- Politics, Institutions, and Public Opinion

A couple of my Hoover colleagues and I are in the process of surveying Americans about their opinions on a flat rate income tax. As part of this research, we wanted to know what Americans thought about a flat tax in the past, which would give us a baseline against which we can measure changes in public opinion.

Here, briefly, is an initial look at some historical public opinion data on the flat tax.

Getting the baseline

Using the Roper iPoll database, a curated repository of public opinion surveys conducted by reputable polling organizations, I searched for all flat tax survey questions asked since 1980 and identified questions that asked respondents to choose between a graduated rate income tax system and a flat tax. I wanted questions that prompted respondents to express an opinion on the core difference between a flat tax and our current system: under a flat tax system, everyone would pay the same income tax rate, while under a graduated tax system, people with higher incomes pay higher income tax rates. I set aside questions that asked how favorable respondents were to a flat tax, without referring in some way to a graduated rate system.

Because I wanted to try to isolate American’s opinions about the general idea of a graduated income tax versus a flat tax, I also set aside questions that made any mention of tax deductions, credits, or exclusions, no matter whether the question indicated that these tax provisions would be retained or eliminated, whether in full or in part, in a flat tax system. How any flat tax proposal treats these elements of the tax code will undoubtedly affect Americans’ opinions about the plan. For this purpose, however, I wanted measures of support for a single rate system unadulterated by opinions about favored deductions.

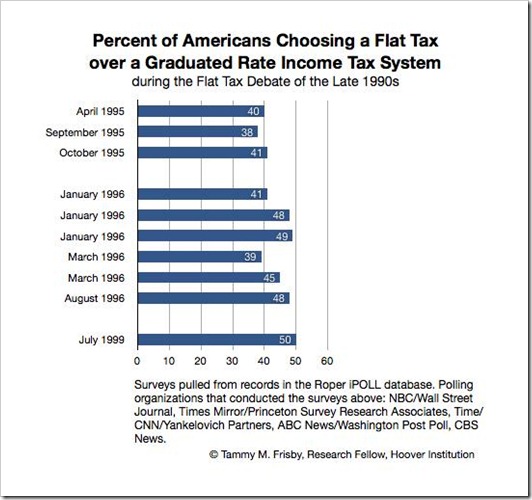

After applying these selection criteria, I was left with ten survey questions, asked in three years: 1995 (3 questions), 1996 (6 questions), and 1999 (1 question). These are, as you might recall, years in which there was a lively public debate over the flat tax, spearheaded by Republican presidential candidate Steve Forbes, who ran in both the 1996 and 2000 contests, and Majority Leader Dick Armey (R-TX), who promoted a flat tax plan from inside Congress. None of these questions, though, mentioned the proposed flat tax rate or the name or political party of a flat tax promoter.

Nine of the ten questions compared the two tax systems explicitly, using the phrase, “people with higher incomes pay a higher tax rate” or some slight variation to describe the basic feature of a graduated rate income tax system. The tenth question made the choice between two systems implicit, but explicitly told respondents that, under the proposed flat tax, everyone would pay the same tax rate regardless of their income. (This is the August 1996 question, one of six questions from that year, so we’re able to compare the response to this question wording to the other question format. As you’ll see, the alternate wording does not appear to make much difference.)

A minority, but a large minority, preferred a flat tax.

The graph below shows that the last time we had a serious public debate about adopting a flat tax, a large minority of Americans said they preferred a single rate income tax system to a graduated system that taxed people with higher incomes at higher rates. During the late 1990s, surveys showed between 38 and 50 percent of Americans supporting a flat tax, even when prompted to compare a flat tax to an income tax system where people with higher incomes pay higher tax rates. In 1995, as Steve Forbes began a national conversation about his flat tax plan, a flat tax consistently drew support from about 40% of Americans. Four of the six surveys conducted in 1996 had support in the mid-to-high forties, and the lowest two levels of support were 39 and 41 percent. The single question from 1999 measured support for a flat tax at 50 percent. All the surveys included here had a sample size of about 1,000 adults and a margin of error of plus or minus three percent.

Three of the questions asked in 1996 added one additional piece of information about the flat tax plan: low-income Americans would not be taxed under a flat tax system. The inclusion of this detail is correlated with a bump in support for a flat tax system. These three questions - the two January 1996 questions and the second from March 1996 - had support for a flat tax over a graduated rate system at 48, 49, and 45 percent, respectively. These are the highest rates of support during 1995 and 1996. The 1999 question, which recorded support for a flat tax at the high mark of 50%, did not include information about how the flat tax would apply to low-income Americans.

What should we expect today?

It would be reasonable to expect that, in 2011, Americans will be less supportive of a flat tax than they were fifteen years ago. In the midst of high and prolonged unemployment and with the current attention to the gains in income by the top 1% of earners over the last decade, we might find the public more attracted to taxing people who earn higher incomes at higher rates.

That shift, however, is far from inevitable. But it is up to proponents of a flat tax to persuade a substantial number of Americans that a flat tax will encourage investment and spur the robust economic growth and job creation that has thus far been elusive.

(photo credit: Sue)