- Economics

- Budget & Spending

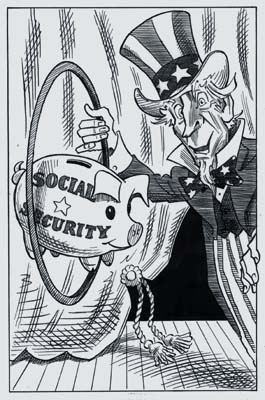

They say a picture is worth a thousand words. But, in this age of spin-masters, a picture can be more deceiving than a thousand words.

Illustration by Taylor Jones for the Hoover Digest Illustration by Taylor Jones for the Hoover Digest |

In response to those economists, including Senator Phil Gramm, who have been saying that the Social Security “trust fund” is a myth, Kiplinger’s magazine sent a reporter down to Parkersburg, West Virginia, to photograph the trust fund. He came back with a picture of the securities in that trust fund, as well as a diagram of the safe in which these securities are kept and a picture of the computer that keeps track of the Social Security trust fund.

The March issue of Kiplinger’s even gave us the latitude and longitude of Parkersburg, in case we want to go there and check it out. Yes, Virginia, there is a trust fund—or is there?

Let us think the unthinkable, that there is no Social Security trust fund. Where would the baby boomers’ pensions come from? From money that will arrive in Washington after they retire.

However, since we have photographic proof that there is so a trust fund, where will the baby boomers’ pensions come from? From money that will arrive in Washington after they retire. It seems that the distinction between a trust fund and no trust fund is one of those “distinctions without a difference” that lawyers talk about.

As a purely formal paper transaction there is a trust fund. Money comes in from the millions of paychecks from which there has been withholding under the Federal Insurance Contributions Act—the FICA listed on paycheck stubs. The Social Security system then uses this money to buy interest-bearing securities from the Treasury Department. When cash is needed to pay retirees, some of these securities are sold to get the money to pay them their Social Security pensions.

Still looking at form, rather than substance, this system has the further political advantage that the securities held by the Social Security system are not counted as part of the national debt, because it is one government agency owing money to another. What that means is that, when the government spends more money than it receives in taxes— which it is still doing, despite the official budget “surplus”—it spends money from FICA to cover the difference and gives the Social Security trust fund an IOU that does not count as an IOU in figuring the annual deficit or the accumulated national debt.

If only we could all make our debts disappear so conveniently!

Turning from form to substance, what the government is doing is spending the Social Security money for current outlays, not only for pensions to retirees, but also for everything from congressional junkets to nuclear missiles. What is left in the trust fund for future retirees, including the large and much-feared baby boomer generation whose pensions are scheduled to cost trillions in the twenty-first century?

What is left is a promise to pay them. That is precisely what would be left if there were no Social Security trust fund. Treasury securities are nothing more than claims against future revenues from general taxation. Social Security can of course also draw against the continuing inflow of FICA from workers, but everybody knows that this source will be completely inadequate to pay what will be owed to the baby boomers.

The staggering amounts needed to make up the difference—greater than the costs of financing a major war—will have to come from somewhere. Either there will be huge increases in tax rates on those still working or some form of welshing on the promises made to retirees. No doubt there will be creative compromisers who will come up with some judicious blend of higher taxes and partial defaults, whether by inflation to reduce the real value of the pensions, an older retirement age, or higher taxes on Social Security income, in order to take back with one hand part of what was given to retirees with the other.

No matter how it is done, it will always be possible to photograph the checks that Social Security recipients receive, thereby “proving” that there has been no default. The question is how much comfort and reassurance that will be to a generation that knows it has been cheated of what they were promised and paid for, even if they cannot follow the accounting sleight-of-hand by which it was done.

No, Virginia, there really is no Social Security trust fund. Politicians have already spent it, behind their smoke and mirrors.