On December 2, the government reported that national unemployment had fallen to 8.6 percent in November, yet unemployment persists at levels not seen in a generation. On the same day, the Hoover Institution’s Working Group on Economic Policy sought to answer the question, why has the current economic recovery been so slow and unemployment so high? Are those factors due to policy uncertainty, failure to address long-term problems, inappropriate monetary and fiscal actions, special factors rooted in the financial crisis and the great recession, or external factors?

The one-day conference, “Restoring Robust Economic Growth in America,” at Hoover, aimed to diagnose the problems and to develop policies to address the slow growth of the economy and the persistent unemployment. Organized by John Taylor, the George P. Shultz Senior Fellow in Economics at the Hoover Institution and the Mary and Robert Raymond Professor of Economics at Stanford University, and Lee Ohanian, a senior fellow at Hoover and an economics professor at UCLA, the conference brought together economists with extensive research and policy experience to address these issues.

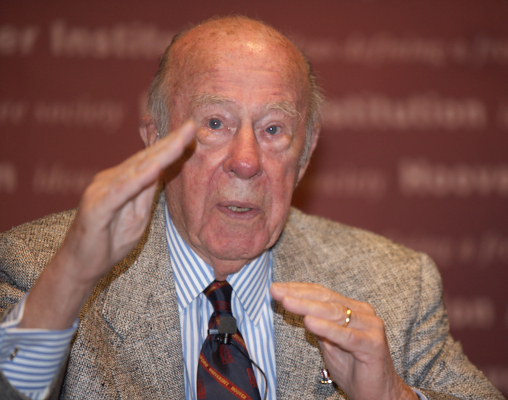

George P. Shultz, the Thomas W. and Susan B. Ford Distinguished Fellow at the Hoover Institution, laid out the problems in his opening remarks. In the day’s first presentation, special guest Alan Greenspan (for eighteen and a half years chairman of the Federal Reserve Board) concluded that government activism is hampering the recovery. Using US data going back to the 1930s, his comparisons attributed the lackluster rebound to the collapse of long-term illiquid asset markets, which he blames, in large part, on the great uncertainties in competitive, regulatory, and financial environments faced by the business and private sectors.

John Raisian, the Tad and Dianne Taube Director of the Hoover Institution, moderated a luncheon panel that highlighted the day’s events. John Cochrane, the AQR Capital Management Distinguished Service Professor of Finance at the University of Chicago’s Booth School of Business, joined Shultz and Greenspan on the panel.

Seeking to restore sound economic policy, Greenspan suggested relaxing the strict H1B visa limits that restrict the number of math and science experts who can work in the United States. He suggested further that the burdensome Dodd-Frank legislation be reviewed and revised. Shultz stressed education, at the K–12 level, citing the abysmal performance of America’s students’ having long-term tragic consequences.

Cochrane attributed the financial, currency, political, and banking crises in Europe to government guarantees and bailouts that sent the wrong signals. New government policies must build in the correct incentives, avoid the moral hazard problem, and reduce intrusion in the market.

In responding to questions, all three panelists agreed that the role of the government must be well defined and limited. Further, reforming the tax structure (for both individuals and businesses) and addressing problems associated with federal entitlement programs are necessary. Shultz added that cutting spending now is essential to fixing the country’s deficit.

Additional presentations were made by Edward Prescott of the Federal Reserve Bank of Minneapolis, Robert Hall, a senior fellow at the Hoover Institution and a professor in the economics department at Stanford University, Hoover senior fellows John Taylor and Lee Ohanian. Prescott discussed long-term reforms in his speech titled “On Efficiently Financing Retirement.” Hall spoke on the impact of monetary issues in his speech titled “How the Financial Crisis Caused Persistent Unemployment.” Taylor discussed fiscal issues in his speech “Why Federal Stimulus Grants to the States Did Not Help the Recovery.” Ohanian continued the discussion on fiscal issues in his speech “Economic Policies and Delayed Recoveries.”

Please click here to view the agenda.