- Economics

- Law & Policy

- Regulation & Property Rights

Studies about the lack of competitiveness of the U.S. capital markets were coming out well before the 2007-2008 financial crisis. In November 2006, a market-oriented blue-ribbon Committee on Capital Regulation led by R. Glenn Hubbard and John Thornton observed that America was losing its dominance of world securities markets and urged modest deregulation. Then in early 2007, a study commissioned by New York Senator Charles Schumer and New York City Mayor Michael Bloomberg surprisingly urged more of the same. And in March 2007, a panel commissioned by the U.S. Chamber of Commerce was the focus of a conference led by then Secretary of the Treasury Henry Paulson.

In the immediate post-World War II period, the U.S. was, literally, the only place to invest because the U.S. was the last capital market standing. So it is hardly surprising that from the end of World War II until sometime in the middle of 2002, America dominated the worlds’ capital markets surely and completely. The Sarbanes-Oxley Act, passed in the summer of 2002, was a body blow to the competitiveness of U.S. capital markets. Dodd-Frank’s passage possibly was the death knell. The passage of Dodd-Frank further undermines the competitiveness of U.S. capital markets.

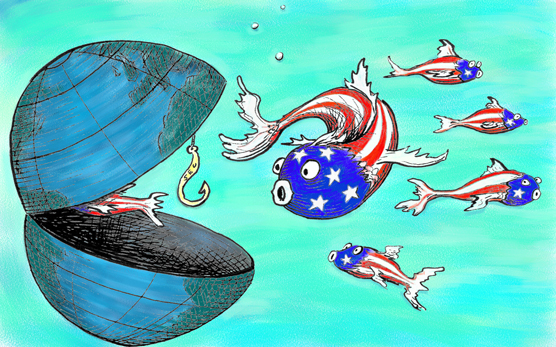

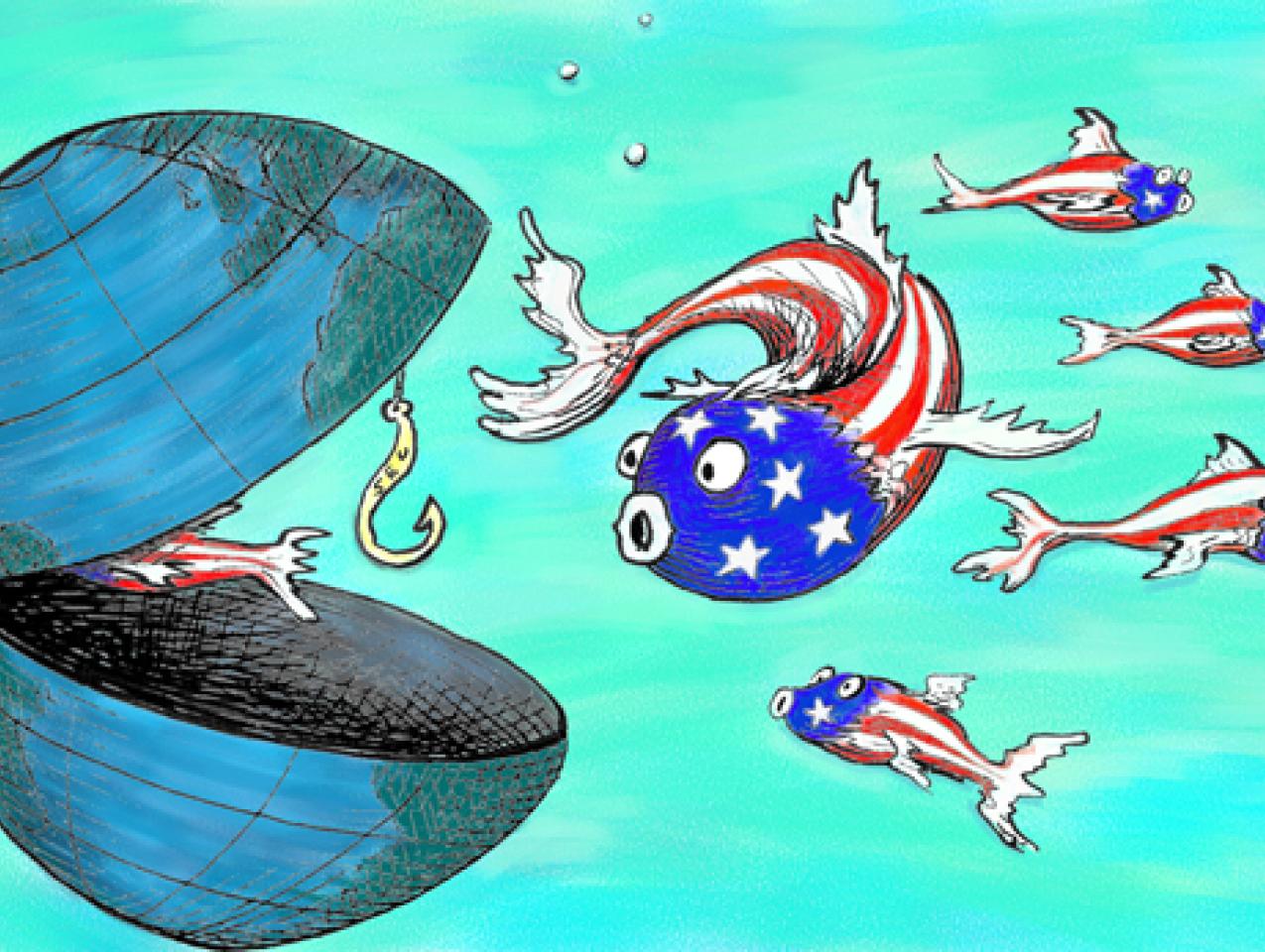

Illustration by Barbara Kelley

Dodd-Frank is just the latest in a long list of oppressive regulations, regulatory burdens, and litigation risk imposed gradually over decades on firms that go public here. But the regulations and the litigation impose costs without offering much, if anything, in the way of less corporate crime or better corporate governance. The Securities and Exchange Commission, the body that oversees and enforces these regulations, is now a vocal part of the problem, hunting for headlines as it pursues high profile cases against U.S. firms.

A large part of the problem is that the SEC, the bureaucracy charged with enforcing these securities laws, is failing in its mission to protect capital markets, but succeeding in its mission of imposing a heavy regulatory burden on those companies whose misfortune it is to be publicly listed on a U.S. trading venue.

The SEC, as currently constituted, suffers from three serious maladies. Malady number one is that the metrics of success used to evaluate the SEC create very perverse incentives. This causes the SEC to fail, even when it thinks that it is succeeding.

The SEC is failing in its mission to protect capital markets.

Malady number two is that the SEC has no clearly defined clientele: in other words the SEC has no idea who it should help.

Malady number three stems from the fact that the SEC is run entirely by lawyers. The few economists there are marginalized. As a result, the SEC does not understand the economics or financial implications of the regulations it generates by the boxcar.

Turning to malady number one, the SEC’s most perverse incentive is its incentive to promote the appearance that the capital markets are in crisis and to discourage (or prohibit) the development of market mechanisms that might fix the very problems that the SEC is tasked with solving.

As long as it generally is viewed that the SEC is needed in times of crisis, and that there are no superior substitutes for the particular sort of crisis intervention done by the SEC, then there will be a felt need for the Commission. Ironically, the more financial crises there are, the more the SEC can claim that it needs greater resources to manage such crises.

The SEC is largely evaluated on the basis of how well its Division of Enforcement performs. In the words of the SEC’s own website, "first and foremost, the SEC is a law enforcement agency." As the economic sociologist William Bealing has observed, the activities of the Enforcement Division of the SEC are what "legitimize the Commission’s existence and its federal budget allocation to Congress." Political scientists have observed that the SEC’s enforcement agenda is designed to meet the interests of the relevant congressional leaders responsible for the SEC’s funding.

The SEC satisfies its monitors in Congress, in academia, and in the press by focusing on factors that can be measured. In particular, the SEC focuses on two factors: (a) the raw number of cases that it brings; (b) on the sheer size of the fines that it collects.

The more cases that are brought and the greater the amount of fines collected during a particular time frame, the better the enforcement staff at the SEC is thought to perform. This has long been the case, but the problem got worse as a result of the political challenge that the SEC has faced from politically opportunistic state attorneys general, particularly Eliot Spitzer.

The passage of Dodd-Frank further undermines the competitiveness of U.S. capital markets.

For example, when criticized for failing to respond to numerous tips from whistle-blowers and red flags in the case of Bernard Madoff’s massive Ponzi scheme, the SEC noted in Congressional testimony that: "comparing the period from late January to the present to the same period in 2008, Enforcement has: opened more investigations (1377 compared to 1290); issued more than twice as many formal orders of investigation (335 compared to 143); filed more than twice as many emergency temporary restraining orders (57 compared to 25); and filed more actions overall (458 compared to 359)."

The SEC’s 2008 Annual Report’s is similarly clear in its emphasis on such easily measurable criteria:

During 2008, the SEC completed the highest number of enforcement investigations ever, brought the highest number of insider trading cases in the agency’s history, and brought a record number of enforcement actions against market manipulation—including a precedent-setting case against a Wall Street short seller for intentionally spreading false rumors. The SEC in 2008 also initiated the second-highest number of enforcement actions in Commission history.

During each of the last two years, the SEC set the record for the highest number of corporate penalty cases in agency history. For the second year in a row, the Commission returned more than $1 billion to harmed investors using our Fair Funds authority under the Sarbanes-Oxley Act. To support this record level of law enforcement activity, more than one-third of the SEC staffs now serve in the enforcement program. That is a higher percentage of the SEC’s total resources than at any time in the past 20 years.

The SEC devoted more funds to enforcement in 2008 than at any time in agency history. In 2008, the number of enforcement personnel grew by 4 percent.

The perverse incentives facing the SEC explain what the New York Times has described as the "long-standing criticism that the S.E.C. has largely failed to prosecute cases against corporate executives, opting for quick settlements in which companies themselves are penalized instead of their leaders." The SEC rationally has pursued a policy of opting for quick settlements because it is largely judged on the basis of the number of cases it wins. (The SEC needs fewer resources to sue companies than individuals because companies don’t defend themselves as vigorously as individuals do). Hence, the SEC’s penchant for suing and settling with entire industry groups, such as mutual funds, begins to make sense when one understands the SEC’s desire to register large numbers of cases brought and fines collected.

The metrics used to evaluate the SEC’s success create very perverse incentives.

Likewise, the SEC in recent years has pursued policies of attempting to expand the contours of the law (which makes it easier for them to bring cases) and of keeping the law vague (i.e. refusing to define insider trading).

Finally, and most importantly, the SEC has pursued a policy that is consistent with its rational self-interest but clearly suboptimal from a societal perspective: namely, it scrimps on doing investigations because thorough investigations are costly and time-consuming. The SEC gets better mileage by suing and settling without much, if any, investigating. It’s no wonder that the SEC goes after high profile industry players like Goldman Sachs, who are more willing to settle, rather than low profile crooks like Madoff.

The number of enforcement actions and the size of the fines are not the best criteria by which to evaluate the conduct of the SEC, but they are data that are "available," in the social psychology and behavioral finance sense of the word. Something is "available" in this context when it can be easily recalled from memory or readily available sources. The availability heuristic is one of the most widely shared assumptions in decision making as well as in social judgment research. The focus by the SEC (and Congress and the public) on how many cases the SEC brings and on the size of the fines collected appear to represent the availability heuristic in action. And, as in other contexts, this reliance on availability leads to predictable biases.

Thus, the SEC’s apparently odd behavior in recent years is not due solely or even primarily to corruption or incompetence. Rather, the SEC simply has been responding, more or less rationally, to the rather odd set of incentives that it faces from its overseers in Congress and from other important constituents.

To that effect, the SEC has strong incentives to promote the appearance that the capital markets are in crisis and to eschew the development of market mechanisms that might solve the very problems that theit is tasked with. This puts the SEC in a difficult position. On the one hand, of course, the SEC wants to be viewed as successful. On the other hand, if financial crises did not arise every so often, the SEC might well come to be viewed as largely superfluous.

From the SEC’s perspective, the optimal way to handle this balancing act is to blame any and all of its failures on a lack of resources. The SEC pursued this strategy with great success after the collapse of Enron in 2002. The SEC claimed that it faced a "staffing crisis" due to its "inability to compensate our employees adequately."

So over the past decade, starting with the collapse of Enron in 2001, there have been unprecedented budget increases for the SEC staff. In 2003 and 2004, the SEC was the only federal agency to receive substantial budget increases. And notwithstanding the fact that the SEC’s budget nearly tripled between 2000 and 2010, the Commission’s current chairman and senior staff have argued that its recent failures can be addressed by increasing the agency’s funding.

Finance in the U.S. has long been built on the strength of its capital markets rather than on the strengths of its commercial banks.

Turning to problem number two, the SEC lacks direction because it has no clearly identifiable clientele. In other words, the SEC has no idea who it should help. For example, in the most famous SEC enforcement action since the financial crisis of 2007 and 2008 (and perhaps ever), the Commission sued Goldman Sachs and its star trader Fabrice Tourre for "making materially misleading statements and omissions in connection with a synthetic collateralized debt obligation (‘CDO’) that GS&Co structured and marketed to investors." But what investors were these? According to the SEC’s own complaint, those being rescued by the intrepid SEC were: (1) IKB Deutsche Industriebank AG, a large commercial bank headquartered in Dusseldorf, Germany; and (2) ABN AMRO Bank N.V., one of the largest banks in Europe.

One might legitimately wonder why U.S. taxpayers are funding the SEC to referee disputes among the world’s largest banks, whose own access to the world’s best lawyers gives them free reign to litigate for themselves against Goldman or anyone else.

The SEC claims to be trying to benefit small investors, but it has no coherent theory of what role, if any, small investors are supposed to play in capital markets. For one thing, if small investors are going to participate in stock markets, then they are going to lose money and the SEC seems to think that that risk is unacceptable, even in the face of full disclosure by companies that are universally known and admired.

Consider this example. On January 18, 2011, fears of SEC lawsuits and possible criminal prosecution caused Goldman Sachs to abandon its plan to privately sell as much as $1.5 billion in Facebook Inc. shares to wealthy U.S. investors. Instead all of the Facebook shares were offered and sold only to foreign investors. Why? Because the SEC’s strict rules on private placements are designed not only to prevent investors from buying stocks about which "sufficient" information is not available; the rules also are designed to prevent investors from becoming unduly interested in or enthusiastic about new investment opportunities.

The third problem with the SEC is that it is dominated by lawyer. Like most lawyers, the Commission appears to be remarkably uninformed about the fundamental economic and financial characteristics of the markets it regulates.

Take for example William Christie and Paul Schultz's article in the Journal of Finance, "Why Do Nasdaq Market Makers Avoid Odd-Eighth Quotes?" (December, 1994). In this article, the law professors examined trading in the NASDAQ stock market, which, along with the New York Stock Exchange (NYSE), is one of the two principal equity-trading markets in the United States.

Like other U.S. equity markets, the NASDAQ stock market competes for listings and for order flow by offering an attractive trading venue to purchasers and sellers of equity securities. But Christie and Schultz found something else happening on the NASDAQ stock market: a subtle, ingenious, and successful price fixing scheme. This discovery led to massive antitrust and securities enforcement efforts that entailed a private class action lawsuit with a settlement of over $1 billion, an investigation by the U.S. Department of Justice into price fixing that concluded with total fines on major U.S. investment banks exceeding another $1 million, and dramatic new regulations and market practices concerning not only the way orders are handled in the securities markets, but also how securities prices are quoted.

Another major problem with the SEC is that it is dominated by lawyer.

Stunningly, this price fixing scandal was not on the SEC’s radar even after Christie and Schultz’s article appeared, presumably because nobody at the SEC bothers to read the Journal of Finance. It’s only the world’s most important journal of financial economics. It was not until the Wall Street Journal published a story about the article that the SEC took notice.

Another major regulatory initiative, ignored by the SEC, concerns the backdating in the granting of corporate stock options to corporate executives and other employees. This initiative was years in the making. In 1997, David Yermack, professor of finance at New York University, published a paper on the relationship between stock prices and option grants. Yermack was interested in the ability of corporate managers to influence their own compensation. Utilizing a sample of 620 stock option awards to the Chief Executive Officers (CEOs) of the largest U.S. corporations made between 1992 and 1994, Yermack found that the timing of stock option awards coincided uncannily with favorable movements in companies’ stock prices. Specifically, CEOs received stock option awards shortly before favorable corporate news that led to upturns in company share prices.

Yermack was not able to explain whether executives were receiving stock options at low price points because of luck, prescience, or some other factor. But subsequent research by another professor, Erik Lie, was the first to suggest a nefarious explanation for the timing of executive stock option grants. Lie's research indicated that the best explanation for the timing of stock option grants might be rather unsavory. He posited that the available evidence was consistent with the theory that public companies were backdating stock-option grant dates to enrich their senior executives.

Options backdating is the practice of granting an employee a stock option that permits the grantee to purchase shares at a lower price recorded on a date prior to the date that the company actually granted the option. For example, suppose that a company's share price was $25 per share on March 1, 2008, but has risen to $35 per share on April 30. Clearly, an option to purchase stock in the company at the lower March 1 price is more valuable than an option to purchase stock in the same company at the higher April 30 price.

That said, the Commission’s odd behavior is not due solely or even primarily to corruption or incompetence.

Such backdating raises legal and regulatory reporting and disclosure problems. Lie extended the earlier work of Yermack by examining options grants by companies that granted options to executives in consecutive years, but not on the same day every year. Lie discovered a pattern: stock prices systematically tended to fall just prior to the date on which the options were said to have been granted, but they rose almost immediately after the grant. In other words, if one thinks of a stock-price chart, options were granted at a dip in the market price that preceded a price increase.

Of equal interest to Lie was the fact that the options granted to lucky executives did not always precede good news about the particular company for which an executive worked. Instead, options often appeared to have been granted just prior to increases in stock prices for the entire stock market that had nothing to do with any events in the company granting the options. In other words, the executives receiving stock options grants not only appear to have been very prescient about news at their own firms; they also appeared to have been very prescient about the stock market in general. These results led Lie to the conclusion that "at least some of the awards are timed retroactively."

Lie actually sent a copy of his article to the SEC in early 2004 and later received an acknowledgement stating it was "interesting." Then, in March 2004, building on Lie's work, the Wall Street Journal printed a story on the front page that reported on Lie's study and used its own statistical analysis to identify several companies with highly suspicious grant practices. Among other findings, the Wall Street Journal looked at several option grants made to Jeffrey Rich, the former CEO of Affiliated Computer Services, Inc. Ostensibly, all of his grants were made immediately prior to sharp spikes in Affiliated's share prices. The Journal estimated that the odds against this happening by chance were 300 billion-to-one, twice as bad as the 146 billion-to-one odds against winning the Powerball lottery with a $1 ticket. After that, the SEC, Department of Justice, and state enforcement actions came fast and furious.

Unlike most other economies, such as those of Germany and Japan, finance in the U.S. has long been built on the strength of its capital markets rather than on the strengths of its commercial banks. For this reason, the erosion of the competitiveness of the U.S. capital markets represents a profound threat to the competitiveness of the broader domestic economy. To reverse this trend, we need regulators at the SEC who at least understand how markets work. After they begin to understand the markets, they may even begin to appreciate them.