- Economics

- Monetary Policy

- International Affairs

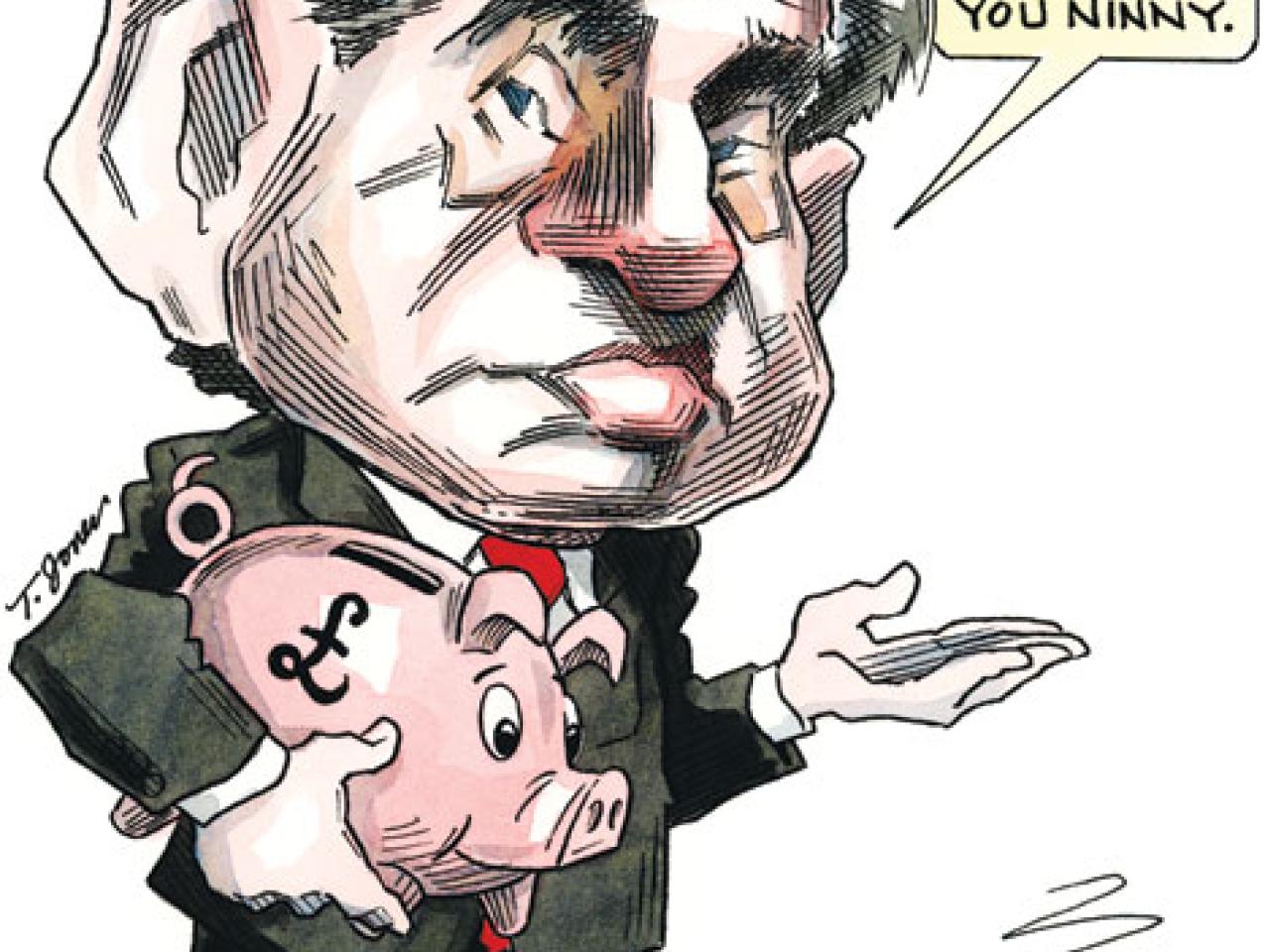

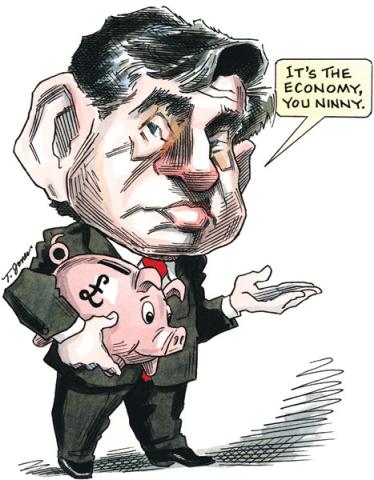

The financial and economic crisis has been kind so far to one national leader, Prime Minister Gordon Brown of Britain. For the most part, national economic problems are a political plague, as in Bill Clinton’s successful campaign against President George H. W. Bush in 1992, summed up in a succinct phrase, "it’s the economy, stupid." Brown may be the only incumbent national leader in memory to actually gain from a troubled economy.

Brown’s rebound is an interesting story rooted in his personal credentials, his government and political experience, and his actions at the beginning of the crisis. By no means do any of these insulate him permanently from trouble ahead—economic calamities are unpredictable national traumas—but at least at its outset the Brown story is unusual.

Brown’s political gains during the first month of the international financial crisis, which afflicted Britain as severely as any other country, are clearly visible in Britain’s public opinion polls. As the crisis began, he and his Labour government were deeply unpopular. Labour had been in power for more than eleven years, first under Tony Blair for ten years and since June 2007 under Brown. During his first four months, Brown enjoyed a typical political honeymoon, at a time when Labour enjoyed a lead over the opposition Conservatives of somewhat more than 5 percent. But beginning in October 2007, Brown saw his support virtually collapse as political and policy problems mounted in every direction. His government also suffered from problems such as the Iraq war, which he had inherited from Blair’s administration. A year later, just before the financial and economic crisis emerged in October 2008, Labour had sunk to a huge deficit in the polls, about 20 points behind the Conservatives.

But as the October crisis intensified, support for Brown and his government rose dramatically, erasing about half the Conservative lead, from about 20 points to 10. Labour remained well behind, but its comeback was remarkable.

Gordon Brown may be the only national leader in memory to actually gain from a troubled economy.

Given that the next British elections may not occur for another year and a half, until as late as June 2010 (prime ministers may call elections whenever they wish but not longer than five years after the previous election), Labour has become competitive again. In fact, the Labour Party is even better off than it looks because the demographic distribution of seats in the House of Commons gives Labour a statistical advantage over the Conservatives, meaning that the Conservatives will need to win approximately 6 percent more votes nationally than Labour to win a majority of seats in the House of Commons and thus take power.

Let’s look more closely at why Brown and his government gained rather than lost popularity in the tumultuous fall of 2008.

To begin with, Brown, though lacking the charisma of his predecessor, Blair, is widely seen as the most qualified person in any political party to manage Britain’s economic and fiscal affairs, even though he is often described as pedantic and boring. Thus his personality and style contrast poorly with the far more congenial, articulate, and friendly leader of the Conservative Party, David Cameron. But under the suddenly changed circumstances, Brown’s personality shifted from political liability to advantage. His serious, intense, manner now serves him well. Cameron, on the other hand, seems less attractive as a prime minister in waiting. To many critics, he now seems a lightweight, who, although still likable, lacks the requisite gravitas to either understand or deal with a crisis of such magnitude.

Brown also brings enormous experience to the table. He was Blair’s chancellor of the exchequer (similar to the U.S. secretary of the treasury, though politically more important) and steward of Britain’s eleven unbroken years of prosperity. He is often cited as Britain’s greatest chancellor—but that compliment can cut both ways. His backers see him as the best person to deal with the crisis; the Conservatives, however, point to the current troubles as evidence that Brown steered Britain into the disaster, making his eleven years of apparent success a sham and a path to the worst difficulties since the Great Depression. This argument, however, does not at present seem to be convincing the British electorate. For even more important in Brown’s political revival has been the way he has reacted to the crisis and the applause he has received from scholars and fellow national leaders in other Western democracies.

Brown’s personality has shifted from political liability to advantage. His serious, intense manner now serves him well for a time of economic crisis.

For example, whereas the American government took some days to react to the crisis and then floundered around, finally offering the $700 billion bailout that Congress passed with great agony, the British government moved quickly to set out and implement government intervention measures. The most important and widely publicized of these was partially nationalizing important British banks by buying their shares and thus injecting cash to stabilize and rescue them. At the same time, Brown took the lead among his fellow European Union countries by pressing for broad cooperation, which was extended to a collaborative international effort including the United States. Washington, in fact, ultimately embraced Brown’s approach, injecting cash into the American banking system by buying up shares of key banks.

Paul Krugman, recently awarded the Nobel Prize in economics, applauded Brown’s moves.

"Has Gordon Brown, the British prime minister, saved the world financial system?" Krugman wrote in the New York Times in October. "Mr. Brown and Alistair Darling, the chancellor of the exchequer . . . have defined the character of the worldwide rescue effort, with other wealthy nations playing catch-up."

Krugman extolled the British government for acting with "stunning speed," especially in comparison with the U.S. government, and particularly then-Treasury Secretary Henry Paulson. "This combination of clarity and decisiveness hasn’t been matched by any other Western government, least of all our own," Krugman added bitingly. He went on to say that

despite initially basing the U.S. plan on buying up "toxic" mortgage debts, Mr. Paulson has since suggested that he may follow Mr. Brown in injecting money directly into the banks as fresh capital. Several European leaders are also expected to announce similar plans.

Luckily for the world economy, Gordon Brown and his officials are making sense. And they may have shown us the way through this crisis.

Of course we do not yet know whether Brown’s policies and leadership will solve the crisis, much less allow him to keep his political gains. Prime Minister Harold Wilson’s famous line of forty years ago that a "week is a long time in politics" certainly rings true. It is not only Brown’s poll numbers that count but the changes in Brown’s credibility and stature. Only two weeks before the crisis struck, he was being fiercely challenged from within his own party, accused of failure as prime minister. There was tentative action toward initiating a leadership election within the party, talk that has disappeared, at least for the time being. Brown will almost certainly lead Labour in the next election.

The odds against Labour being re-elected for a fourth straight term of office are still fairly long, if only because many other accumulated discontents can defeat a government that has been in office for so long—in this case, thirteen straight years. But politics is a tricky business.