- Budget & Spending

- Economics

- Law & Policy

- Regulation & Property Rights

- US Labor Market

- International Affairs

- World

- Economic

- History

All scholars strive to make important contributions to their discipline. Thomas J. Sargent irrevocably transformed his.

In the early 1970s, inspired by the groundbreaking work of Robert Lucas, Sargent and colleagues at the University of Minnesota rebuilt macroeconomic theory from its basic assumptions and micro-level foundations to its broadest predictions and policy prescriptions.

This “rational expectations revolution,” as it was later termed, fundamentally changed the theory and practice of macroeconomics. Prior models had assumed that people respond passively to changes in fiscal and monetary policy; in rational-expectations models, people behave strategically, not robotically. The new theory recognized that people look to the future, anticipate how governments and markets will act, and then behave accordingly in ways they believe will improve their lives.

Therefore, the theory showed, policy makers can’t manipulate the economy by systematically “tricking” people with policy surprises. Central banks, for example, can’t permanently lower unemployment by easing monetary policy, as Sargent demonstrated with Neil Wallace, because people will (rationally) anticipate higher future inflation and will (strategically) insist on higher wages for their labor and higher interest rates for their capital.

This perspective of a dynamic, random macroeconomy demanded deeper analysis and more sophisticated mathematics. Sargent pioneered the development and application of new techniques, creating precise econometric methods to test and refine rational expectations theory.

But by no means has Sargent limited himself to rational expectations. Among his dozen books and profusion of research articles are key contributions to learning theory (the study of the foundations and limits of rationality) and economic history, including influential work on monetary standards and international episodes of inflation.

Sargent, a Hoover senior fellow, was awarded the Nobel Prize in economics in 2011, along with Christopher Sims, a professor at Princeton University. Here are excerpts of an interview conducted before they were awarded their shared Nobel.

MODERN MACROECONOMICS UNDER ATTACK

Art Rolnick: You have devoted your professional life to helping construct and teach modern macroeconomics. After the financial crisis that started in 2007, modern macro has been widely attacked as deficient and wrongheaded.

Thomas J. Sargent: I know that I’m the one who is supposed to be answering questions, but perhaps you can tell me what popular criticisms of modern macro you have in mind.

Rolnick: OK, here goes. Examples of such criticisms are that modern macroeconomics makes too much use of sophisticated mathematics to model people and markets; that it incorrectly relies on the assumption that asset markets are efficient in the sense that asset prices aggregate information of all individuals; that the faith in good outcomes always emerging from competitive markets is misplaced; that the assumption of rational expectations is wrongheaded because it attributes too much knowledge and forecasting ability to people; that the recent financial crisis took modern macro by surprise; and that macroeconomics should be based less on formal decision theory and more on the findings of “behavioral economics.” Shouldn’t these be taken seriously?

Sargent: Sorry, Art, but aside from the foolish and intellectually lazy remark about mathematics, all of the criticisms that you have listed reflect either woeful ignorance or intentional disregard for what much of modern macroeconomics is about and what it has accomplished. That said, it is true that modern macroeconomics uses mathematics and statistics to understand behavior in situations where there is uncertainty about how the future will unfold from the past. But a rule of thumb is that the more dynamic, uncertain, and ambiguous is the economic environment that you seek to model, the more you are going to have to roll up your sleeves, and learn and use some math. That’s life.

Rolnick: Putting aside fear and ignorance of math, please say more about the other criticisms.

Sargent: I have two responses to your citation of criticisms of rational expectations. First, note that rational expectations continues to be a workhorse assumption for policy analysis by macroeconomists of all political persuasions. To take one good example, in the spring of 2009, Joseph Stiglitz and Jeffrey Sachs independently wrote op-ed pieces incisively criticizing the Obama administration’s proposed PPIP (Public-Private Investment Program) for jump-starting private sector purchases of toxic assets. Both Stiglitz and Sachs executed a rational-expectations calculation to compute the rewards to prospective buyers. Those calculations vividly showed that the administration’s proposal represented a large transfer of taxpayer funds to owners of toxic assets. That analysis threw a floodlight onto the PPIP that some of its authors did not welcome.

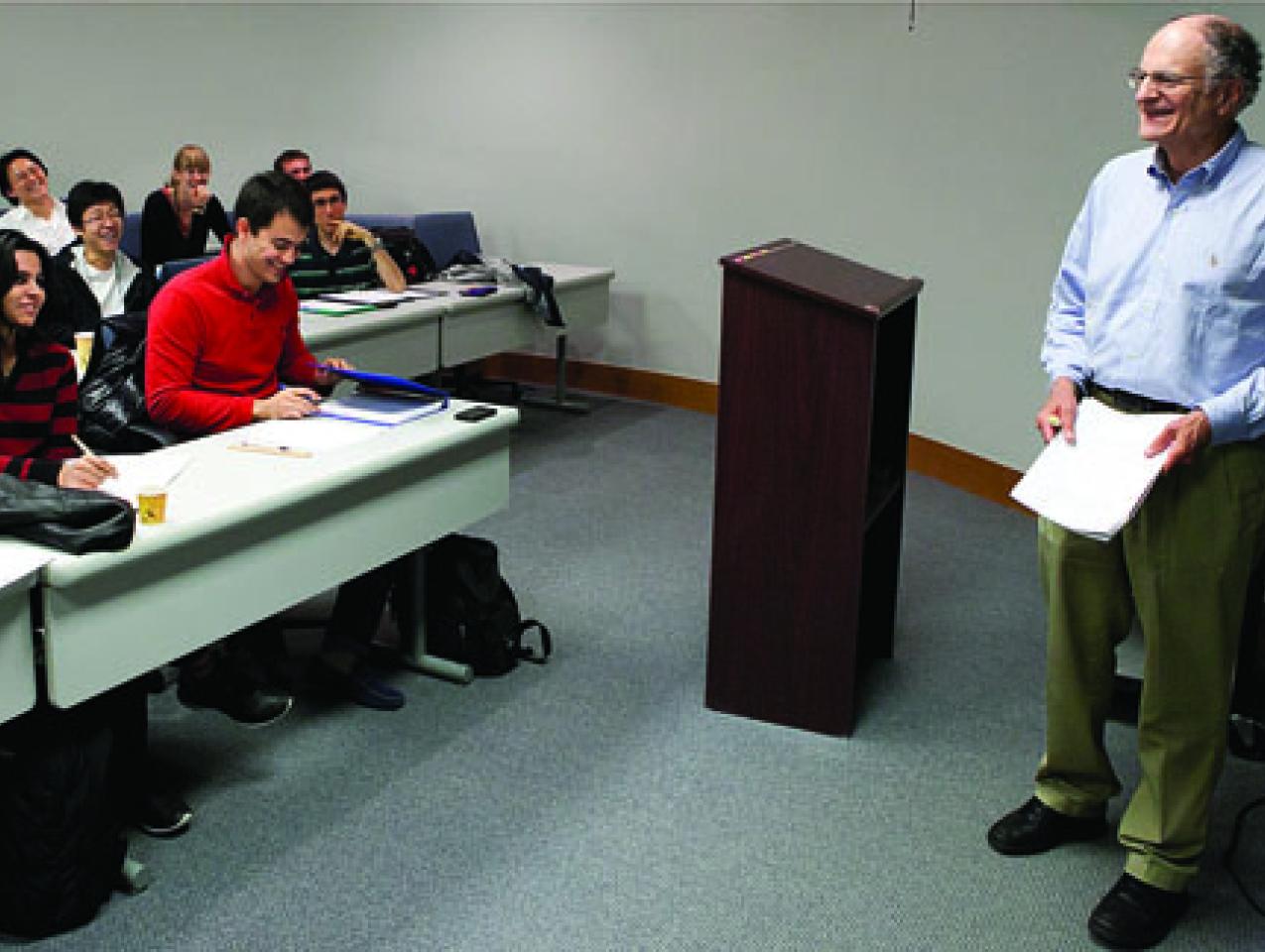

Hoover senior fellow Thomas J. Sargent teaches a graduate course on macroeconomics at Princeton on October 10, the day the economics Nobel was announced. In an interview about his role on the frontiers of research, he said, “We try to experiment in our models before we wreck the world.”

And second, economists have been working hard to refine rational-expectations theory. For instance, macroeconomists have done creative work that modifies and extends rational expectations in ways that allow us to understand bubbles and crashes in terms of optimism and pessimism that emerge from small deviations from rational expectations.

Rolnick: What about the most serious criticism—that the recent financial crisis caught modern macroeconomics by surprise?

Sargent: Art, it is just wrong to say that this financial crisis caught modern macroeconomists by surprise. That statement does a disservice to an important body of research to which responsible economists ought to be directing public attention. Researchers have systematically organized empirical evidence about past financial and exchange crises in the United States and abroad. Enlightened by those data, researchers have constructed first-rate dynamic models of the causes of financial crises and government policies that can arrest them or ignite them. The evidence and some of the models are well summarized and extended, for example, in Franklin Allen and Douglas Gale’s 2007 book Understanding Financial Crises. Please note that this work was available well before the U.S. financial crisis began in 2007.

THE 2009 FISCAL STIMULUS

Rolnick: A January 2009 article quotes you as saying, “The calculations that I have seen supporting the stimulus package are back-of-the-envelope ones that ignore what we have learned in the last sixty years of macroeconomic research.” What calculations had you seen?

Sargent: I said something like that to a reporter. I had just read an Obama administration Council of Economic Advisers document e-mailed to me by my friend [Hoover senior fellow and Stanford University economist] John Taylor. I agreed with John that the CEA calculations were surprisingly naive for 2009. They were not informed by what we learned after 1945. But I suspect that the council was asked to do something quickly, and they did what they thought was “good enough for government work,” as some of us said during my days at the Pentagon in 1968 and 1969. Back-of-envelope work can be a useful starting point or benchmark. But it does mischief when it is oversold.

In early 2009, President Obama’s economic advisers seem to have understated the substantial professional uncertainty and disagreement about the wisdom of implementing a large fiscal stimulus. In early 2009, I recall President Obama as having said that while there was ample disagreement among economists about the appropriate monetary policy and regulatory responses to the financial crisis, there was widespread agreement in favor of a big fiscal stimulus among the vast majority of informed economists. His advisers surely knew that was not an accurate description of the full range of professional opinion. President Obama should have been told that there are respectable reasons for doubting that fiscal stimulus packages promote prosperity, and that there are serious economic researchers who remain unconvinced.

PERSISTENT UNEMPLOYMENT

Rolnick: Let me go on to another set of questions that I have struggled to answer. Is U.S. unemployment in this recession special? Is it different from the previous ten recessions? If so, do you have any explanation for why that might be the case? Why it went so high and why it’s staying there as long as it is, relative to the pattern of other recoveries? I haven’t heard many economists expound on this, but clearly the labor markets are behaving much differently than they did in previous recoveries, and it’s not obvious to me why. I’m curious what you might say about that.

Sargent: I have little new to say about the details of the big rise in U.S. unemployment since 2008, although the financial crisis was a huge adverse shock to the labor market, so I suspect that we’ll be able to explain the rise. But the main thing that concerns me is the threat of persistent high unemployment, and here the European experience of the last three decades fills me with dread.

The prospect that concerns me might sound like I’m hardhearted, but that’s just the opposite of my feelings. What you’ve seen in the recent recession—and it’s quite natural, because it’s been so severe—is a tendency of Congress to expand unemployment benefits, over and over again. If, in the United States, we create a system where unemployment and disability benefits are permanently extended in their generosity and their duration, we will inadvertently put ourselves into the situation that much of Europe has suffered for three decades. I don’t know enough about politics to predict whether that’s likely to happen. The unfortunate thing is you can see a multiple equilibrium trap here. Low unemployment rates enabled the United States politically to sustain a modest unemployment compensation system. But the politics of the current situation can imply that so long as unemployment is high, we’re going to extend the duration and generosity of benefits. And that extension, done out of the best of motives, is exactly what can lead to the trap of persistently high unemployment. An intriguing thing is that some European countries like Sweden and Denmark are now moving exactly in the opposite direction.

EUROPE AND “UNPLEASANT ARITHMETIC”

Rolnick: Let me ask another question about events in Europe. Some people believe there’s a serious conflict between fiscal and monetary policy, that it’s the result of the Europeans having asked monetary policy to do things it can’t without real fiscal discipline. And as you and Neil Wallace pointed out thirty years ago—was it that long ago?—in “Some Unpleasant Monetarist Arithmetic,” you’d better worry about those links. Is that the way you would interpret what’s going on in Greece, or Europe in general, and concern over Europe’s ability to maintain the euro, that they face some unpleasant arithmetic that could undermine the euro?

Sargent: The people who set up the euro clearly knew about the unpleasant arithmetic and they strove to set things up to protect the euro from any adverse consequences of that arithmetic. Indeed, the whole system was designed to force governments to balance their budgets in a present value sense, adjusting appropriately for growth. Indeed, the Maastricht treaty actually put in fiscal rules that amounted to overkill in the interests of creating a fail-safe system.

Rolnick: So what’s the problem now?

Sargent: Here is what went haywire. In the 2000s, France and Germany, the two key countries at the center of the EU, violated the fiscal rules year after year. Of course, an intriguing thing about the unpleasant arithmetic is that it’s about present values of government primary deficits, and not just deficits for one, two, or three years. And remember that the overkill Maastricht treaty rules are sufficient but not necessary to sustain present-value budget balance, adjusted for real economic growth, so maybe there was no cause for alarm at that time. But in hindsight, there was cause for alarm. The reason is that France and Germany lost the moral authority to say that they were leading by example. They lost the moral high ground to hold smaller countries to the fiscal rules intended to protect monetary policy from the need to monetize government debt.

Rolnick: And so . . .

Sargent: So, a number of countries at the European Union economic periphery—Greece, in particular—violated the rules convincingly enough to unleash the threat of unpleasant arithmetic in those countries. The telltale signs were persistently rising debt-GDP ratios in those countries. Of course, the unpleasant arithmetic allows them to go up for a while, but if that goes on too long, eventually you’re going to get a sovereign debt crisis.

Rolnick: What could the European Central Bank do then?

Sargent: Well, here is one thing that you can imagine the ECB doing (which it hasn’t). It could take the stance, “If the government of Greece wants to try to issue euro-denominated bonds, let them do it, or try to do it. And if investors want to hold euro-denominated bonds that are understood to be liabilities of the Greek government, and not of the ECB, let them do it. It’s not any of the ECB’s business. If those bonds threaten to go bad, if Greece just isn’t a good risk, that’s the bondholders’ problem. Let the investors bear that risk. And if Greece defaults or renegotiates, that’s the investors’ problem, not the ECB’s problem.”

Rolnick: Of course, the ECB hasn’t said that, or at least not yet!

Sargent: Well, one reason the ECB hasn’t said that yet is that after the financial crisis of 2008, what seemed to some European banks to be a promising source of higher-yielding instruments was sovereign debt in the form of euro-denominated bonds issued by countries like Greece. The banks located in the center of the euro area, France and Germany, hold Greek-denominated debt, so a threat of default on Greek government debt threatens the portfolios of those banks in other European countries. Because it is the lender of last resort, now it is the ECB’s business.

Rolnick: Did things have to get to this point?

Sargent: Ultimately, that’s a question about politics, about which I know too little. But in purely economic terms, things could have gone differently. Here’s a “virtual history” of what could have happened: France and Germany stay holier than thou from beginning to end, and always respect the fiscal limits imposed by the Maastricht treaty. They thereby acquire the moral authority to lead by example, and the central core of euro-area countries are running budgets that without doubt are balanced in a present-value sense. Therefore, the euro is strong. The banks of the core countries (France and Germany again) are well regulated, so the banks in France and Germany are not holding any dodgy bonds issued by governments of dubious peripheral countries that have adopted the euro but that flirt with violating the Maastricht treaty rules. In this virtual history, the ECB could play tough and let the Greek government default on its creditors by renegotiating terms of the debt. For the euro, letting the Greek bondholders suffer would actually be therapeutic; it would strengthen the euro by teaching peripheral countries that the ECB means business.

Rolnick: Right. Although if that scenario had been foreseen, Greece might not have been able to issue that debt in the first place.

Sargent: Aha! The plot thickens. So then we confront again the issue of how separate can monetary and fiscal policy be? In the spirit of your observation, remember that there were huge capital gains on Italian debt after it became clear that it would be allowed to join the euro area. So, what really was the reason for those capital gains? Were they based on expectations of a reformed and more disciplined fiscal policy in Italy? Or was it rather an expectation that by joining the euro, Italy had gained access to bailouts from other euro-zone countries? Note that a related point pertains to the 2009 stress tests in the United States. What did it truly mean when a bank passed the stress test? Did it mean that the bank’s balance sheet was solid? Or did it mean that since the Fed said that bank had passed the stress test, the Fed would make sure that henceforth that bank would have access to lender-of-last-resort facilities? It’s difficult to sort these things out.

But notice that throughout our discussion, Art, we’ve been using the vocabulary of rational expectations. In our dynamic and uncertain world, our beliefs about what other people and institutions will do play big roles in shaping our behavior.

Rolnick: Indeed. Thank you again, Tom.