- Budget & Spending

- Economics

- Law & Policy

- Regulation & Property Rights

- Monetary Policy

- Economic

- Politics, Institutions, and Public Opinion

- History

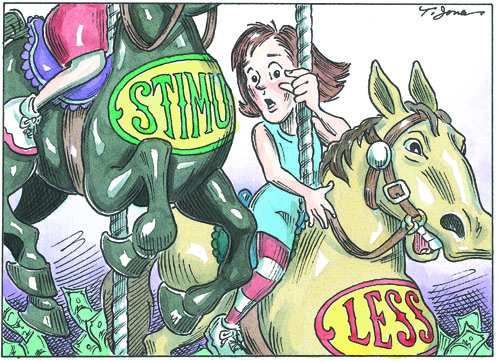

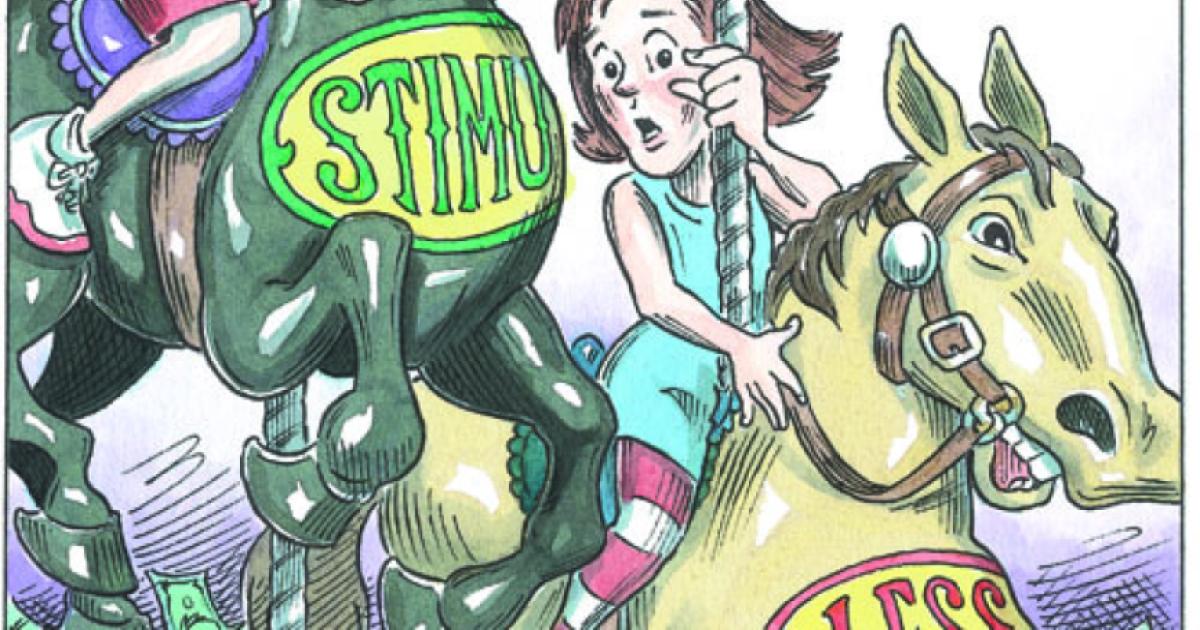

For more than two years, economists have been debating the merits of federal stimulus programs. President Obama’s compromise on the Bush tax cuts late last year might be seen as at least partial recognition that keeping marginal tax rates from rising across the board is the best stimulus now, especially if the deal leads eventually to making the cuts permanent. The economic data rolling in confirm that recent temporary, targeted stimulus programs have not worked, and that their enactment was a triumph of Keynesian wishful thinking over practical experience.

In September 2009, we reported empirical research showing that the temporary tax rebates and transfer payments in the Bush and Obama administrations’ stimulus programs were ineffective. Here we consider new data on the impact of increases in government purchases, which were heralded as a major stimulating factor in the Obama package.

The key tenet of Keynesian economics is that government purchases of goods and services stimulate additional economic activity beyond the amount of the purchase itself. The impact on GDP of the stimulus depends on both the dollar volume of additional government purchases and the size of the government-purchases multiplier, that is, the effect of a change in government purchases on real GDP.

Although the policy debate has mainly focused on the multiplier’s size, data covering the first year and three quarters of the 2009 American Recovery and Reinvestment Act (ARRA) show that despite the large size of the program, the dollar volume of additional government purchases that it has generated has been negligible.

The ARRA attempted to stimulate government purchases in two ways. First, it provided funds to finance federal government purchases of goods and services (mainly for infrastructure, law enforcement, and education). Second, it provided grants to states and local governments to enable them to increase purchases of similar goods and services.

Recently released Commerce Department data show that of the $862 billion stimulus package, the change in government purchases at the federal level has, thus far, been extremely small. From the first quarter of 2009 through the third quarter of 2010, government purchases increased by only 3 percent of the $862 billion ($24 billion). Infrastructure spending increased by an even smaller amount: $4 billion. In a $14 trillion economy, such amounts are immaterial.

The Commerce Department also provides data on ARRA grants to state and local governments and the amount of purchases by these governments. According to these data, state and local government purchases of goods and services did not increase at all in response to the large federal stimulus grants. These purchases have remained slightly below their pre-ARRA level since the fourth quarter of 2008.

Meanwhile, state and local revenues fueled by the receipt of ARRA grants have grown 10 percent over the same period. The low level of state and local purchases is consistent with the initial falloff and subsequent slow growth in revenues excluding ARRA grants. Our statistical analysis shows that once revenues are controlled for, ARRA grants have no statistically significant impact on state and local government purchases.

The absence of any discernible impact of federal grants on state and local government purchases should come as no surprise to students of U.S. fiscal policy history. In 1979, the late Ned Gramlich, former governor of the Federal Reserve Board and University of Michigan professor, studied the impact of similar grants in stimulus packages of the late 1970s. He found that the federal grants to state and local governments had little effect on their purchases of goods and services.

Therefore, Gramlich concluded, “the general idea of stimulating the economy through state and local governments is probably not a very good one. Plain old permanent federal income tax cuts retain their superiority as a fiscal stabilization device.”

So where did ARRA’s state and local grant money go? While some of it increased transfer payments to individuals in the form of welfare and Medicaid, the major part was used simply to reduce borrowing. As ARRA grants increased, net borrowing by state and local governments decreased. In the third quarter of 2010, for example, state and local governments received $132 billion in stimulus grants at an annual rate. In that quarter they borrowed $136 billion less at an annualized rate than they had in the fourth quarter of 2008, even though their revenues from all other sources were only $76 billion higher.

The bottom line is that the federal government borrowed funds from the public and transferred these funds to state and local governments, which then used the funds mainly to reduce borrowing from the public. The net impact on aggregate economic activity is zero, regardless of the magnitude of the government-purchases multiplier.

This behavior is a replay of the failed stimulus attempts of the 1970s. As Gramlich found in his work on the anti-recession grants to state and local governments: “A large share of the [grant] money seems likely to pad the surpluses of state and local governments, in which case there are no obvious macrostabilization benefits.”

The implication of our empirical research and Gramlich’s is not that the stimulus of 2009 was too small, but rather that such countercyclical programs are inherently limited. The lesson is to beware of politicians proposing public works and other government purchases as a means to stimulate the economy. They did not work then and they are not working now.