Late last week, California Gov. Jerry Brown called for a special session of the State Legislature to address revising ACA 4, a constitutional amendment negotiated by then-Gov. Arnold Schwarzenegger and Republican and Democratic state legislative leaders to institute a “rainy-day” fund. Since its approval by lawmakers in 2010, ACA 4 has been moved from the June 2012 primary election ballot to the November 2014 general election ballot. Now, Gov. Brown and Democratic legislative leaders want to amend the language before voters have a say.

In its current form, ACA 4 would boost reserves from 5% to 10% of the General Fund, mandate 3% of the general revenues be deposited for most years into the reserve, require non-recurring revenues above historic trends be deposited into reserve, and limit spending. ACA 4 would also only allow withdraws from the reserve when state revenues drop below last year's budget, adjusted for population and inflation, and for other rare reasons like a declared emergency.

Liberals criticize the current version for being too restrictive (i.e., it saves too much therefore preventing large future spending increases), while conservatives are wary of Gov. Brown and legislative Democrats’ revisions for being too loose (i.e., not enough money is saved and it can too easily be withdrawn and spent).

Here’s a bit of California reality that neither side can dispute: while it’s good news that Sacramento is showing a renewed interest in a rainy-day fund, the state’s volatile budget requires more than just slipping a few coins into the Golden State’s piggy bank in years of plenty.

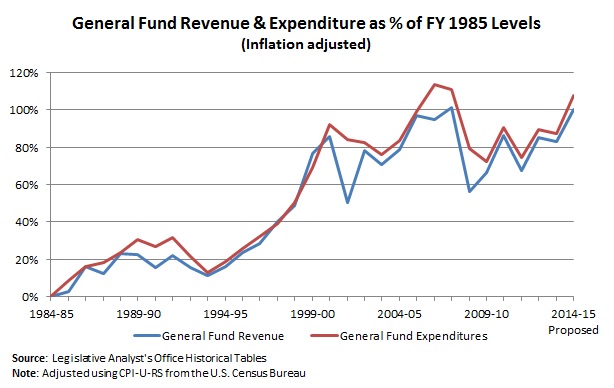

As the chart shows, general fund expenditures, adjusted for inflation, have consistently outpaced general fund revenues by an average of 6% since FY 1985 resulting in an average deficit of $900 million. California’s revenue is notoriously volatile, which results in largely unpredictable surpluses and deficits.

This volatility stems in large part from the heavy reliance on the personal income tax. In FY 2015, California’s personal income tax will account for 66% of general fund revenues and 48% of total state revenues, up from 41% of the general fund and 37% of total revenue in FY 1985. The personal income tax is heavily reliant on high-income earners. In 2011, those making $1 million or more in adjusted gross income (AGI) accounted for 30% of California’s total personal income tax liability ($200,000 or more accounted for 62%). As a result, California’s budget revenues are overly exposed to fluctuations among high-income earners.

Further exacerbating the problem is California’s top earners’ dependence on capital gains realizations. In 2011, the state’s Department of Finance estimated that taxes from capital gains realizations were $4.2 billion (15% of the total tax liability for those with AGI of $200,000 or more). However, capital gains realizations are anything but consistent. From 2007 to 2009, taxes from capital gains dropped 67%. Since 2009, taxes from capital gains have jumped 250%.

In summary, capital gains income is very dependent on the economy; the wealthy are particularly exposed to capital gains valuations; the state’s personal income tax is dependent on high-income earners, and the state’s budget is reliant on personal income tax. Therefore, even a small shift in capital gains can cause budget uncertainty. Based on Department of Finance estimates, the effective tax rate on capital gains realizations will be 9.7% in FY 2014; if capital gains realizations fall 30% (the average drop in capital gains realizations in the years that saw negative capital gains growth since 2005), General Fund revenue could drop $3.2 billion.

So what does all of this have to do with a rainy-day fund? It’s an important but not sufficient component to fixing California’s wild state budget roller-coaster ride. Transformative and long-lasting fiscal reform requires four actions (one of which being saving).

1) Control: General Fund expenditure growth should equal previous year inflation plus previous year population growth. Since FY 1985, this simple calculation would have yielded a maximum annual expenditure growth, on average, of 4.3% (versus an actual average annual growth of 7.2%). If this control had been enacted under Gov. George Deukmejian (who served two terms from 1983-1991, succeeding the first Jerry Brown administration), the proposed FY 2015 General Fund expenditures would have been $93 billion compared to $107 billion and the estimated surplus (assuming current revenue projections) would be $14 billion instead of the current $2.2 billion.

2) Pay Down: Use the additional resources to pay the state’s non-market debts – i.e., unfunded liabilities such as pension and retiree health obligations and special fund loans to the General Fund. Even the Brown Administration’s more conservative estimates show California facing massive long-term debt obligations (at least $354 billion).

3) Save: This is simple: fund a simple rainy-day fund, as complexity results in saving thresholds rarely being triggered. A reasonable approach would be for the rainy-day fund to collect all surplus funds (the “reserve”). If the reserve exceeded 30% of current fiscal year expenditures, then funds totaling 30% of current fiscal year expenditures would be refunded to taxpayers. The fund would not collect reserves until previous accumulated deficits have been eliminated. If this simple rainy-day fund had been imposed under Gov. Deukmejian (assuming the above expenditure control was also in place and historical revenues), the current rainy-day fund would total approximately $13 billion.

4) Tax Reform: California’s tax code is a significant driver of the state’s budget volatility. The only real way of eliminating this issue would be to eliminate taxation on capital gains. To prevent the short-term shock of eliminating 8-10% of General Fund revenues, first implement the rainy-day fund (to absorb the shock) and phase in the elimination (i.e. one percentage point each year). California currently has the highest federal and state capital gains tax rate while nine states (Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming) do not tax capital gains at all. Also, capital gains taxation is among the least efficient forms of taxation out there. However, note: this tax reform only addresses the budget volatility; it is not a holistic tax reform concept to address California’s high tax burden and inefficient tax system.

One way or another, voters will see before them in November some form of a rainy-day fund. Will Brown’s version (or even the current ACA 4) likely lead to a more responsible budget? Probably not, but by calling a special session, Gov. Brown hopes to reap the political reward from looking fiscally responsible in a fiscally irresponsible town.

Here’s hoping image isn’t everything: to actually fix California’s budget, much more action is necessary.

Follow Carson Bruno on Twitter: @CarsonJFBruno