- Economics

- Budget & Spending

- Law & Policy

- Regulation & Property Rights

- Health Care

In 1994, during the fight over President Clinton’s health care reform proposal, Senator John Breaux told a story meant to illustrate how confused Americans were about health care policy. Breaux, a Louisiana Democrat, described being accosted at the New Orleans airport by an elderly constituent who yelled at him: “Don’t you let the government get a hold of my Medicare!” It was meant to be funny: Medicare, which provides health coverage to the elderly and disabled, is of course a huge government program. The fact that people wanted to keep the government out of it suggested that opposition to increased federal involvement in health care was motivated not by concerns about government’s administrative abilities, but rather by an ignorant resistance to change.

Joking aside, Breaux’s constituent made a point—whether she intended to or not—that today’s Medicare reformers would be wise to keep in mind. The administration of government programs can be influenced to greater or lesser degrees by politics, and Medicare suffers enormously from its constant micromanagement by Congress and the executive branch. The current debate over Medicare reform is often framed as a choice between centralized administration and market mechanisms, but there is a more clarifying way to evaluate the various reform proposals: by examining how much they would allow politics into the program, and how they would manage the competing desires of lawmakers, administrators, interest groups, health care providers, and beneficiaries.

In recent years, reform proposals have fallen into two broad categories. Both aim to restrain the ballooning costs of Medicare without undermining the program’s ability to provide comprehensive coverage for the elderly. The first category of reform would layer changes to Medicare on top of its current structure, in which the government sets the terms of coverage and the prices for health services. President Obama and Congress adopted this model in the recent health reform law, which created the Independent Payment Advisory Board (IPAB), a fifteen-member panel tasked with recommending annual changes to Medicare payment rates and other policies to keep the program’s costs down.

The second approach to reform would instead transform Medicare into a marketplace of regulated, private health plans with government-provided subsidies for the premiums. This “premium support” model has been proposed most recently by Democratic Senator Ron Wyden of Oregon and Republican Congressman Paul Ryan of Wisconsin, but versions of the premium-support idea have been around for many years. Under the Wyden-Ryan plan, the government would each year set a standard for coverage, stipulating the basic procedures and treatments any eligible plan would have to include. Private insurers would then submit bids to see who could provide the required coverage at the lowest cost. (A federal fee-for-service insurer would also submit a bid, so that traditional Medicare-style coverage would be considered along with private-sector bids.) The government would set the level of the premium subsidy to match the cost of the second-cheapest plan (allocating more- generous premium subsidies to the poorest, sickest, and oldest seniors), ensuring that there would always be one option less expensive than the subsidy amount. If a senior chose this least expensive option, he could pocket the difference; if he chose a more expensive option, he would have to make up the difference on his own.

Such a mechanism would provide beneficiaries with incentives to choose less-costly plans, in turn giving insurers incentives to organize their networks of health care providers as efficiently as possible. This would restrain the overall costs of Medicare, and the costs of health care more generally.

These models embody the two basic approaches to curbing cost growth in Medicare and, as such, have been debated extensively in the ongoing political fight over Medicare reform. But largely missing from this debate has been a consideration of Medicare’s politics, and of the ways each approach would lessen or increase lawmakers’ ability to tamper with the program’s administration to serve their own ends (and those of their supporters).

THE TROUBLE WITH MEDICARE

The fiscal trajectory of the federal government is completely unsustainable. If current trends continue, government debt held by the public will grow rapidly for the foreseeable future, quickly eclipsing the size of our entire economy. By 2022, America’s debt will exceed 90 percent of gross domestic product; by 2037, it will be nearly 200 percent, according to the Congressional Budget Office (CBO). As a consequence of this debt explosion, interest payments will start to squeeze out other public spending. Policymakers will be less able to respond to unexpected challenges, lacking the funding to pay for military operations or disaster response. We will be at risk of a sudden fiscal crisis if investors lose confidence in our ability to make good on our obligations.

Higher taxes alone cannot pay the bills coming due. The Congressional Budget Office’s latest Long-Term Budget Outlook shows that achieving fiscal sustainability through tax increases alone would require every source of government revenue—personal income taxes, corporate taxes, firearm-license fees, everything—to go up by more than 20 percent, starting immediately. And these figures don’t account for the effects of higher taxes on behavior—impelling people to work less, alter investment strategies, or simply engage in more evasion. This means that taxes for everyone else would have to go far higher still. Such staggering tax hikes are, of course, politically impossible.

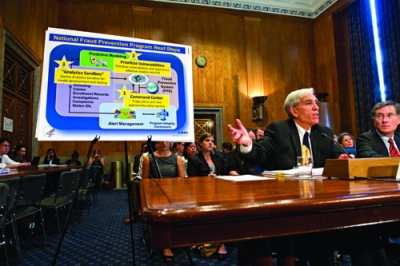

Peter Budetti of the Centers for Medicare and Medicaid Services, left, and Lewis Morris, a Health and Human Services official, testify before a Senate panel in July 2011 at a hearing on fraud in Medicare and Medicaid.

The fiscal gap will therefore have to be addressed largely through spending restraint, which will need to focus on the main causes of our deficits and debt. Without a doubt, the foremost driver of our long-term fiscal problems is the Medicare program, the growth of which has vastly outstripped all other increases in spending in recent decades. In 1970, according to the CBO, Medicare spending equaled 0.7 percent of GDP, while all other federal spending combined (except interest on the debt) was 17.9 percent of GDP. This year, Medicare spending will equal 3.7 percent of GDP (more than five times what it was in 1970), while all other federal spending will be 18.3 percent of GDP. And that trend is expected to continue: in the future, the CBO expects Medicare costs to continue to increase as a share of the economy, while all other federal spending combined will remain roughly constant or actually decline.

Certainly some of this additional Medicare spending is worthwhile. It is indisputable that health care in the United States has made remarkable advances over the past fifty years. No one would seek to turn back the clock on medical care or medical spending to the 1960s.

But at the same time, the volume of resources that we spend unwisely—on care that delivers minimal or no medical benefit—has also increased enormously. And this waste is a huge driver of Medicare’s cost increases. Although reasonable people disagree about the precise magnitude, there is no disputing that the amount of low-value treatment is large and growing. The problem is that in the field of medicine, it can be difficult to determine what precisely constitutes waste: an important treatment for one patient may be useless for most others, and vice versa.

Medicare will have to be sharply and relentlessly focused on high-value care. But in its current form, the program is simply incapable of rising to this challenge. The problem is not one of government incompetence: the program is administered by a highly knowledgeable, professional staff at the Centers for Medicare and Medicaid Services (CMS), part of the Department of Health and Human Services. Rather, the problem is fundamentally political. Medicare is not focused on high-value care because it is structured in a way that allows other priorities to take precedence.

To begin with, Congress routinely intervenes in Medicare’s operations, in both formal and informal ways. It has the final authority over the many complex formulas that determine the administrative prices that Medicare pays for everything from days in intensive care to MRI scans, home health care visits, and wheelchairs. One need not be a political-science professor to see that this offers Congress plentiful opportunities to dole out benefits to well-organized constituencies. And Congress has seized these opportunities, over and over again. Both parties play political games often and enthusiastically, and these games cost taxpayers billions of dollars each year.

There is nothing surprising about spendthrift politicians, of course. But what makes Medicare different is the vast amount of money involved—the program now spends over half a trillion dollars a year—and the complexity of modern medicine, which makes it difficult for opponents of waste to identify and eliminate it. Political scientists describe this state of affairs as a “public-choice failure”—a situation in which the political incentives all point toward waste, and focused interest groups are rewarded at the expense of society as a whole.

For more than three decades, reformers both within CMS and in Congress have tried various means of containing cost growth through administrative requirements: price controls, pre-set maximum growth rates for physician reimbursement, and assorted payment schedules and mechanisms. And all have failed, because Congress ultimately was not willing to see them implemented.

Beyond the danger of direct congressional intervention, Medicare’s centralized design and its exposure to political micromanagement also mean that it is subject to intense pressures from key interest groups—such as providers of medical products and services and lobbies that benefit financially from the current system. These pressures push the system toward more spending rather than more value, prevent the usual interplay of supply and demand from informing prices, and leave no one with any incentive to curb fraud and abuse.

LIMITING CONGRESS

Both the IPAB approach and premium support reflect an awareness of the danger of direct congressional micromanagement of Medicare. Both proposals tie the hands of Congress and delegate many responsibilities for particular decisions about prices and payments to an entity less subject to political pressure.

In the case of IPAB, that entity is an appointed expert board that makes recommendations that Congress must consider within ten weeks. If Congress does not approve the recommendations or find other means of achieving the same level of savings within six months, the board’s proposals are implemented automatically.

In the case of premium support, the price-setting entity is the market. Although the required minimum level of insurance coverage would still be defined each year by CMS (a federal agency answerable to Congress), the original cost of providing coverage, and the annual growth of that cost, would be determined by an annual bidding process among competing insurers. Decisions about which benefits or payment rates to cut or restructure would be determined by supply and demand (though they would still be subject to significant political oversight through regulation).

Thus both proposals attempt to tackle the great challenge of reining in political influence. But they are not equally well suited to the task. IPAB’s most serious limitation on this front is that its charter does not require Congress to hold up-or-down votes on the panel’s recommendations. Instead, the law allows Congress to consider amendments to IPAB’s cost-cutting proposals as long as the changes “meet the same fiscal criteria under which the Board operates”—meaning they achieve the same level of savings. This provision enables Congress to, for example, replace the changes recommended by the board with lawmakers’ own reimbursement-rate cuts—which can then be undone by subsequent legislation—and still satisfy the health care law’s requirements. This provision reintroduces politics into Medicare’s management at a crucial juncture.

As a 2011 report from the Kaiser Family Foundation explains, IPAB suffers from other flaws. There are statutory limits to its authority. Payments for inpatient and outpatient hospital services—the lion’s share of Medicare’s expenditures—are exempt from IPAB-proposed reductions in payment rates until 2020, for instance. IPAB is also prohibited from making any recommendation that would ration care, restrict benefits, raise beneficiary premiums or cost-sharing, or modify eligibility criteria. These constraints make it hard to see how IPAB could achieve savings of the magnitude our fiscal situation demands.

IPAB’s charter also requires its mandated spending reductions to be “scoreable” by the CBO within a single implementation year. Such a requirement virtually guarantees that the board will seek savings by reducing reimbursement rates rather than making more fundamental changes (which take longer to kick in), despite the fact that such fundamental changes would likely be more effective and more difficult to undo.

Some defenders of the IPAB approach argue that it will allow for the use of an alternative payment system—one with a better chance of controlling costs—within Medicare’s current administrative structure. This approach, known as “bundled payment,” involves making one payment for an “episode of care”—including, say, the hospital charges, surgeon’s fees, and follow-up visits for a hip replacement—rather than a separate payment for each individual service. The idea behind bundling is to create incentives for providers to manage care better, which would ultimately reduce low-value spending.

Although bundled payment is a good idea, there is little evidence to suggest that it will be enough to overcome Medicare’s fundamental public-choice problem. The results of a recent pilot project, the 2005–10 Physician Group Practice Demonstration Project, suggested that bundled payment might be able to improve quality of care but would have a much harder time generating savings.

Premium support stands a much better chance of insulating the system from political manipulation. Although the IPAB may be more removed from interest-group interference than Congress is, it too is a fundamentally political institution. Premium support, on the other hand, entrusts decisions about particular cuts to a market.

Of course, in premium support’s initial phase, patient and provider groups will lobby to make the support payment and the required benefit package as generous and favorable to their interests as possible. Even so, they will have far less incentive to rig the system than they would under IPAB because each party will be able to capture only a fraction of the benefits of any victory the group as a whole might achieve. For instance, if hospitals lobbied for higher premium-support payments, how would they know that the extra funding would flow to them rather than to ambulatory surgical centers, doctors, or medical-device manufacturers? That distribution would eventually be determined by who is best able to offer an attractive insurance product to consumers on an open market. And since no one knows for sure what his competitors will do, there is less of an incentive to fight for the program’s expansion and more incentive to focus on providing a more attractive service at lower cost.

In a reasonably functional market system—one in which insurers compete to supply a defined package of benefits—providers are likely to focus far more on efficiency than they do under today’s system, or than they would under IPAB.

SETTING PRICES

Prominent among the sources of inefficiency in the Medicare system today is how the program sets prices. Medicare currently uses a top-down approach: starting with direction from Congress and the administrator of CMS, the program’s staff determines what goods and services Medicare wants to offer to beneficiaries and what it will pay on the basis of internal analysis and the input of interested external parties. The alternative is a bottom-up approach, in which CMS would solicit bids from sellers to obtain information about the costs and characteristics of available goods and services and make its decisions accordingly.

Economists describe these two approaches as administrative pricing and competitive pricing, respectively. As Robert Coulam, Roger Feldman, and Bryan Dowd explained in the Journal of Health Politics, Policy, and Law in 2011, administrative pricing has a fundamental disadvantage: information flows from the party that knows little about costs (Medicare staffers) to the party that knows a lot (providers). Under competitive pricing, on the other hand, it is providers who tell Medicare staffers about the resources required to provide a given product or service.

At first glance, it might seem that administrative pricing gives CMS an advantage over the providers, since those providers have to deal with the prices and payments dictated by the agency. But the opposite is true. Administrative pricing is good for providers for the same reason that it is bad for society: it allows providers to exercise their natural informational advantage over Medicare. They organize their work with knowledge of how particular products and services will be reimbursed, and thus design their care with the aim of receiving maximal reimbursements, rather than of providing the best form of the service or product CMS wants at the lowest possible price. It is thus not surprising that providers’ opposition to competitive pricing in Medicare has been so vigorous: they stand to lose out under a more efficient, market-based system that makes Medicare rules more difficult to manipulate. (The public, however, would gain.)

Competitive pricing is not inconsistent with the current structure of Medicare—but it is inconsistent with Congress’s interests. Again, the problem is politics. Administrative pricing creates opportunities to make decisions that favor narrow groups of providers, thereby giving politicians valuable benefits to distribute to their advantage.

Premium support breaks this link between politics and pricing in a way that IPAB and bundled payment do not. Once the value of the overall support payment is determined, the myriad individual prices that the competing insurance plans pay and charge will be determined by the market. And the result of that process is more likely to be politically stable. Under traditional Medicare, providers who oppose competitive pricing have no natural counterpart; under premium support, however, both insurers (who would claim some of the residual profits of successfully competing for customers) and beneficiaries (who would share in efficiency gains through lower premiums) would play this role.

Premium support would make use of markets on the demand side as well. Insurers would be forced to offer good value relative to their competitors; if they failed to do so, they would lose customers’ business. Beneficiaries, too, would face tradeoffs: between the extra features of more expensive coverage and their own money.

FIGHTING FRAUD AND RENT-SEEKING

Defenders of today’s Medicare program often point out that Medicare spends much less on administrative activities than private health insurance plans do. A major appeal of the IPAB over premium support, they suggest, is that it would retain Medicare’s administrative structure, which seems to involve significantly less overhead. Premium support, by contrast, would involve private insurers far more extensively in the operation of Medicare, and they tend to have higher administrative costs.

But are Medicare’s low administrative costs really a strength of the program? Is a dollar spent making sure that a doctor is really delivering the care he claims to deliver a dollar wasted? Like everything else, spending on administration is sometimes good and sometimes bad: it is good when it generates savings that exceed costs and bad when it does not.

By any realistic measure of this sort, Medicare spends too little, not too much, on administration and oversight. The program’s standards for the enrollment and payment of providers are notoriously lax, having been well documented in a series of 2011 reports by the U.S. Government Accountability Office. The GAO found that CMS had not adhered to its own internal procedures for determining whether a potential provider was a legitimate business before enrolling it in the program and making payments. Medicare also routinely underinvests in prepayment review of claims—automated payment controls that delay or select for further scrutiny questionable claims, such as those associated with unusually rapid increases in billings or items or services unlikely to be prescribed in an appropriate course of medical care (like removing the same patient’s gallbladder twice on the same day). Indeed, in 2006, the GAO estimated that a $1 investment in prepayment review would save $21 in improper Medicare payments. CMS has made changes designed to address some of these vulnerabilities, but it is clear that many problems remain.

Why does this laxity continue? Again, the reason is political. In traditional Medicare, even honest providers have an incentive to lobby against aggressive efforts to control fraud and abuse. They have no opportunity to share in the gains of rooting out fraud; for reputable providers, stricter auditing requirements simply result in higher accounting costs.

Premium support would change the political dynamic. Privately administered health plans can (and do) offer to share gains from controlling fraud and abuse with the vast majority of legitimate providers, thereby weakening their incentive to oppose anti-fraud measures. Similarly, beneficiaries in traditional Medicare have no reason to demand tighter oversight because any gains accrue entirely to the program without the beneficiaries’ even knowing about them. With premium support, however, this situation would change: seniors would enjoy some of the benefits of rooting out fraud in the form of lower premiums and costs.

Health care providers are not the only parties with an interest in preserving Medicare as we know it. Special-interest groups, too, are deeply invested, and thus highly engaged in the politics of entitlement reform. AARP (formerly the American Association of Retired Persons), for instance, lends its name to commercial insurers for the sale of AARP-branded Medicare supplemental, Medicare Advantage, and Medicare prescription-drug policies. AARP earns enormous royalties from these sources; indeed, they now account for about half of the group’s income.

Hence the ferocity of the group’s opposition to premium support. In a system like the one proposed by Wyden-Ryan, seniors would select coverage from among plans that all have the same required minimum benefits; as a result, there would be much less uncertainty about what one plan or another would or would not cover. This, in turn, would reduce seniors’ reliance upon AARP endorsements or branding to select plans. And insurers, forced to compete for seniors’ business—by offering a good product at the lowest possible price—would have every incentive to eliminate unnecessary costs. Immense royalty payments to AARP in order to borrow the group’s name would surely be among the first expenses to go. Moreover, any serious premium-support insurance plan would probably eliminate traditional Medicare’s unlimited cost-sharing—thereby undermining the political and economic rationales for Medicare supplemental policies in the first place.

AARP offers only one example of how premium support would keep politics out of the system, and thereby help keep spending under control.

PROVIDER POWER

To be sure, premium support is not without its drawbacks. But the common criticisms of such a market-based approach are not persuasive. One set argues that premium support would hurt the poorest, sickest, and oldest—and thus the most vulnerable—Medicare beneficiaries. For these seniors, the argument goes, higher health care costs would not be covered as easily by a set payment, and so patients would confront gaps in coverage.

Although premium support could be implemented in such a way, no realistic proposal would do so. All serious premium-support proposals, including Wyden-Ryan, graduate their support payments on the basis of income (more for the poor than for the rich), health status (more for the sick than for the healthy), and age (more for older retirees than for younger ones). Given the extensive racial and socioeconomic disparities in the quality of care provided by Medicare today, arguing for the status quo on the grounds of fairness is particularly unreasonable. Indeed, premium support has the potential to do better in this respect, by explicitly giving a larger payment to people who are socioeconomically disadvantaged.

One concern about premium support does merit further consideration. Some areas of the country are served by only one or two hospitals, particularly for certain high-level, technologically intensive procedures like treatment for trauma, rare cancers, or serious cardiac illnesses. In these places, a premium-support system might give providers market power over private insurers, and thus increase the effective price that beneficiaries pay for care. Today’s Medicare program exercises nationwide, take-it-or-leave-it buying power, which gives it negotiating leverage over even these regional health care powerhouses. That take-it-or-leave-it monopoly status is, of course, part of the problem with Medicare. But while eliminating that power would improve efficiency in some ways, in these areas, it might tip the balance of power back to the regional behemoths—thereby leading to price increases so large as to outweigh premium support’s other gains.

Empirical evidence about the effects of provider market power suggests that this is a real problem. But it remains an open question whether retaining Medicare’s administrative-pricing structure is the appropriate policy response. In other contexts, giving a public agency the power to determine prices is not generally seen as a way to address failures of competition. Smarter and more assertively enforced antitrust laws would be a superior alternative. This concern has not been prominent enough on the agendas of advocates of premium-support reforms; if such reforms are to proceed, these advocates will need to take the problem seriously and provide substantive means of addressing it. Premium support depends on healthy competition, and there is a role for regulators in ensuring such competition and combating monopoly power.

SOLVING THE MEDICARE RIDDLE

Medicare’s out-of-control spending is the natural result of its centralized, politicized structure. The creation of a centralized board of cost controllers—all political appointees—is thus not the way to address it.

Premium support, in contrast, would deal with Medicare’s fundamental problems far better. It would commit the program to a structure more resistant to lobbying by interest groups and meddling by Congress. It would create incentives for insurers and beneficiaries to avoid low-value care and invest appropriately in controlling fraud and abuse. And its market mechanisms would allow Medicare to make greater use of prices to transmit information about the real costs of treatment decisions and insurance-policy design. All of these factors would make Medicare better at delivering good value and controlling spending.

Premium support does carry risks, but when compared to the idea’s advantages—and the vastly greater danger of national fiscal collapse—those risks are worth taking. No approach to reforming Medicare is perfect or certain to work. But the question of how we keep the program’s spending under control, protect the poorest and sickest beneficiaries, and preserve the program for the future is one that nevertheless needs answering. Of the available options, premium support is the best approach.