The Atlanta Fed, through its “macroblog,” has joined the discussion about reform of the Federal Reserve. It’s a good discussion to have. David Altig, Senior Vice President of the Federal Reserve Bank of Atlanta and main blogger, wrote the latest entry on my Wall Street Journal article of last week which offered proposals to return to sound fiscal and sound monetary policy. Macroblog has no quarrel with the proposals for sound fiscal policy but, as in past posts, disagrees with the analysis of monetary policy.

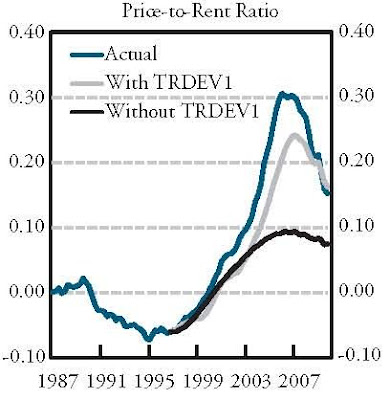

The latest macroblog entry starts by appealing to a paper from New Zealand which shows that an “estimated” Taylor rule indicates that interest rates were not too low for too long in 2003-05 as I have argued. But the “estimated” policy rule in that paper doesn’t looks anything like what I proposed and given that there are already scores of existing models I fail to see the advantages of another model from New Zealand. For example, at the Federal Reserve Bank of Kansas City, George Kahn shows that deviations from a policy rule were a major reason for the housing price boom and bust. A chart from his paper which I copy below shows clearly that policy without the Taylor Rule deviation (TRDEV1) would have avoided the boom and bust.

The Atlanta Fed’s macroblog post also argues that the Fed has already laid out an exit strategy for reducing its balance sheet, and it gives a link to minutes of the FOMC with a list of tools. However, as I explained in testimony to Congress last year, a list of tools is not a strategy. A strategy is a path or contingency plan for the balance sheet over time. I gave an example in the tesimony. If it is good to lay out a path to reduce the federal debt as a share of GDP, then why not lay out a contingency path to reduce the Fed’s balance sheet?