- Economics

- Budget & Spending

- Monetary Policy

- Law & Policy

- Regulation & Property Rights

In a Wall Street Journal op-ed on July 18 called "An Unnecessary Fix for the Fed," economist Alan Blinder takes aim at legislation now under consideration in the House of Representatives to amend the Federal Reserve Act. Mr. Blinder focuses on what he calls the "meat-and-potatoes" of H.R. 5018: Section 2, Requirements for Policy Rules for the Federal Open Market Committee, which would require the Fed to submit to the Congress and the American people its rule or strategy for monetary policy. But Mr. Blinder actually shoots at a straw man of his own making, not at the proposed law itself.

Mr. Blinder's main argument is that the legislation "seeks to intrude on the Fed's ability to conduct an independent monetary policy, free of political interference." I anticipated and refuted this argument in a July 16 Journal op-ed, "How to Spark Another 'Great Moderation.' " As I stated there, the legislation is very clear that "the Fed, not Congress, would choose the rule and how to describe it," and "since the Fed chooses its own rule, its independence is maintained."

Nevertheless, Mr. Blinder still tries to press his lost-independence argument. He points out that the bill specifies a certain "Reference Policy Rule" with which the Fed would have to compare its policy rule. He notes that the reference rule is actually the Taylor rule (based on a proposal I made in 1992, a point I also made in the July 16 op-ed). But the legislation does not require that the Fed follow the reference rule or any other specific rule. It simply requires that the Fed compare its rule with the reference rule.

Mr. Blinder claims that "In a town like Washington, the message to the Fed would be clear: Depart from the original Taylor rule at your own peril." That's nonsense. People at the Fed—as well as in academia and markets around the world—routinely compare monetary policy proposals with that rule. Federal Reserve Chair Janet Yellen gave a speech in 2012 comparing a policy rule she was considering for the Fed with the Taylor rule. There is no creation of a "holy writ" in this legislation, as Mr. Blinder would have us believe.

He argues that if the legislation were passed, the Fed would simply "concoct" and "pretend" to follow a rule in a nontransparent way to get around the law. But even if the Fed staff could fool a few people with such tactics, it would not be for long, and I doubt that the Fed's experienced and dedicated professionals would go the way he suggests.

Mr. Blinder says that the reference rule is "sensible" for normal times, but he argues—echoing Ms. Yellen—that these are not normal times. Indeed, much of his op-ed is devoted to making a list of what he sees as problems with the reference rule in the current situation, even though such a list is irrelevant to the case he is making because the legislation does not require that the Fed follow that rule. He calculates that the reference rule would now call for a federal funds rate at 1.25%, and he sounds a false alarm that this is "vastly higher than the actual near zero rate." But the legislation does not say that the Fed should increase the interest rate immediately, and if the Fed should decide to do so, it could go there slowly and with lots of warning.

Mr. Blinder also claims that the reference rule does not work when the interest rate hits zero. The recommended procedure in the case of the Taylor rule has always been to keep money growth from falling when the interest-rate target hit zero. There is nothing unworkable about that. But the reference rule would not have been used as a rationale for the extended bouts of quantitative easing, including the highly questionable QE3.

Some of Mr. Blinder's other arguments against the bill dredge up old long-discredited arguments against rules-based policy in general. He claims that a policy rule "forces monetary policy to respond . . . mechanically in ways that can be programmed into a computer," going so far as to say that "a handheld computer would do." Historians and statisticians who have found that periods of rules-based monetary policy work well do not base their findings on such mechanical characterizations of rules-based policy. There is nothing inherently mechanical about having a strategy or clearly stated method for achieving particular goals. In my view, it is the Fed's repeatedly interventionist and ad hoc actions in the past few years that are knee-jerk and mechanical.

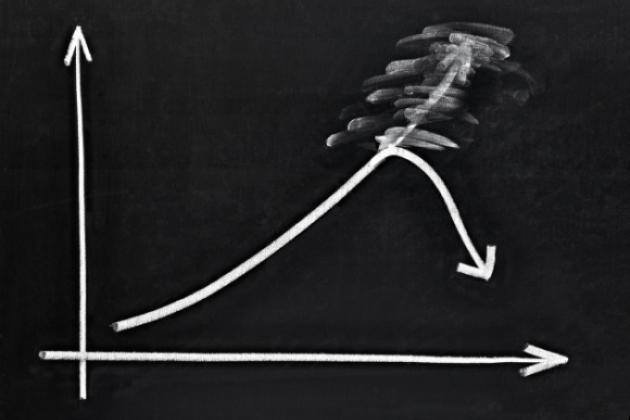

Mr. Blinder says that Fed policy has been working well, so a fix is unnecessary. But it has not been working well. Since the time the Fed deviated from the rules-based policy that had worked well in the 1980s and 1990s, we have had a financial crisis, a deep recession and a very disappointing recovery. The deviation from its previous rules-based policy in 2003-05, when it held its interest-rate target very low, helped create the boom and bust and can be traced to this poor performance.

The purpose of the House bill is to prevent such harmful departures from rules-based policies in the future. The de jure independence that the Congress has granted the Fed has not prevented such deviations. Moreover, there is a clear precedent for such congressional oversight. During another period of poor performance in the late 1970s, the Federal Reserve Act was amended to require that the Fed report the ranges for the future growth of the money supply. These requirements were removed from the law in 2000. The requirements did not reduce Fed's independence, though the Fed complained about the legislation. In fact many judge that the 1980s and 1990s were a time when the Fed regained its de facto independence. That could well happen again if Section 2 of H.R. 5018 were passed into law.

Mr. Taylor, a professor of economics at Stanford University and a senior fellow at the Hoover Institution, served as Treasury undersecretary for international affairs from 2001 to 2005.