- Economics

- Politics, Institutions, and Public Opinion

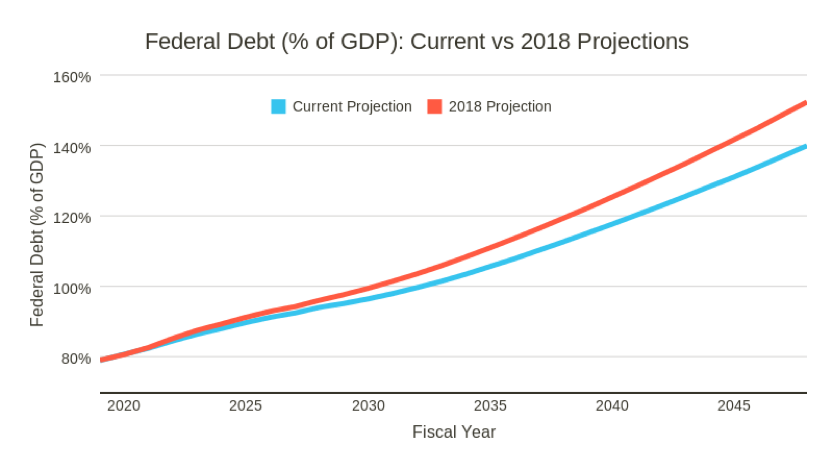

It seems every month, the Congressional Budget Office (CBO) releases another report showing sharp increases in the federal debt. In June, CBO released its annual Long-Term Budget Outlook showing debt would pass 100% of GDP in 2034 and hit 144% in 2049. And, just last month, CBO’s updated 10-year budget forecasts showed even larger deficits than previously predicted.

It is easy to become numb to the deluge of reports sounding alarms about the debt. Even for those who worry about the debt, CBO’s periodic reports merely confirm what they already know: future debt levels will reach unprecedented heights, and the culprit is rising entitlement spending.

But recent legislation has complicated this story. While the primary drivers of this future debt remain programs such as Social Security, Medicare, and Medicaid, the list of federal spending categories contributing to the growing debt has expanded well beyond entitlements.

No matter which data one uses, the debt outlook remains dire. After accounting for CBO’s most recent updates, however, we can see a modest improvement from last year’s projections. In 2018, publicly held debt was projected to exceed 100% of GDP in 2030 and 152% in 2048. Now, it will not pass the 100% mark until 2033, and will only reach 140% in 2048. The (slight) improvement results from two sources: a small reduction in long-term entitlement projections and lower interest spending due to downward revisions to expected interest rates. Importantly, in both cases, the new spending projections were due to small changes in long-term trends and revised economic assumptions, not due to legislative action.

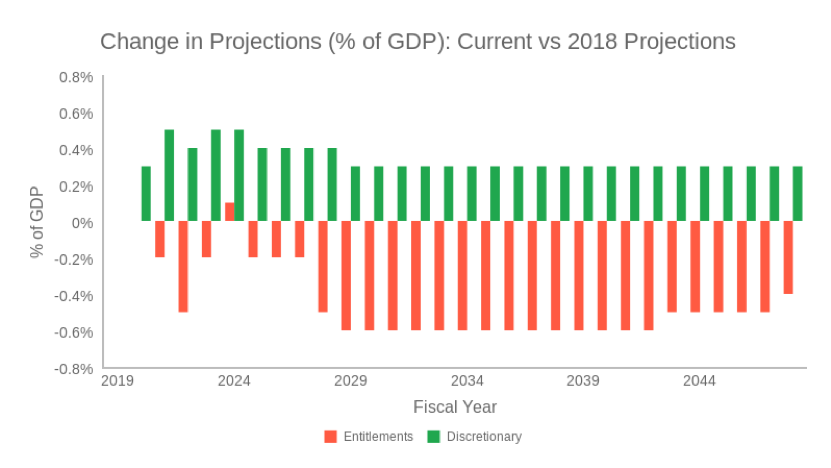

Since the 2018 projections, the only substantive legislative change was the recent budget deal. It increased discretionary spending (the spending that funds most federal departments and agencies, including the Defense Department) by $320 billion over the next two years. Ostensibly, the deal increased spending authorizations for only the 2020 and 2021 fiscal years. But under CBO budgeting rules the deal permanently increases the discretionary-spending baseline. Thus, through the miracle of federal budget accounting, the $320 billion in new spending actually added $1.5 trillion to the 10-year discretionary-spending baseline.

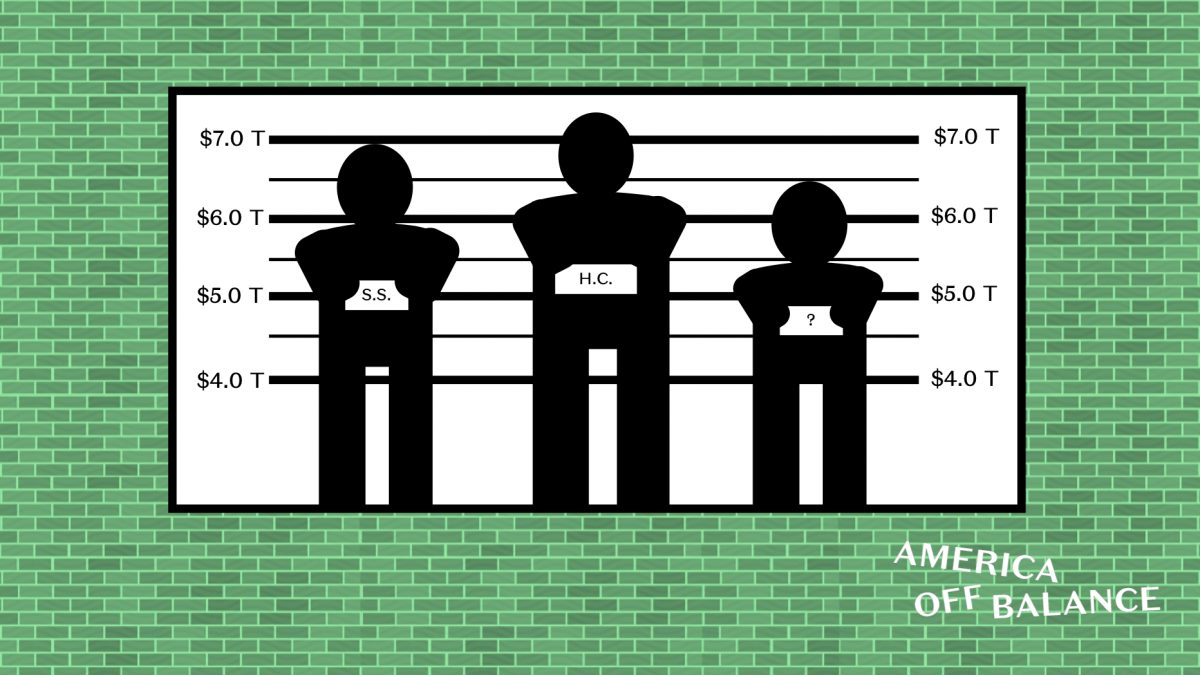

The budget deal was nothing new. As we explained in July, it was only the most recent of several budget acts that increased discretionary spending. This deal, however, produced a permanent increase in the baseline with large consequences for future debt levels. Using the America Off Balance Budget Calculator, we can see how the budget deal affected long-term discretionary-spending projections: discretionary spending in 2030 and beyond is now projected to be about 0.3% of GDP higher than it was last year. That is in contrast to entitlement-spending projections, which are actually lower than previously projected.

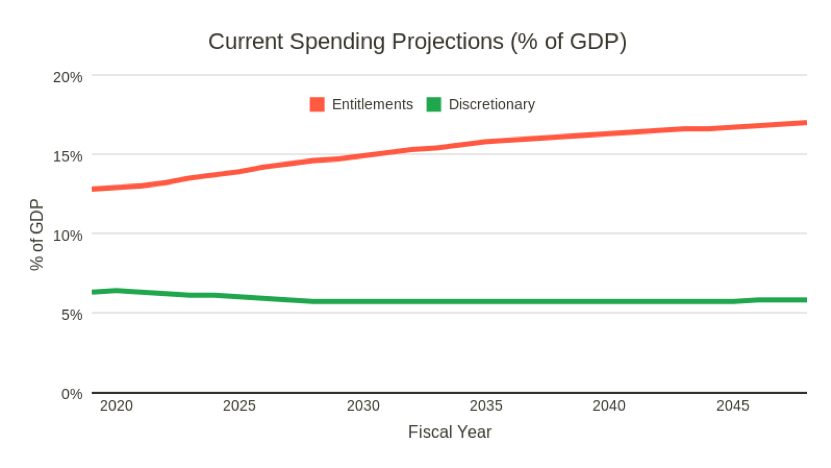

Make no mistake, entitlement spending is still to projected to grow much faster than discretionary spending. Over the next 30 years, entitlement spending will grow from 12.8% of GDP to 17.0%, while discretionary spending will fall slightly, from 6.2% to 5.8%.

Nevertheless, there is a clear danger in focusing only on entitlement spending. This was evident in the recent budget deal. Some members of Congress justified their vote for the deal by blaming entitlements. Discretionary-spending increases are fine, they argued, because future entitlement spending is skyrocketing.

If that logic sounds backward to you, that is because it is. It makes no more sense than justifying the purchase of an expensive new car by pointing to how large and unsustainable your mortgage payments happen to be. In the same fashion, an awareness that entitlements will squeeze future budgets should make policymakers more, not less, skeptical of other spending increases.