- US Labor Market

- Economics

- Law & Policy

- Regulation & Property Rights

- Monetary Policy

- Budget & Spending

- Economic

- History

Will the financial crisis mark a substantial retreat from the world’s movement during the past several decades toward a competitive market system? Many journalists and others have been suggesting that this crisis will lead to much more active government involvement in the economy, and even induce a return toward government ownership of many companies in the nonfinancial as well as the financial sector. In my opinion, what will happen to worldwide support for competition and privatization, freer trade, and market-based economies depends greatly on how the American and other major economies fare during the next year or so.

The United States and much of the rest of the world appear to have entered a recession, with falling GDP and rising unemployment. This recession may be steep and somewhat prolonged. The extreme example of a major depression is the Great Depression of the 1930s, in which real GDP declined sharply for a few years during the early 1930s, and unemployment grew from 3 percent in 1929 to 25 percent in 1933. Unemployment was still at the remarkably high rate of 17 percent in 1939, before World War II broke out.

By contrast, American recessions since 1959 have been so mild that in no year did real GDP fall by much more than 1 percent, and yearly average unemployment rates peaked at about 10 percent. Unemployment approached this level in both 1982 and 1983 as the Fed squeezed inflationary expectations out of the system with interest rates that sometimes exceeded 20 percent. Still, real GDP fell only a little between 1981 and 1982 and then rebounded in 1983, even though unemployment that year was still high.

I do not expect the current crisis to develop into a major depression. I do expect that most governments will place any worldwide recession that develops, even a severe one, in the context of the sizable world economic developments of the past forty years, not only in the United States but also in Europe, Japan, China, and most other countries. Even a couple of years of declines in GDP and relatively high unemployment will not overshadow the remarkable economic achievements of those decades, including unprecedented growth in GDP in formerly poor to very poor countries, such as Japan, South Korea, China, India, Malaysia, Chile, Spain, and Portugal. Growth in mainly market-oriented developing economies swept away dire poverty for hundreds of millions of families in Asia, Europe, and South America. This sustained growth also led hundreds of millions of others into middle-class status, where they could afford to buy cars, well-equipped homes, televisions, cell phones, computers, and other goods that not long ago were well beyond the means of a typical family in all but a few countries.

Yet, even with a recession of the type I expect, there will be increased regulation of financial institutions. It is difficult to propose long-term reforms, but the following few seem reasonably likely to reduce the probability of future financial crises:

- Increase capital requirements. The capital requirements of banks relative to assets should be increased after the crisis to prevent the highly leveraged ratios of assets to capital of financial institutions during the past several years. A minimum ratio of capital to assets should possibly be imposed by the Fed on investment banks and money funds. As much as possible, the measure of capital should not be its book value but its market value, such as the market value of publicly traded shares of banks. Book value measures, we recall, apparently badly overlooked the plight of Japanese banks during their decade-long banking crisis of the 1990s.

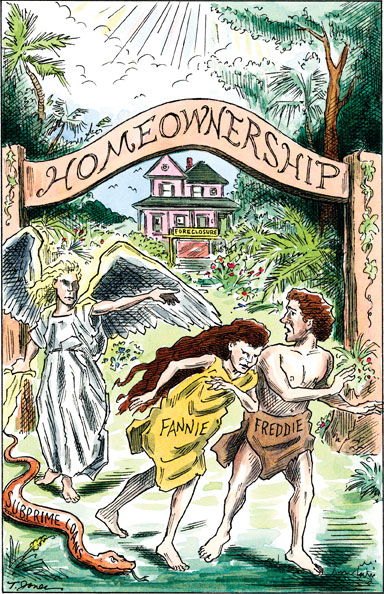

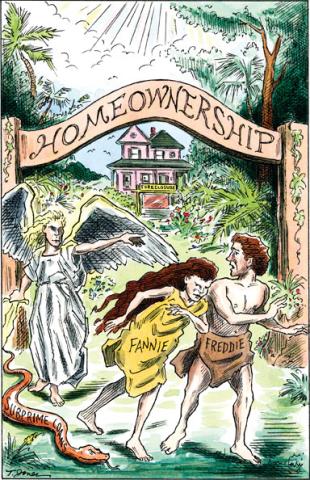

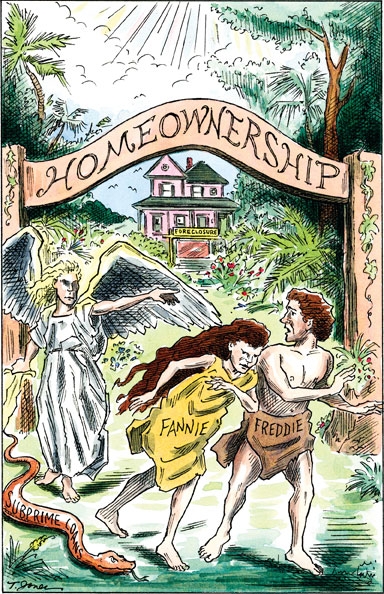

- Sell Freddie and Fannie. The government should as quickly as possible sell Freddie Mac and Fannie Mae to fully private companies that receive no government insurance or other help. Those two giants did not cause the housing mess, but in recent years they greatly contributed to it, partly through congressional pressure on them to increase their purchases of subprime loans. They have owned or guaranteed almost half of the $12 trillion in outstanding mortgages with a small capital base. The housing market already has excessive amounts of government subsidies, such as the tax exemption of interest on mortgages, and should not have government- sponsored enterprises that insure mortgage-backed securities.

- No more bailouts. The “too big to fail” approach to banks and other companies should be abandoned as new long-term financial policies are developed. The “too big” approach is inconsistent with a free market economy. It has caused dubious company bailouts in the past, such as the large government loan years ago to Chrysler, a company that remained weak and should have been allowed to go into bankruptcy. All the U.S. auto companies have asked for handouts because they cannot compete against Japanese, Korean, and German car makers, partly because the U.S. companies have been incredibly badly managed. A “too many institutions in trouble to fail” principle, as in the present financial crisis, may still be necessary on rare occasions, but the failure of large, badly run financial and other companies is healthy and indeed necessary for the survival of a robust, competitive free-enterprise system.

Although there may be other regulations and controls, I would not expect the federal government to hold on for long to its preferred stock interest in various investment banks. I have not supported such government equity interests, and it would be a grave mistake if the government continued to maintain such ownership.

Is this the final crisis of global capitalism—to borrow the title of a George Soros book written shortly after the Asian financial crisis of 1997–98? The crisis that kills capitalism has been said to loom during every major recession and financial crisis ever since Karl Marx prophesied the collapse of capitalism in the middle of the nineteenth century. Although I admit to having greatly underestimated the severity of the current crisis, I am confident that sizable world economic growth will resume before very long under a mainly capitalist world economy.

On the other hand, if I am wrong and there is a prolonged and deep worldwide depression, not simply a recession, the retreat from capitalism and globalization could be severe, as happened during the Great Depression. Many countries would increase their tariffs and other trade barriers to reduce the competition from imports. Nationalization rather than privatization would be in favor as governments took over ownership of many weak companies. Regulation of executive salaries and other wage and price controls would become much more common. Competition would be stifled as governments encouraged companies to coordinate their pricing and other policies and changed laws to make it easier for unions to organize. These are not attractive prospects.

Few people have sympathy for the hedge-fund managers and others who made hundreds of millions, and sometimes billions, of dollars during the boom years, Still, middle-class and poor families would be hurt the most by unwise government policies and attacks on the foundations of a competitive economy. Policies that frighten entrepreneurs and discourage them from accumulating private capital and investing in innovations will hurt most of us, but will especially hurt workers.