In the days leading up to Tax Day 2012, CNN/ORC polled Americans about their opinions about the U.S. tax system. Over the last week, the press has highlighted that 68% of respondents agreed with the statement that "the present tax system benefits the rich and is unfair to ordinary working men and women."

So have the message of Occupy Wall Street and the President’s calls for the rich to pay their "fair share” caused more Americans than ever before to be disgruntled with the U.S. tax system?

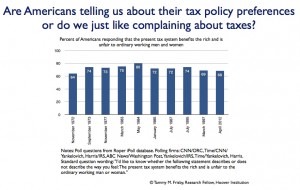

To answer this question, we can look at the latest poll compared to earlier surveys of Americans’ opinions about the U.S. tax system. It turns out that the same question asked by CNN/ORC this week has been asked nine other times over the last forty years by major polling firms. The two most recent previous polls were conducted in by CNN (with Time/Yankelovich Partners). The seven earlier surveys were all run by other reputable polling firms like Harris, ABC News/Washington Post, and Yankelovich Partners.

How does the latest poll compare?

As measured by these poll questions, 2012 is not the high water mark in the ostensible sentiment that the tax system is rigged for the rich and socking it to ordinary Americans. In fact, this is the second lowest percentage registering this complaint in the the last four decades. The lowest percentage was recorded back in November 1972, when 64% of Americans agreed with the statement.

This new poll records discontent with the tax system at the same or slightly less than it was the last two times Americans were asked this question. In March 1997, 69% of Americans agreed with the statement. More, 75%, agreed in July 1995.

In seven of the ten polls, discontent with the U.S. tax system was recorded in the mid-to-low 70%s. The largest percentage was in May 1984, when 80% of Americans agreed with the statement.

Read as another data point in the time series, the latest poll suggests that, in the aggregate, Americans feel about the same way about the fairness of tax system today as they have before. This is despite the best efforts of those calling for higher tax rates on high earners. Even the use of Warren Buffet as the poster boy for the “tax the rich” movement has not produced historic changes in the public’s attitudes on this question.

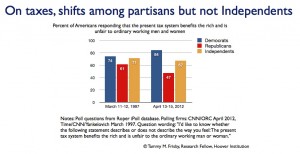

There is some evidence in these polls that, at least among Americans who identify as either a Democrat or a Republican, opinions about the tax system have become more partisan. The last time CNN asked this question, back in March 1997, 74% of Democrats described the tax system as benefiting the rich and unfair to ordinary working men and women, compared to 61% of Republican identifiers. Today, more Democrats, 84%, give that same response, while fewer Republicans, 47%, lodge this criticism of the tax system.

In the midst of that change, Independents have shown remarkable stability. In 1997, 71% agreed with the description; 67% today. This is further evidence that the President’s arguments about taxing the rich have not persuaded a substantial bloc of these swing voters.

In these percentages, there are also as many questions as answers. Among them, who do Americans think “the rich” are when they answer?

Many of the questions stem from the question wording: "I'd like to know whether the following statement describes or does not describe the way you feel: The present tax system benefits the rich and is unfair to the ordinary working man or woman." In the language of survey research, this is what is called a double-barreled question. Although some of the question wording ("the following statement") indicates one description of the tax system is to come, respondents are actually being given two descriptions: one, that it benefits the rich, and, two, that it is unfair to the ordinary working men and women of this country.

This produces two problems for interpreting the responses: First, respondents who think their own taxes are unfair and want to grumble look like they are agreeing with the "benefits the rich" description no matter their opinion about that. Second, respondents perceptions of the fairness of their own taxes may not hinge on their perceptions of the tax burden of the rich, although the question wording suggests these are necessarily related.

Looking at the relative stability of public opinion on this question over time, maybe Americans are telling pollsters that they - “the ordinary working men and women of our country” - don’t like to pay taxes and they wish someone else - “the rich” - would do it for them.

For all our political differences and all that has changed over the last forty years, that is one thing that most of us can still agree on.