- Economics

- Budget & Spending

- History

- Economic

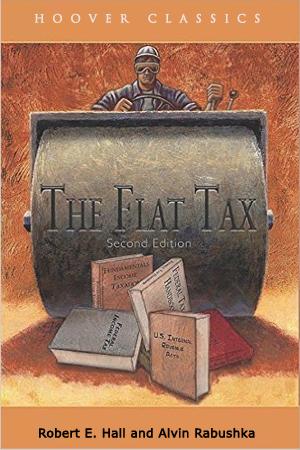

Editor’s note: This article is an updated summary of the introduction to Alvin Rabushka and Robert Hall’s book The Flat Tax (Hoover Institution Press, 2007). You can read excerpts from the book here.

First proposed in 1981 by Hoover fellows Alvin Rabushka and Robert Hall, the flat tax was intended to simplify the federal tax system by replacing the progressive federal income tax system with a low and simple flat tax. They believed that the flat tax is the fairest and most efficient, simple, and workable tax plan. Their Wall Street Journal article “A Proposal to Simplify Our Tax System” featured an image of a postcard that became symbolic of the flat-tax movement, as the simplicity it proposed would allow a business or individual to file tax returns via a postcard-sized form.

The flat-tax proposal gained steam in the 1980s and inspired President Reagan’s Tax Reform Act of 1986. Two rates of 15% and 28% replaced the prior system’s multiple tax brackets. In 1990, Congress added a third rate of 31% on higher incomes, reducing the simplicity of the tax structure. Just a few years later, under President Clinton, additional brackets effectively gutted what had been a relatively flat tax system. In 1995 the flat tax was proposed again but never made it to the House or Senate floors.

While the flat tax has lost steam as the basis for tax reform in the United States today, it’s currently in use in 24 countries around the world. Since 1994, Estonia has had a simple flat tax, currently 20%, and the Tax Foundation ranks it the most competitive in the world. In 2001, Russia implemented a 13% flat tax on individual income, which it has retained to this day. Other countries among the 24 with a flat tax include Belarus (13%), Belize (25%), Bulgaria (10%), Georgia (20%), Hungary (15%), Kazakhstan (10%), Mongolia (10%), Romania (10%), and Saudi Arabia (20% on foreign residents).

While the United States may not have a federal flat income tax, several states have implemented flat-rate individual income taxes, including Colorado, Illinois, Indiana, Massachusetts, Michigan, North Carolina, Pennsylvania, and Utah. Perhaps the use of flat tax rates by states may eventually bring back support for flat taxes at the federal level.