- Budget & Spending

- US Labor Market

- Economics

- Law & Policy

- Regulation & Property Rights

- Politics, Institutions, and Public Opinion

- The Presidency

- Congress

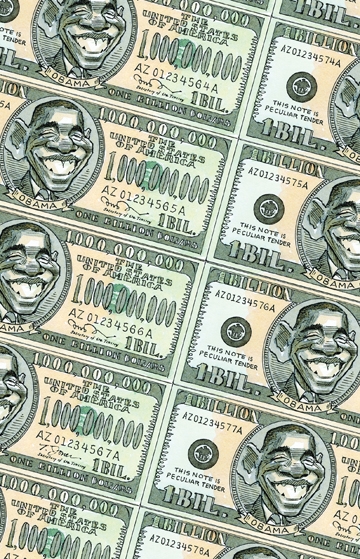

In Brewster’s Millions, a comedy starring Richard Pryor, a man is told he can keep $300 million if he manages to spend $30 million in one month. The movie documents—with a great deal of humor—his difficulties in getting the money spent. The Obama administration is currently facing a similar problem with its “stimulus” spending, only without the humor.

With the economy weak and the labor market continuing to decline, there is now talk of a second stimulus (which is actually the third, counting President Bush’s 2008 tax rebates). This would be a mistake. The truth is there hasn’t been any stimulus to speak of so far this year. Moreover, what’s being called stimulus is just a smoke screen for a permanent expansion of government. Let’s start with some facts.

By June 26, about $56 billion had been spent on the stimulus from the American Recovery and Reinvestment Act of 2009, passed February 17. A large portion of that actually reflects mere transfers from the federal government to state governments, so the amount that has gotten into the economy is significantly lower.

But even if we call all of the $56 billion spending, it’s still not enough to make a meaningful impact. By the same time of year in 2008, the Bush administration’s tax rebates had distributed about $80 billion. Most economists believe that the rebates had a positive but hardly dramatic effect on the economy.

The Obama stimulus, being significantly smaller, cannot possibly be expected to turn the economy around. The economy will improve. But it will do so because the financial sector is recovering, which is largely because of Fed policies to enhance liquidity and the success of the Bush administration’s Troubled Asset Relief Program (TARP), continued by the Obama team, in helping recapitalize the banks.

Congress and the Obama administration have used the economic downturn as an excuse to expand the size of government. Calling it a stimulus, they have instead put in place a spending agenda that will unfold over the next two years. Although a little over one-third of the American Recovery and Reinvestment Act of 2009 goes to tax relief, the rest is in the form of spending programs that will be difficult to stop once they are up and running.

Only a small share of the spending will occur in 2009, even though Keynesians would argue that stimulus spending should be front-loaded to kick-start growth. The Congressional Budget Office estimates that the largest share of the spending will occur in 2010, with the amount in 2011 being slightly larger than in 2009. Again, the timing exacerbates the problem: it will be tough to cut back on spending written into budgets as far out as 2011.

Additional evidence that the Obama administration wants to expand government rather than stimulate the economy comes from the president’s own statements about deficit reduction. When the budget came out, he announced a goal of reducing the deficit to around 4 percent of GDP by 2013, at which point the administration believes the economy will be fully recovered. Yet to keep the ratio of public debt to GDP constant, the deficit must actually stay below about 2.7 percent.

For perspective, recall that the Bush deficit, which has been criticized for being too large, reached a peak of 3.6 percent of GDP in 2004. But it fell steadily, to 1.2 percent of GDP by 2007 before rising again to about 3 percent after TARP.

Some argue that a tax cut is a weaker stimulus than direct government spending; this point is debated among economists. But it is clearly much easier for the Treasury to write checks to the public than it is to get agencies to rev up spending programs and do so in a way that does not simply throw away money.

It’s a bit odd that the Obama administration and some congressional leaders have reacted to a policy that has not worked by promoting a similar policy. One interpretation is that this is yet another opportunity to spend more on programs that Democrats have wanted for years.

It may be that the country wants more government, that Americans now believe the European model of big government is best. That is a decision that society must make. But it should do so with no illusions: the current stimulus and calls for another in the future are primarily government growth policies, not strategies to shorten the current recession.