- Health Care

Of late there has been a vigorous public debate over the significance of a recently-observed slowdown in the rate of US healthcare cost growth. Some have suggested that this cost growth slowdown may reflect transformative changes in the healthcare sector that could lead to improved Medicare finances, possibly even rendering further program reforms unnecessary. Unfortunately, the voicing of these hopes reflects a misunderstanding of the methodology underlying current Medicare projections. When these methods are fully understood, it becomes clear that despite the recent cost slowdown, Medicare faces substantial financial challenges that are best corrected sooner rather than later, and that Medicare costs are much more likely to be higher than current projections than lower.

In this piece I review the recent health cost slowdown and explain what it has meant for Medicare finances to date. I then explain the current projections for future Medicare finances, and why I and the other trustees have warned in our recent reports that “Medicare’s actual future costs… are likely to exceed those shown by the current-law projections.”

The Recent Health Cost Slowdown’s Effects on Medicare Finances

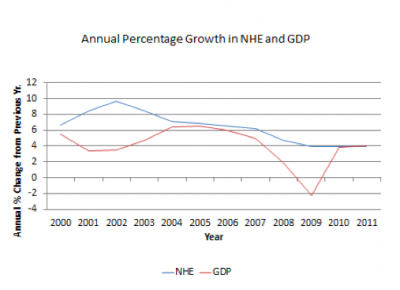

Over the years 2008-11, national health expenditure (NHE) growth was substantially lower than in previous years. Having fluctuated between 6.2% and 9.7% in the years from 2000-07, NHE growth slowed to 4.7% in 2008 and further to 3.9% in each of the years 2009-11. These annual growth rates were also markedly slower than those seen in earlier years (11.0% in 1990, 13.1% in 1980, 10.6% in 1970). Early evidence is that health cost growth remained relatively slow in 2012.

This slower NHE growth coincided with a recession, raising the question of how much of the cost deceleration was caused by the generally weak economy. The question is of interest to those concerned about Medicare finances because if the causes of the slower growth are rooted in the recession, it may not be sustained once the economy recovers more fully. If on the other hand the cost slowdown reflects healthcare sector changes that are largely independent of the recent recession, it could suggest that cost growth will remain slow going forward.

Numerous healthcare analysts and policy advocates have debated the causes of the recent cost slowdown, producing widely varying estimates of the extent attributable to the recession. I make no attempt to settle this ongoing debate other than to offer some general observations. One is that a prime reason that different studies of this issue have produced different results is that they have asked different questions. For example a recent Congressional Budget Office (CBO) working paper, misinterpreted by some as finding the Great Recession had no effect on recent Medicare cost growth, actually concluded instead that the recession had no measurable impact on consumer demand for Medicare services, a much narrower issue. Others, such as the Kaiser Foundation and the CMS Medicare actuaries, reached different conclusions partially because they allowed for other recession-related effects.

Second, some (including the Obama White House) have pointed to future projection scenarios unrealistically assuming that the recent low nominal health cost growth rate will be sustained. But the recession contributed to slower nominal Medicare growth almost by definition, because it slowed the growth of both worker wages and general consumer prices. Both of these trends put downward pressure on the growth of health providers’ input prices which, by law, are a critical basis for calculating Medicare reimbursement rates. Holding all other factors constant, slower growth in input prices produces slower growth in Medicare payments and is one acknowledged effect of the recent recession that is unlikely to be perpetuated.

Third, while it is open to debate how much the passage of the Affordable Care Act (ACA) in 2010 has subsequently altered practices in the health sector, the cost slowdown cannot be traced primarily to that legislation, for the simple reason that the cost slowdown began well before the ACA was enacted.

Fourth, and perhaps most importantly, the recent cost slowdown has not improved the state of Medicare finances to date. By any measure, Medicare finances are in worse shape than before the cost slowdown began.

Understanding this requires some understanding of Medicare’s complex finances. Medicare has two trust funds, a Hospital Insurance (HI) trust fund and a Supplementary Medical Insurance (SMI) trust fund. They are financed in different ways. The HI trust fund is financed primarily by a payroll tax, and its financial solvency is largely a function of the relationship between incoming taxes and outgoing payments. The SMI trust fund is by contrast provided with whatever revenues it needs from the government’s general fund, in addition to beneficiary premiums and other revenues. When SMI expenditures grow, insolvency is not threatened, but taxpayers and beneficiaries face higher cost burdens.

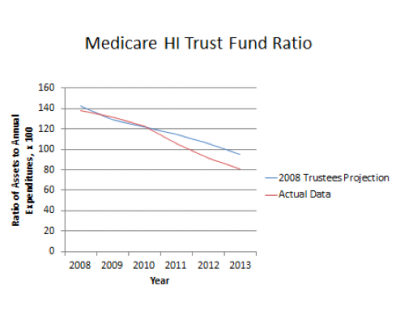

Neither side of Medicare has been strengthened by the recent cost slowdown. To the contrary, each is weaker than before it began. The Medicare HI “trust fund ratio” (the ratio of trust fund assets to annual program costs) is now lower than it was in 2008, and indeed also lower than it had then been projected to now be.

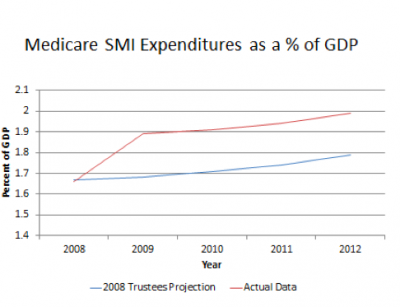

Medicare SMI costs, relative to Americans’ productive output, are also higher than they were previously projected to be.

What has happened is that the recession may have reduced Medicare expenditures somewhat but it also reduced Medicare revenues and broader US economic output by even more.

To think clearly about the effect of the recent cost slowdown on Medicare finances it is necessary to distinguish between the documented effects to date, and those that are merely projected going forward. To date, the period of slower cost growth has not strengthened Medicare finances but instead weakened them. Thus, for this recent cost slowdown to produce a brighter financial future for Medicare there must be reason to believe current projections are overstating future Medicare costs. An examination of current projection methods, however, reveals that this is not the case.

Current Medicare Projections and the Factors Affecting Them

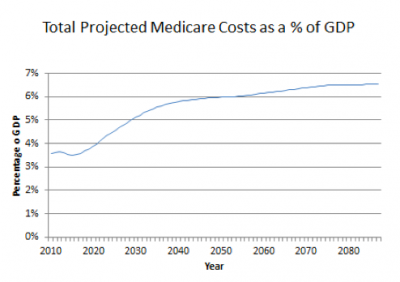

Under current projections, total Medicare costs will continue to outpace economic growth for the indefinite future, the slope of this cost growth being particularly steep in the next couple of decades. Total Medicare costs, now 3.6% of GDP, are projected to rise to 5.6 percent of GDP by 2035.

One result of this projected cost growth is that Medicare’s HI trust fund is projected to be insolvent in 2026. The trustees’ report makes clear that under current projections, prompt legislative action is desirable to avert HI insolvency and to control SMI cost growth to minimize the risk of disruptions for beneficiaries, taxpayers, and healthcare providers. If for example legislators waited until 2026 to address projected HI insolvency and thereafter made only the minimum necessary changes, the consequences would be dire: by 2047 the required HI tax increase would be 41 percent or alternatively, benefits would need to be reduced 29 percent.

For the next several decades the primary reason for Medicare’s cost growth is demographics—the explosive growth in the number of program beneficiaries as the baby boomers flood the benefit rolls. These beneficiaries are also living longer than any previous generation, while the eligibility age for Medicare benefits (65) hasn’t risen since the program’s inception. Last year there were 3.3 workers to support each Medicare beneficiary’s benefits, a ratio expected to decline rapidly to 2.3 by 2030.

In sum, under current projections the vast majority of Medicare cost growth relative to GDP will occur during the next couple of decades and be driven principally by demographic changes that are unmitigated by the recent healthcare cost slowdown. Thereafter the rate of general healthcare inflation becomes a relatively more important factor, but that is long after significant legislative reforms will be required to avert HI insolvency and to slow the growth of Medicare costs generally.

Medicare Costs Are Likely to be Higher than Now Projected

Regardless of whether the recent slowdown in national healthcare cost growth is sustained, it is overwhelmingly likely that additional Medicare financing reforms will be needed, the sooner the better. Future Medicare costs are much likelier to be higher than under current projections than they are to be lower.

The first reason for this is straightforward: legislative history indicates that it is highly unlikely that certain aspects of current law will be sustained. Under current law Medicare physician payments would be cut by approximately one-quarter in early 2014. However, since 2003 legislators have consistently overridden such payment reductions and are widely expected to continue to do so. Continuing this pattern would by itself raise long-term Medicare costs relative to current projections by over 10%. Beyond this, current projections assume the successful implementation of the ACA’s ambitiously compounding Medicare cost-reduction measures. But it is not yet known how the medical and political systems will respond to these scheduled payment reductions; indeed substantial political pressure is already building to overturn some of them, potentially raising costs higher.

The second reason costs are likely to be higher is rooted in the way that the trustees’ projections are currently done. Simplifying, the projections already assume a substantial slowdown in per capita Medicare cost growth, far surpassing that which has occurred to date.

The reason this substantial per capita cost slowdown is projected is that current Medicare projections are built from projections for NHE growth. The trustees assume that over long timespans NHE growth must ultimately converge with the rate of GDP growth, or else health spending would eventually swallow up the rest of the economy. This convergence by itself requires a substantial deceleration relative to historical patterns, but under the ACA most Medicare payments are constrained to grow even more slowly than that—roughly 1.1 percentage point slower each year.

This means that over the long term per capita costs in many parts of Medicare are assumed to eventually grow substantially slower than per capita GDP, forever. There is no historical precedent for this, and is one reason why many are skeptical that these ACA provisions will be permanently sustained. Still further, the projections assume (pursuant to a Medicare Technical Panel recommendation) that the ACA will further constrain growth in the volume and intensity of Medicare services, slowing program costs even more.

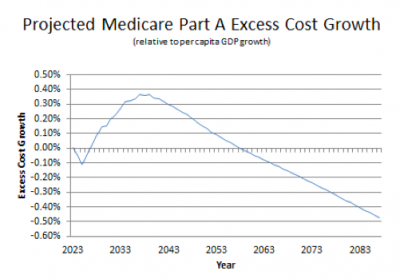

As a result, projected per capita cost growth in Medicare HI (Part A) is as on the graph below. These projections assume that per capita HI costs will ultimately shrink relative to per capita GDP.

Reflecting the skepticism that many hold as to whether the ACA will succeed in holding down per capita Medicare cost growth to the extent depicted above, the trustees’ report warns that actual costs may be higher than under these projections. Clearly there is nothing in the recent health cost deceleration that suggests that the current methodology overstates likely costs. Thus, speculation that Medicare’s projected financial difficulties may resolve themselves appears to be rooted in a lack of awareness of how much the projections already assume slower cost growth of far greater significance than anything that has occurred in recent years.

In sum, while experts will continue to debate the causes and the implications of the recent slowdown in NHE growth, there is one debate that we should be able to close: that being whether further legislative reforms will be needed to sustain Medicare finances. The answer is a resounding yes, and nothing in the recent healthcare cost deceleration suggests otherwise.