Earlier this month, the California Employment Development Department released good news; California’s unemployment rate decreased 0.2 points to 8.1% in January 2014. Based on EDD data, the number of unemployed dropped 29,000, while the number employed increased by 50,000.

This is good news – unemployment dropping, employing rising, and a growing labor force. But, it isn’t necessarily great news. Great news would be California recovering faster than a) previous recessions and b) other states’ rate of recovery.

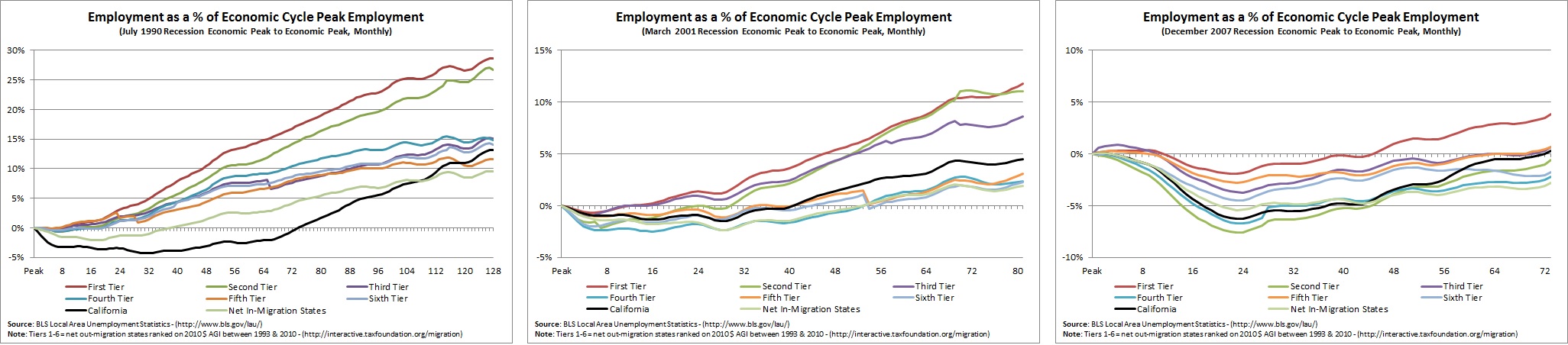

Using state-level seasonally-adjusted employment, unemployment, and labor force Bureau of Labor Statistics data, the charts below show the three metrics relative to the economic cycle’s peak for the previous three recessions and recoveries – when the metrics return to pre-recession levels (i.e. cross 0%). For instance, at California’s December 2007 economic peak, employment totaled 17,014,221. As of January 2014, it was 17,068,468 – a difference of 0.3%.

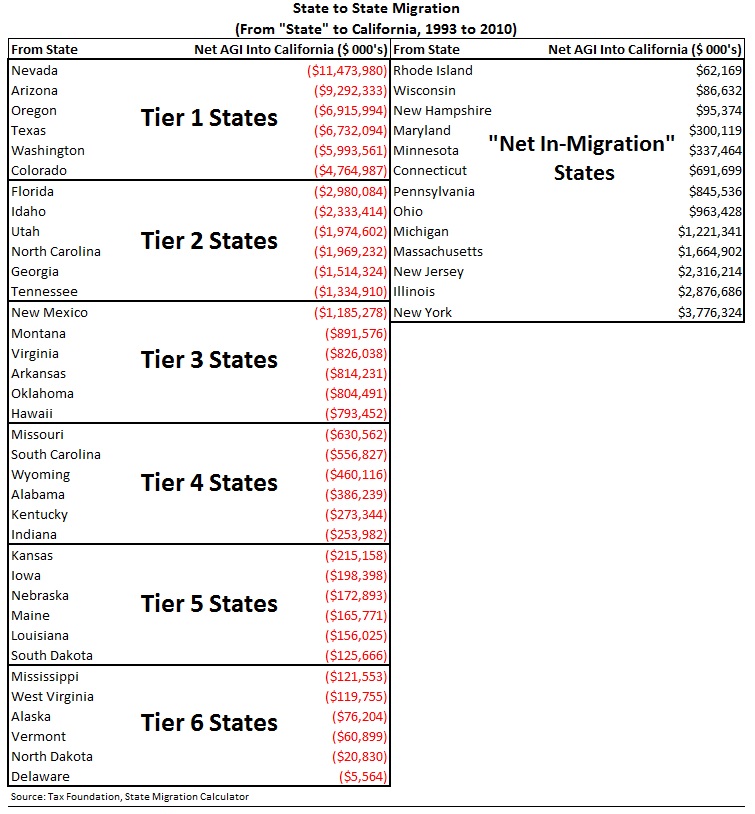

As shown in the table to the right, the data are broken into 8 categories: California, Tier 1 to 6 states, and “Net In-Migration” states. These categories are assigned based on net domestic migration. For instance, Tier 1 states are those where the most Adjusted Gross Income (AGI) migrated (on a net basis) from California.

Employment

The July 1990 recession represented a seismic restructuring of California’s economy as the Cold War came to an end and Southern California’s aero-defense industry found itself the victim of its own success. However, while it took only a few months for Tier 1, 2, 3 and 5 states – and roughly 1-½ years for Tier 4 and 6 states – to return to pre-recession employment, California took over six years to come back. Of note, California even lagged behind the “Net In-Migration” states, who theoretically should be worse economic performers than the Golden State.

California actually better weathered the next recession, caused by the dot-com bubble and furthered by the September 11th attacks. Tier 1, 2, and 3 states continued to perform better than California, but the Golden State didn’t underperform the other tiers by much and significantly over-performed the “Net In-Migration” states. California bounced back within roughly 3 ½ years—about half the time of the previous decade’s recession.

Most recently, Tier 2 and 4 states experienced deeper drops in employment than California. California lagged behind the other Tiers for most of the recovery, and only recently has the Golden State begun to over-perform the “Net In-Migration” states. Echoing the 1990 recession, it has taken California over 6 years to reach pre-recession level employment. You’ll notice in the spring/summer of 2012, California’s growth began to accelerate corresponding with strong stock market growth and a series of somewhat successful tech IPOs, including Facebook.

In terms of employment, California appears to be on track with its 1990’s recovery performance, but is underperforming relative to the March 2001 recession. Compared to other states, California is lagging behind Tier 1, 3, and 5 states, while not out-performing the others by that much.

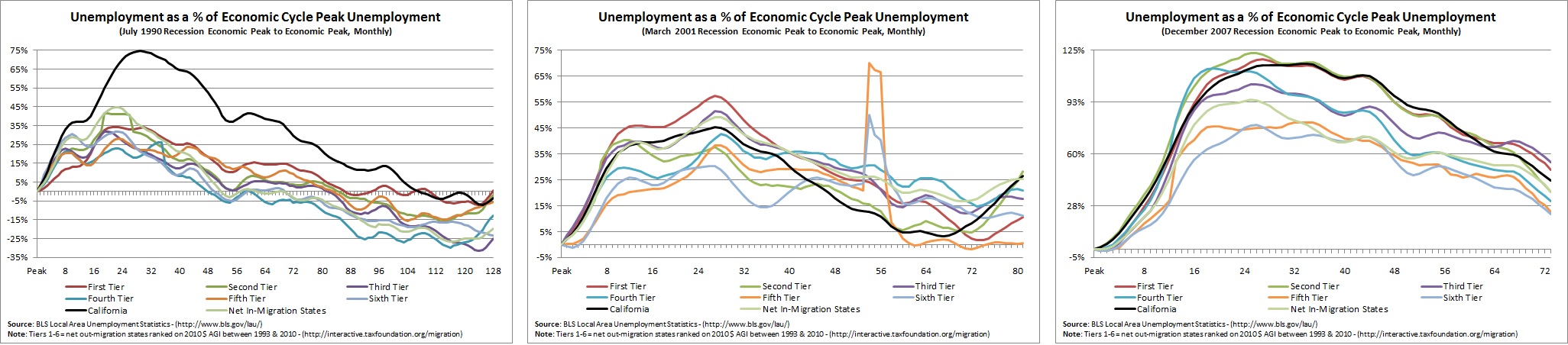

Unemployment

Unemployment metrics reinforce how painful the 1990 recession was for California. It took 9 years for California to reach pre-recession levels – about 2 years longer than most other states.

Again, the March 2001 recession was much milder for California; however, the Golden State’s unemployment decrease was no better or no worse than the other states. Interestingly, its unemployment begins to tick upward about 6 to 10 months before other states began experiencing unemployment growth again.

For the previous two recessions, 73 months after the economic cycle’s peak, California’s unemployment was 28% above pre-July 1990 recession unemployment levels and 10% above pre-March 2001 recession levels. Currently, it is 43%. However, holding all else constant and based on the current trajectory, California would return to pre-recession level unemployment in approximately another 30 to 40 months—similar to 1990 recession. This suggests that, compared to that prior recession, California is decreasing its unemployment at a faster rate. Nonetheless, most other states have out-performed California reducing its unemployment relative to pre-recession levels.

Looking at unemployment, California’s current recovery, again, appears to be tracking closely that of the 1990’s.

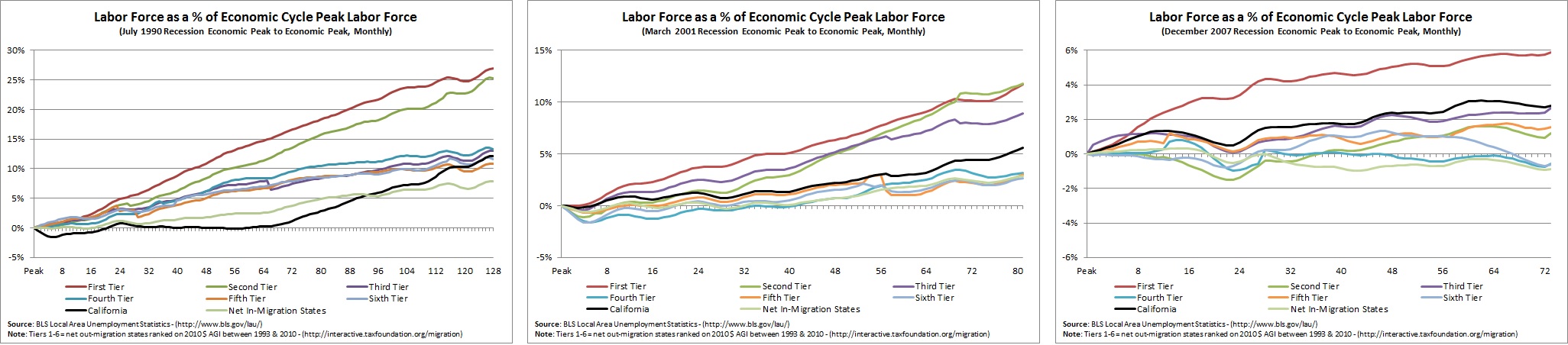

Labor Force

A growing labor force is an important indicator of economic health, particularly during recoveries. For instance, what if the unemployment drop remained the same but instead of adding 50,000 employed in January 2014, California only added 20,000? The unemployment rate still would have fallen to 8.1%, but because 9,000 people had given up looking for work, not because more people were employed.

The stagnation of the labor force during the early 1990’s is further proof this was a time of serious economic upheaval in California.

The March 2001 recession actually showed continued growth and remained in the middle of the pack of the other states. Yet, Tier 1, 2, and 3 states saw substantial growth in their labor forces.

More recently, California’s labor force has grown, just not as strongly as the early 2000’s. However, it is outpacing all but Tier 1 states, which is a positive sign. Here, California diverges from the 1990 recession, suggesting that while the Golden State’s economy is going through a serious struggle, it might not be a seismic restructuring.

It isn’t a surging comeback (more on that here and here) nor is it consistent across the state, but at least California is slowly recovering. The best historical example for California moving forward might be remembering a lesson from its past.

During the 1990’s, Governor Pete Wilson recognized the end of the Cold War meant California had to adapt. His administration focused on pro-growth policies like fiscal responsibility, smart regulation, and low taxes that promoted new investment and innovation. Fast-forward 30 years: California has wagered its economic prospects on Silicon Valley’s tech industry. A similar, but lesser-so lack of diversification hurt California in the early 1990’s. Sacramento would be wise to remember what happened then—and how Pete Wilson responded—and not allow a little bit of good news distract from the need to promote an economic environment that could yield even greater results.

Follow Carson Bruno in Twitter: @CarsonJFBruno