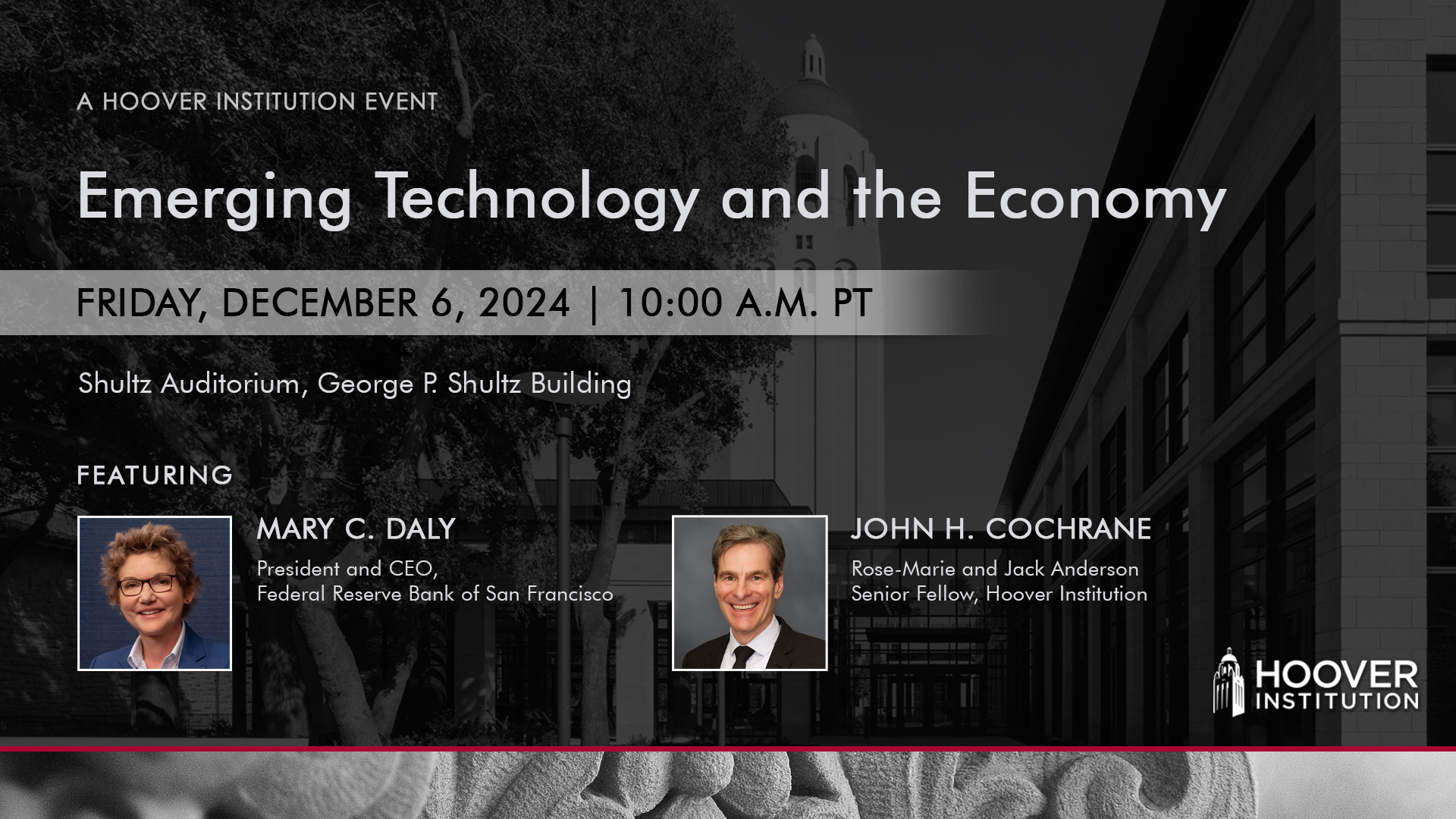

The Hoover Institution held a conversation with President and CEO of the Federal Reserve Bank of San Francisco, Mary C. Daly and Hoover Institution Senior Fellow, John H. Cochrane on Emerging Technology and the Economy on Friday, December 6th at 10:00 a.m. in the Shultz Auditorium, George P. Shultz Building.

WATCH BELOW

>> John H. Cochrane: Well, looks like everybody is here. Welcome everyone, I am absolutely delighted to welcome Mary Daly.

>> Mary C. Daly: Thank you for having me.

>> John H. Cochrane: Mary is the President and CEO of the Federal Reserve bank of San Francisco. And as such, she's part of the Federal Open Market Committee, which sets interest rates.

But she does a lot of other interesting things, too. Her background is a labor and public policy economist. She's been a visiting professor at Cornell and UC Davis, an advisor to the Congressional Budget Office, Library of Congress, the Social Security Administration. I won't go on, I cut all the wonderful things in your book.

>> Mary C. Daly: Good, thank you.

>> John H. Cochrane: We can get going, but I do wanna say she hosts an award winning podcast, Zip Code Economies. Welcome, Mary, it's wonderful to have you here.

>> Mary C. Daly: Thank you.

>> John H. Cochrane: So we're gonna do some questions for a while and then there'll be time for questions from you at the end.

So let's start. You're an expert on labor markets and how monetary policy affects labor markets. So let's start by talking about labor markets and what do you see in the intersection of emerging tech, labor markets, monetary policy, AI, go.

>> Mary C. Daly: Okay, that's a big question. So let me start with just where we are in the labor market in my perspective, from my perspective.

Right now, and you saw this in the labor market report that came out this morning, the labor market remains in a good position. Its jobs are expanding, there's about one vacancy for every unemployed worker. So that's a balanced labor market, that's a good thing. That means people are still getting jobs and firms can find workers.

So those are things that are really important. And against that backdrop, we're also seeing just a general trend in the United States that firms still want more workers than they can find. And they're turning to technology to augment their workforce and make their workforce, better and more productive.

And I was on the podium with the CEO of Honeywell and back in the summer and he said, at Honeywell, they haven't let a single person go as they brought AI and generative AI in because they didn't have enough people to do the work that they needed to do to expand their growth.

So instead they've used technology to assist their employees, to make them better, do things that are more tedious or can be done by the models, and then put their workforce to better and faster uses and more innovative uses. So I think right now, when usually some people are dystopian about the use of emerging technology.

I think right now, when we go out and talk to CEOs about it, they are telling us, no, we're using it to assist workers. And ultimately where we really wanna go is to the unimaginable. We don't know today what the technology will allow us to do, and so we're thinking about how to do that.

But first we have to practice. And that's an important aspect of this. It's so important in my judgment to the economy that in San Francisco Fed we opened what we call the Emerging Tech Economic Research Network in January of this year. We just had David Autor come and give a seminar and talk to us about what's possible.

So it's academics, it's CEO roundtables, it's sourcing from technologists and asking them where will the technology go and what is possible. So that's a short summary, not quite using ChatGPT, but a short summary of how I think all of those interact. But you can ask me a follow up if I didn't get it all.

>> John H. Cochrane: Yeah, well, we could keep going on this for the whole hour, but there is this big debate, is AI coming to replace all of us? We'll all be out of jobs, out of work. The other side of it is AI is a productivity enhancing technology like so many we've had.

Some people will get substituted, but other people will become more productive. It will lower costs for business who will expand, so overall it'll be a good thing. So I will put you down as a techno optimist on that.

>> Mary C. Daly: Well, let me just tell you where I really lie.

So there's a fact that I think people don't know all the time. You'll know it, John, and many people will know it. But technologies of any type, across the entire history of technologies, have never reduced net employment. They do take the jobs of some and those workers, if it's really working well, go and find other opportunities.

But it does not reduce net employment because they're generating opportunities as well. So between what I would call the enthusiasts and the doomsayers, I am in kind of in the middle where I am optimistic about our use. But I also recognize that technology is a tool. It's not doing this to us and the choices we make about how we use it, what resources we bring to bear and do we use it for faster, better, cheaper, or do we use it for what I think many call moonshots?

Do we look to the sky and say, boy, what could be possible. If we look to the sky and say what could not it doesn't have to be in the sky, but if we look big, if we think big, a lot of things are possible that we wouldn't even have imagined.

So I am optimistic, I guess.

>> John H. Cochrane: So I wanna ask you about our region cuz you worry about our region. There's a lot of optimism versus pessimism about California, the region, so forth. I guess your optimism about AI would make you optimistic about the future of the Bay Area and our California region as well for employment as well as businesses and so forth.

>> Mary C. Daly: So interesting, one of the most common questions I get asked if I'm in a region, from in our region, is California dead? Is it the doom cycle? Is it over? And I remind people that, this has been said many, many times. California and Silicon Valley and San Francisco has a way of reinventing itself, suffered many shocks and continues to go.

Now, will it be as rapid as I think people living in this area would like it to be? Probably not, but all the ingredients are there. We have very well educated people, they're entrepreneurial, they're innovative. We live in a beautiful place. There's a lot of interest in collaboration.

And so I see those as key ingredients. So I am on the path of we have a lot of potential here, and it's hard to hold down potential and not have a good thing happen. But we're gonna have to do a lot of things to ensure you just don't sit in your living room and hope for the best.

You have to work for the best.

>> John H. Cochrane: Well, I'm kind of we have a lot of potential, but it's really hard to get the permits to do anything about the potential.

>> Mary C. Daly: Yeah, fair enough, I mean-

>> John H. Cochrane: As one who has rehabbed a house in Palo Alto, let me tell you about that process.

>> Mary C. Daly: Well, it's often a question of why is there such a housing shortage, not just in California, but across the country. And increasingly, when you go and talk to local leaders, what you're hearing is, we have so many rules and things that were meant to solve a particular problem, but now we have a very different problem.

We don't have enough housing to house our people. And that's up and down, the income distribution, the age distribution. And so what's really interesting is this is no longer a California or a San Francisco problem. This is a Boise, Idaho problem, I have the 12th district. For those of you who don't know as much about the 12th district, it's all the intermountain states, Nevada, Utah, Arizona, Idaho, the coastal states, and Alaska and Hawaii.

I can go anywhere in the nation, but certainly in the 12th district, and everybody's talking about housing and they're talking about permitting. So, John, I think you might have a roadshow. You can go on.

>> John H. Cochrane: So employment is half of what the Fed does. I'm interested, so how does this have anything to do with the Fed?

And one way of putting it is I'm still worried about people on the lower end of the spectrum. There's a shocking amount of people who don't work at all. And when we think about that, a lot of that is structural. So we kind of separate structural lack of employment from business cycle lack of employment.

And there's labor regulations, can't find housing near your job there's bad schools. There's all the disincentives of social programs, all those things that are really hurting the people on the lower end of the spectrum. But the Fed, if you have a lever at all to labor markets, it's cyclical stuff.

You can't fight that with more aggregate demand. So there must be A, a little frustrating and B, how do you, how do you think about where the Fed can do some good, where the Fed couldn't do some good? Maybe the Fed should be yelling a little more about get rid of these structural barriers.

But it's not really your job, you face labor markets all the time. How do you deal with this?

>> Mary C. Daly: No, it's a great question and much of my career has been trying to balance those two things. So, unfortunately, maybe fortunately, I mean, I really appreciate the way the Federal Reserve is set up and the fact that we have narrow goals.

But I just remind us all, we have one tool, interest rates, and we have two goals already, full employment and price stability. And to solve more problems than that, we just don't have the mandate or the tools. So when you think about labor markets, where can we be helpful?

Well, first of all, we better get the cyclical right, right? We better restore price stability and ensure we do so in a way that doesn't injure the labor market unnecessarily, doesn't push it down when it doesn't need to push down for, for inflation to get to two. The other thing, though, that's been really important is in my career, most, a lot of my research has been done on labor markets.

And one of the aspects of my research is to consistently demonstrate that labor force participation, the number of people in our economy who participate in the labor market is lower than in our industrialized competitors. So we have a lower labor force participation rate than Canada, than England, than France.

I mean, France really. So it's like, look, if you think about these things where we have a view of what is going on in other countries, but the reality is we participate at lower levels and that's in the prime work age of people's lives, 25 to 54. So I think that's a problem that is not just about people with lower skills.

It's just a problem in general about, what is. And if we wanna grow faster, then more people have to participate. So the other aspect of this that I'll mention, John, that is really may not be as well known is when we have a durable expansion, many people who might be typed as not able to work, they come into the labor force.

So the expansion that only ended with the pandemic, that was almost an 11 year expansion, the longest in our recorded history. One of the things you saw again and again and again is employment gaps and labor force participation gaps between those at the lowest level of the skill distribution and the highest were closing.

Wage gaps were also closing, consumption gaps were closing and income gaps were closing. And at the end of that expansion, wealth gaps were closing. So I think ultimately, if we're doing our job well and we can create the conditions that support a durable expansion with price stability, then we are participating in making and letting more people come into the labor force.

Now we can't control who it is or whether that even happens, but we can create the conditions where it's possible.

>> John H. Cochrane: Yeah, and I think this is something to celebrate that maybe the average zeitgeist doesn't have it. That in the expansion that ended with COVID and I think the trend is coming back again.

>> Mary C. Daly: Yes.

>> John H. Cochrane: That this was wonderful not just for employment but also for wages.

>> Mary C. Daly: Complete.

>> John H. Cochrane: All measures of inequality shrank.

>> Mary C. Daly: Yep.

>> John H. Cochrane: On the lower end we're doing great. In some sense that the college educated upper crust was doing badly. But, what the heck, they can take care of themselves.

>> John H. Cochrane: So let's talk a little bit about inflation, but I don't wanna embarrass you too much.

>> Mary C. Daly: I'm hard to embarrass, I just get busy.

>> John H. Cochrane: The Fed's target was 2%. We hit 8%, something went wrong. So I'd like, let's talk about that a little bit. Now for example, some people talk about other shocks, some shock hit us, fiscal shocks, supply shocks, relative demand shock.

But the Fed doesn't really look at those. Maybe you should more, let me just leave it to you. What's the plan for not letting this happen again?

>> Mary C. Daly: Sure, it's a terrific question. So let me just unpack what my view of what happened because obviously you think about this.

Missed the target, we did not hit our target. It's 8%, 7% and it's supposed to be 2%. And when you think about that, it's not just a number. It's a tax on all the individuals in the economy whose wages weren't keeping up with inflation and people are falling further and further behind.

So obviously we have to think about what happened. My own judgment about what happened is this, that we were slow as an institution to recognize that the supply shock, which looked to be temporary, was actually more persistent. So we do look for supply shocks all the time John, it's something that one of my first jobs at the fed came in 1996 was to look for two potential supply shocks, positive supply shocks.

The labor force increased because of welfare reform that moved single women, single moms, into the labor force, that was one job. And how did that increase the labor force and thus that's a positive supply shock in the labor market. And the other was to look for evidence that productivity was going to go up.

And that was a positive supply shock from productivity so the economy can expand more broadly. So we have those tools and techniques and we look at those all the time. The issue was that we misestimated that and many other people did too. But I'm not gonna talk about many other people, I'm gonna talking about us, that supply wouldn't come back, right?

The global supply network was something we all thought was quite durable and resilient and would rebound. Demand came back with a vengeance, I'm sure you all remember that. You were probably part of it. We all left our homes and started doing things and buying things. And so that was very robust.

And then it was additionally made robust by the fiscal support and the fiscal stimulus pushed demand up even further. And supply was just very slow to recover. I mean, just didn't come back. And part of that's because the pandemic continued on and it located itself in different countries in different time periods.

And so, the fragility of the supply network was something you can see firsthand, if China goes, locks up a factory or a port for two weeks, the domino effect on all things. The stacking up at the ports, because in LA because all the goods come in at once and they can't get the trucks over.

These are just things that took a long, long time to repair. And so inflation was high. The soul searching, I guess I think you might put it that way. The soul searching or the sort of post mortem or the what the heck happened here is really to say, okay, yeah, we haven't had a pandemic in 100 years and so we missed it.

But I think a broader lesson is not to dismiss so quickly the idea that a supply shock might persist. And that can go on both sides. It can go when labor markets are productive, when labor supply or productivity is going up or when it's constrained, it can go when supply chains are broken.

But I was taught in early macro, you look through a supply shock and especially if you don't think it's going to be persistent. But I think the miss wasn't that that model was wrong, the miss was that it was much more persistent than we thought. And then you add on the fiscal and you have another problem.

>> John H. Cochrane: Yes, as you know, I would emphasize that fiscal part, especially that the price level remains higher and that the supply shock led to $5 trillion of fiscal stimulus, of course, we got inflation, but let's not fight about fiscal versus supply shock now. I'm very curious about your supply shock view cuz let's look forward a little.

Your optimism, boy, I'm getting excited here. Your optimism about AI sounds like an optimism that we'll have a good supply shock, letting the Fed really do good things on both inflation and labor markets.

>> Mary C. Daly: You don't know when the timing is though, that's the problem.

>> John H. Cochrane: Yeah, and technology has always taken longer than we think.

We read about it in the newspapers say, yeah, here come the self driving cars.

>> Mary C. Daly: Exactly, it's true.

>> John H. Cochrane: But there are also supply shock dangers looking out there, let's call it, whether tariffs or deglobalization or what you wanna call it, that sounds like a potential negative supply shock.

Geopolitical events could cause horrible supply shock. You said once in a century, that seems to happen once every ten years now. But something happening around Taiwan would be a horrendous supply shock. Is the Fed ready to jack up interest rates fast if that should happen again? Where are we going?

To the extent you can say.

>> Mary C. Daly: Okay, so let me think through that broad question. Okay, so the 100 years was a reference to pandemics.

>> John H. Cochrane: Yes.

>> Mary C. Daly: And hopefully, we'll have another 100 years before we have a global pandemic. I don't know but one hopes, but the supply shocks are more routine and the question is, well, our supply shocks, not only more routine, but are they more persistent?

And I think that's the question that we have to answer. And I'm gonna look to some of the academics in the room too to help us with this. Should we expect geopolitical events to just drag out and disrupt? There's also weather related events that disrupt but those tend to be short in time frame.

There's all these things that are putting pressure on the global supply chain and you're seeing near shoring and friends shoring and a variety of other things that have the likelihood of in the short-term lifting prices and in the long-term perhaps spurring how people do work. I remember both in the pandemic and before in some of the trade disruptions, what you saw was firms moving from one country to another, bringing things to the US moving them nearer.

So it really matters where production is located. So now let me get to the question you asked at the end, which is the Fed prepared to think about those things? We do think about those things. We think about supply all the time. And we actually have many different measures of supply chains and whether they're back to normal, where the disruptions are, what are the likelihoods they'll spill over onto us.

So that's very helpful input. But ultimately, that it all comes down into do you see inflation rising and what do you do when it does? And I think that's where we have to be more thoughtful about. And we've been fighting inflation from below our target for so long that there was a kind of concern that it was just gonna drag back down.

The gravitational pull was gonna pull it back below our target. Now, I think there's a really important question about whether we gonna be fighting our inflation, bringing it to target from above our target. And that's gonna be US and global. And so I think again, I'm gonna push some of that out to you, not just us as researchers in the Fed, but academic researchers.

What's the future of neutral rate of interest, the fighting inflation from above our target versus below our target? Have we entered a new period? That's gonna matter for our policy decisions.

>> John H. Cochrane: Well, let me ask you, as you know, the review of the monetary policy strategy is coming up and those of you who don't follow this as obsessively as I do.

The Fed had a grand process of articulating a strategy, much of it designed to combat a persistent low inflation, let's not call it deflation thing. And so that's gonna change coming around, and I'll ask specific questions. One is are you gonna think more in a, let's call it data dependent rather than here's what we're gonna do, how are we going to react to events?

And the other one is that the last strategy had a concept that if inflation came out low for a while, we'd let it run hot to bring the price level back up a bit. Well, the price level is 20% higher than it used to be, people are mad about it.

Would it make sense now to move to a regime where if you made a mistake on the upside, to squeeze the price level back a little bit?

>> Mary C. Daly: So let me start with the first part of the question. Well, let me just start with generally the framework.

>> John H. Cochrane: Or wherever you wanna go with it.

>> Mary C. Daly: Yeah, I'll start with the framework review. So when we did the framework review five years ago, Chair Powell said, we're committed to doing a framework review every five years. And I just think personally that is good practice for an institution. You can't make a framework 30 years ago and hope that it persists for 30 years.

So I do think this practice of five year review is a really healthy one. So we're coming up on this period, we're gonna do the new framework review. We have not announced the dimensions of that framework review. You don't take the entire whiteboard and say, well, look at everything.

You take on certain things and I'm gonna wait for Chair Powell to announce that after we've deliberated and decided. So I won't tell you specifics because those are in discussion and I'll let Chair Powell announce those. But what I will say is, what are some of the things in the old framework that I've learned from?

And so I'm gonna speak for myself. I should have said that right at the beginning. I am speaking for myself and not the Federal Reserve System or any of my colleagues, but I'll speak for myself. So one thing is, and this is a tendency of institutions in general, but it's a tendency I see in the Fed as well, is we are, I don't wanna be too pointed here, but we often just fall into the trap of fighting the last battle.

And that is something that as an institution, you have to fight the future battles and you have to know what the future battles are gonna look like. And so one way you can do it is you can predict the future battles and you can be very precise about how you deal with them, or you can recognize that a broad program, a broad paradigm of how to deal with many things that could happen is the appropriate one.

So I like that broad breadth and more latitude because we actually don't know what's gonna happen in the future. So the second principle that I would like to see is that we have a dual mandate, it's been given to us by Congress. Price stability, full employment. So we know what those are.

We have that one tool and we're meant to put this together. The idea that we were gonna constantly, and I didn't interpret our framework the way you just stated. I interpreted our framework on inflation. We've been fighting inflation from below our target, people have come to believe that 2% is a ceiling, not a symmetric goal.

We wanna make sure they don't think it's a ceiling, and we also aren't that surgical. We cannot hit 2%, other countries, many of them have a range. And so having a recognition that it might be 1.8, but they could be 2.2, and something in the range of 2 is you're comfortable with.

I think that's important. So that came out as average inflation targeting, but the way it was portrayed, it's more like asymmetric average inflation targeting.

>> John H. Cochrane: Yeah.

>> Mary C. Daly: Right, so you're comfortable with it going up, but you're not so comfortable with it going down. But that, again, is if it's 1.8 and the anchor in inflation expectation is drifting down globally, that's a different kind of issue.

So I think some of these kind of concerns are real, the ones you've raised, and we should really tackle them and take them on. And then the final one was on employment, and I think that was ultimately confusing. That's how I've seen people respond to it, is it wasn't about allowing inflation to rise to keep employment growing.

It was about, we don't know what the natural rate of unemployment is. I know that's a revelation. We do estimates of it, but it's not a truth that falls from the sky, and it's like, that's the natural rate of unemployment. And so using models that say if the labor market's too hot and you've got to get it down because inflation might go up two years from now, that wasn't really effective when inflation was 1.8.

And so we're only going to eliminate employment shortfalls, we're not going to fight a good labor market. In the practicality of how this framework was applied. When inflation rose to seven and eight, rates raised aggressively to get inflation down. And we said again and again, inflation is our primary target right now, our primary goal, because the labor market's strong.

And that's the spirit in which I think the framework is a guide, but it doesn't tie your hands. I didn't feel our hands were tied, we raised rates 75 basis points a clip. And the only constraining factor there was not disrupting financial markets. And that's an aggressive strategy that we had to do because inflation was so high.

But it's also an aggressive strategy that I hope gives you some confidence that we're agile enough to change our posture when a situation emerges which is completely untenable.

>> John H. Cochrane: Yeah, I mean, my own view is that you have now this problem how do you fight inflation from above?

And that expectations are really important. The joke I told Mary, what we came down here is that fighting inflation is like fighting cockroaches. And just because you've got it down from 100 to 3 doesn't mean you're done. But you really wanna persuade people that should inflation break out again, the Fed is ready to do.

>> Mary C. Daly: We are ready.

>> John H. Cochrane: Whatever it takes, in the words of Mario Draghi. And that itself will help current inflation.

>> Mary C. Daly: And I hope that that's what we've been conveying. I mean, I'm regularly out there, I was actually using an AI model. Many of them, I won't name names, and it'll look like I'm marketing them.

But if you do that, you can see the number of times that we've listed inflation as a really important goal. We're resolute to get inflation down to 2%. I mean ultimately, if you think about the toxicity of inflation, especially to low and moderate income families, everybody experiences it, but low and moderate income families, it's just a direct tax on their well-being, then it's really important.

2% inflation in my mind is an underlying foundation of all other parts of how the economy functions.

>> John H. Cochrane: So I was gonna ask about that. Those who didn't know it learned clearly in this last episode that people of modest means were hurt most by inflation. And I think we both told each other that the story of the versus look, if there's a recession, 1 in 20 of us loses their job.

If there's inflation, we all lose our jobs. So to that extent are the doves, and I made the mistake of alleging that Mary might be a dove and she said no.

>> Mary C. Daly: But then I went on the models again and I said it at Seaport they think I'm a hawks.

It depends on where you're going.

>> John H. Cochrane: But there are doves at the Fed. Are the doves at the Fed becoming a little more convinced that low inflation is the number one thing, even if you care most about those with lowest opportunity?

>> Mary C. Daly: So it's interesting I will say this, not that people in this audience care as much as John and I do about hawks and doves.

But I think that is not as much of a good description of Fed officials as it once might have been. I think we've outgrown it, and ultimately a good disciplining device to outgrow things is a period of high inflation, right? If you have high inflation, you immediately say, everyone I talk to tells me that high inflation is their number one challenge.

I mean, I was telling John a story. So as a regional bank president, a lot of my time is spent out in the district and across the nation sourcing information from people who live in the economy. You can't do the job we do just by looking at some published data and thinking you've got the answers.

You have to actually ask people how do they experience the economy. So we did all these focus groups in the period of high inflation and we asked people, what are you worried about? Is it high inflation or jobs? And again and again and again they said what you just said with the 1 in 20 lose their jobs is that if one of our community members loses a job or one of our family members, we can self insure because there's other people who have jobs we can share, we can get resources from our community.

But if everyone in our community is experiencing high inflation and can't pay for the things they need, food, transportation, housing, well then the entire community can't self insure. And so inflation becomes a much worse burden than employment. But that is not to say that employment also isn't important.

It just says that when inflation is there at its high, that's the first thing and the only thing people think about. And I think that's the lesson from this. So I think it has, if you thought that it wasn't a toxic tax on people and you just went through this, I mean I knew that I grew up like this.

I was a teenager in the 70s when inflation was high and I was telling John, I remember my parents, figuring out which bills they could pay and which bills they couldn't. And then the Volcker disinflation comes and then employment a challenge. So I knew what it was like.

But I think if you've never experienced it, you just saw what it was like. If you were anywhere in the community.

>> John H. Cochrane: My parents and grandparents knew something about the Great Depression and they came to a different view but yes, they didn't have to see inflation. Let me ask you-

>> Mary C. Daly: That's not good either.

>> John H. Cochrane: Yeah, we don't-.

>> Mary C. Daly: I mean, honestly that's why we have a double mandate. Because you don't want the Great Depression or anything like it. Think of the financial crisis that was terrible for the labor market. So you don't want either one, both are bad.

>> John H. Cochrane: So let me, as you focus on labor markets, I think about interactions between monetary and fiscal policy. Right now interest costs on the debt are a trillion bucks. That's a lot of money. And every time the Fed raises interest rates 1%, that raises the interest costs on the debt another 1% and therefore the deficit goes up 1%.

Now I know in the Fed you like to be polite and not tell the treasury what they ought to be doing and they try to be polite, not tell the Fed what they ought to be doing. But these things are going to interact. If there's another surge of inflation and you got to raise interest rates 2 or 3, 4%, that explodes the interest cost on the budget and Congress is going to be fairly unhappy about that sort of thing.

And in the past these things have really mattered. In the wake of World War II, the Fed was told, hold interest rates down cuz you're going to hold down the interest costs on the debt. That could happen again. So do you worry about, that interaction, how our fiscal mess may actually make it difficult for the Fed to fight inflation if and when the time comes?

>> Mary C. Daly: You know what I worry about is if we have that we raise interest rates, then people feel, especially if it comes in the near term, then people feel doubly burdened, and they're they're far behind. I spend more time thinking about that than I do about any fiscal or elected official pressure on us.

I mean, you're right. If you look through periods of history, there have been many periods of history where the Fed has been pressured to change what it thinks is the best thing to do, because the fiscal agents need a different result. But most of those times you don't see the caving, a couple of times you did.

And so I think this is one of the reasons Congress when the Fed was created in 1913. It was independent from political persuasion and independent from shifts that come with changes in political office. I see that as a strength of our system. It's one of the things that ensures we're not funding the debt and financing the debt.

And I think that's a good thing for fiscal discipline. But we do face the challenges that you named and how they'll be resolved is not yet clear. But I will focus on our work and our work is to make. It's interesting, someone asked me about, does the change in administration, the upcoming change in administration, change what you do?

I said administrations change, but our goals are always the same, price stability, full employment. And that's what's really important about the Fed. And that's why our independence is important, I think, for persisting in that view.

>> John H. Cochrane: Well, and a little bit financial stability creeps in there as.

>> Mary C. Daly: Yes, absolutely.

>> John H. Cochrane: Yeah, if you have to raise interest rates, it's not persistently. I think the Fed got in some sense lucky that inflation came down so quickly. If you have to raise interest rates persistently, that's gonna tank a lot of financial institutions. A lot of people are gonna be very mad about their mortgage rates going up, the ones who were on floating rate mortgages or need to buy new houses.

As well as the federal government being mad about having to pay higher interest costs. It's gonna be a difficult thing to do, especially in today's financial and fiscal environment. To really repeat in 1982, to say nothing of the pain of a recession of something like.

>> Mary C. Daly: I wanna pull on that a little bit.

When you said the Fed was just lucky, I'm not sure the Fed was lucky on this thing. If you look at the original shock that came to, and we were debating whether it was all fiscal or supply shocks too what helped us get inflation down so quickly was that supply chains recovered.

And since supply chains were a big constraint, we didn't have to bring demand down as much as you would if supply chain stayed stuck. And so those two things worked together and inflation fell rapidly. What's happening now is inflation is falling more slowly because supply chains are recovered and demand is just bringing the rest of it down.

So maybe that's good luck. I think it's just the shock was what it was and we moved what's really good, John, and I knew you care a lot about this is what's really remarkable, good credibility enhancing, etc. Is that medium and long run inflation expectations really didn't move very much.

People still believed that the Federal Reserve is gonna get back down to two, and that aids us in getting to two. If people believe that it's gonna be two, then they act like it's gonna be two. And it helps, it's just a positive force behind our work and then the supply chains recovering.

So I think we would continue to do that, I mean, ultimately you don't wanna have to persistently fight inflation. That's what we had to do in the Volcker disinflation. But that's because the anchor, well, there was no anchor. The inflation went up, wages went up, expectations went up and that we avoided this time, which I feel really good about.

And I think that's the principal thing we have to keep avoiding.

>> John H. Cochrane: So let me ask you, what keeps you up at night and in the following sense we had, in the last 15 years. We've had two once in a century crises, a once in a century financial crisis, a once in a century pandemic.

Let's hope there those two are once in a century. But surely the challenge for the Fed is not gonna be if we keep this beautiful late summer economy just kind of growing along. Europe is stagnating, we're doing with the best economy in the world right now and trundling along and something little goes wrong.

But the next shock is surely gonna be the question for the Fed, which could be geopolitical, it could be another pandemic, it could be a debt crisis of some sort, it could be a sovereign debt crisis. Who's the first to go when we've all got 100% debt to GDP ratios and promises to old people we can't keep.

So what keeps you up on the item? What do you think? How is the Fed preparing for the next unknowable?

>> Mary C. Daly: Yeah, sure. And I think that's a good way to say-

>> John H. Cochrane: Cyber, I should have mentioned.

>> Mary C. Daly: Yeah, and cyber. So when I'm thinking about what we need to do, I focus not on the ever longer list of possible things that could happen.

But I recognize that if you make that ever longer list, those things are very different and they might have different impacts on the economy and they might call for different policy responses. So what I'm really focused on is how do we make our system at the Federal Reserve as agile as it can be?

Agility is probably the most important aspect of policymaking. You've got to be committed to your goals, price stability, full employment. You've got to be evidence based and data dependent and thinking about things. Just have to be looking to the future, analyzing where the risks are. And agility is more than just changing your posture, it's actually being willing to change your thinking, right.

Because it's not about tactics, it's about thinking. So you can always get the tactics right. You can pivot the tactics and say, okay, we were doing this, now we should do this. But it's more like a fundamental way to think about the world and maybe it's more dynamic, maybe it's more vulnerable to shocks.

I also think another place, what I'm really working on is, monetary policy, when I came out of school, PhD was like what everyone wanted to study. Everyone wanted to study monetary policy and macro. And I think we would really benefit if that was, there was a resurgence in how we think about what's the right way to do policy.

How do you marry the evidence with the models? How do you think about collecting real time information? These are things so we spend a lot of time having conferences and gonna conferences with academics and really pushing our thinking. How do we become more agile? How do we become more prepared?

So I'm not really up at night except working, but I am absolutely working.

>> John H. Cochrane: I hate to tell you the good way to get a lot of people to focus on monetary policy is to screw up big time.

>> Mary C. Daly: We seem to gotten a lot of new friends.

>> John H. Cochrane: Well, finally I want to give you a chance. Well, a lot of attention gets focused on the FOMC and interest rates up and down. But you're the president of the San Francisco Fed, a regional bank and I'd like to give you a chance to put in a good word for the importance of regional banks and the regional bank system.

Which I happen to think is a wonderful institution but I want you to say so rather than me to say so. I'll cheer you on.

>> Mary C. Daly: I'm happy to talk about why regional banks are so important. So in 1913, I think it was really a terrific idea. You can look back and you can say they were extremely forward looking and innovative or you can say they were making a decision that tried to create a compromise.

But I think they were innovative and forward looking in that you can't make monetary policy if you don't understand the lived experience of the people across the nation. And the best way to gather the lived experience of the people across the nation to really understand is to be in the areas.

So we have 12 regional reserve banks. Presidents of regional reserve banks spend a considerable amount of time on the road talking to the people in their district, learning from businesses, learning from the communities. Learning from workers, and understanding how the economy is not only evolving right now, my lived experience, but how they expect to evolve.

Because ultimately, the published data that we get and you could all look at if you were in DC is insufficient to make good policy. And having those community connections, realizing that what's happening here in the 12th district might be very different than what's happening on the eastern districts or in the Middle West.

And having all of those voices come, what we recognize, though, is that having all that information, having those contacts, we've redefined what data means. When people say, data dependent, I think they mean that I was waiting for today's jobs market report. Well, it's certainly I was interested in what that said, but I'm also interested in what the 25 CEOs I've been talking to in the last week are saying about are they hiring?

Do they have layoff plans? Are they investing? What are they worried about? Those things together and across all my colleagues in Reserve Banks matter. You said something that I really liked earlier when we talked. The Fed is an aggregator of information. We collect and we aggregate and we recognize that the diversity of views we can gather from our constituents in our district actually make us better at making policy.

And that's why I think the Reserve Banks are so important. Their presence is in the community. We manage the payment system and we supervise banks. And you put all of that together, and having presence in the community, not just in DC allows people in my district to know that they're being listened to, they're being heard, and their views are important to the policies we decide on.

>> John H. Cochrane: So to reverse the old joke, data is the plural of anecdote, after all. And I wanna put in a plug for the research departments at-

>> Mary C. Daly: My research guys will love this, my folks will love this.

>> John H. Cochrane: As well as the other ones, because, well, you mentioned agility, thinking agility.

>> Mary C. Daly: Yes.

>> John H. Cochrane: Recognizing, say I think we were talking about supply shocks. The big difference is this one was a aggregate supply shock. You might have an oil price supply.

>> Mary C. Daly: Sure.

>> John H. Cochrane: And you're used to thinking about, well, that's a relative price it'll go away.

>> Mary C. Daly: Right.

>> John H. Cochrane: But this one hit everything.

>> Mary C. Daly: Everything, right.

>> John H. Cochrane: And there's a tendency at the fed, especially in D.C. to live in a little bubble. And the regional bank research departments are there to knock on the door and say, wait, and that often that can get in the bubble and help you to think in an agile way.

>> Mary C. Daly: So I remember Janet Yellen, she's president, and I'm talking to her about regional. And I'm saying there's a push that maybe the research departments at the regional feds will be assigned centers of excellence. And she said, no, absolutely not. Because what we want is 12 different research departments studying the same kinds of topics and having different views.

I'm like, yes, preaching to the choir here. But I think it was really important. It's an important recognition that more diversity and debate of opinions makes us better, right? You don't want echo chamber thinking, you don't want everybody to go to the same model, say the same thing.

In fact, when I took over as president now, I ran the research department, but I took over as president. My teams come and say, what do you want? I said, I want you to tell me why I'm wrong. I want you to bring alternative views. You can believe them or not believe them, but make the opposite case, because it doesn't do me any good for people to tell me I'm right.

That's completely irrelevant. And if I come out saying, okay, but I think that this is correct, or we all talk and we get to that view, but I don't think that this is what the regional banks, I think are strong at. We have these regional research departments. They're all very different, studying various things, but all dedicated to the same goal, which is making our policy decisions more informed and better and hopefully more agile.

>> John H. Cochrane: So it's time for questions from you. Let's try to ask them as questions, this is the game of Jeopardy. Try to keep them short and polite. If it's okay with you, Mary, we'll take three or four.

>> Mary C. Daly: Sure.

>> John H. Cochrane: And I brought you the notepad.

>> Mary C. Daly: I sometimes need this, John, you are a savior.

>> John H. Cochrane: And I don't have my glasses on, so forgive me if I don't recognize you. Your job is to get the attention of the people with the microphone, and whoever gets the microphone gets to ask the question. Harold, I can see you in the back.

>> Harold Ullig: Yeah, so, thanks, John, thanks, Mary.

Very interesting, Harold Ullig University Chicago. Visiting fellow at Hoover. With the incoming Trump administration, there's a lot of talk about raising tariffs, and there's a lot of concern, OPEDS written how that's gonna impact inflation. If I understand you right, you're saying, no inflation, that's our job to watch out for that.

So I wonder what's the thinking inside the Fed? Are you gonna wait until maybe tariffs are raised and there's an impact on the price level, inflation, and you're gonna react to that? Or are you thinking if it's known that tariffs are going to rise in the future the Fed is going to have a plan for how monetary policy preemptively avoids the impact on inflation that's going to come?

Or are you going to say the impact on inflation that's tariffs, that's not us. The Fed has nothing to do with that.

>> John H. Cochrane: Let's take a couple more if that's okay.

>> Mary C. Daly: Okay, so tariffs.

>> John H. Cochrane: Yes.

>> Mary C. Daly: That's why you gave me the pen.

>> John H. Cochrane: Whoever can get the microphone first.

Tariffs, yes. Steve.

>> Steve Davis: Yes, Steve Davis, Hoover Institution thanks for the engaging, interesting conversation. I wanna go back to something Mary said earlier, and she pointed out that the US Performance with respect to employment rates, labor force participation among people 25 to 54 is somewhat disappointing relative to many of our other major rich country economies.

So that's right. On the other hand, if you look over the past 15 years, certainly, and in the wake of the pandemic, it's remarkable how the US disappointing as its performance might be in some respect, has outperformed Germany, France, the UK, Canada and so on. So I just would invite you to reflect a little bit on the comparisons of the US performance to these other major economies.

What are we doing right? What are they doing wrong? What lessons should we draw from that?

>> John H. Cochrane: Sure, I think one more and then-

>> Ie-Chen Chang: Thank you for being here. Ie-Chen Chang, Premier America Credit Union, what risks do you see to the independence of the Fed in the next few years?

>> John H. Cochrane: I like the shortness and the question mark. Mary go for it.

>> Mary C. Daly: Okay, let me talk about tariffs. So it's a question I get asked all the time. I actually was asked it on two different media programs, Fox and PBS. And I gave this answer and this is the answer that I'll give to you that several things are true.

One, we have an incoming president elect not even in office yet. And so I think it's just out of respect we would not speculate about what policies will occur when the president hasn't even taken office yet, hasn't worked with his team, hasn't put together the plan. And so I think that's just the right answer in these times.

Second, if you look at the any incoming administration, just not the one that's about to take office, but the ones that have taken office over a long course of our history, they don't just come with one plan, part of their plan, they come with a slate of plans.

So if you think about a plan that lowers taxes, in this case raises tariffs, changes the immigration policy and other things, you can make a little chart for yourself that says plus on growth, plus on inflation, negative on this. And ultimately, what you realize if you make this chart, this little rudimentary chart, is that it really depends on what the net net is.

So if taxes spur growth and we grow out of things and we can produce them ourselves, then of course, it's different than if we can't import anymore or there's tariffs and it's costly, and then we don't produce anything different. Our economy is the same. So it's net, net.

That's the second, the second part, the third thing is that when people talk about policies, and I've seen the commentary, they are often put forth as if they're light switches. All the immigrants will leave, terrorists will come, and policy doesn't work that way. I was reminded in the Obama administration, many, many people were deported, 2.5, I think.

If you look at the research literature, I didn't do this calculation myself, but the research literature says 2.5 million and another 500,000 voluntarily left. That's a huge number. But it happened over a period of time and the labor market responded and things went on. Firms purchase technology to make up for differences.

They incented workers who might not have worked otherwise to come in. And so I ultimately think our cautions, Harold, offered to everybody here is the Feds, of course we have risks, of course we know we have histories of how tariffs work, etc. We can do all that research in our staff teams.

But when you think about what's really happening, we haven't had the president start yet. We don't know how the policies will net net and we don't know the duration of time over which things will roll out, and those are important components. And if you preemptively react to a specific thing and start managing policy, you're more than likely to be wrong.

So at least we have to get some more details of how these things are evolving before we make decisions. But of course, we have all the data and information and models to help us with that. So, Steve Davis, I'm gonna answer your question, you're absolutely right. It's kind of a question, right?

How can we have the lowest labor force participation relative to our industrialized partners, our competitors, really, and then still grow? And this is my own view, I don't know if others in the room should share it. Importantly, I don't know if you would share it. I just think we're a dynamic economy.

And I know you talked about how we have too much regulation, but we have a lot of dynamism in our economy. And we have entrepreneurs, it's really interesting after the pandemic, business formation was rising, right? People were out there doing things. And we can have debates about whether it's fallen or it's the same or etc.

But there's a lot of just reinvention that people do and changing who they are and how they work. And I think that's a positive thing for our economy and it's allowed us to grow, it's allowed productivity growth to rise. And we're interrogating AI right now across the nation and businesses.

When I go talk to businesses in the US they're really interrogating AI. How can we use it, what can we do? Let's practice with it, let's think about it in safe ways. Let's do back office or let's have a sandbox. They're not changing their frontline production yet. But if I talk to businesses in some of our other competitive countries, they're like, okay, we're gonna figure out the regulatory frame and then we'll do the experimentation.

And I'm oversimplifying, but I think experimenting before you decide what the rules are, it's scary, but it can be a useful aspect of how innovation occurs. And if you're looking for those moonshots, it can be a helpful aspect as well. So I don't have a full answer, but that conundrum is there.

And I usually have fallen back in all the periods of time that it's occurred to dynamism, innovation, entrepreneurship, and productivity.

>> John H. Cochrane: Threats to Fed independence.

>> Mary C. Daly: Thank you. The best way to maintain our independence, in my judgment, which I view as important, it's the norm in central banks that work well across the globe.

It allows you to have durable policy decisions that are not moving around as administrations change. But the best way to build credibility and trust is to do your job. So if we focus on bringing inflation to 2% and doing it without being so aggressive, we break the economy and leave people without jobs or growth, then that's the best way to tell people we have our goals, they were given to us by Congress and we are doing our work.

And so that's what I focus on.

>> John H. Cochrane: Let's take some more questions, in back and then Elena, and then go.

>> Mei Lin Fung: Hi, Mei Lin Fung, cofounder with Vint Cerf of the People Centered Internet based here in Palo Alto. I am surprised about not hearing the term digital money or cyber cash.

How does your research department bring forward ways for the Federal Reserve to be agile in this tsunami that's coming forward?

>> Elena Pastorino: Thank you, this is Elena Pastorino, Hoover Institution. So being an Italian born economist living and working in the United States, part of my eye and my heart is towards the Fed here and part is towards the ECB. So the ECB is important by its own size one authority that has a very different mandate compared to the Fed. So if I may ask, what is your view for the scope and role of the interplay between the actions of large scale monetary authorities, and is it a constraint to the range of policy actions that such authorities can really contemplate?

Thank you.

>> Tim Henderson: Hi, Tim Henderson. The San Francisco Fed is the largest at 69 million by population. Minneapolis is the smallest, I believe 10 million. Would the system work better if the population sizes were balanced and what would the politics of such a move be?

>> Ann Sophia: Thank you so much, Ann Sophia with Reuters.

I did just wanna ask you, you said you saw the data this morning on the job market. I think you said it showed we're in a good position. You said inflation is still a big tax, it's elevated. Why is there even any debate? Why would you even cut rates coming up?

>> John H. Cochrane: I think you got four hard questions there, Mary.

>> Mary C. Daly: Okay, here we go. So you didn't hear digital money and cyber cash because John didn't ask me about that. But I will-

>> John H. Cochrane: I tried to reduce the list of questions.

>> Mary C. Daly: I'll talk to the issue a little bit.

So we work for the American people and Congress makes decisions about what we can do. If Congress told us we were going to have digital money, we would have digital money. But Congress hasn't told us we're going to have digital money. So we're not gonna have digital money.

But that doesn't mean we don't study it. We study a lot of things where we have no purview, right? And the important thing is we just can't believe that we have decision rights. We have to study them to see how the economy is going to function. Weather is an example.

We have no rights or decision rules or any, any kind of decision opportunity in, in climate or weather. But we study the impact that weather changes are having across the nation because it's really important to know if there's going to be a reallocation of economic activity. So the same is true on digital money, cyber cash, etc.

We have to study how it's affecting the economy in exchange to understand how it might be affecting the economy going forward. But again, Congress is the decider on this issue for the United States and the Fed is not a decider. So let me turn to the ECB/Fed interplay.

Can I broaden the question a little bit and tell me if you just raise your hand and say, that's not what I asked, Mary. But I think you're asking me about the coordination versus just knowledge of what other central banks are doing. Competition, so here's how I think of it, here's how it works in my judgment.

Is that there's a lot of information sharing across central banks, and I see that as a good thing, that central banks are looking at what other central banks are doing, etc. But we all work for our sovereigns and so we make policy for the nation that we work for, right?

When I'm thinking about our policy levers and what's right, I'm thinking about the US economy and price stability, full employment in the US the ECB is doing the same under their mandates. What has been interesting is if when you have a global shock, you actually have central banks across the globe reacting similarly.

And so you had the pandemic, central banks lowered interest rates, then you had high inflation, central banks across the globe raised interest rates. And so there was a lot of synchronicity and there was a lot of discussion then about whether that's an amplifying effect. There wasn't a lot, I mean, it certainly looked like it could be, but there didn't seem to be a lot of evidence that it was an amplifying effect.

Maybe many researchers after will find out that it was, but it didn't seem to make a material difference at the moment. Now it's become less synchronized because central banks are dealing with different problems. As you mentioned, Europe has a much weaker economy and then many parts of Europe have a much weaker economy, Germany in particular, than the US.

And so we are gonna be in a position, in all likelihood, where we're gonna have differences in growth rates, differences in progress on inflation. And differences in the policy rate. And then that will cause desynchronization, or whatever the right word would be. It would cause uncoordination, less correlated.

And we look at that, but the way I think of it is headwinds or tailwinds. Is global growth a tailwind to the US Economy or is it a headwind to the US Economy? And policy in those and in those countries is a component of whether they grow rapidly or they grow slowly.

So that's how I put it. That's how I think about it. And that's, I think in most central banks, well, in the US in particular, policy is for the United States. And you can think of these other things as global financial conditions or global growth.

>> John H. Cochrane: Rebalancing the regional Feds and should we-

>> Mary C. Daly: Thank you.

>> John H. Cochrane: Rates. That's why I have in my notepad.

>> Mary C. Daly: Yeah, that's what I have too. I don't think that it matters for the kinds of things we do because this is really in the weeds on central banking. So this is your next cocktail party conversation.

So the way the Federal Reserve is put together, it was put together in 1913, and people vote at different times. I'm in a rotation for voting with Minneapolis and Kansas City. And you might think that's very strange. But what you recognize is votes are not as important as evidence, models, influence, discussions, the debate, right?

The people always get excited when they say, you're a voter this year. It doesn't really matter on them. Maybe a little bit first, maybe in history, but on the margin what matters is, did you build up an idea? Can you make an argument? Are you thinking about things that matter?

And you've 18 colleagues, are 18 colleagues looking and saying, that makes sense, I get it? Cuz we're coming together to make a decision, you won't always have a full consensus, we have dissents. But you're generally having those discussions around the same issue. And then, in terms of how the activity is sorted up.

We actually sort our activities so you're doing regional work, you're doing the kinds of outreach we talked about. But then different reserve banks have responsibilities for parts of the payment system, part of the financial system. We're doing different work across the system. We all have research departments, Minneapolis is actually one of the best in the country.

So its size hasn't limited its ability to be a heavy hitter. And I think that's why it doesn't seem a problem we need to work on. I'm sure if Congress wanted to do it, they could do it, but it doesn't to me seem like a constraint to our work.

I'm just a bit busier.

>> John H. Cochrane: And the last one was, so what are you doing cutting rates? I hope I summarized that.

>> Mary C. Daly: Yeah, I'm glad you asked the question because it allows me to sort of talk about the two things that are important. So, when I'm talking about the policy rate today, you have to think about both the level of the rate and the pace at which you might get to neutral.

And so let me first, talk about where we are today. So we had inflation, extremely high, and the labor market was frothy at times, just going full bore. Over the last year and a half we've seen tremendous progress on inflation. And we've seen the labor market slow from frothy to strong to really growing to now balanced, in my judgment.

So you got a balanced labor market and you got inflation nearing our 2% goal, but not there yet. So then I ask myself the question, is the policy level, the level of the rate, is that where it needs to be? Well, I can tell you, I'm looking at John back there.

If you look at the Taylor rule, you look at a basic textbook, you look at just history. With inflation not as far away from two as it once was and the labor market balanced, you wouldn't basically have policy as tight as it was. Which is why I was very supportive of a 50 basis point cut, a 75 basis point cut.

I see that as recalibrating the level of policy to ensure that we're not too tight on the economy and we end up, you know, unnecessarily stop stalling out growth and damaging the labor market. There's no reason to do that. But as we get to a level that we think, okay, that level is about right, then additional efforts have to be put on this data dependence.

What more is the economy telling us? How is the economy evolving now and there? I'm a proponent of sort of a gradualism approach. I'm gonna go all the way back to Bernanke's 2003 speech where he introduced this idea that you could go cold turkey or you could go gradually.

So if you go cold turkey, you do that, you make policy decisions all at once when you have a lot of certainty. So in the pandemic there was a lot of certainty that rates needed to come down, we went cold turkey. If you remember, we reduced the rate rapidly to near zero.

In the high inflation, cold turkey. Inflation is very high, the only direction of change for the policy rate is up. And you want to do it as rapidly as you can, conditioning and disrupting financial markets and thus the economy. So that's what we did. But now we're in a much more uncertain world where it's not clear what the evolution of the economy will be, how quickly inflation will come back to 2%, and how durable the labor market, which looks good today, will be.

So you put those things together, and it just calls for a more thoughtful and cautious approach. So right now I'm focused on is the level of policy right to wait and see. So you get the level right and it's watchful waiting. And then after that I would be very comfortable, unless the data changed, with a more gradual approach to policy adjustments.

So that's the answer to the question. I don't know, I'm not answering that question. So I think ultimately, and the reason I'm not answering her question is because ultimately, we have a meeting in a week, a week after next, and that meeting is really important. And I think this is maybe the thing I'll, I don't know how close to the end we are, but I did want to say this, is that the meetings are important because we have 12 Reserve bank presidents, we have 19 people, right?

We have the governors, we have all of us, we're all analyzing, studying, thinking hard. These are not casual decisions. These are decisions you can say, hey, directionally, I think I might go here. But then the meeting itself becomes an informative aspect. Because you're thinking about information that is about the policy change you'll make at that meeting.

But also about future policy changes and how you'll evaluate it. So that's why I won't answer the question about December, because I haven't gone to the meeting yet.

>> John H. Cochrane: Thank you, Mary Daly, that was a wonderful talk.

>> Mary C. Daly: Thank you.

About the Speakers

Mary C. Daly is President and CEO of the Federal Reserve Bank of San Francisco, where she contributes to shaping U.S. monetary policy as part of the Federal Open Market Committee (FOMC). A labor and public policy economist, Daly is devoted to research and to ensuring that it is translated into practices that improve the lives of everyone. In addition to her work with the Federal Reserve, Daly has served as a visiting professor at Cornell University and UC Davis, and has been an advisor to the Congressional Budget Office, the Library of Congress, and the Social Security Administration. Daly is known for her ability to communicate and is a frequent speaker in the U.S. and internationally. She also hosts an award-winning podcast, Zip Code Economies. Daly holds a bachelor’s degree from the University of Missouri-Kansas City, a master’s degree from the University of Illinois Urbana-Champaign, a Ph.D. in economics from Syracuse University, and completed a post-doctoral fellowship at Northwestern University.

John H. Cochrane is the Rose-Marie and Jack Anderson Senior Fellow at the Hoover Institution. He is also a research associate of the National Bureau of Economic Research and an adjunct scholar of the CATO Institute. Before joining Hoover, Cochrane was a Professor of Finance at the University of Chicago’s Booth School of Business, and earlier at its Economics Department. He was a junior staff economist on the Council of Economic Advisers (1982–83). His most recent book is The Fiscal Theory of the Price Level. Cochrane frequently contributes editorial opinion essays to the Wall Street Journal. He maintains the Grumpy Economist blog. Cochrane earned a bachelor’s degree in physics at MIT and his PhD in economics at the University of California at Berkeley.