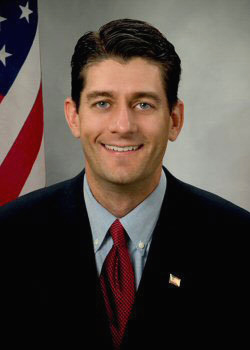

With the addition of conservative thinker and budget expert Rep. Paul Ryan to the Republican presidential ticket, we can hope that the economic dialogue will become more serious. And perhaps this added substance will extend beyond the important issue of long-term fiscal reform to encompass the enduring but still crucial debate about socialism versus capitalism.

Mr. Barro is a professor of economics at Harvard and a senior fellow at Stanford University's Hoover Institution.