- Budget & Spending

- Economics

- Law & Policy

- Regulation & Property Rights

- Monetary Policy

Hoover senior fellow John B. Taylor was invited to discuss tax reform and deficit reduction with the Finance Committee of the U.S. Senate. Here is what he said:

Chairman Nelson, Ranking Member Crapo, and other members of the Subcommittee on Fiscal Responsibility and Economic Growth, thank you for the opportunity to testify at this hearing on “The Role of Tax Reform in Comprehensive Deficit Reduction and U.S. Fiscal Policy.”

The economic recovery from the deep recession is now over two years old. However, the recovery is so weak that it is really a recovery in name only. Real GDP growth has averaged only 2.4 percent per year in this recovery, compared with 6.5 percent in the 1983–84 recovery from the most recent very deep U.S. recession. As a result, unemployment is still over 9 percent. Fewer people as a percentage of the working-age population are working now than when the recovery began.

Some blame the weak recovery on the depth of the previous recession and the need for people to cut back consumption and pay back debt. But during the much stronger 1983–84 recovery, people consumed a smaller fraction of their income. And while housing is weak, it is a much smaller drag than declining net exports were in 1983–84. The economic weakness now is broader than any one sector.

TEMPORARY, TARGETED FISCAL POLICY HAS FAILED

So far, the U.S. fiscal policy responses to the recession and the weak recovery have largely been in the form of temporary and targeted actions and interventions. This approach has not worked very well and, in my view, is a reason why the economic recovery is weak and unemployment is high.

In the 2009 stimulus package (the American Recovery and Reinvestment Act of 2009), the federal government borrowed money and gave it to people in the form of one-time payments or temporary refundable tax credits. I examined where the money went and found that most of it stayed in people’s pockets. The temporary transfers created little or no boost to aggregate consumption or thus to jobs. I found the same thing in the temporary stimulus packages of 2001 and 2008.

In another component of the 2009 stimulus package, the federal government borrowed money and gave it to the states in the hope that they would start new construction projects and hire people. But when my Hoover colleague John Cogan and I examined where the money went, we found that state and local governments put most of it in their coffers. These governments started few if any construction projects that they would not have started without the stimulus. The federal government also undertook its own construction programs as part of the stimulus; but, with few shovel-ready projects, it could increase infrastructure spending only by an immaterial 0.05 percent of GDP.

In my estimation, these interventions and most others—cash for clunkers, first-time home buyers’ credit, quantitative easing by the Fed, and the sharp increase in federal outlays from 19.6 percent in 2007 to 23.8 percent of GDP today—not only have been ineffective but have lowered investment and consumption demand by increasing concerns about the federal debt, another financial crisis, threats of inflation or deflation, higher taxes, or simply more interventions. Most businesses have plenty of cash to invest and create jobs. They’re sitting on it because of these concerns.

Some argue that the economy would have been even weaker without the 2009 stimulus act, but the only evidence they cite are simulations of models which provide no new information. The actual money flows reveal little or no effect.

For these reason, rather than more of these temporary interventions, we need a comprehensive economic strategy that will create strong economic growth and job growth. Permanent and predictable tax reform should be an essential part of that strategy rather than temporary and targeted tax changes.

TOWARD A LARGER REFORM STRATEGY

A natural starting place for such a strategy is the debt-limit cum spending-control agreement reached last summer. Signed into law by President Obama on August 2, the Budget Control Act of 2011 reduces projected increases in spending over ten years by between $2.1 trillion and $2.4 trillion—depending on the recommendations of the Joint Select Committee—and thus reduces the cumulative budget deficit and debt by the same amount.

According to the August 2001 baseline projections of the Congressional Budget Office (CBO), with the Budget Control Act, federal outlays as a share of GDP will decline to 22 percent of GDP in 2021, compared with 24.2 percent in President Obama’s original budget. The Budget Control Act reduces spending growth in a very gradual way, which is appropriate in a weak economy. The agreement thus has the benefit of reducing some of the uncertainty hanging over private investment decisions without incurring the cost of sudden, unanticipated short-term spending cuts.

However, while representing substantial progress, the agreement does not fully deal with the debt and the deficit problem. This is why it needs to be embedded in a broader economic strategy with the goal of closing the rest of the budget gap through pro-growth reforms.

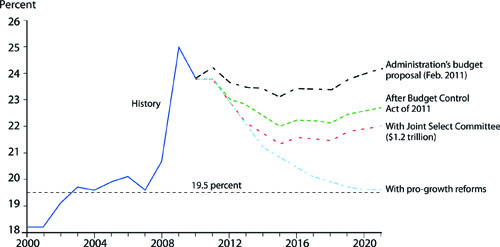

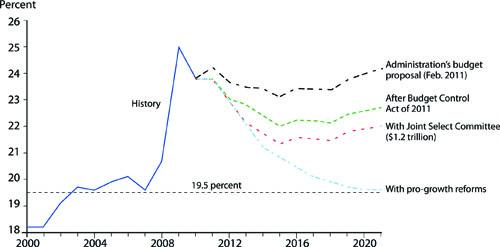

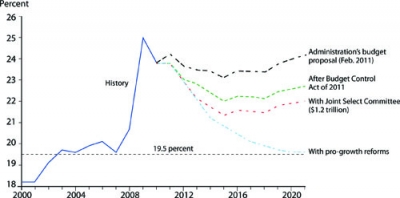

Figure 1: Federal Outlays as a Percentage of GDP

REVENUE-NEUTRAL TAX REFORM

There are, of course, differences of opinion about the reforms needed to achieve this goal.

Given that spending was 19.6 percent of GDP as recently as 2007, a strategy that brings spending back to that percentage is sensible and doable. This approach has the important advantage of taking tax increases off the table, in the sense that by 2021 tax revenues as a share of GDP would be close to this percentage if the tax system in place in 2007 remained in place.

In other words, the budget would be brought into balance with that tax system.

Hence, a comprehensive economic strategy that includes holding outlays to around this 2007 percentage could also include a fully revenue-neutral tax reform and still balance the budget. By reducing marginal tax rates while broadening the base, such a tax reform will be beneficial to economic growth. And of course, with higher economic growth, tax revenue growth will also be higher.

Figure 1 explains this strategy. It shows federal outlays as a percent of GDP from 2000 to 2021. The history of the years from 2000 to the present—but especially from 2008 to the present—is a history of increasing federal spending as a share of GDP.

The impact of the Budget Control Act is seen by comparing the path of outlays in the top line, which shows the original February 2011 budget submission of the administration, as scored by CBO, with the next two lower lines. The line labeled “After Budget Control Act of 2011” is simply the new CBO baseline estimated in August. It thus incorporates the Budget Control Act as well as other changes since the CBO scored the administration’s budget, including the 2011 Continuing Resolution. The next line, labeled “With Joint Select Committee,” shows the additional spending reductions as a share of GDP that would occur if the Joint Select Committee were to reduce outlays by $1.2 trillion over ten years. The year-by-year distribution of outlays over those years is based on CBO assumptions published in the “Budget and Economic Outlook: An Update” of August 2011.

Clearly the Budget Control Act has substantially changed the budget picture since the start of 2011, but there is still a long way to go.

The lowest line in the graph illustrates the comprehensive budget strategy proposed here. Nothing changes relative to the Budget Control Act until 2014, when outlays as a share of GDP start moving down further, until they gradually reach the 2007 percentage level and thereby allow for fully revenue-neutral, pro-growth tax reform.

While the Joint Select Committee might expand its mandate to consider such a reform, the obvious differences of opinion may have to be hammered out in the 2012 election, with all Americans participating. Tax reform, as well as entitlement reform, regulatory reform, monetary reform—indeed the fundamental role of government in the economy—should be part of that debate, but with a clear commitment to the strategy of America living within its means, as in the strategy illustrated here.

The gradual nature of the strategy avoids abrupt and unanticipated changes in spending. The more credible the strategy, the greater its benefits, and the smaller any adjustment costs.

Such a comprehensive budget strategy will take us toward a more stable and predictable economic policy with less uncertainty about the future. It will thereby increase both demand and supply and get the economy growing and creating jobs again.